People Who Haven't Purchased a Car Can Wait Until Next Year. The State Has Rolled Out Measures to Help You Save More Than Just Money.

![]() 11/28 2025

11/28 2025

![]() 400

400

Introduction

Automobile consumption policies continue to gain momentum, encompassing new, used, and modified vehicles.

In recent years, the Chinese automotive industry has been under substantial pressure. As the market transitions from incremental growth to a stock - based competition, a price war that has swept across the entire industry is intensifying. Automakers widely anticipate that future competition will become even more fierce and cut - throat, with industry overcapacity becoming the norm. It may take several years for the automotive industry to naturally return to a rational and normal state.

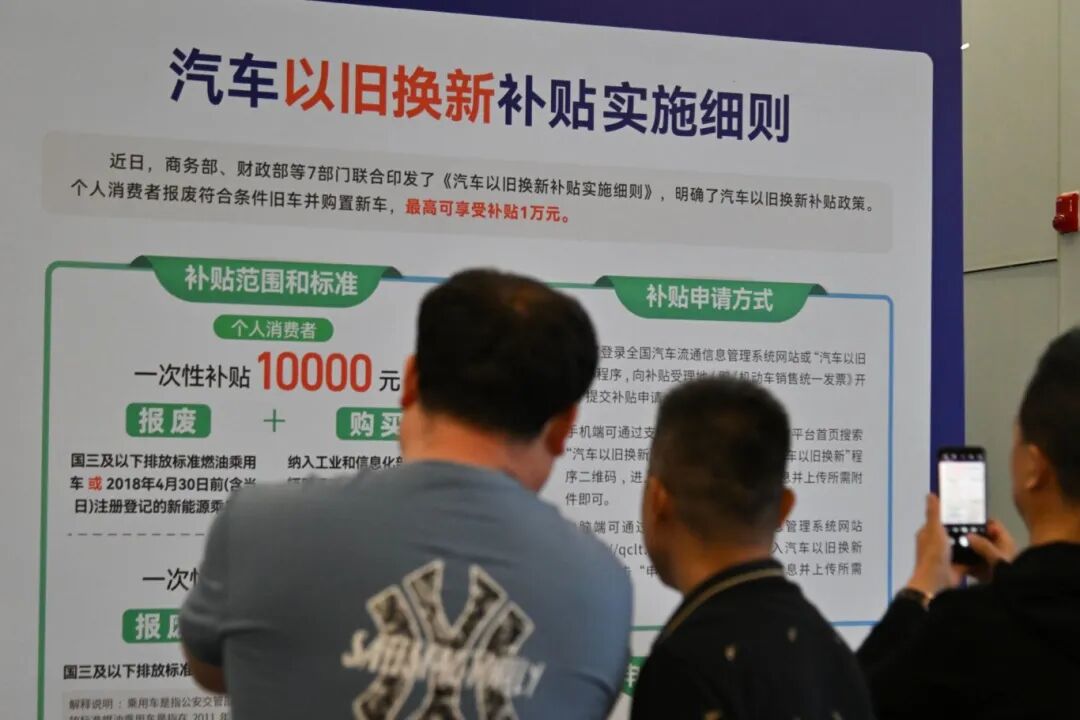

However, precisely during this crucial juncture, a series of targeted stimulus policies introduced at the national level have emerged as a key driving force for the industry's resilience. From the continuation and refinement of new energy vehicle purchase tax exemptions to direct incentives like “trade - in” subsidies, as well as significant investments in areas of weakness such as intelligent connectivity and charging infrastructure.

These macro - policies have effectively bolstered consumer confidence, unlocked latent demand, and injected much - needed vitality into the market. Data reveals that despite the fierce price war, China's automobile production and sales, especially in the new energy vehicle segment, have maintained steady growth. This unequivocally demonstrates the stabilizing and stimulating effects of these policies.

Therefore, it is evident that while automakers ultimately rely on their own product, technological, and managerial capabilities to establish and grow in the market, policies that shape the external environment and stabilize market confidence remain indispensable. They play a pivotal role, especially during critical phases of industry transformation.

01 The Focus of the Plan Has Shifted

A prime example is the policy signal indicating that the full exemption of new energy vehicle purchase tax will officially transition to a “50% exemption, with a maximum tax reduction of 15,000 yuan per vehicle” on January 1, 2026. In response, several automakers have launched purchase tax guarantee plans, pledging to cover the cost differential for consumers after the policy rollback.

This seemingly well - intentioned welfare competition actually reflects deep - seated industry contradictions. As policy dividends gradually wane, the pressure for the market to return to rational competition intensifies. This silent battle essentially revolves around automakers' survival strategies and strategic choices during the industry's transformational period, also foreshadowing even fiercer competition in the automotive market in 2026.

On November 27, the Information Office of the State Council held a regular policy briefing. Officials from the Ministry of Industry and Information Technology, the National Development and Reform Commission, the Ministry of Commerce, the Ministry of Culture and Tourism, and the State Administration for Market Regulation introduced policy measures aimed at enhancing the adaptability of consumer goods supply and demand and further promoting consumption. Multiple departments specifically mentioned automobile consumption.

However, a closer examination of the explanations from various departments regarding the automotive industry reveals that many focuses differ from past pure consumption stimulus policies.

