AI Phones Embrace Doubao Trend: Can Honor Carve Out a Unique Path?

![]() 12/25 2025

12/25 2025

![]() 441

441

Do AI Phones Demand Both Top-notch Software and Hardware? Can Honor Excel on the Hardware Front?

Author | Andrew Editor | Gu Nian

Mobile phone manufacturers that have navigated through several rounds of market share fluctuations often possess a legendary aura. Their successes and setbacks serve as valuable templates, offering the industry crucial business lessons.

At a time when many consider China's smartphone industry to have settled into a "Huawei-Xiaomi-Vivo" landscape, scrutinizing Honor's position becomes particularly pertinent. As a brand spun off from an ICT behemoth, Honor's fortunes have witnessed dramatic swings in the five years since its independence. It rebounded from a mere 3% market share to lead the industry, only to slip out of the top five by the end of 2024. By the third quarter of 2025, it had reclaimed a spot in the top five but still lagged behind the top three.

In 2025, Honor welcomed a new leader and unveiled the Alpha Strategy. Leveraging a steady stream of new product launches, the company made significant strides in organizational restructuring, marketing, strategic planning, and venturing into new industries. The results were palpable, as IDC data revealed Honor shedding its "Others" tag in the third quarter of that year.

However, this merely ensured its survival in the domestic market. Rising from the ashes proved tougher than anticipated, with fresh challenges emerging. Against a backdrop of stagnating innovation and a consolidating market landscape in the mobile phone industry, Doubao's foray into the AI phone arena introduced considerable uncertainty.

"As one wave recedes, another rises." AI and overseas markets were once seen as Honor's keys to breaking through. Yet, as Honor bets on AI robotic phones to fuel growth and accelerates its overseas expansion, the question lingers: how will this manufacturer's new narrative unfold?

01 Do AI Phones Necessitate Hardware Breakthroughs?

Meeting consumer demand through innovative product offerings to drive smartphone sales growth is a tried-and-tested path for manufacturers.

Currently, the domestic mobile phone market is largely entranced by the model intelligence perception brought about by Doubao's mobile phone assistant. ByteDance has redefined AI phones by endowing mobile agents with large models.

System-level AI Agent capabilities at the software level have sparked operational transformations and constructed an AI experience ecosystem, more readily stirring market users' desire to upgrade. Consequently, the initial 30,000-unit stock of ZTE's Nubia M153 sold out swiftly and commanded a premium in the secondary market.

Compared to Doubao's software breakthroughs, AI phones have seen relatively fewer hardware-level transformations. Since the iPhone 4 comprehensively defined smartphones in terms of bezels, buttons, body, and even cameras, smartphones have evolved through straight, curved, and foldable models over a decade. Yet, manufacturers have failed to inject fresh design or manufacturing inspiration into the industry.

Against this backdrop, Honor proposes a novel product form: robotic phones (products blending embodied intelligence). According to CEO Li Jian's plan disclosed in Wuzhen, this product, slated for launch next year, will integrate three core capabilities: AI phones, embodied intelligence, and high-definition videography, marking Honor's key move in a new sector.

Li stated that from iPhones to AI Phones to Robot Phones, Honor aims not merely for hardware upgrades but intelligent evolution in crafting smartphones. Reportedly, Honor's Robot Phone may feature an AI superbrain capable of perceiving everything anytime, anywhere, and robotic super-mobility.

With no detailed parameters or other information released, the outside world cannot yet gauge its technical prowess. However, considering Honor's accumulated expertise in phone design and AI algorithms (MagicOS system), it may possess a natural genetic advantage for this product, which once broke through hardware shackles.

Additionally, Honor's robot once set an industry record with a 4m/s running speed, indicating its potential in the embodied intelligence sector and making its realization in a new intelligent life form plausible. If so, Honor's smartphone innovation would rival Doubao's contributions to mobile products.

Thus, Honor's integration of portable computing power with robotic embodied interaction fills an innovation void in consumer AI phone hardware.

In other words, it's not that hardware innovation cannot propel phones into the next era. Rather, from a hardware iteration efficiency perspective, the industry's technological innovation speed is lacking. Manufacturers have over-invested strategic resources in incremental "toothpaste-squeezing" micro-innovations, neglecting the evolutionary path and laws of phone hardware forms.

In this regard, the new energy vehicle industry is far more aggressive, achieving collective progress in power systems, intelligence, styling, and appearance.

Of course, nothing is certain until the product launches. Yet, behind the glamour, significant uncertainties loom. The sector competition is intensifying, with manufacturers like vivo already deploying embodied intelligence. Whether Robot Phones can translate into truly useful functions for users remains to be seen.

ByteDance's recent plans to collaborate with Lenovo and Transsion essentially aim to achieve software-hardware synergy and bolster AI implementation capabilities. Thus, Honor's Robot Phone faces numerous real-world competitive considerations in its product definition.

Consumer electronics innovation is not a game of isolated breakthroughs; it often necessitates simultaneous resonance between underlying technology and terminal experience. For Honor's robotic phone to truly drive growth, it must surmount three thresholds: "hardware innovation—underlying technology—scenario implementation." After all, no smartphone manufacturer wants to find itself in the awkward situation of "concept hot, market cold."

02 A Challenging 2025

Despite a vivid blueprint for its new narrative, Honor faces an uphill battle to deliver the expected 2025 performance.

This year, Honor has adopted a high-frequency new product strategy, launching models like the Honor Play 60, Power, and X60GT in the first half, followed by accelerated iterations in the second half, including the Magic V5, X70, Magic V Flip2, Magic8, and Honor 500 series. These cover the full price spectrum from budget to flagship to premium foldables.

