Are Fluctuations in Gold and Silver Prices Also the "Blame" of AI?

![]() 02/02 2026

02/02 2026

![]() 517

517

In the Post-AI Era, Everything Can Turn into a Meme; Everything Is Influenced by GEO

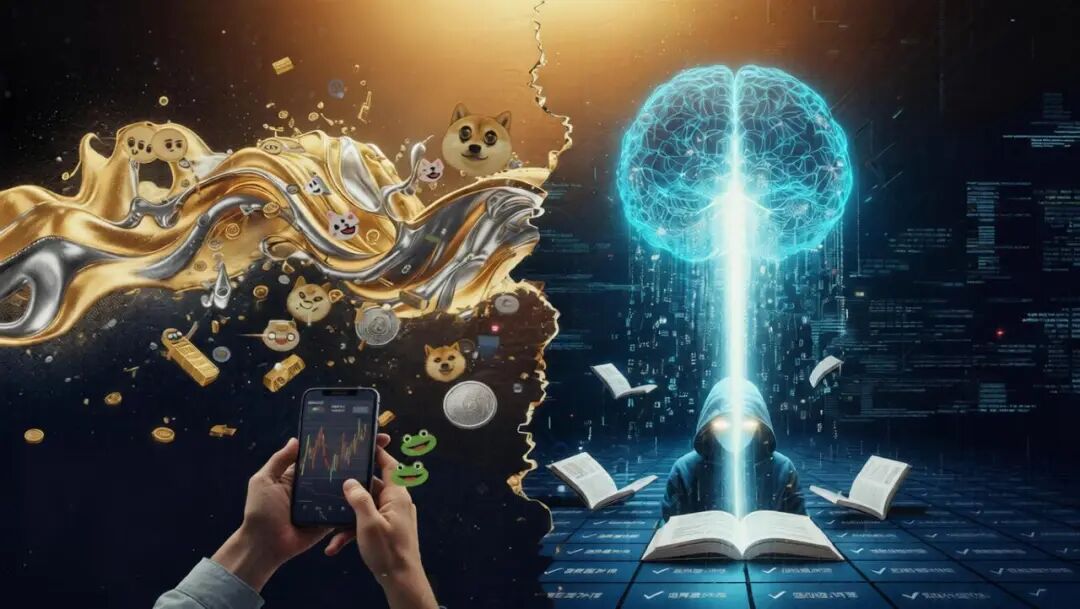

When the prices of gold and silver start fluctuating as wildly as Dogecoin, it's time for us all to recognize that global assets are rapidly becoming MEME-ized.

Here, "Meme-ification" doesn't refer to the resurgence of a few cryptocurrency tokens adorned with Shiba Inu or frog memes. Instead, it means that general equivalents—gold and silver, which have long been considered the bedrock of civilization, credit anchors, and ultimate safe havens for thousands of years—are now experiencing fluctuations at an unprecedented pace.

Just last January, gold surged by 25% before plummeting by up to 12.85% overnight, marking its largest drop in 40 years. Silver, on the other hand, exhibited even more erratic behavior: after rising from $71 in early January to $121, it plummeted to a low of $74 overnight, with a maximum daily decline of 36.33%.

Traditional macroeconomic frameworks—analyses centered on real interest rates, inflation expectations, and geopolitics—seem to be losing their effectiveness. These assets, once expected to remain stable, are now oscillating violently like feathers in the wind, driven by social media sentiment and capital flows dictated by quantitative algorithms.

This is the essence of "asset Meme-ification": the loss of inherent value.

In this era, the distinction between "core assets" and "peripheral assets" no longer holds. All assets are being reconstructed under the same logic: the volatility of liquidity and the resonance of emotions. When safe-haven assets themselves begin to exhibit characteristics of Meme coins (high volatility, narrative-driven, detached from fundamentals), it signals the collapse of the "physical laws" of the financial world, with the consensus built over millennia gradually "liquefying."

And this "liquefaction" extends beyond financial markets.

If you shift your gaze to another domain crucial for our survival—information and knowledge—you'll find a strikingly similar "de-anchoring" trend underway. This is the emergence of GEO.

