Top 10 XR Technologies to Watch in 2025 | Annual Feature

![]() 02/12 2026

02/12 2026

![]() 519

519

Technological Wave Driven by AI and AR Boom

By VR Gyroscope Wan Li

If there’s an idiom to describe the XR industry in 2025, I’d choose 'overwhelming'—in a good way.

This year, XR hardware has seen a surge in new releases, with a corresponding boom in underlying optical and interaction technologies, along with related trending events.

Against this backdrop, VR Gyroscope reviews and highlights the top 10 XR technologies that have captured attention in 2025. These technologies have demonstrated clear paths to breakthroughs over the past year and are profoundly shaping the design boundaries and industry outlook for XR products.

01

LCoS

In September 2025, Meta unveiled its first consumer-grade AR glasses, the Meta Ray-Ban Display, which achieved unexpected success. The product sparked a buying frenzy at launch and required reservations for in-store experiences for an extended period. In January, Meta announced a temporary halt to its overseas sales plan for the year to alleviate supply constraints in the U.S. market.

The Meta Ray-Ban Display stands as a prime example of AR glasses innovation in 2025, boasting numerous impressive technological features (contributing three major tech entries to this list).

The product employs a monocular LCoS + geometric waveguide near-eye display optical solution, with the display area located on the right lens, offering a resolution of 600×600 and a FoV of 20°. Additionally, the glasses feature an EMG wristband for interaction, a unique offering among similar products.

Let’s first examine LCoS, one of the current mainstream AR microdisplay solutions. Meta’s module supplier is OmniVision. Overall, LCoS offers several key advantages:

1. Mature full-color solution. LCoS is currently more mature than Micro-LED technology, especially in full-color display. Given Meta’s focus on manufacturability, LCoS was a logical choice. Its technological maturity also translates to cost advantages.

2. Continuous evolution. Some argue that LCoS lags behind Micro-LED in brightness and form factor, but upstream manufacturers continue to innovate.

Regarding power consumption, Micro-LED’s self-emissive nature erodes its power advantage over LCoS as APL increases. In terms of size, Appotronics recently released its latest module, the Dragonfly G1 mini, which has been refined to 0.2cc (monochrome). Finally, replacing LCD light sources with laser light sources represents LCoS’s latest technological direction, further enhancing its display performance and brightness.

TrendForce data indicates that, driven by the Meta Ray-Ban Display, LCoS’s market share in AR glasses will rise to 13% in 2026. The recently announced Shargee S1 also officially adopts Appotronics’ LCoS solution.

02

Array Waveguide

The application of array waveguide technology in the Meta Ray-Ban Display has significantly boosted its market attention.

Waveguides, known for their compactness and high transparency, are widely regarded as the ultimate optical solution for AR glasses. They can be categorized into surface relief grating waveguide (SRG), volume holographic waveguide (PVG), and array waveguide based on different technical routes. The first two rely on light diffraction, while array waveguide operates on light reflection.

Overall, array waveguide offers high optical efficiency, an order of magnitude better than other solutions. Data indicates that one-dimensional array waveguide achieves 5–10% optical efficiency, while two-dimensional versions reach around 5%. Additionally, array waveguide delivers superior display performance, with a large Eyebox and no rainbow artifacts seen in other solutions.

However, the primary limitation of array waveguide lies in manufacturing. Cold processing techniques are used for glasses fabrication, involving processes like mirror coating, bonding, and cutting, which result in relatively low yields. Meta’s array waveguide is supplied by Lumus and manufactured by Schott, with external estimates placing the cost per waveguide at $70–80.

Domestically, companies like LetinAR, Crystal-Optech, and Gudong Technology focus on array waveguide technology. In September 2025, LetinAR released its flagship two-dimensional array waveguide product, the “L2-S30.” The waveguide is just 0.8–1.2mm thick and weighs under 4g. Additionally, its modulation transfer function (MTF) remains above 0.4 at a high spatial frequency of 20PPD. LetinAR revealed that once module production reaches KK-scale, the target price will be set at $50.

03

EMG Wristband

The Meta Ray-Ban Display pairs with the Neural Band, an interaction wristband based on EMG technology that captures muscle signals and converts them into interactive commands.

Meta has been deeply involved in EMG technology for years, acquiring EMG developer CTRL-Labs in 2019. The non-retail Meta Orion, released in 2024, also featured an EMG wristband.

Currently, AR glasses offer various interaction methods, including voice, ring, app, and vision-based gesture controls. Among these, EMG wristband interaction stands out as the most futuristic, offering several advantages:

1. High privacy: Users can access menus with their hands in their pockets. 2. Versatility: Functions smoothly in darkness, silent mode, and other scenarios. 3. Handwriting input support with decent efficiency (currently in beta and limited to English). This demonstrates its potential for complex interactions, laying the groundwork for future gaming applications.

