API Limits, Revenue Slowdown: How Can iFLYTEK Succeed in the Second Half of the Large Model Journey?

![]() 07/09 2024

07/09 2024

![]() 620

620

Abstract: As OpenAI further tightens API usage restrictions in China, more challenges will fall on the shoulders of various vendors.

Among them, iFLYTEK also faces numerous issues.

On the one hand, despite several iterations, iFLYTEK's Spark large model still lags significantly behind OpenAI, the leader in the large model race, in terms of technology.

On the other hand, the large model market has just taken off but is already witnessing a price war, fueled by the intensifying competition and resulting survival anxiety.

In terms of revenue, the high growth of iFlytek has come to an abrupt halt since 2022. Accompanying this are the increasingly high levels of debt each year and the continuous government subsidies that serve as a financial lifeline for the company.

While the AI large model pie is tempting, there is still a lack of more refined scenario applications. Proprietary data will be crucial for subsequent iterations. Differentiation may be the first step before the prosperity of large models.

Here's the main text:

Although the AI and large model sectors have been overcrowded since last year, up until now, there has been no clearly defined, high-penetration product in China.

Among them, iFLYTEK is one of the most widely applied enterprises in the field of artificial intelligence, and it has invested heavily in its Spark large model in recent years.

Based on iFLYTEK's 2023 annual report disclosed on April 23, the total number of employees at the end of 2023 was 14,356, with technicians accounting for the largest proportion, totaling 8,908, or 62.05% of the total employees.

The high proportion of technicians also reflects iFLYTEK's emphasis on artificial intelligence.

However, iFLYTEK's journey in the AI sector has not been smooth. Like most competitors, its performance and operational status in recent years indicate that large model research and development and commercialization are arduous tasks.

The AI sector has always been a money-burning game. As more competitors upgrade and iterate their large model products, the pressure on iFLYTEK will only increase.

All Aiming at ChatGPT, Competitors Are Dissatisfied

In the early morning of June 25, some domestic developers received emails from OpenAI.

In the email, the OpenAI team stated, "Starting July 9, we will take additional measures to block API traffic from regions not on our list of supported countries and regions. To continue using OpenAI's services, you need to access them from a supported region."

China is not included in OpenAI's open list, meaning OpenAI will terminate its API services to China from July 9.

Frankly speaking, companies that develop localized applications based on GPT models will suffer significant business setbacks in the future. However, this incident is also an opportunity for domestic large model vendors with self-built computing power. Many domestic large model vendors have also launched "zero-cost migration plans" for domestic developers.

It is worth noting that from May 2023 to June 2024, within just one year and one month, Spark was upgraded from 1.0 to 4.0.

At the beginning of 2024, iFLYTEK released Spark V3.5, which significantly improved several core capabilities such as logical reasoning and language understanding. Officially, some capabilities are claimed to surpass GPT-4 Turbo.

On June 27, the Spark large model V4.0 officially debuted, upgrading seven core capabilities and launching hardware such as the Spark Smart Correction Machine for C-end users and the Spark Enterprise Agent Platform for B-end users.

Image Source: iFLYTEK Official WeChat

However, the current issues with domestic large model products are: firstly, insufficient technological intelligence; secondly, the industry has become competitive, and the race for market share has begun before epoch-making breakthroughs.

On the one hand, iFLYTEK still lags significantly behind OpenAI, the leader in the large model race, in terms of technology.

Although iFLYTEK has repeatedly claimed to surpass ChatGPT in functionality, its Chairman Liu Qingfeng has also admitted, "Domestic large models still lag behind GPT-4 in complex knowledge reasoning, fast learning from small samples, ultra-long text processing, and cross-modal unified understanding."

On the other hand, the price war in the large model market is intensifying.

In May this year, ByteDance's cloud platform Volcano Engine announced that its self-developed Doubao large model was officially available to the public, offering pricing significantly lower than the industry mainstream. Subsequently, Alibaba, Baidu, Tencent, iFLYTEK, and other vendors followed suit with price cuts.

Behind the price war is the reduction in computing costs brought about by accelerated technological evolution and the survival anxiety caused by the intensifying competition. Vendors are competing to reduce the usage cost of large model APIs to compete for market share.

This is not a good sign at the initial stage of a "money-burning" business.

Revenue Slowdown, Rapid Financial Pressure Growth

In February 2021, iFLYTEK set a goal at its annual corporate planning conference to reach "one billion users, achieve revenue of ten billion yuan, and drive a trillion-yuan industrial ecosystem" in the next five years.

