OpenAI's Supply Cut, Reigniting the Billion-Dollar Market Battle for Domestic Large Models

![]() 07/03 2024

07/03 2024

![]() 572

572

In the early hours of June 25, Beijing time, OpenAI users in multiple regions received an official email. The email stated: "The API traffic you are using originates from a region that is currently not supported by OpenAI. We will take additional measures starting July 9th to prevent API access from regions not on our list of supported countries and regions."

An API, or Application Programming Interface, allows developers to greatly simplify application development by embedding OpenAI's models directly into company tools and products.

Previously, domestic users accessed OpenAI's API services primarily through two channels: one was directly obtaining the API from OpenAI officially through a proxy, with fewer restrictions; the other was through Microsoft Azure, which had certain requirements for corporate qualifications. Therefore, many domestic AI development companies mostly used the former directly. For Chinese users, the Microsoft interface has not yet been affected, while the official interface has been more significantly impacted.

What are the reasons behind OpenAI's supply cut to multiple countries, including China? What impact has this "supply cut" had on Chinese AI enterprises? Will future AI diverge and take different paths as a result?

Is OpenAI no longer "open," a deliberate move or a necessity?

In fact, from a commercial perspective, OpenAI has always been a closed-source AI, with the source code for models like GPT-3.5 and GPT-4 not being publicly released. Additionally, OpenAI has always had strict policies regarding the registration and use of ChatGPT, only later relaxing its registration requirements due to the rise of models like Claude.

Regarding this supply cut, the company has considerations from both a regulatory and compliance perspective, as well as competitive concerns. On one hand, a draft rule issued by the U.S. Department of the Treasury on June 22 requires oversight of U.S. investments in critical technology areas, including semiconductors, quantum computing, and artificial intelligence. Therefore, under the backdrop of increased U.S. oversight of technology investments in China, OpenAI, as a U.S. company, must comply with relevant regulations.

Moreover, the cybersecurity background of newly appointed board member Paul M. Nakasone, a retired U.S. Army general, may have influenced OpenAI's decision-making, pushing for stricter requirements in compliance and data security.

On the other hand, OpenAI's discontinuation of API access to China reflects the concerns of American large model companies towards Chinese AI.

According to news reports, on May 29th, the AI team at Stanford University released a multi-modal large model called Llama3-V, claiming that it could train a model comparable to GPT4-V for only $500. This model quickly gained popularity on social media and even briefly topped the Hugging Face (global model ranking) homepage.

However, it was later revealed that this model was a plagiarized copy of the open-source model "MiniCPM-Llama3-V 2.5" developed jointly by Tsinghua University and Mianbi Intelligence in China. Subsequently, the two authors from the Stanford team formally apologized to the Mianbi MiniCPM team on social platforms and removed the model.

In the early days, it was often domestic AI companies that copied ChatGPT's shell to make money in China, but now the situation has reversed, with American research teams "reverse-copying" Chinese AI. At a micro level, this is academic misconduct by some American AI researchers, but it reflects a fact: the AI gap between China and the United States is gradually narrowing.

