20-Day Lightning Inquiry: Tencent-Backed AI Chip Company Rushes Toward IPO

![]() 02/12 2026

02/12 2026

![]() 428

428

Author | Zhang Lianyi

With cumulative losses of 5.1 billion yuan over three years and Tencent contributing over 70% of revenue, can this domestic AI chip 'unicorn' with a 1.4% market share sustain its 20 billion yuan valuation?

On February 11, the Shanghai Stock Exchange's official website updated: Shanghai Enflame Technology Co., Ltd.'s IPO review status on the STAR Market changed to 'inquiry initiated.'

From IPO application acceptance on January 23 to entering the inquiry phase, this unicorn in the cloud AI chip sector took only 20 days. Following standard procedures, if Enflame Technology smoothly responds to the inquiry, its next step will be to appear before the review committee. As the earliest established yet latest to list among China's 'Four Little Dragons' of domestic GPUs, Enflame is rapidly catching up to capitalize on the market window.

According to the plan, Enflame Technology aims to raise 6 billion yuan for the R&D and industrialization of fifth- and sixth-generation AI chip series products, as well as advanced AI hardware-software collaborative innovation projects.

This is Enflame's 'blood transfusion' plan for itself, as well as its commitment and gamble to the capital market.

01

Tencent's Seven-Year Marathon

Founded in March 2018, Enflame Technology is the most veteran yet latest to go public among the 'Four Little Dragons' of domestic GPUs.

The core founding team behind Enflame Technology hails from AMD.

Zhao Lidong, Founder of Enflame Technology

Zhao Lidong, Founder of Enflame Technology

One of the founding members, Zhao Lidong, serves as Chairman and CEO of Enflame Technology. A graduate of Tsinghua University's Wireless Communication Department (Class EE85) with a professional background, he later joined AMD to lead R&D of core IP such as CPUs and GPUs.

Subsequently, he joined Unisplendour Corporation, where he was responsible for semiconductor investment-related matters.

Another founding member, Zhang Yalin, serves as COO and previously worked with Zhao Lidong at AMD for five years, with Zhao serving as his direct supervisor. This likely explains why these two tech luminaries came together.

Thanks to their impressive backgrounds, Enflame has completed multiple funding rounds in nearly eight years since its establishment, backed by over 20 investment institutions. From renowned financial investors like ZhenFund and CICC Capital to industrial and local government forces such as the National Integrated Circuit Industry Investment Fund, Shanghai State-owned Investment, Wuyuefeng Capital, and Chengdu State-owned Assets, as well as industrial groups like Tencent and Meitu, its shareholder lineup spans 'national teams,' local state-owned enterprises, market-oriented VCs, and industrial capital.

Throughout these funding rounds, Tencent has been a consistent presence.

Enflame Technology's Shareholding Structure

Enflame Technology's Shareholding Structure

Starting from the Pre-A round, Tencent has continuously participated in every key funding round for Enflame. To date, Tencent Technology and its concerted action party, Suzhou Paiyi, collectively hold a 20.26% stake in Enflame Technology, firmly securing its position as the largest institutional shareholder. Yao Leiwen, Managing Director of Tencent Investments, has also joined Enflame's board of directors, becoming an important member of its strategic decision-making layer.

According to the '2025 Hurun Global Unicorn List,' Enflame Technology ranks 395th with a corporate valuation of 20.5 billion yuan.

Behind this valuation lies the need for product support.

While domestic GPU manufacturers generally opt for the GPGPU route compatible with NVIDIA's CUDA ecosystem, Enflame Technology has chosen a more challenging path.

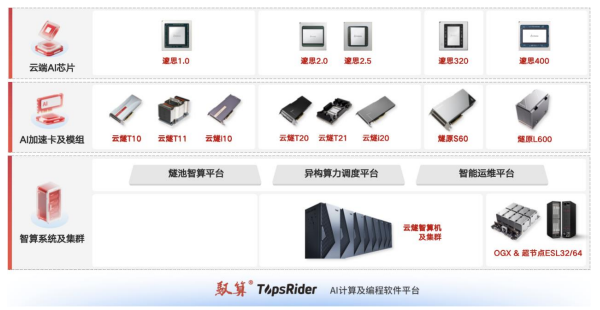

Based on its proprietary instruction set, Enflame independently developed the GCU-CARE accelerated computing unit and GCU-LARE inter-chip high-speed interconnection technology. At the software level, it has built a complete AI computing and programming platform—'TopsRider.'

This non-GPGPU architecture achieves higher operational efficiency in specific scenarios, but at the cost of building a new software ecosystem from scratch. This is the underlying reason for Enflame's consistently high R&D investment.

