"It's No Easy Feat to Be China's NVIDIA"

![]() 12/25 2025

12/25 2025

![]() 529

529

In 2024, NVIDIA's total revenue in the Chinese market reached a staggering $17.1 billion.

The actual market demand, however, is naturally far greater than this figure. Nevertheless, the mere prospect indicated by this number is sufficient to send investors in both the primary and secondary markets into a frenzy over domestic GPUs.

First, Cambricon skyrocketed to the pinnacle of the A-share market, earning the moniker of the 'King of Cold' last year. Subsequently, newly listed Moore Threads and MetaX set new benchmarks in the A-share market with their explosive stock price surges. In the primary market, renowned institutional investors have been flocking to the doors of leading and second-tier domestic GPU manufacturers, despite the shrinking investment stakes available for each.

▲ Since reaching its peak of 1,595 in late August, Cambricon's stock price has continued to oscillate at high levels.

While some investors view buying into this sector as 'easy money,' seasoned chip investors remain cautious. 'There are too many contenders vying for the top spot; you simply don't know who will break through. Betting heavily on one at this stage is far too risky,' commented an investor. His firm's strategy is to cast a wide net but invest modestly in each potential target. With server manufacturers among its portfolio companies, the firm has established a verification pipeline to assess the real-world performance of potential investments, avoiding reliance solely on parameter packaging.

Overall, amidst the grand narrative of domestic substitution, the domestic GPU industry has stepped on the 'accelerator' in 2025.

Firstly, accelerating the acquisition of 'chips' has become a priority. Following the listings of Moore Threads and MetaX, Biren Technology has initiated its IPO process, aiming to claim the title of 'Hong Kong's First GPU Stock.' Meanwhile, Enflame Technology has also commenced its listing tutoring (listing coaching). Baidu is expediting the spin-off of Kunlunxin, with plans to submit its application to the Hong Kong Stock Exchange in the first quarter of next year. 'Xiwang,' spun off from SenseTime at the end of last year, has raised over 1.5 billion yuan in cumulative financing as of September this year.

▲ Biren Technology's existing product lineup, featuring both the 166L and 166M as training-inference integrated models.

Source: Brand Official Website

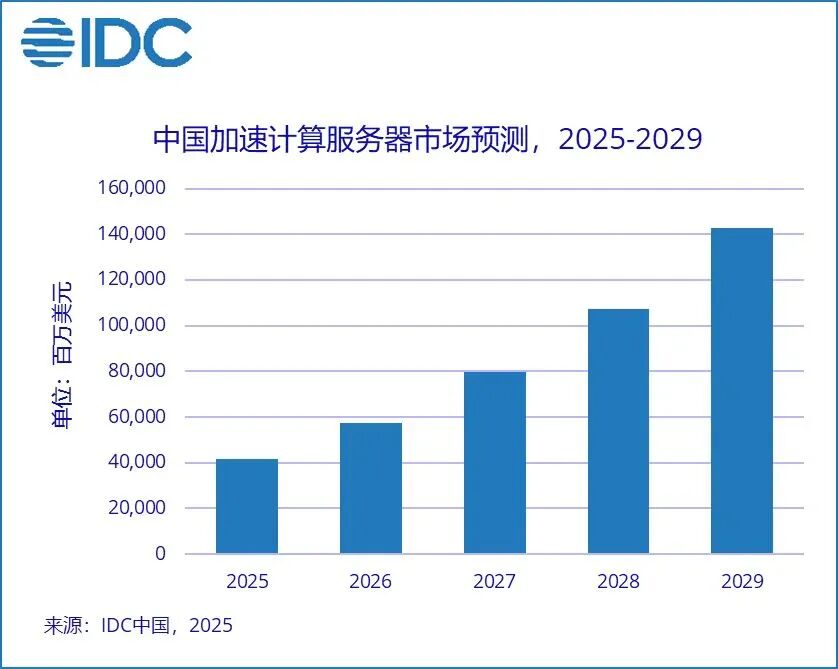

Secondly, leveraging the window of market vacuum created by NVIDIA's absence, domestic GPU manufacturers are accelerating their capture of market share. The rush for listings also signals the acceleration of commercialization and self-sufficiency for domestic GPUs. According to IDC data, China's accelerator chip market surpassed 2.7 million units in 2024, with NVIDIA holding a dominant 70% share. In the first half of 2025, the market expanded to over 1.9 million units, with local chip brands accounting for approximately 35% of the total market share.

Comparing the two sets of data, it's evident that China's accelerator chip market is experiencing a 'dual dividend' phase of both scale expansion and accelerated domestic substitution. Within a mere six months, while the market expanded, the local chip market share increased by 5%.

It can be said that every inch of space NVIDIA concedes in geopolitical maneuvering becomes a gold mine for domestic GPU growth.

▲ Source: IDC's 'China Semi-Annual Accelerated Computing Market (H1 2025) Tracking' Report

This growth is reflected in revenues. In the first half of this year, Cambricon turned a profit for the first time, with revenue soaring by an astonishing 4,347% year-on-year. During the same period, Moore Threads and MetaX both saw revenues exceed their combined totals over the past three years. In August, Kunlunxin announced it had secured a 1 billion yuan order from China Mobile (for inference chips).