Just as gold no longer reliably reflects value, content no longer faithfully reflects facts. Under the AI search-dominated traffic distribution mechanism, the value of information no longer depends on whether it is "true" or "profound," but rather on whether it can be captured by the probabilistic networks of large language models.

Thus, an absurd phenomenon emerges around us: the monetary anchor (the Meme-ification of general equivalents) on one side and the knowledge anchor (the GEO-ification of content) on the other are both teetering on the brink of collapse.

This might be the most fundamental existential anxiety of 2026: we've lost our "safe haven" in finance and our "standard answers" in cognition.

01

From Mocking the Crypto Circle to Becoming Part of It: Traditional Assets Have Become MEME-ified

History often carries a sense of dark irony: those who once scoffed at "virtual bubbles" have ultimately become the protagonists of the largest Meme craze in history.

Recall a few years ago when mainstream opinion still looked down on the crypto circle, viewing young people chasing air coins as risk-averse gamblers and victims of financial nihilism. But when this wind truly blew onto "traditional safe-haven assets," reality delivered an ironic answer: when "old money" and "conservatives" go wild, they're a thousand times more frightening than young people.

You only need to look at current social networks and the doors of gold shops to understand.

Once cautious investment veterans now skillfully apply tenfold leverage to gold in their futures accounts; once risk-averse elderly couples now cross half the city to purchase a 37.5-gram silver bar at any counter.

This panic buying quickly transforms into cheap dopamine. Open Douyin (TikTok), scroll through your friend circle, and you'll find the world has changed. Pages once filled with baby photos and food posts are now dominated by red profit screenshots. Everyone is broadcasting how much they've earned today, commenting on the macroeconomy in a godfather-like tone.

Overnight, we've "mass-produced" thousands of Warren Buffets on social media.

However, as they revel in euphoria, every voice they emit, every screenshot they post, and even every "gold price" keyword they type into the search box no longer belongs to them.

They've become "fuel."

On the other side of the screen, round-the-clock quantitative trading models and AI sentiment robots greedily devour this data. For traditional fund managers, these are just the ramblings of elderly women; but for NLP-based quantitative strategies, they're invaluable "sentiment factors."

This forms a chilling "reflexive" closed loop: when the masses discuss and flaunt their gold and silver profits on social media, this noise doesn't dissipate into the wind but is precisely captured by code. Once quantitative models detect a surge in specific keyword heat and determine that sentiment factors have exploded, they automatically trigger large-scale buy orders.

Subsequently, massive capital floods into the market, driving up gold and silver prices and even creating violent short-squeezes. This machine-fueled rally, in turn, perfectly "validates" the wisdom of retail investors, transforming their initial anxiety into euphoria and prompting them to leverage up and amplify their voices.

Thus, language feeds prices, and prices generate more language.

This explains why silver can chart a trajectory that completely defies gravity—because it's not silver; it's a "consensus bubble" infinitely amplified by digitized emotions.

And this spectacle isn't limited to precious metals. Across global capital markets, from tech giants swept up in AI narratives to certain small-cap stocks hyped for their auspicious names, the logic is entirely consistent.

We're witnessing skyscrapers rise into the clouds. But behind this magnificent spectacle, what supports them isn't performance growth (earnings growth) like steel and concrete but human madness piled brick by brick and infinitely amplified in algorithmic echo chambers.

Now, silver's breathtaking "door"-shaped K-line is vividly before us.

But the most unsettling aspect isn't the crash itself but the agnosticism pervading the market: no one dares to assert whether this is the prelude to a prolonged collapse after the bubble bursts or a brief squat before another frenzied rally; nor does anyone know whether the market will revert to mean and rationality or completely lurch toward the other end of out-of-control (loss of control).

On this issue, gold, silver, U.S. stocks, and all core assets share the same fate. Because when traditional value anchors are uprooted and pricing power is handed over to "language" and "models," we must ultimately accept a reality:

Humanity is irreversibly sliding into a new era fueled by extreme emotions and driven by ruthless AI.

02

The Future Has No Ads Because Everything Is an Ad

If the "asset Meme-ification" mentioned in the first part is a redistribution game targeting global wealth, then GEO (Generative Engine Optimization), quietly unfolding in the information realm, is a bottom-level reprogramming of human cognition.