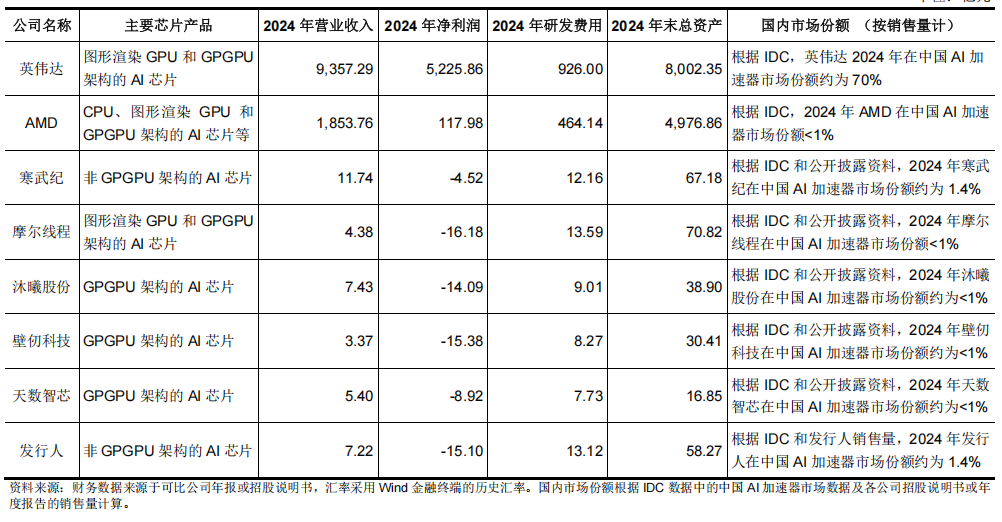

Comparison of Enflame Technology's Operating Performance with Peers

Comparison of Enflame Technology's Operating Performance with Peers

According to Enflame, in 2024, it sold 38,800 AI accelerator cards and modules, capturing approximately 1.4% of China's AI accelerator card market. Its third-generation inference accelerator card, the 'Enflame S60,' which entered mass production in the second half of 2024, received orders for over 100,000 units.

On July 27, 2025, at the World Artificial Intelligence Conference, Enflame Technology unveiled its fourth-generation training-inference integrated AI chip, the Enflame L600.

Featuring 144GB of storage capacity, 3.6TB/s of storage bandwidth, 800GB/s of interconnection bandwidth, and supporting FP8 low-precision computing, Enflame claims it 'rivals NVIDIA's H20 in computational performance and significantly surpasses it.' This marks Enflame's direct charge into the high-end market.

According to the roadmap, the fifth-generation AI chip is expected to launch in 2027, with the sixth-generation product slated for 2028. This means Enflame is stockpiling ammunition for the technological competition over the next three years.

Enflame Technology's Product and Service Matrix

Enflame Technology's Product and Service Matrix

In this 6 billion yuan funding round, Enflame Technology will also focus on the R&D and industrialization of fifth- and sixth-generation AI chip series products, as well as hardware-software collaborative innovation projects.

02

High Growth and High 'Blood Loss'

Like many startups, Enflame Technology faces the paradox of soaring revenue and persistent losses.

According to Enflame's prospectus, from 2022 to 2024, its revenue surged from 90.1038 million yuan to 722 million yuan, with a compound annual growth rate of 183.15%. In the first three quarters of 2025, this figure continued to climb to 540 million yuan.

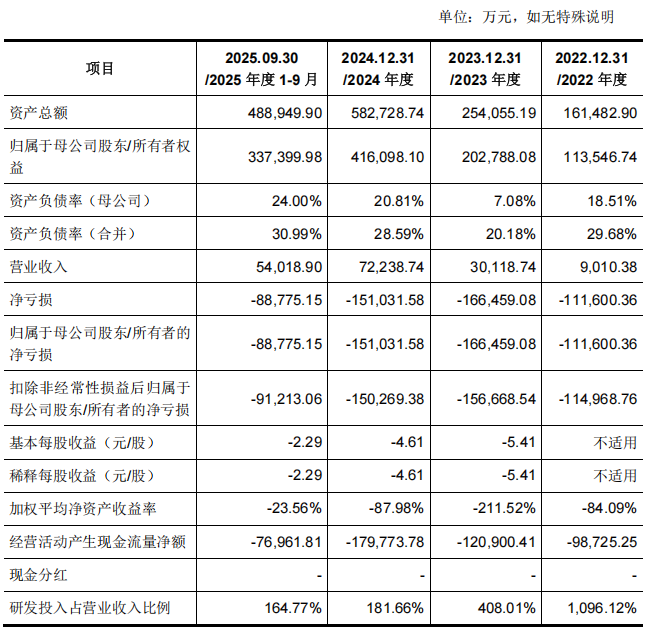

Enflame Technology's Key Financial Performance

Enflame Technology's Key Financial Performance

However, the profit picture tells a different story: cumulative net losses during the reporting period reached 5.179 billion yuan, with 888 million yuan lost in just the first three quarters of 2025.