In 2020, iFLYTEK's total revenue was 13.025 billion yuan. If it wants to increase revenue to 100 billion yuan by 2025, this means iFLYTEK needs to achieve an average annual revenue growth rate of about 50.33%.

At that time, iFLYTEK had achieved annual revenue growth of over 25% for ten consecutive years, and it was confident when proposing the ten billion revenue plan. However, since 2022, iFLYTEK's high revenue growth has halted abruptly.

iFLYTEK's operating revenues in 2022 and 2023 were 18.82 billion yuan and 19.65 billion yuan, respectively, with year-on-year growth rates of only 2.77% and 4.41%, a sharp decline compared to previous years.

Moreover, the full-year revenue in 2023 did not reach 20 billion yuan, less than 20% of the completion of the ten billion revenue target.

Image Source: WIND

In recent years, its net profit attributable to shareholders has also performed poorly. In 2022, the net profit attributable to shareholders was 418 million yuan, a year-on-year decrease of 57.31% compared to 979 million yuan in 2021. The 2023 annual report disclosed a net profit attributable to shareholders of 118 million yuan, another sharp decline, down 71.74% year-on-year.

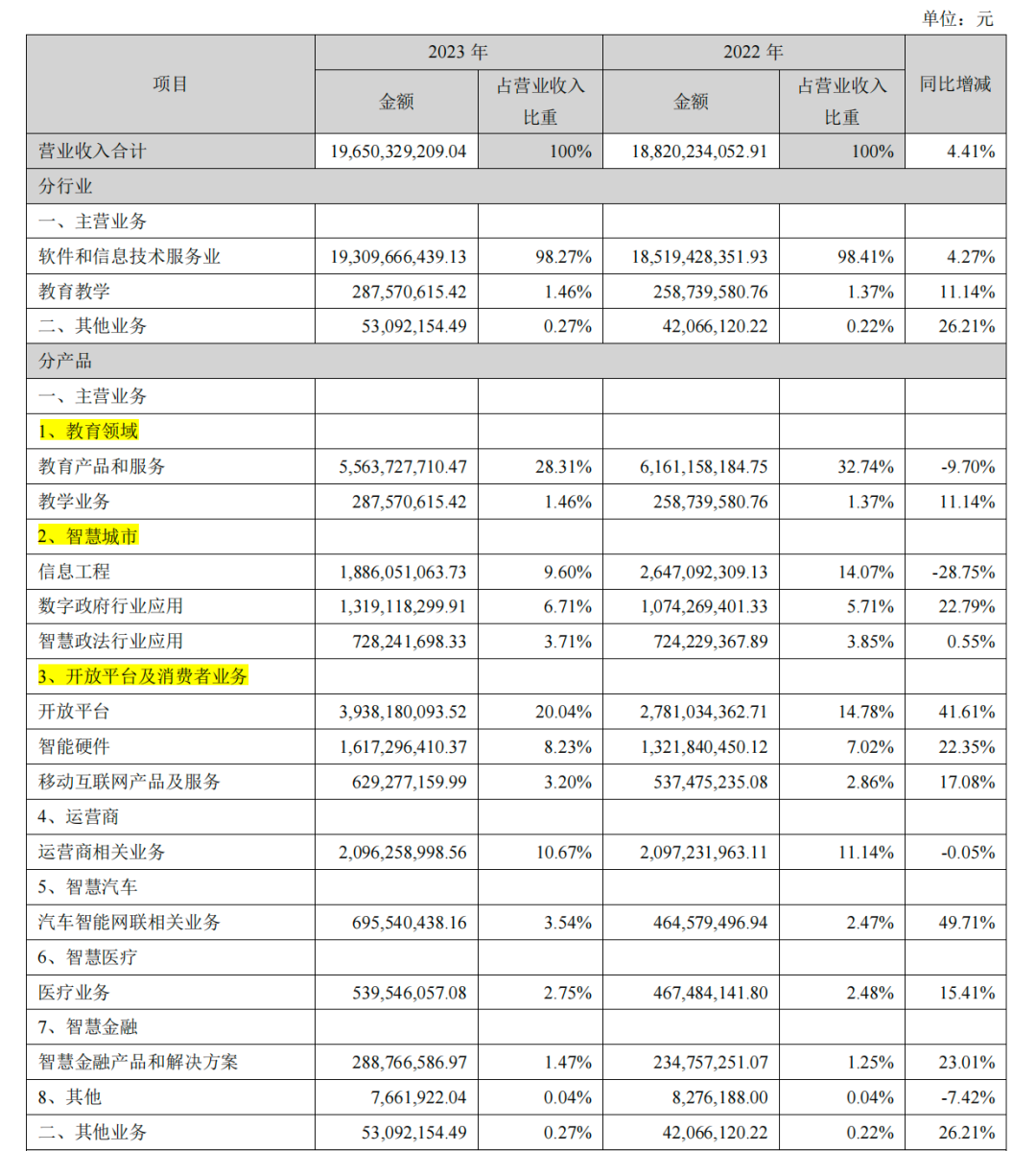

In terms of specific businesses, iFLYTEK's business scope is diverse, covering education, smart hardware, smart vehicles, and other aspects. Currently, iFLYTEK's main revenue sources are three areas: education, smart cities, and open platforms and consumer businesses.

