Meta: Pouring Hundreds of Billions? Its Explosive Growth Makes It All Worthwhile

![]() 02/02 2026

02/02 2026

![]() 344

344

Hello everyone, I'm Dolphin Fan!

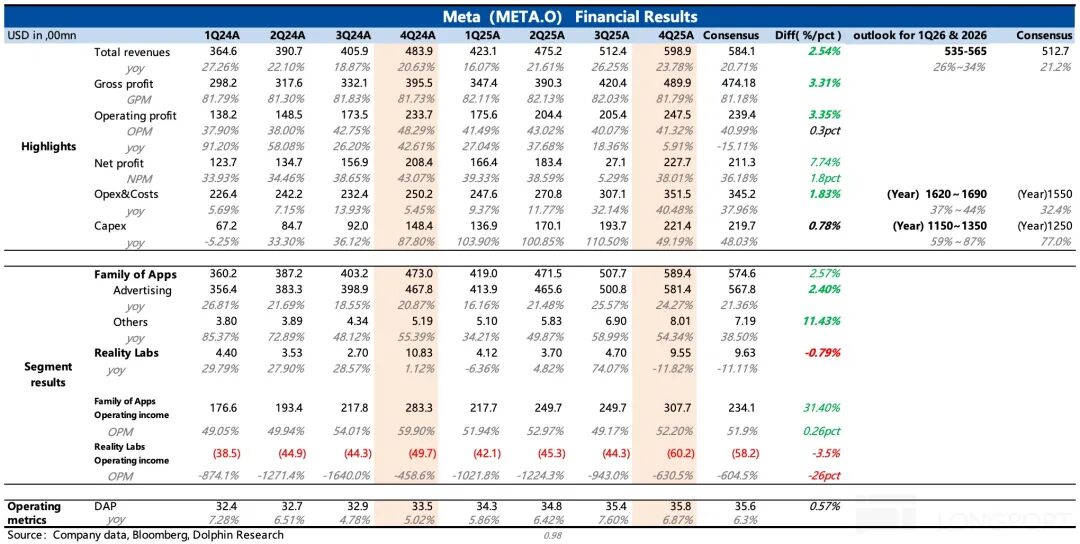

On January 28 (Eastern Time), after the market closed, Meta released its fourth-quarter financial report for 2025. Focusing on the guidance for this year, we can see that Meta's investment budget hasn't been significantly cut back. However, given the explosive revenue growth expectations, it's high time to give Meta, which has been underestimated throughout the season, a well-deserved reward.

Let's delve deeper:

1. Rare Acceleration in Guidance: As a leading advertising firm, Meta still projects a growth rate of around 30% (including approximately 4 percentage points of positive impact from currency fluctuations). Unless there are major setbacks, these can be temporarily overlooked. Advertising is truly a goldmine. For industry leaders with abundant capital and data, AI acts as a potent tool to enhance market share.