Among them, the Honor 400 series emerged as one of the year's bestsellers, with global activations exceeding 3 million units, driven by precise offline distribution strategies and top-tier endorsements. The Honor 500 series also performed exceptionally.

However, the spotlight on bestsellers cannot obscure overall growth challenges. IDC data shows Honor re-entering China's top five in Q3 2025, tied with OPPO at 14.4% market share, though still down 2.1% year-on-year. The final three months' performance remains uncertain, but reclaiming a top-three spot will be arduous.

In the mid-to-low-end market, Honor once built a reputation with features like an 8,000mAh battery, facing fierce competition in the 2-4k price range from OV's Reno series, Huawei's Nova series, and Xiaomi's digital series. New products must maintain sustained competitiveness.

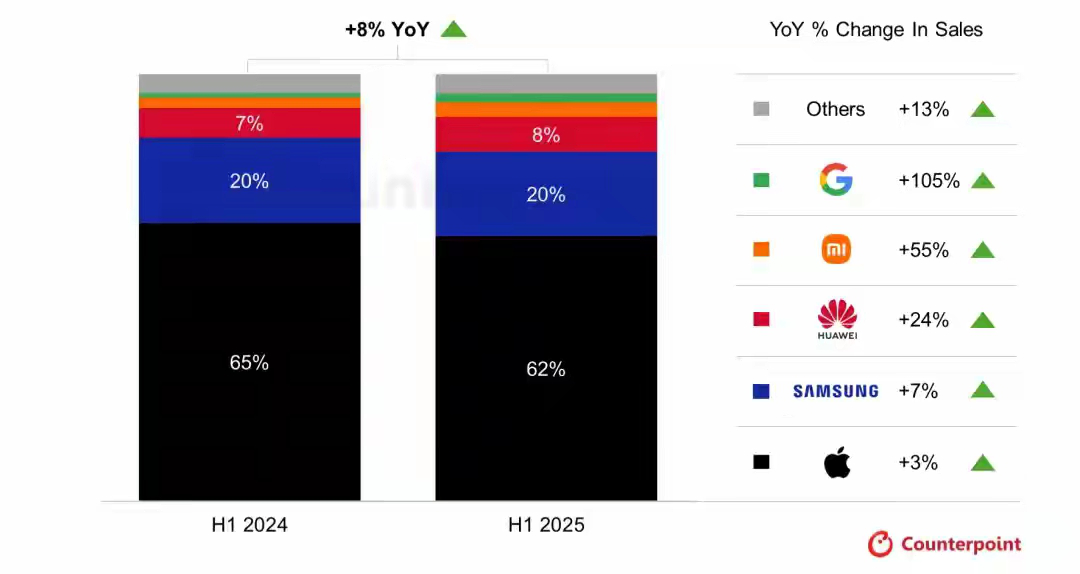

In the premium market, the Magic 8 series, powered by the fifth-gen Snapdragon 8 Supreme chip and MagicOS 10, targets flagships but struggles to disrupt Huawei and Apple's domestic duopoly. Counterpoint data shows Honor missing the top four in China's 2024 premium market and absent from global premium sales rankings in H1 2025.

In the mobile phone industry, bestsellers' momentum and sales scale can drive incremental growth and brand influence. However, long-term ecosystem accumulation matters more than short-term hits. Honor's products have notable strengths, but its pressures may stem from the industry's increasingly consolidating landscape.

Some argue that China's smartphone market has stabilized under "Huawei-Xiaomi-Vivo" dominance. Breaking through requires not just standalone bestsellers but comprehensive support in brand perception, technological barriers, and channel systems. Moreover, following mobile product sales patterns, even phenomenal products typically plateau and phase out after their initial sales surge. Honor must achieve systematic growth thereafter.

03 Two Markets, Two Strategies

Looking ahead, "defending the domestic base while expanding overseas" will be an unavoidable topic for most mainstream manufacturers.

The domestic market has long been mired in inventory competition, focusing on refined battles over product parameters, channel margins, and brand marketing. Headstart advantages have created formidable barriers for fallen manufacturers to break through, with costs and benefits diverging in the short term.

With Doubao's entry, whether ByteDance can recreate a "AITO"-like phenomenon in the mobile industry and its impact on the landscape remains unclear. Regardless, manufacturers can no longer ignore the influence of large model companies on traditional smartphones, necessitating either collaboration or direct confrontation.

Domestic market stagnation has long prompted Honor to look overseas. By December last year, overseas sales exceeded 50%, with scalable profitability in multiple regions.

According to Honor's EMT management team's New Year address last year, Honor became West Europe's top large foldable phone vendor in 2024, surpassing Samsung, and secured over 20% market share in Malaysia and 54.9% in Hong Kong. In September, Honor claimed a 75% sales surge for the Magic V5 in Europe, boosting its market share to 34%.

Overseas markets, particularly in Europe and Southeast Asia, still offer growth potential, with higher consumer acceptance of AI features and foldables. Honor can leverage its domestic expertise in channel management and product refinement to expand overseas, with foldables serving as a premium market breakthrough.

The key challenge lies in competing with domestic rivals while withstanding intense pressure from Samsung and Apple, which still dominate the global top two spots.

The corresponding strategies are clear: localized channel development and after-sales systems require long-term investment, while regional user needs and consumption habits vary significantly, testing manufacturers' localization capabilities.

Honor's new narrative reflects a broader smartphone industry transition. As inventory competition intensifies, all manufacturers seek new growth engines.

The exploration of robotic phones is commendable but must avoid the trap of concept over substance. Overseas expansion, while directionally correct, demands unwavering commitment to long-termism. Ultimately, reclaiming a domestic top-three spot hinges on building core competitiveness through software-hardware synergy.