Baidu Should Learn from Tesla

![]() 07/24 2024

07/24 2024

![]() 485

485

Recently, one of the funniest jokes in the tech circle came from Apollo Go: The possibility of Robotaxi replacing human drivers "in a short time" is certainly less likely than foot massage being covered by medical insurance.

The reason for this stems from Baidu's self-driving taxi service "Apollo Go" charging as low as 0.8 yuan per km, making it a public enemy of taxi drivers in Wuhan. Coupled with a recent video of Apollo Go hitting a pedestrian who ran a red light, these two incidents combined triggered a joint protest from human drivers.

However, the "protest" was soon replaced by excitement from the industry, as brokerages churned out research reports titled "Robotaxi Commercialization Accelerates," and Baidu's share price soared, as if large-scale Robotaxi deployment was just around the corner.

Not everyone was pouring cold water, though. He Xiaopeng expressed his opinion in a roundabout way on his social media, stating that "Robotaxi capabilities, regulations, and business loops are not yet in place, and saying it will soon break even is because many accounts have not been settled."

Who he was referring to is self-evident. Baidu had previously announced that it expects to achieve break-even in Wuhan by the end of 2024 and enter a full profit period in 2025.

After pouring cold water, He Xiaopeng shifted gears to promoting end-to-end solutions, leaving Baidu and other Robotaxi operators flustered.

1

How to View Robotaxi Profitability?

After Apollo Go ignited public opinion, in addition to media reporters, a brokerage firm also went to experience the service and returned with a research report detailing their test ride experience.

The brokerage's final assessment was: "An inhuman-like novice driver, safe but with weak decision-making, and low driving efficiency."

They then provided an explanation from a technical perspective.

Apollo Go's current algorithm architecture is based on a modular approach using high-precision maps, following a "perception-decision-control" divide-and-conquer approach. The perception module utilizes a neural network algorithm that fuses multiple sensors such as lidar, cameras, and millimeter-wave radars. The decision-making and control module employs traditional rule-based algorithms, which are artificially written rule logics.

With continuous resolution of corner cases and remote safety driver monitoring, safe operation can be achieved, but driving performance lacks flexibility and anthropomorphism, especially in complex road conditions where decision-making abilities are weak, far from the ideal Robotaxi that can fully replace human drivers.

Compared to the intelligent driving solutions currently available in mass-produced passenger vehicles, Apollo Go's algorithm performance does not significantly outperform the top-tier city NOA solutions without high-precision maps.