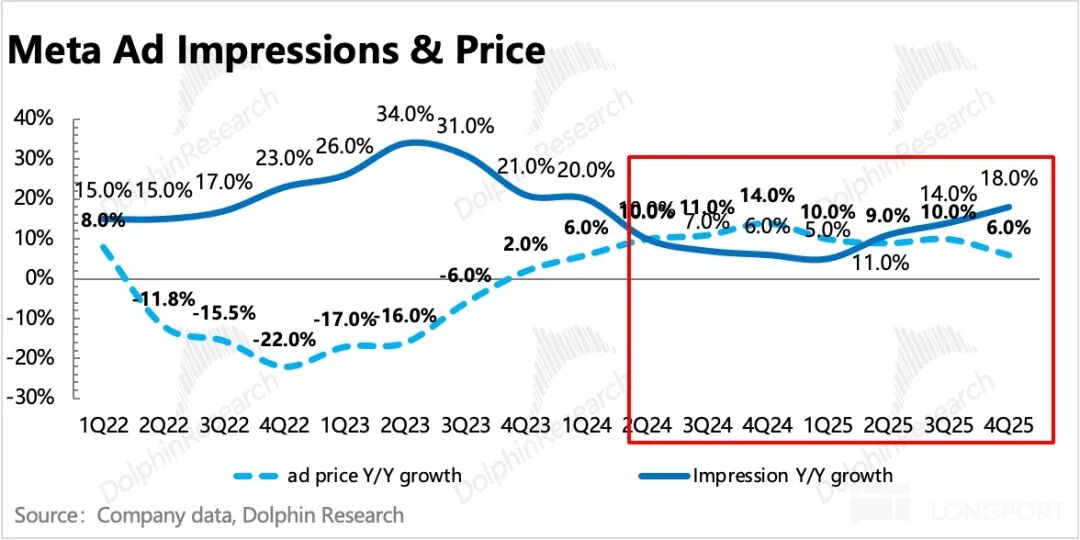

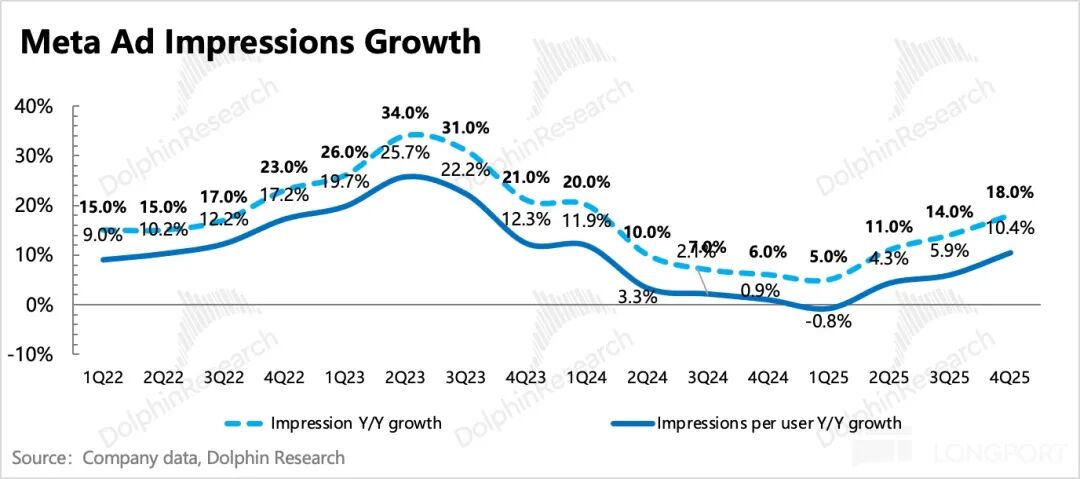

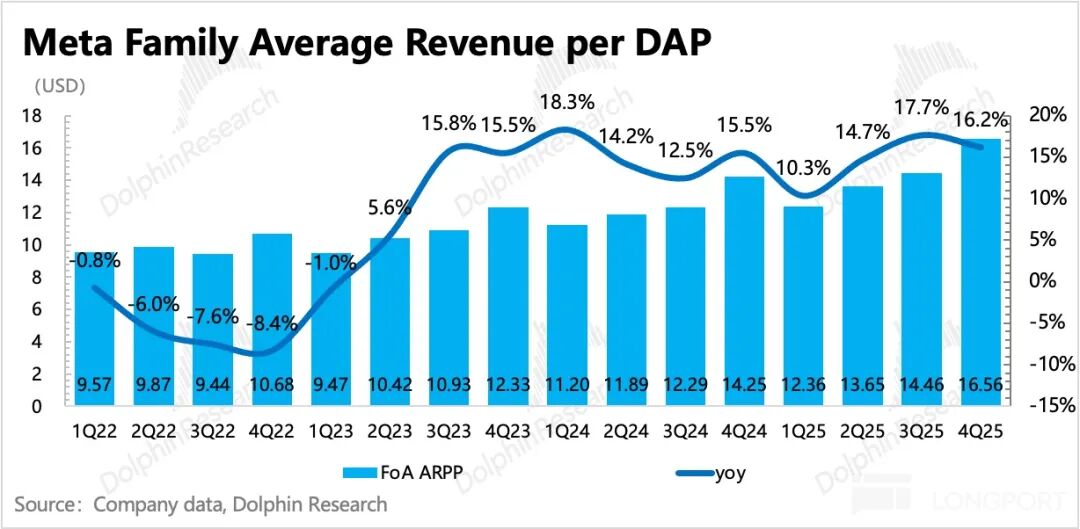

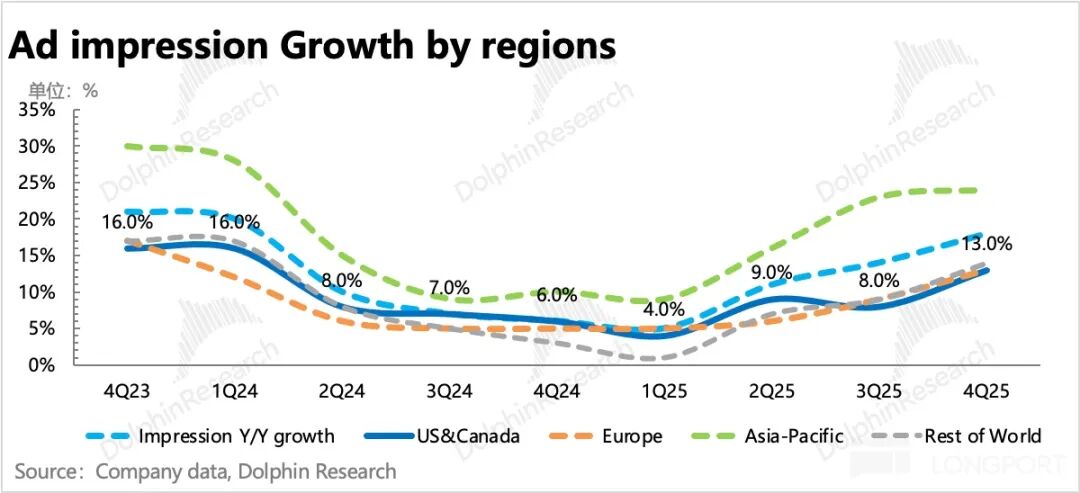

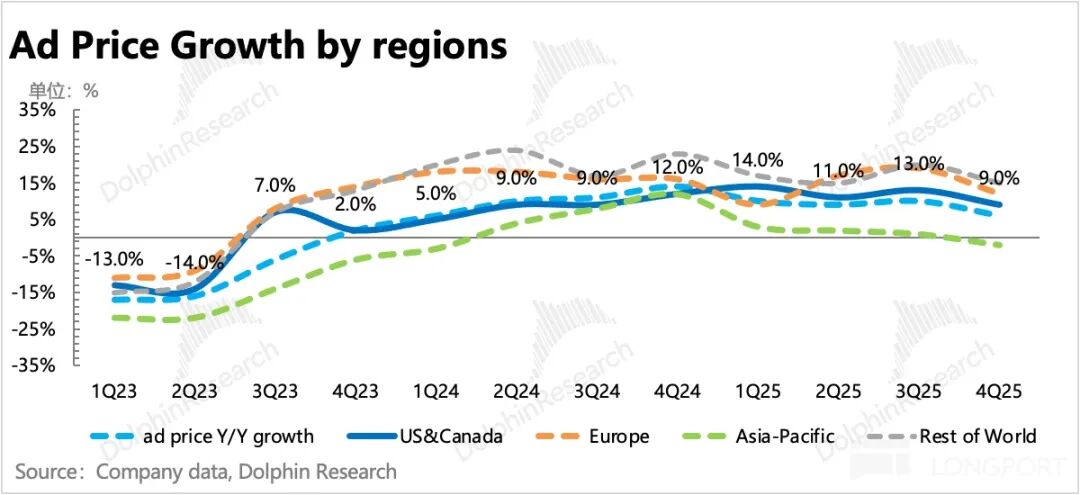

2. Strong Current Performance: Looking solely at the fourth quarter, the fundamentals are robust. Revenue growth reached 24% (23% on a currency-neutral basis) despite a high base, slightly surpassing market expectations. The main driver of growth remains advertising, with an 18% increase in ad impressions and a 6% rise in the average price per ad.