However, EMG wristbands currently face some challenges. First, they have a steeper learning curve. Meta designed an entirely new set of gestures for the wristband, such as double-tapping the middle and thumb fingers to wake/sleep the screen, swiping the thumb across the index finger to scroll, and pinching the thumb and index finger while rotating clockwise to increase volume. Users need time to adapt initially.

Second, estimates suggest the Neural Band’s BOM cost may range from $50–150. With the Meta Ray-Ban Display priced at $799, the EMG wristband significantly raises the overall cost.

Beyond Meta, more vendors are recognizing the potential of EMG wristbands. At CES 2026, Goertek showcased an AR glasses reference design integrated with an EMG neural wristband. Additionally, Willin Technology released a neural wristband this year.

04

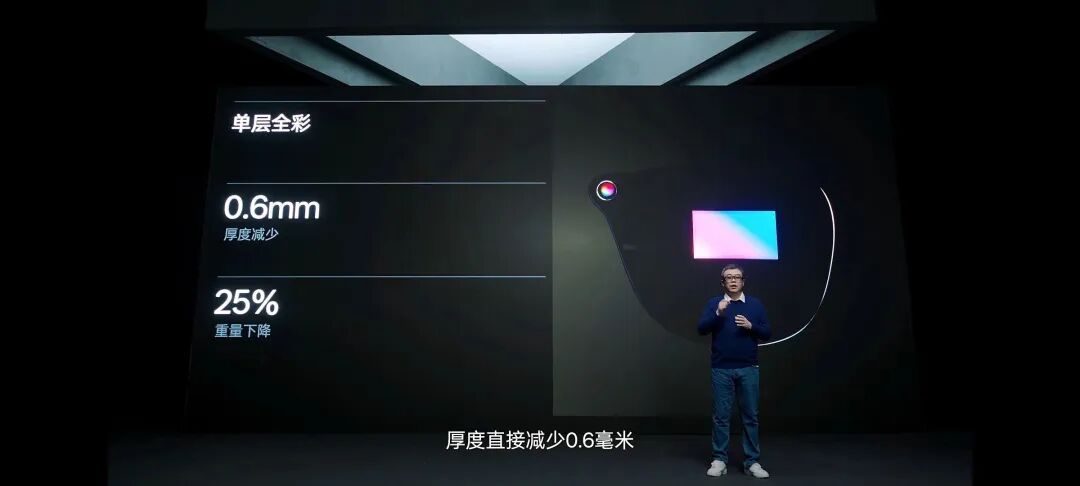

Full-Color Micro-LED

Most current standalone AR glasses use monochrome microdisplays, primarily due to Micro-LED’s technological maturity. However, full-color displays represent an inevitable long-term trend, with major Micro-LED manufacturers making significant strides in this area last year.

JBD: Launched the 0.2cc Hummingbird II color light engine in September, based on a 0.1-inch tricolor X-Cube combination scheme. Weighing just 0.5g and 50% smaller than its predecessor, it became the smallest mass-produced color light engine. Its mechanical length was also reduced from 11.99mm to 8.57mm, greatly enhancing design flexibility for temple structures.

Raysolve: Focuses on quantum dot photolithography for full-color displays. Its latest PowerMatch 1 series features a 0.13-inch screen with 4µm pixel pitch and a peak full-color brightness of 500,000 nits (under white balance). The company also developed a full-color light engine measuring just 0.18cc.

Hongshi: Released the Aurora XC6, a next-gen full-color light engine, in September. Based on quantum dot color conversion (QDPR) technology, it achieves a volume of 0.35cc, brightness exceeding 2.5 million nits, and efficiency of 8LM/W. The company is also exploring single-panel full-color solutions using a proprietary hybrid stacking structure. In May, it announced mass production of single-green Micro-LED screens and previewed full-color module mass production in the second half of the year.

NuVision: Showcased a full-color microdisplay based on the VSP (vertical stacking pixel) route at an expo. The 0.13-inch model offers a resolution of 640×480 and peak brightness reaching millions of nits.

Image Source: JBD

05

Dual-Eye Waveguide

Dual-eye waveguide technology uses a single light engine to drive waveguide panels displaying content for both eyes, achieving binocular display. Visually, the waveguide appears as a single dual-eye panel with a central coupling area. The popular Rokid Glasses employ this design, with waveguides sourced from Optinvent.

Dual-eye waveguide offers several advantages: 1. Achieves binocular display with just one light engine, saving one compared to conventional binocular glasses. 2. Eliminates the need for binocular fusion—a production challenge where two light engines must precisely align visuals for consistency—as this technology avoids it entirely.