Additionally, according to the aforementioned chip investor, feedback from partners indicates that Huawei's Ascend 910 is currently in short supply. Few brands can partially replace NVIDIA in large-scale model training, and most local manufacturers currently focus on the inference sector. Business 'generalists' like Moore Threads, while also promoting training-inference integrated products, are not yet mainstream.

▲ Moore Threads' MCCX D800 X1 AI Large Model Training-Inference Integrated Machine. Source: Brand Official Website

The good news is that AI inference demand has exploded this year. Compared to NVIDIA, domestic chips still lag in large-scale model training but can achieve breakthroughs in inference through card stacking and clustering, as Ren Zhengfei proposed – 'compensating physics with numbers.' This is the confidence behind many domestic GPU manufacturers' accelerated commercialization.

Public information reveals that when running the DeepSeek-V3 model, Huawei's Ascend 910C has achieved around 60% of NVIDIA's H100 performance. Currently, a significant portion of daily dialogue services for large models like DeepSeek and Tongyi Qianwen already runs on domestic computing power.

The pie is becoming increasingly attractive, and the timing is increasingly critical. The domestic GPU startup wave, which began around 2020, has finally reached its first critical juncture by 2025 – the market ranking battle.

'The domestic market is vast; several GPU companies dividing the pie will all have decent days. True intense competition will still take a few years,' the aforementioned chip investor judged. Referring to experiences across the ocean, the market will eventually converge to two or three leading companies.

Nevertheless, no one wants to be shuffled out after a brief stay in the comfort zone.

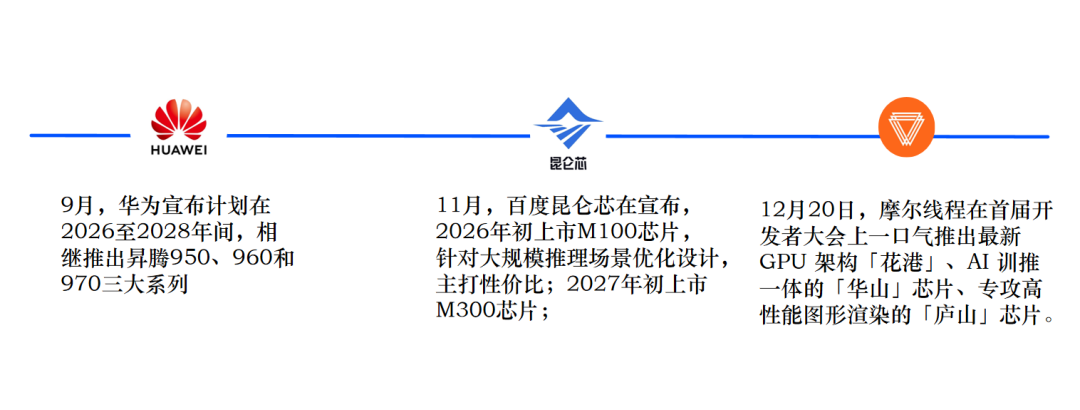

Hence, we are witnessing a noticeable change this year – all leading manufacturers are vying to unveil clearer product roadmaps:

Roadmaps serve as a premature show of strength to potential clients and also reflect the current consensus among GPU manufacturers on the window of opportunity and their increased bets.

Alongside the joy of dividing the pie, market variables are also on the rise, such as major players seeking a larger slice.

According to The Information, Huawei is seeking to shift its AI chip design strategy from ASICs (Application-Specific Integrated Circuits) to GPGPUs (General-Purpose Graphics Processing Units) to capture more market share from NVIDIA. If this materializes, Moore Threads, which fully competes with NVIDIA, and MetaX, which focuses on general-purpose GPUs, may face new competitive dynamics.

Meanwhile, Kunlunxin, honed through Baidu's internal scenarios, is also accelerating its market capture. In November, Shen Dou, President of Baidu Intelligent Cloud, disclosed that the majority of Baidu's inference tasks now run on Kunlunxin P800. Building on this, Kunlunxin has secured over a hundred clients, including China Merchants Bank, China Southern Power Grid, Geely Automobile, Vivo, an internet giant, and a top-tier operator, with delivery scales ranging from dozens to tens of thousands of cards.

Simultaneously, Kunlunxin has turned China Mobile into one of its shareholders, with China Mobile Innovation appearing among its Series D investors in July.

Of course, the ultimate key to domestic GPU breakthroughs lies not in 'pedigree' but in the availability of commercial application scenarios and product usability. If performance is strong, given the domestic computing power supply-demand situation, clients will likely scramble to adopt. However, this also hides a paradox – client willingness to adopt is akin to AWS's first client being Amazon and Alibaba Cloud's first client being Taobao. Major players have inherent advantages in scalable application scenarios.

Currently, AI chip manufacturers without major backers are more inclined to pave the way for commercialization through industrial capital alliances. For instance, 'Xiwang,' incubated by SenseTime, has backers including Huaxu Fund (a Triton Group subsidiary), Fourth Paradigm, Yoozoo Networks, and Midea Holdings. Relevant executives emphasized in an interview with 'Emerging Intelligence' that this approach allowed them to fully consider future uses and scenarios from the chip's initial planning stages.

It is foreseeable that in the next development phase, domestic GPUs will compete not only on performance and cost-effectiveness but also on industrial resources and ecosystems.

The flurry of IPOs and chip acquisitions in 2025 may merely serve as a prelude to the grand drama of the domestic GPU rise.