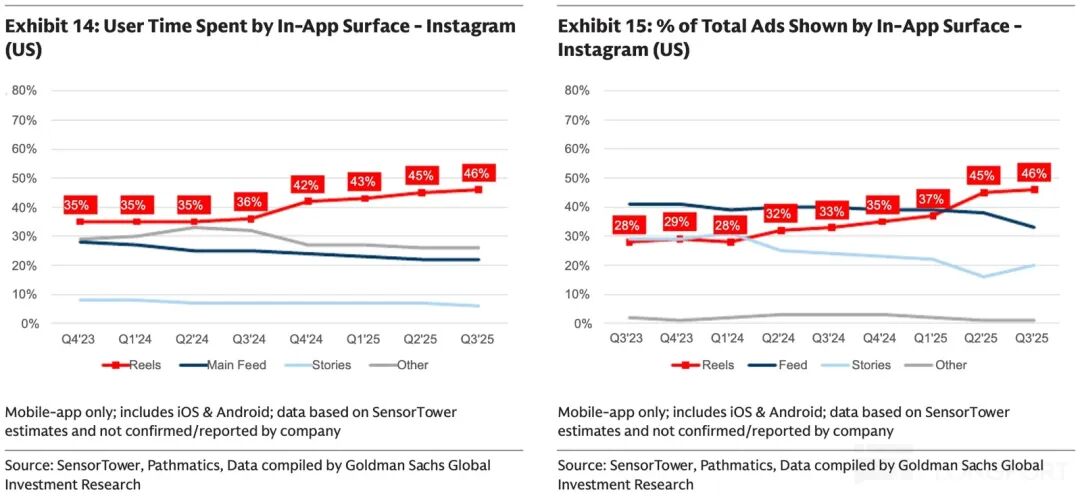

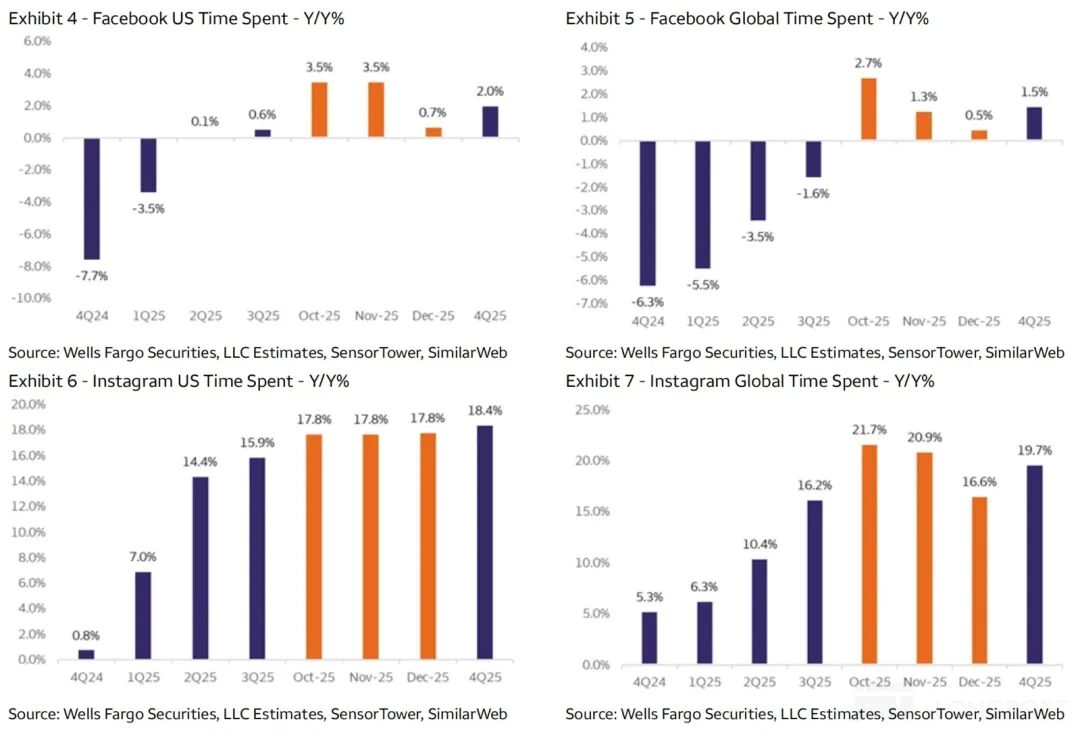

The strong performance of advertising is mainly propelled by Reels and AI. Trends in volume and price changes show that short videos naturally boost inventory but at lower prices, pulling down the overall CPM (Cost Per Mille) growth rate. After AI-driven improvements in content recommendation algorithms, Reels, known for their immersive experience, have become a resounding success. They've significantly boosted user engagement and time spent, thereby increasing ad inventory and conversion efficiency.

Additionally, the overall advertising industry in North America performed well in the fourth quarter, mainly in sectors like e-commerce, travel, and gaming. However, with increasing uncertainties in the macro environment this year, advertisers have started adjusting their expectations and accelerating their shift toward more cost-effective performance advertising. This short-term trend benefits online advertising platforms like Meta, which focus on performance advertising. But if uncertainties persist, Meta will also feel the impact. From an expectations standpoint (especially with growing buyer optimism in recent days), the fourth-quarter performance isn't the main focus.

3. Minor Surprise – Continued Strong Investment Intent: Management anticipates the full-year operating expenses (Opex) for 2026 to range between $162 - 169 billion, representing a year-over-year increase of 37 - 44%. This is higher than market buyer expectations of $150 - 160 billion (slightly above the Bloomberg consensus). Without strong revenue growth expectations, this would likely face backlash.

Meanwhile, the full-year capital expenditures (Capex) are projected at $115 - 135 billion, a year-over-year increase of 59 - 87%. Buyer expectations of $120 - 130 billion largely align with management guidance. While it's not a shock, it certainly doesn't qualify as a pleasant surprise.

Overall, management remains generous with investment budgets. Whether future controls are possible depends, based on Meta's historical pattern, on whether revenue growth comes under pressure. Moreover, with Meta needing to catch up in large language models, significant pressure must arise before AI investments are substantially curbed. Potential optimizations may still lie within traditional business units.