However, dual-eye waveguide currently has limitations. For instance, both screens display identical content, preventing 3D playback via parallax. Additionally, the single-panel structure gives the glasses a clunky frontal appearance, requiring design compromises.

Among currently available products, besides Rokid Glasses, the Xuanjing M5 and M6, INMO GO3, and the recently released Shargee S1 also adopt dual-eye waveguide technology. Shargee S1’s waveguide comes from Gudong Technology and is based on the PVG route.

On a side note, the waveguide industry currently has two prominent “cost-saving” approaches: dual-eye design and volume holographic waveguide. While volume holographic waveguide faces material challenges, its manufacturing process is relatively simple. Here’s some data from Gudong’s official website:

- Array waveguide full-color single panels cost approximately ¥400–500. - Surface relief grating (SRG) types: Imprinted monochrome waveguides cost ¥250–400 per panel, while etched monochrome waveguides range from ¥350–500. - Gudong’s self-developed volume holographic waveguide achieves a breakthrough pricing of ¥150–200 per panel.

An LCoS + PVG waveguide dual-eye AR glasses optical solution could reduce terminal product prices to the ¥1,500–2,000 range.

Many budget-friendly or value-oriented AR glasses expected in 2026 will likely adopt dual-eye waveguide solutions.

Image Source: Optinvent

06

Silicon Carbide Waveguide

This AR optical technology route, popularized by Meta, was first applied in the 2024 Meta Orion.

Waveguides can be categorized by material, such as resin or glass waveguides. Silicon carbide represents a novel material in this space.

Silicon carbide offers several excellent properties. Its refractive index of 2.7 far surpasses materials like high-index glass, lithium niobate, and resin. This high refractive index reduces light attenuation during propagation, enabling larger FoV designs. The Meta Orion achieves an impressive 70° FoV.

Additionally, silicon carbide’s low density allows for lighter waveguide panels, effectively reducing glasses weight. During the February 2026 SPIE event, AAC and Dispelix showcased a silicon carbide waveguide module with a 50° FoV and a waveguide weight of just over 3g.

Silicon carbide also boasts good thermal conductivity and superior rainbow artifact control compared to other materials.

However, silicon carbide waveguides are still maturing industrially. Tao Hongyan, General Manager of AAC’s XR Business, estimates commercialization will take around four years. Moreover, silicon carbide waveguides are costly—Dr. Lu Min, Chairman of Zhenjing Semiconductor, stated that an 8-inch silicon carbide wafer costs ¥10,000, translating to a waveguide cost of ¥2,000 per pair of binocular silicon carbide waveguide glasses.

Additionally, current mainstream nanoimprint manufacturing processes cannot fully leverage silicon carbide’s high refractive index, requiring an upgrade to etching techniques.

Overall, silicon carbide waveguides remain at the frontier of exploration, though domestic products like those from Chengmu Technology and Mode Micro-nano have already adopted this technology.

Chengmu Technology's Silicon Carbide Waveguide Glasses, Image Source: VR Gyroscope

07

Etching Process

This is the latest optical waveguide processing technique, with mainstream domestic optical waveguide manufacturers such as GN Optoelectronics, Goertek, AAC, and Kunyou already beginning to adopt it.

The magic of optical waveguides comes from their nano-scale grating structures inside, which guide light to propagate through the lens and transmit it to the human eye. To process these gratings, nanoimprinting is the mainstream technique in the industry, where a resist is spin-coated onto a substrate, and a template engraved with grating structures is then imprinted onto the substrate before demolding and fixation.

Nanoimprinting offers low cost, high efficiency, and scalability, but it has the following drawbacks: the grating structures are located within the imprint resist, leading to material refractive index limitations; nanoimprinting may result in processing defects due to mold wear, ultimately affecting waveguide performance; and long-term use stability is relatively poor.

Building on this, the etching process has emerged. As the name suggests, equipment such as EBL and DUV is used during waveguide processing to directly complete grating fabrication on the substrate (etching is also used in the master mold fabrication for nanoimprinting). Its advantages lie in high processing precision and reliability, which translate to better display effects in glasses. Additionally, the etching process can be used to process substrate materials with higher refractive indices, laying the foundation for single-piece full-color waveguides. However, since the current volume of AR glasses has not yet increased significantly, etching cannot maintain cost advantages through large-scale production.

Many significant events occurred in 2025. For example, in November, AAC acquired Dispelix, with the company targeting single-piece full-color SRG waveguides; Sunny Optics and Goertek Optics merged, and Sunny Optics purchased a DUV lithography machine in July, likely to deploy etching-based optical waveguides and meet future explosive market demand. For end-user products, Meta Orion and Thunderbird X3 Pro utilize the etching process.