R&D investment acts as a 'money pit,' devouring revenue. In 2024, the R&D expense ratio stood at 181.66%, remaining as high as 164.77% in the first three quarters of 2025.

The company also lacks self-sufficiency in generating cash. From 2022 to the first three quarters of 2025, the net cash flow from operating activities Cumulative (cumulatively) reached -4.764 billion yuan and never turned positive. The company explains this by citing large-scale inventory and prepayment buildups due to key material stockpiling.

Nevertheless, in its prospectus, Enflame Technology states that based on factors such as its current order backlog, product delivery schedules, and R&D plans, it expects to reach the breakeven point as early as 2026.

Enflame Technology's Revenue by Business Segment

Enflame Technology's Revenue by Business Segment

From a revenue structure perspective, AI accelerator cards and modules constitute the company's primary revenue source.

However, it's worth noting that since 2023, Enflame Technology's production and sales ratio for AI accelerator cards and modules has generally been on a downward trend, declining from 99.46% in 2023 to 78.53% in 2024. In the first three quarters of 2025, this ratio further dropped to 69.48%.

The company attributes this to proactive stockpiling in anticipation of customer procurement demands in the fourth quarter of the year, leading to a lower production and sales ratio compared to the full-year 2024 level.

Additionally, affected by the iterative upgrades of AI accelerator cards, the gross margin of this business has fluctuated significantly. From 2022 to 2024, the gross margins for this business were 46.25%, 15.51%, and 40.78%, respectively.

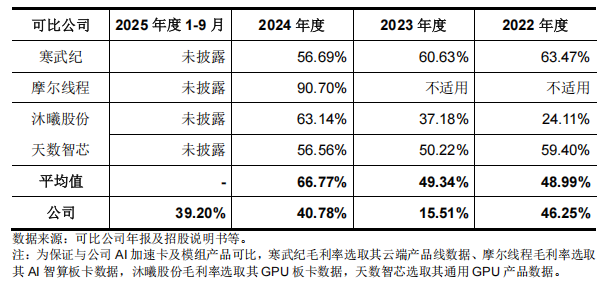

Comparison of Enflame Technology's Gross Margins with Peers

Comparison of Enflame Technology's Gross Margins with Peers

Meanwhile, Enflame Technology's gross margin for AI accelerator cards and modules lags behind the industry average. In 2024, the industry average gross margin stood at 66.77%, significantly higher than Enflame's 40.78%.

At the business level, Enflame Technology is deeply tied to Tencent.

From 2022 to the first three quarters of 2025, sales to the top five customers accounted for over 90% of Enflame's total revenue. Among them, sales to Tencent Technology skyrocketed from 8.53% in 2020 to 33.34% in 2023, 37.77% in 2024, and reached 71.84% in the first three quarters of 2025.

This means that for every 100 yuan in revenue Enflame generates, 71 yuan comes from Tencent.

This is both sweet nectar and deadly poison. Stable orders keep Enflame afloat, but over-reliance on a single customer casts doubt on its growth potential. The prospectus admits: 'It is expected that a relatively high proportion of sales to Tencent will continue for a certain period in the future.'

The predicament Cambrian Technologies faced after parting ways with Huawei looms large. Enflame may also need to prove to the market that it can survive without Tencent.

03

Capital Convergence of the 'Five Little Dragons'

With the AI large model craze and NVIDIA's products—as the computing infrastructure—gradually being closed off, the domestic substitutability of AI chips has become a major concern.

Against this backdrop, the 'Four Little Dragons' of domestic GPUs emerged, including Moore Threads, MetaX, Biren Technology, and Enflame Technology.

Among them, Enflame is the only vendor focus on (specializing in) cloud-based AI chips.

Since 2025, Moore Threads and MetaX have successively listed on the STAR Market. On January 2, 2026, Biren Technology rang the bell at the Hong Kong Stock Exchange, becoming the 'first domestically produced GPU stock listed in Hong Kong.' Three of the four little dragons have now completed capitalization.

Moore Threads' Stock Price

Moore Threads' Stock Price

Peer performance in the secondary market has fueled imagination: Moore Threads, with a pre-IPO valuation of 30 billion yuan, saw its market capitalization briefly surpass 400 billion yuan after listing. MetaX's market cap once exceeded 300 billion yuan post-listing.

Enflame's valuation in its latest funding round stood at around 20 billion yuan. The market awaits its capital market debut.

Twenty days of lightning inquiry, a 6 billion yuan funding blueprint, billions in cumulative losses, and 71.84% reliance on Tencent.",