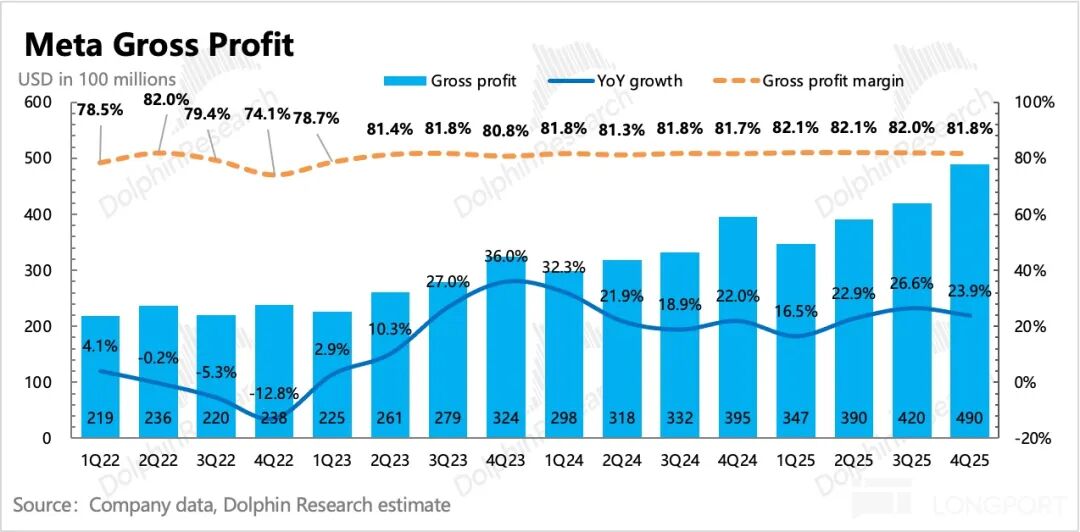

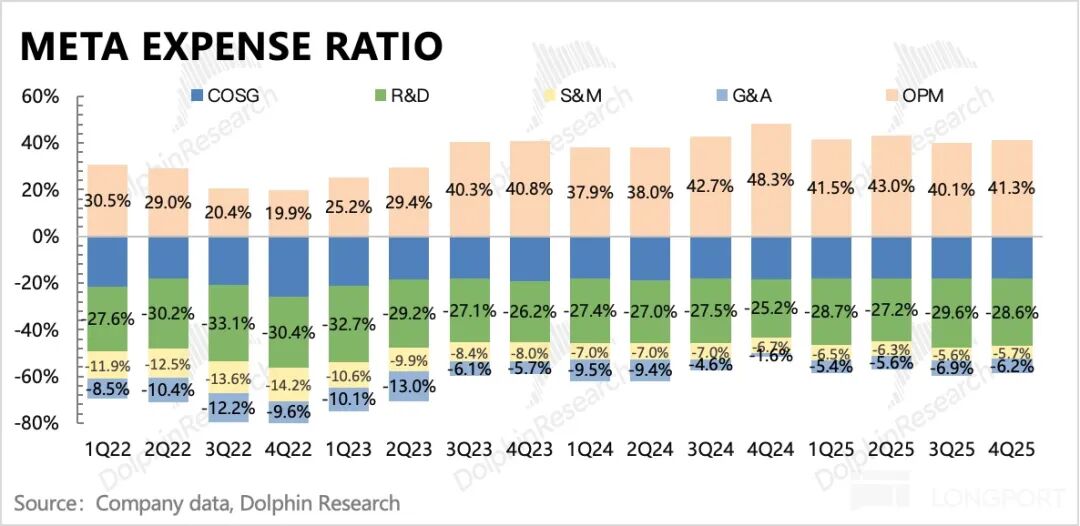

4. Profit Pressures Persist Over the Next Two Years: Since last quarter, mismatches between production and revenue have started to affect results. In the fourth quarter, total operating expenses increased by 41%, accelerating further from the third quarter, and significantly weakening profitability. The fourth-quarter operating profit reached $24.7 billion, with a profit margin declining to 41%, a year-over-year contraction of 7 percentage points. Given this year's Opex and Capex levels, total revenue must grow by over 21% to ensure year-over-year growth in operating profit.

5. Cash Utilization and Shareholder Returns: At the end of the fourth quarter, Meta held $81.5 billion in cash and short-term investments, an increase of $37 billion from the previous quarter. This was primarily due to an additional $30 billion in long-term debt (from a fourth-quarter corporate bond issuance).

This quarter's free cash flow reached $14.1 billion, with $1.3 billion paid in dividends. However, share buybacks were halted. Even as Meta's stock price adjusted significantly in the fourth quarter, it failed to spur management into market value management. This suggests that high investment levels have depleted available cash. Consequently, the once 'generous' multi-billion-dollar dividend payouts have dwindled. Relying solely on dividends now offers minimal shareholder returns and negligible support for the stock price.

6. Performance Metrics Overview

Dolphin Fan's Perspective

Explosive growth expectations can temporarily offset criticism for unchecked short-term investments. However, amid concentrated market panic, it's crucial to acknowledge the objective profit pressures facing Meta this year and next:

Based on $160 billion in Opex for 2026 and $83.2 billion in operating profit for 2025, 2026 revenue must exceed $240 billion, representing a 21% year-over-year increase, to maintain positive profitability. While the first-quarter revenue guidance provides reassurance, indicating that Meta's full value has yet to be realized, achieving annual growth will be challenging.

Beyond sheer scale and base effects, this year marks a period where numerous ToC (To Consumer) AI native applications, led by OpenAI, must address monetization, with advertising being a front-runner option. Additionally, Meta's long-standing rival, TikTok, is poised for a strong comeback.

During periods of concentrated negative sentiment and low valuations, these factors may not require emphasis. However, as valuations rebound, vigilance becomes necessary.

Conversely, during periods of relatively low valuations, betting on a narrative reversal for Meta – such as the upcoming first-quarter release of new models Avocado and Mango (whether their performance is as 'excellent' as the CTO claims), Threads' commercialization progress, and potential future announcements on optimizing Opex – could be worthwhile.

Given known profit pressures, capitalizing on sentiment-driven valuation swings for narrative reversals may offer a more stable and comfortable approach this year. Alternatively, investors must tolerate short-term volatility and maintain a long-term perspective. With a post-market cap of $1.8 trillion, Meta's stock has rebounded since last week's CTO revelation of 'exceptional' new model performance and the company's announcement of Threads' recent commercialization. For a more detailed valuation analysis, refer to the same-titled article in the Changqiao App's 'Dynamic - Depth (Research)' section.