The 2023 annual report shows that the education sector generated revenue of 5.852 billion yuan, accounting for 29.78% of total revenue; the smart city sector generated revenue of 3.933 billion yuan, accounting for 20.02% of total revenue; and the open platform and consumer business segment generated revenue of 6.185 billion yuan, accounting for 42.14%.

In 2023, the revenue growth of open platforms and consumer businesses was very rapid, becoming a new revenue growth point. B-end business has always been iFLYTEK's strength, with smart vehicle business revenue increasing by 49.71% year-on-year, smart financial products and solutions increasing by 23.01%, and smart healthcare also achieving a year-on-year increase of 15.41%.

Data Source: iFLYTEK 2023 Annual Report

Although there are bright spots in its business, iFLYTEK's liabilities are also increasing year by year. The growth rate of revenue cannot keep up with the growth rate of liabilities.

From the end of 2019 to the end of 2023, iFLYTEK's total assets increased from 20.101 billion yuan to 37.831 billion yuan, an increase of about 88%. However, the total liabilities increased more significantly, from 8.366 billion yuan to 20.099 billion yuan, an increase of over 11.7 billion yuan, or about 140%.

iFLYTEK's asset-liability ratio also shows an upward trend. From the end of 2019 to the end of 2022, the debt ratios were 41.62%, 47.77%, 44.78%, and 48.73%, respectively, while at the end of 2023, the debt ratio reached 53.13%.

In addition, iFLYTEK's increased expenses in market investment and research and development have also pushed up the company's liabilities to a certain extent. In the first quarter of 2024, the company's new investments in large model research and development, as well as core technology autonomy and controllability of the industrial chain, reached 300 million yuan, with research and development expenses reaching 842 million yuan, an increase of 126 million yuan compared to the same period last year.

However, all of this is necessary investment in entering the AI large model sector, and such financial pressure will continue for a long time before stable commercialization.

Commercialization Remains a Challenge: How Can Large Models Support Themselves?

It is worth noting that iFLYTEK's long-term development has been accompanied by government subsidies.

According to the 2023 annual report, the government subsidies included in current profits and losses amounted to 404 million yuan. The net profit attributable to shareholders in 2023 was 657 million yuan, with government subsidies accounting for up to 61.5% of the company's net profit.

In fact, over the past few years, government subsidies have consistently contributed at a high level to iFLYTEK's net profit, ranging from 180.28% in 2016 to 84.31% in 2022. From this perspective, iFLYTEK's profit realization relies heavily on government financial support.

Facing the reality of subsidy dependence, iFLYTEK Chairman Liu Qingfeng has actually planned three commercialization paths for Spark.

The first is to empower C-end hardware. iFLYTEK started with smart voice and has developed a series of C-end products, including translation devices and smart voice recorders.

However, the C-end market is sensitive to price, and competition in the product market is intensifying. How to maintain product competitiveness is a question worth considering for iFLYTEK.

The second is B-end service empowerment and large model customization, such as implementation in education, healthcare, and automotive scenarios. iFLYTEK already has multiple successful cases in the B-end market, such as the promotion of smart education solutions.

However, B-end market projects tend to have long cycles and slow payment, making cash flow a crucial issue.

The third is open platform API services. In May 2024, iFLYTEK announced that its Spark Lite API would be permanently free, while competitors also raced to offer free services during the same period. How to maintain and highlight its unique features is a question iFLYTEK needs to consider.

Image Source: iFLYTEK Official WeChat

Artificial intelligence has come a long way, but all intelligent applications related to "people" are still in the basic definition stage. Commercialization is an issue facing all vendors.

Behind the fierce price competition lies product homogeneity. In this situation, precisely defining scenarios based on one's own advantages is the first step towards commercialization. In fact, iFLYTEK has already accumulated a certain amount of experience in educational products.

As OpenAI further tightens restrictions on domestic vendors, proprietary data and scenarios will be crucial for subsequent iterations. Differentiation may be the first step before the prosperity of large models.