Image Source: Thunderbird Innovation

08

Glasses Payment

Glasses payment is one of the most attention-grabbing AI glasses application scenarios in 2025, with products like Thunderbird V3, Xiaomi AI Glasses, Rokid Glasses, and Quark AI Glasses S1 already supporting this feature.

In terms of usage, users simply need to look at the payment QR code, then issue payment instructions, specify the amount, and confirm the payment to complete the entire process. Thunderbird X3 Pro takes this a step further by automatically acquiring the payment amount when looking at a contactless payment device, requiring only a "confirm payment" verbal command from the user.

Currently, Ant Group is the sole technology provider for glasses payment in China, with rumors suggesting that WeChat is collaborating with Rokid to launch a WeChat glasses payment solution this year.

From a user experience perspective, glasses payment is a trendy and efficient payment method. For example, it frees up hands when scanning codes to pay for parking, making it highly practical. Of course, it remains a relatively niche payment method, and some users may experience an awkward adjustment period when first using it.

In the long run, integrating payment functionality into glasses means that platforms have preliminary completed (preliminarily completed) a key part of internet infrastructure construction, which will further spur the development of various high-quality paid applications and content (such as visual shopping), thereby expanding the glasses content ecosystem.

09

Glasses Main Control Chips

The Snapdragon AR1, released in 2023, is currently the most widely used AI glasses chip, without exception. Mainstream glasses with cameras all adopt this solution, with the Ray-Ban Meta being a representative product.

With the acceleration of the AI glasses industry, a notable phenomenon in 2025 is the emergence of many new glasses chip solutions in the market. Some are comprehensive upgrades based on the AR1, while others serve as cost-effective alternatives to the Snapdragon AR1.

In June of last year, Qualcomm released the AR1+ Gen 1, an upgraded version of the AR1, featuring several major improvements: a 26% smaller size, enhanced ISP, 7% lower power consumption, and improved NPU performance. The chip is equipped with Qualcomm's third-generation Hexagon NPU, capable of directly running 10B-parameter SLM models locally.

In 2025, many domestic companies also released main control chips for AI glasses, such as the BesTechnic 2800, Allwinner V821, and Ingenic T32ZN.

Notably, domestic main control chips are becoming the choice of more and more manufacturers. For example, the Li Auto AI Glasses, LLVision Leion Hey2, and L’Atitude 52°N all adopt the BesTechnic 2800. Additionally, the Allwinner V821 is a popular choice among "Huaqiangbei" products, driving AI glasses prices into the two-hundred-yuan range.

In other developments, BesTechnic revealed that it is developing a new generation of AI glasses chip, the BES6000, which is expected to enter the sampling phase in the first half of this year.

10

Gaussian Splatting

Compared to AI and AR glasses, notable new technologies in the VR and MR sectors in 2025 appear relatively scarce, likely due to the industry's declining heat (popularity) and fewer new hardware releases. If one must identify a representative technology in the VR and MR industry, Gaussian Splatting would be a key term.

Gaussian Splatting is a computer graphics technique used for 3D scene representation and novel view synthesis. It describes the geometry and appearance of a scene using a large number of 3D Gaussian distributions, then projects these Gaussians into screen space for superimposed rendering to generate images. Unlike traditional triangular meshes, Gaussian Splatting does not rely on explicit surface structures but instead uses a continuous, volumetric point representation.

In short, Gaussian Splatting is a more efficient 3D reconstruction solution. Compared to photogrammetry and NeRF, it achieves high-quality generation results and enables real-time rendering, opening up new possibilities for the 3D ecosystem.

2025 also marked the widespread application of Gaussian Splatting, with technologies like Meta VR's 3D scanning application Hyperscape, Vision Pro's Persona, and 2D-to-3D conversion all utilizing it. Additionally, many large-scale VR projects employed Gaussian Splatting to replicate real-world offline scenes, such as the Liangzhu VR Large Space.

Innovusion is a well-known domestic provider of 3D reconstruction solutions, with products including handheld 3D scanners, point cloud processing software, and 3D content production platforms. Its latest product, the Lingshi P1, is a 3D spatial camera that integrates Gaussian Splatting and SLAM technologies to reproduce real spaces as vivid 3D models.

Source: Innovusion

Conclusion

Looking back at these XR key technologies repeatedly mentioned in 2025, it is evident that the industry's focus is undergoing subtle yet clear changes: from breakthroughs in single-parameter performance to system-level synergy; from technological demonstrations to user experience and scalability. The technological trends mentioned above collectively point toward a lighter, more stable, and more usable XR terminal form.

Looking ahead to 2026, the technological foundations laid last year will continue to shine brightly in the new year.