Detailed Analysis Below

I. Rare Acceleration in Guidance:

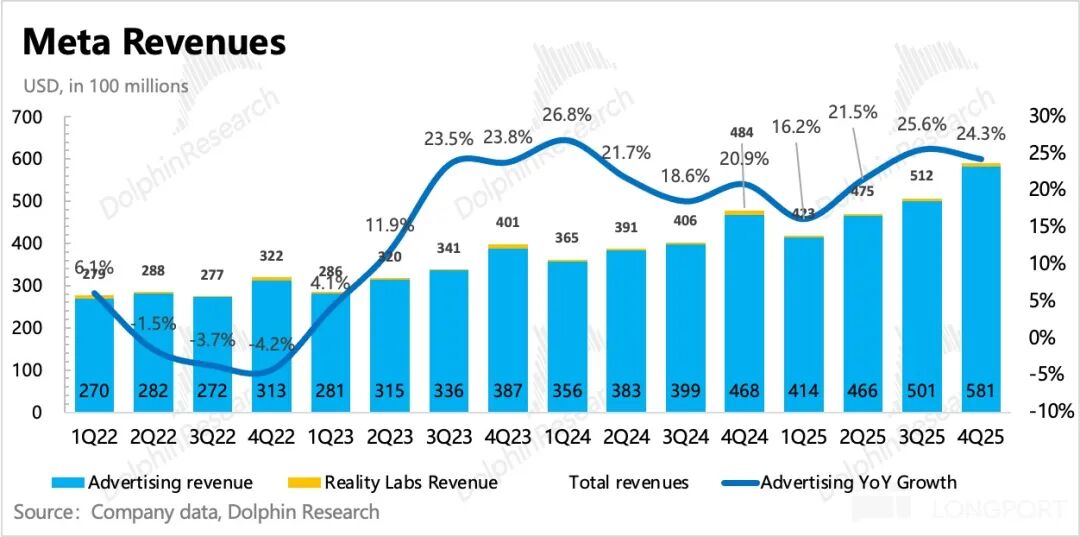

Meta's fourth-quarter revenue reached $59.9 billion, accelerating to 24% year-over-year growth (23% on a currency-neutral basis), exceeding seller expectations and aligning with buyer expectations.