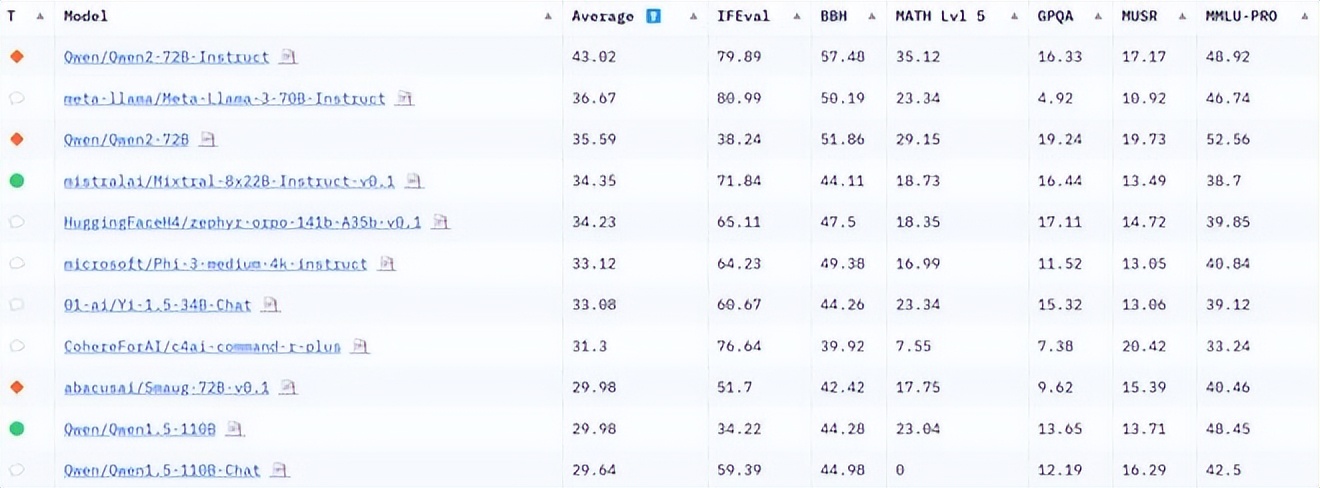

According to the Hugging Face large model ranking list released on June 28th, Alibaba's newly open-sourced Qwen2-72B model outperformed Meta's Llama-3 model and Mistralai's Mixtral model, becoming the top-ranked open-source model. Meanwhile, Yi-1.5-34B-Chat from Lingyiwanwu ranked 7th, with Qwen1.5-110B and Qwen1.5-110B-Chat ranking 10th and 11th respectively. As Clem, the co-founder and CEO of Hugging Face, said, "Chinese open-source models dominate overall."

Additionally, the "Beijing AI Industry Large Model Innovation Application White Paper" released in 2023 mentioned that while China still lags in areas like high-end chips and basic software, it enjoys advantages in massive data resources and application scenarios, demonstrating stronger overall planning and coordination capabilities in industrial layout.

From this perspective, OpenAI's supply cut essentially stems from the narrowing AI gap between China and the United States, which made OpenAI feel a sense of "crisis." Therefore, it used the guise of "compliance" to restrict Chinese AI enterprises. After all, during the heyday of large models, China emerged with many

Price reductions and migration assistance, can domestic large models seize this "tremendous wealth?"

However, for truly independently developed domestic large models, OpenAI's ban on domestic interfaces means that a portion of customer demand will be left vacant in the market, turning this ban into an opportunity.

On the market level, AI concept stocks rebounded across the board on June 26th, led by video creation, multi-modal AI, AIGC concepts, and computing power leasing.

In terms of news, domestic large model companies have launched a combination of "price reductions + relocations" to capture this influx of orders:

On June 25th, Beijing Zhipu Huazhang Technology officially launched the "Special Relocation Plan for OpenAI API Users," providing OpenAI migration training, dedicated relocation consultants, and 150 million tokens for developers.

Subsequently, Alibaba Cloud officially stated that it is ready to take over domestic API users affected by OpenAI's supply cut. Alibaba will provide "Alibaba Cloud Bailian Dedicated Migration Services."

Baidu Intelligent Cloud Qianfan has launched the "Home Cloud · Domestic Large Model Inclusive Plan," providing zero-cost SDK migration tools and migration expert services to help domestic API users switch to large model platforms at no cost.

Tencent Cloud has also announced exclusive benefits for large model migration enterprise users. By July 31st, 24:00, newly migrated enterprise users can receive 100 million tokens for Tencent's Hunyuan large model free of charge. Tencent Cloud provides models like Hunyuan Pro and Standard, allowing users to choose freely.

Regarding the impact of this supply cut, Chen Tianchu, a researcher from the Computer System Architecture Lab at Zhejiang University, believes that most existing head applications are developed based on independently developed or domestic models. The unavailability of OpenAI's API services does not have a significant impact on application development. Currently, APIs integrated with domestic head models provide good service for daily Chinese tasks.

Therefore, for domestic companies that independently develop underlying models, OpenAI's ban can be considered a "big gift." After all, most developers' AI needs can also be met with domestic AI models, and domestic AI is often closer to the Chinese application environment, outperforming ChatGPT in specific areas like classical Chinese and dialects.