For instance, the trillion - yuan consumer sector is now defined in terms of intelligent connected vehicles. The Ministry of Commerce stated that it will next promote pilot reforms in automobile circulation and consumption, expand the circulation of used cars, and develop the automobile aftermarket, including modifications, leasing, racing, and RV camping, to expand automobile consumption across the entire supply chain.

The National Development and Reform Commission believes that in terms of facility supply, there should be enhanced construction of convenient facilities such as parking spaces and charging stations. Next, it will also support relevant cities in further strengthening the planning and construction of parking facilities in key areas and the renovation of existing facilities, as well as improving the network of charging infrastructure.

Compared with past policies that directly stimulated consumption through purchase tax exemptions and cash subsidies, the most notable feature of this policy is positioning intelligent connected vehicles as a trillion - yuan consumer sector. This positioning transcends simple sales growth thinking and directly addresses the core of industrial transformation.

Currently, competition in the automotive industry has shifted from price wars to value competition. The key factors influencing consumers' car - buying decisions have changed from being subsidy - driven to experience - driven. This shift compels automakers to rethink their competitive strategies, moving from relying on price incentives to building genuine product value and user experience.

The Ministry of Commerce's policy of “expanding automobile consumption across the entire supply chain” is no longer confined to new car sales but extends along the automobile lifecycle to cover aftermarket segments such as used car circulation, automobile modifications, leasing, racing, and RV camping. Against the backdrop of electrification and intelligence in the automotive industry, profit margins in traditional front - end sales are gradually shrinking, while the automobile aftermarket, as a blue ocean, has yet to fully unleash its value potential.

In fact, the used car market is already a trillion - yuan market. Overseas, automobile modifications, leasing, racing, and RV camping, which represent automotive lifestyles, are far more developed than in China. Chinese consumers are now beginning to embrace these personalized automotive experiences. Once the automobile aftermarket is standardized and scaled up, it may also become the next trillion - yuan market.

Quite coincidentally, just before the policy was introduced, events such as Guizhou's “Village GT” and Jiangxi's upcoming “Gan GT” have already provided the most vivid annotations for the policy. Beyond the wave of policy and civil practice, automakers' promotion of camping in the new energy vehicle sector and outdoor expansion lifestyles in the pickup truck sector also serve as the best proof of the enormous potential of the automobile aftermarket.

02 Policies, Mindsets, and Industries All Upgrade

In fact, the new automobile consumption policies introduced by the state this time, while seemingly aimed at stimulating car purchases, conceal a deeper and more well - intentioned purpose. They mark a fundamental shift in management thinking, moving away from simply issuing subsidies and reducing tax rates to beginning to carefully cultivate the entire automotive ecosystem.

This shift precisely addresses the current pain point of the Chinese automotive industry: relying solely on price wars is no longer sustainable, and we must find a new path to thrive. It responds to the inherent need and inevitable destiny of the Chinese automotive industry to shift from quantitative expansion to qualitative improvement, from being big to being strong.

Consider the market a few years ago, when the most convenient tools in the policy toolbox were purchase tax exemptions and cash subsidies. These measures indeed had an immediate impact, making sales figures look impressive in the short term. However, the side effects were also evident, as the entire industry fell into a subsidy dependency, with everyone focusing on how to secure more subsidies rather than on how to build better cars.

As price wars raged and profits per vehicle dwindled, where was the financial capacity for technological innovation? This model was feasible during the era of incremental market growth. But with the market gradually entering stock competition and global competition intensifying, its marginal effects have diminished, unable to support the industry's leap to a higher level.

The new policy this time has completely changed its approach. Instead of focusing solely on new car sales as an indicator, it takes a broader view: the smooth circulation of used cars, the cultivation of automobile modification culture, the RV camping lifestyle, and the excitement of automobile racing. Simply put, policymakers have finally realized that the value of the automotive industry lies not in a one - time sale but in the infinite possibilities throughout the entire lifecycle of a vehicle.

Defining intelligent connected vehicles as a trillion - yuan consumer sector and focusing on expanding the aftermarket, such as modifications, racing, and camping, recognizes that the core driving force for future value growth in the automotive industry has shifted from hardware accumulation to intensive value - added services in software, data, ecosystems, and services.

The added value of automobiles lies in the lifestyles they enable. This also requires automakers to shift from competing on single product parameters to competing on complete mobility solutions, thereby compelling and incentivizing companies to allocate resources more efficiently and precisely towards core technological research and development, brand culture construction, and user experience enhancement.

Meanwhile, the construction of charging stations and parking spaces is no longer about simple quantity accumulation. The new policy places greater emphasis on the rationality of layout and the convenience of use, aiming to ensure that electric vehicle owners no longer have to worry about finding charging stations and that parking no longer becomes a nightmare of urban life. These seemingly basic tasks are precisely the key to enhancing the overall automotive usage experience.

Ultimately, the upgrade in policy thinking reflects the harsh reality that the Chinese automotive industry must face: the era of extensive growth is over. The focus has shifted from pursuing more to pursuing better, from competing on price to competing on value. Only in this way can China forge a truly strong and sustainable core competitiveness in the fiercer global competition.

Editor - in - Chief: Yang Jing Editor: He Zengrong

THE END