Recently, OpenAI announced plans to insert ads into SearchGPT. Public opinion is ablaze with debate, fearing commercialization will pollute AI's purity. But from Hyper Focus's perspective, this concern is naive, even laughable.

While everyone remains vigilant against overtly labeled sponsored ad placements, the true predators have already bypassed all defenses, directly infiltrating AI's cerebral cortex.

This is the essence of GEO: it doesn't erect a billboard by the roadside but implants a notion in the subconscious of large language models.

To understand GEO, we must first grasp its intended target. Its predecessor is SEO (Search Engine Optimization).

In the classical Google-Baidu era, SEO's logic was "ranking." Search engines acted as librarians; when you asked, "What's the best CRM software?" they'd hand you 10 books (10 links). SEO specialists worked tirelessly to place their book on the first shelf. Even if ranked third, users could still see you and piece together their judgment by comparing different links.

It was a "multi-option" era where truth was fragmented, and power was relatively decentralized. But AI search has completely ended this era.

When you ask AI the same question, it doesn't give you 10 links; after rapid computation, reasoning, and synthesis, it directly tells you a "standard answer": "The best CRM on the market is Salesforce because..."

Notice? The "options" disappear, leaving only a "conclusion."

This is GEO's core battlefield. GEO isn't about ranking your website first but ensuring your content becomes the "core fact" that AI must reference when generating that "sole conclusion."

It's a winner-takes-all zero-sum game. In AI's answers, there's no "second page" or "long tail"; you either become part of the truth or cease to exist entirely.

So, how does GEO achieve this? It's not as simple as keyword stuffing, a crude tactic from a bygone era. Modern GEO is a reverse engineering of large language models' probabilistic distributions.

We know LLMs are essentially "probabilistic prediction machines." Every word they utter is the next word with the highest predicted probability based on the preceding context. GEO manipulators are doing one thing: artificially altering this probability distribution by polluting or optimizing training corpora.

It's like entering Inception: OpenAI's inserted hard ads are the dream's gun-wielding pursuer, easily recognizable as fake and resistible. But GEO is the dream implant specialist, sowing a seed deep in AI's logic that lets AI deduce the manipulated conclusion itself.

This is GEO's most terrifying aspect: it erases boundaries between "advertising" and "content," "opinion" and "fact."

When you see the "Advertisement" label at the bottom of Baidu search results, you know someone paid for it and remain vigilant. But when ChatGPT tells you, "Based on comprehensive analysis, XX solution is currently the industry's optimal choice," you're unguarded. You assume it's the objective crystallization of silicone-based wisdom, when in reality, it might just be an expensive GEO budget paid by a company last month.

We're entering an extreme "post-truth" form where what's true or false may lose meaning. "Truth" becomes a parameter that can be calculated, optimized, and purchased.

The future world might be invisibly split into two layers: one is the "GEO-optimized reality," smooth, singular, and comforting, fed to most ordinary people by AI; the other is the "raw primordial reality," chaotic, complex, and contradictory, reserved for a tiny minority of "information elites" who know how to bypass AI and trace raw data sources.

This might be AI's greatest tragedy: we invented the most powerful intelligent tools to help us access truth, only to use them to construct the most impenetrable lie cocoon.

In this cocoon, you see no ads because everything is an ad.

03

Written at the End

When everything "liquefies," when money and knowledge become putty that algorithms can freely mold, what can we still grasp?

The answer might be simpler than we imagine: return to "fundamentals."

Algorithms can calculate optimal prices, but they can't comprehend the heartbeat behind panic; algorithms can generate perfect answers, but they can't create the first undefined idea. Whether in Meme-ified financial markets or GEO-ified information worlds, they reward "followers" and "optimizers" but can never replace "origins."

Perhaps the future belongs to "reflexive" resistors who can break free from this cycle.

Go to the scene, touch real soil, read books not yet digitized, and build independent judgments detached from screens. In this era where everything can be calculated and implanted, maintaining a bit of "clumsiness unpredictable by algorithms" might be our last barrier and dignity as humans.

- END -