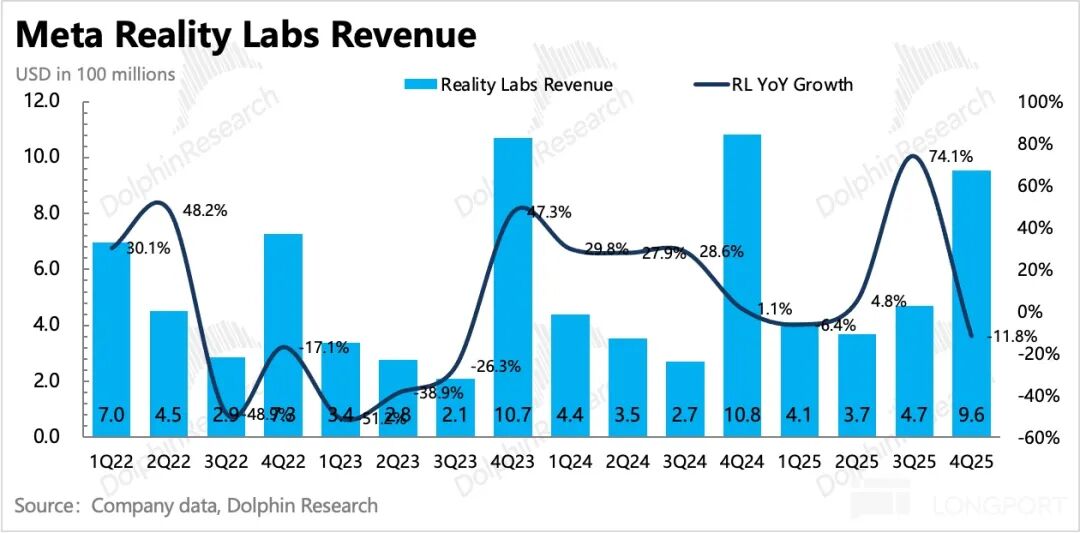

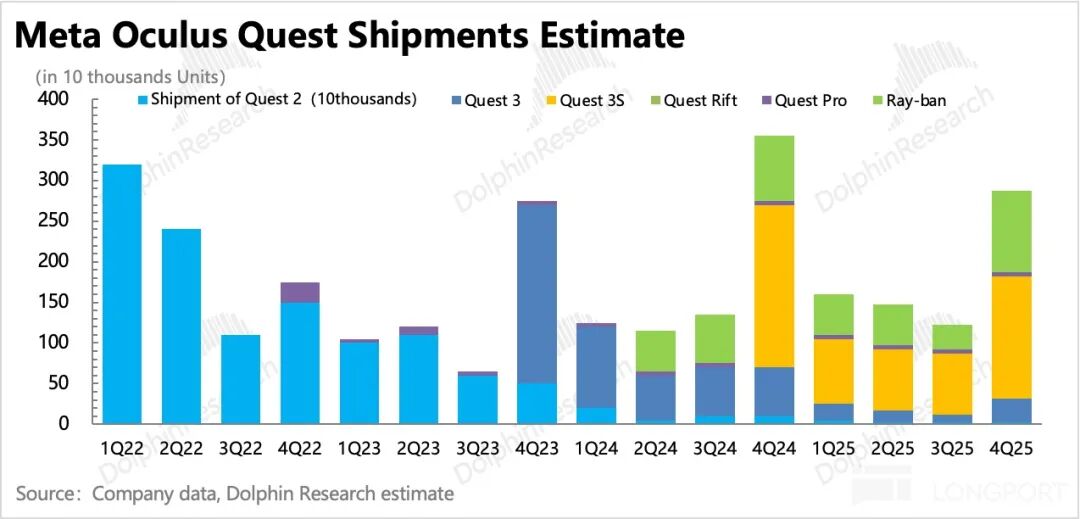

This high growth is primarily attributed to Meta's strengthening user quality metrics, such as engagement time and DAU (Daily Active Users) stickiness, underpinned by products like Reels, driving sustained growth in its advertising business, which accounts for 98% of revenue. While new VR (Virtual Reality) products (Quest 3S and next-gen Ray-Ban AR smart glasses) have launched, their high costs and lack of content have limited their immediate impact.

First-Quarter Revenue Guidance: Meta management projects total first-quarter 2026 revenue between $53.5 - 56.5 billion, representing a 27 - 34% year-over-year increase, including a 4 percentage point positive impact from currency fluctuations. This guidance significantly exceeds the seller consensus of $51.5 billion. Given management's historically conservative outlook, first-quarter growth is likely to stabilize above 30%.

Breakdown by Business Segment:

1. Advertising Business: Driven by Reels and AI

For the advertising business, Dolphin Fan prefers to analyze trends in volume and price growth to better understand the current macro environment and competitive landscape.

1) Ad Impressions

Fourth-quarter ad impressions growth accelerated to 18%.

This stems from an expanding user base, with DAP (Daily Active People across Meta's app suite) accelerating to 7% year-over-year growth. Additionally, recent quarters indicate accelerated monetization of Reels ads. Dolphin Fan estimates that average ad impressions per user grew by 10% year-over-year in the third quarter, a significant acceleration.

Historically, during periods of stable app type composition, Meta typically avoids excessively increasing ad load during periods of rising ad prices (driven by favorable macro conditions and advertiser demand) to prevent degrading user experience. Ad load increases typically occur during periods of declining ad prices to boost revenue.

Currently, we are witnessing a rare period of simultaneous growth in both advertising revenue and ad impressions per user. In the fourth quarter, ad impressions growth accelerated across all regions, particularly in Asia. Dolphin Fan attributes this primarily to increased consumption of Meta Reels short videos (with Reels content now accounting for half of Instagram's time spent), as short video ads naturally have higher fill rates, structurally elevating the group's average.

Increased short video ad penetration naturally suppresses overall ad price growth. Additionally, ad prices are influenced by macro conditions and competitive dynamics. However, it's challenging to determine in the fourth quarter whether ad price growth slowdowns were affected by these latter factors.

Starting this week, Threads will begin commercialization, rolling out ads globally to all users. Advertisers can directly place ads through the Advantage+ automated ad system, including on Threads. Currently, Threads boasts over 400 million monthly active users and 140 million daily active users, with a stickiness rate of 35%, comparable to other Meta-owned social platforms.

2. VR: Business Adjustment and Contraction

Fourth-quarter Reality Labs revenue reached $960 million, a 12% year-over-year decline. Last year, Quest 3S's initial shipment coincided with Christmas, driving a sales peak.

When excessive investments once again incited shareholder backlash, Reality Labs became a direct target for group-level cost-cutting and efficiency improvements. Previous media reports suggest $3 billion in cost savings for 2026. While this remains a drop in the bucket regarding loss reduction, it reflects the group's commitment to organizational efficiency.

II. Unavoidable Short-Term Profit Pressures

Since last quarter, mismatches between production and revenue have started to affect results. In the fourth quarter, total operating expenses increased by 41%, accelerating further from the third quarter, and significantly weakening profitability. The fourth-quarter operating profit reached $24.7 billion, with a profit margin declining to 41%, a year-over-year contraction of 7 percentage points. Given this year's Opex and Capex levels, total revenue must grow by over 21% to ensure year-over-year growth in operating profit.