Where will China's AI go in the second half?

In fact, China's restrictions extend far beyond just large model interfaces. From early restrictions on underlying hardware like semiconductors and lithography machines to the current ban on application-end software, the United States has always been hostile towards China's AI development.

As one of the core racetracks for globalization competition in the next 20 years, AI is also a crucial battleground for technological innovation competition between China and the United States. In the past, the United States has long been in an advantageous position in the technology sector, allowing it to profit effortlessly in the previous round of competition. As the core racetrack for international competition in the next 20 years, AI represents not only the next generation of efficiency revolution but also a manifestation of national strength. The strong rise of China's AI industry undoubtedly poses a threat to the United States.

From this perspective, OpenAI's ban on China's API is an attempt to hinder the development of China's AI industry, prevent China from becoming a global leader in AI, and thereby maintain its technological advantage and seize the initiative in the second half of the competition.

However, China's development is not dependent on the will of other countries.

Currently, China's AI industry has formed a systematic and comprehensive lead in terms of development advantages and comprehensive layout. Data shows that as of 2019, China's AI patent applications exceeded 110,000, surpassing the United States' 80,000 and ranking first in the world. From 2018 to 2021, the world added a total of 650,000 new AI-related patents, with China, the United States, and Japan ranking in the top three. Among them, China accounted for 445,000, or 68.5%.

Behind the abundance of patent numbers lies the richness of application scenarios in the Chinese market. Both in terms of layout breadth and depth, China has formed a clear competitive advantage. At the same time, China's AI industry generally has obvious originality, occupying the dominant position in most innovative applications. With the accelerated implementation of scenario applications, the follow-up development momentum remains strong.

Taking large models as an example, in 2023, the fierce "Hundred Model War" promoted technological progress in domestic large models. In 2024, as the "Hundred Model War" comes to an end, the top six emerging large model startups have emerged (Zhipu AI, MiniMax, Dark Side of the Moon, Baichuan Intelligence, Lingyiwanwu, and Mianbi Intelligence), along with giants like Baidu Wenxin, Alibaba Tongyi, iFlytek Spark, ByteDance Doubao, Tencent Hunyuan, Huawei Pangu, and Kunlun Wei Tiangong AI, forming the first camp of "Thirteen Guardians," announcing that the basic stage competition of large models has come to an end, and the next phase will be the "implementation race."

Nowadays, both large AI companies and startups are focusing on the "implementation" of large models. Different foundational and vertical large models are developing differently, forming specialties in their respective areas of expertise. For example, Baichuan Intelligence emphasizes language cognition and advantages in scenarios like healthcare; Kimi stands out in long-text processing; Zhipu AI, in addition to its powerful technology, emphasizes inclusive concepts with a low threshold for developers...

At this crucial moment, platforms like DingTalk, ByteDance, and Alibaba Cloud have launched a "model selection" mode based on an open model, allowing developers to choose the most suitable large model for their application scenarios and seamlessly switch and quickly migrate, similar to a "distribution entry" for large models. This means that users have more options, and competition among foundational large models will only become more intense. After all, while generous migration incentives can attract developers, ultimately, what determines whether developers stay and use a model long-term is the performance of the AI large model.

According to data from GeekPark's large model evaluation report on June 24th, current AI models perform well in humanities subjects but poorly in subjects like mathematics and physics. Among nine large model products, only GPT-4o, Wenxin Yiyan 4.0, and Doubao scored above 60 points in mathematics.

From this perspective, domestic large models still need to continuously improve their capabilities in algorithmic optimization and data training in mathematical and physical aspects to better adapt to complex and diverse knowledge assessments and application scenarios. The new round of competition will no longer revolve solely around computing power and price, but rather a comprehensive contest in vertical application areas, which will only become more intense and exciting.

Therefore, for most domestic AI companies, OpenAI's "supply cut" is equivalent to voluntarily ceding the market, providing China's AI industry with an opportunity to continue independent innovation and development.

How to seize this opportunity and embrace this "tremendous wealth" will be a key consideration for major manufacturers going forward.

Source: Hong Kong Stock Research Society