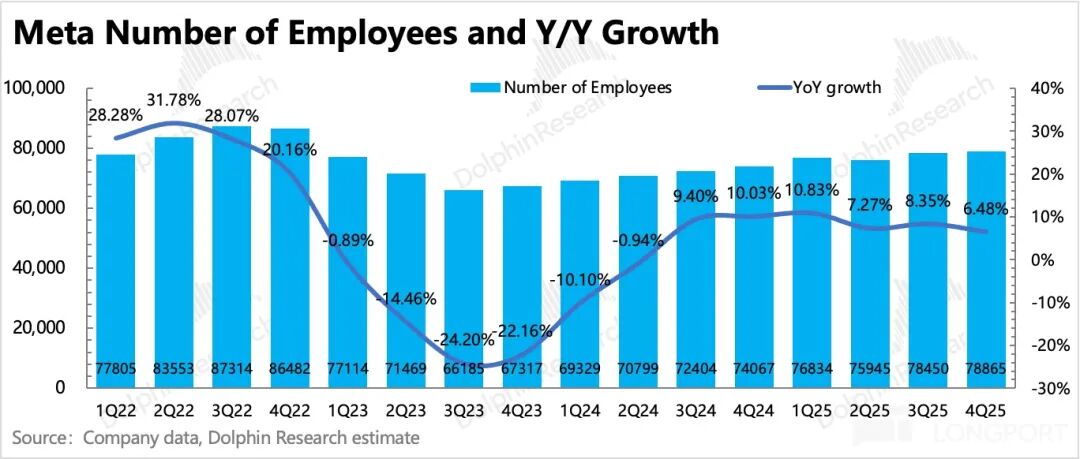

The fourth-quarter headcount remained largely flat quarter-over-quarter, with only 15 new hires. Excluding sales expenses, research and development (R&D) and general and administrative (G&A) expenses continue to grow rapidly, driven by high costs for AI R&D talent and legal expenses such as penalties.

Specifically, R&D expenses increased by 41%, while administrative expenses surged due to legal expenses, personnel costs, fines, and other factors. Although the final revenue growth was impressive, the profit of $23.7 billion only saw a year-on-year increase of 4.9%. According to Dolphin Research's estimates, it is expected to further impact profit margins by 5 - 6 percentage points in 2026.

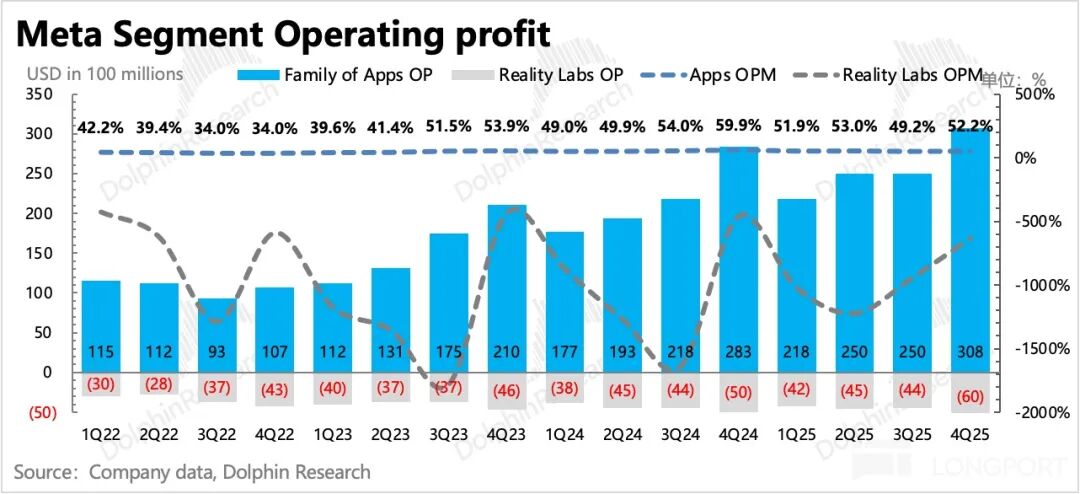

When examining operating profits by business segment, the sources of losses become more apparent. Subsequent margin pressures will primarily manifest in advertising revenue from the main APP catering to entire families, along with sporadic other income streams.

Capital expenditures reached $22.1 billion in the fourth quarter, continuing to increase by nearly $3 billion sequentially. The

This report is crafted exclusively for the purpose of providing general and comprehensive data. It is intended for the users of Dolphin Research and its affiliated entities, serving as a source for general reading and data reference. It is crucial to note that this report does not factor in the specific investment objectives, preferences for investment products, risk tolerance levels, financial circumstances, or unique needs of any individual recipient. Prior to making any investment decisions based on the content of this report, investors are strongly advised to consult with independent professional advisors. Any individual who makes investment decisions relying on or referring to the content or information presented in this report does so at their own full risk. Dolphin Research shall not be held accountable for any direct or indirect liabilities or losses that may occur as a result of utilizing the data contained within this report. The information and data presented in this report are sourced from publicly available materials and are provided solely for reference.

Dolphin Research makes every effort to ensure the reliability, accuracy, and completeness of the relevant information and data, but it does not offer any guarantees in this regard. Under no jurisdiction should the information mentioned or views expressed in this report be considered or interpreted as an offer to sell securities, an invitation to purchase or sell securities, or as advice, solicitation, or a recommendation concerning relevant securities or related financial instruments. The information, tools, and data in this report are not intended for, nor are they to be distributed to, jurisdictions where such distribution, publication, provision, or use would violate applicable laws or regulations. Additionally, they are not meant for citizens or residents of jurisdictions where this would lead to Dolphin Research and/or its subsidiaries or affiliated companies being subject to any registration or licensing requirements.

This report is a reflection of the personal views, insights, and analytical methods of the relevant creators only. It does not represent the official stance of Dolphin Research and/or its affiliated entities.

This report is produced by Dolphin Research, and the copyright is exclusively owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual is permitted to (i) produce, copy, replicate, reproduce, forward, or distribute in any form whatsoever, any copies or reproductions of this report, and/or (ii) directly or indirectly redistribute or transfer it to any other unauthorized persons. Dolphin Research reserves all related rights.