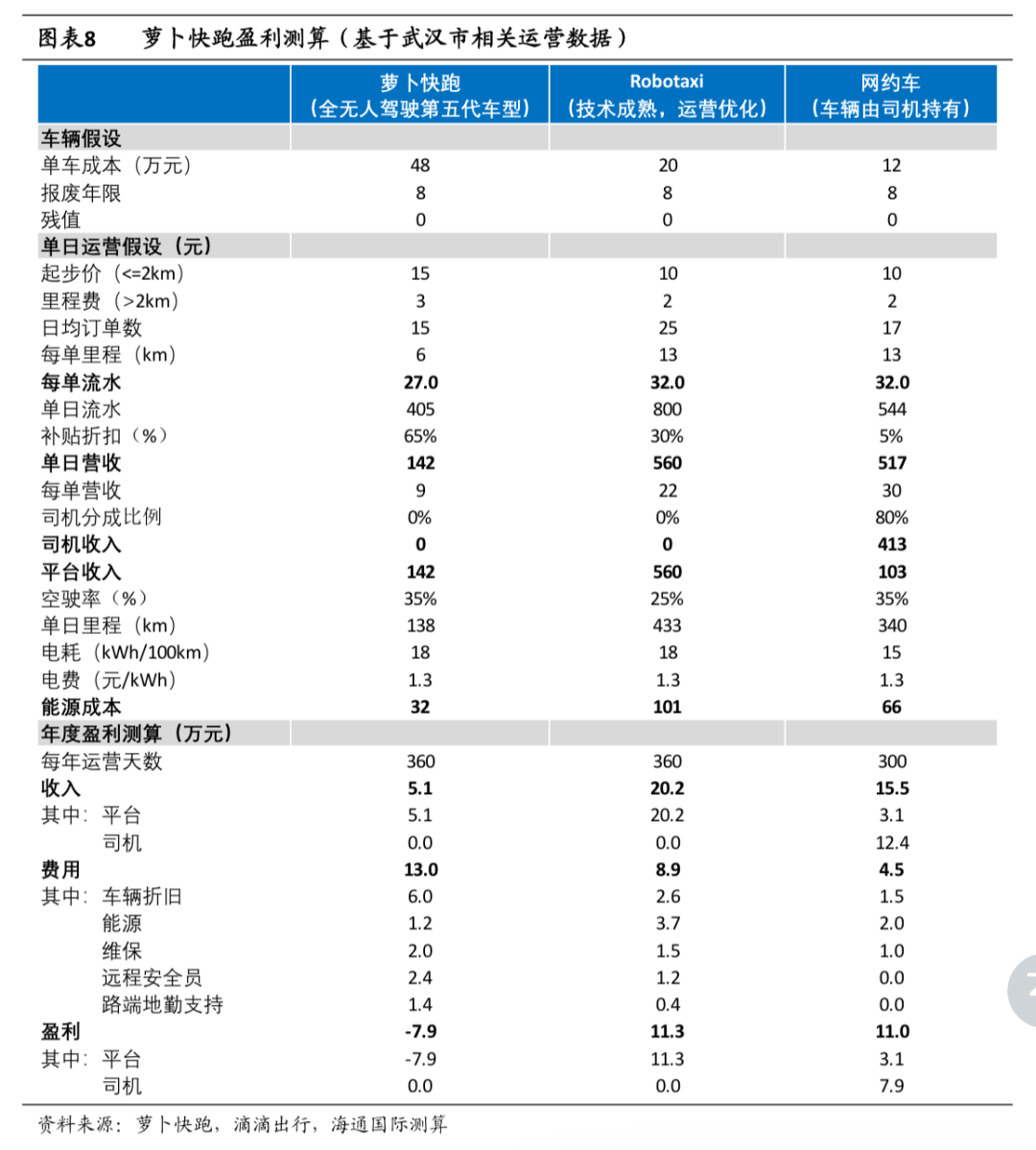

The brokerage then conducted a profitability analysis comparing Apollo Go, technically mature Robotaxi, and ride-hailing services.

Assuming Apollo Go primarily uses its fifth-generation vehicles and Robotaxi vehicles cost 200,000 yuan, the analysis considered vehicle costs, pricing, operating hours, and operating expenses. The result showed that with a 65% subsidy discount, Apollo Go's fifth-generation vehicles would incur a loss of 79,000 yuan per year, while Robotaxi and ride-hailing services would generate profits of 113,000 yuan and 110,000 yuan, respectively.

The reasons behind these profitability projections are twofold: Firstly, Apollo Go's current low revenue per ride mileage and high subsidy discounts impact overall revenue, with low mileage primarily due to conservative compliance strategies and weak decision-making abilities leading to longer ride durations. Secondly, high expenses stem from vehicle depreciation, remote safety drivers, and roadside ground support.

The main factors affecting profitability are vehicle manufacturing costs and the iteration progress of autonomous driving algorithms. According to Baidu Apollo Day 2024, the cost of the sixth-generation RT6 model has dropped to 204,600 yuan, while the latter will determine whether Robotaxi can improve operational efficiency from vehicle to person.

Regarding Baidu's publicly announced profitability plan, if they deploy 1,000 autonomous vehicles within the year, including 600 lower-cost sixth-generation models, break-even at a specific level is achievable. Moreover, with the continuous deployment of the sixth-generation models next year, profitability should not be a challenge.

However, it's worth noting that brokerages estimate the baseline for profitability is at least 5,000 vehicles and open access to over 70% of city areas. Furthermore, if we consider He Xiaopeng's "many accounts not settled," referring to platform operation (e.g., cloud computing, operation and maintenance) and R&D costs not yet factored into previous profitability projections, these are crucial and substantial investments in Robotaxi.

2

Where is Robotaxi Headed?

Apart from Baidu, Tesla is arguably the most notable player in the global Robotaxi space. However, during Apollo Go's recent spotlight, Tesla was rumored to have delayed its Robotaxi plans, costing it a $70.9 billion market value overnight.

Tesla's Robotaxi was first introduced in 2016 as part of its "Master Plan, Part Deux," with Elon Musk boldly predicting 1 million Robotaxis on the road the following year. It turns out that Musk is not only skilled at making cars but also at painting rosy pictures.

Yet, the delay is not a cancellation, and Tesla has paved a new path for Robotaxi.

The development of autonomous driving algorithm architectures can be broadly described as progressing from modular solutions based on high-precision maps to mapless modular solutions and, more recently, to the emerging end-to-end approach, which Tesla pioneered.

In simple terms, the end-to-end approach can be divided into two stages. The first involves utilizing a "Transformer+BEV" perception architecture to achieve a mapless transition, enhancing the generalization ability of perception and localization. The second stage, amid the wave of large AI model technologies, extends deep neural network algorithms from perception to decision-making and control, potentially breaking through the development bottlenecks of existing mainstream solutions with its strong generalization capabilities for traditional long-tail problems in autonomous driving. Meanwhile, its data-driven nature significantly accelerates iteration speeds.

In February this year, Tesla rolled out FSD V12 based on the end-to-end architecture to select users, marking the first large-scale deployment of this approach. Its performance surpassed that of modular solutions iterated over years, exhibiting smoother driving and stronger decision-making abilities, more anthropomorphic.

Just a few months later, domestic players like Xpeng, Li Auto, Huawei, Yuanrong Qixing, and SenseTime also unveiled their new end-to-end autonomous driving architectures, signifying a comprehensive technological transformation among domestic leaders.

In the past, L4 and L2 levels of autonomous driving were led by startups/software giants and suppliers/OEMs, respectively, both adopting a divide-and-conquer approach. In recent years, as the bottlenecks of modular solutions have gradually emerged, the technological gap between the two has continued to narrow.

Under the new end-to-end approach, the player landscape may undergo significant changes:

1) Firstly, under the traditional mainstream approach, top players have largely implemented mapless "Transformer+BEV" perception solutions. The gap primarily lies in the accumulation of rule-based code in the decision-making and control module. The end-to-end approach brings all players to the same starting line.

2) The end-to-end approach transforms autonomous driving algorithms from rule-driven to data-driven, even turning them from technical issues into engineering problems. Consequently, data and computing power become the focus of competition.

As a result, leading OEMs and Huawei, with their vast amounts of data from smart cars and significant financial resources to support computing expenses, are poised to take the initiative in the end-to-end era.

However, there are also reports suggesting that Tesla's delay in launching Robotaxi might be due to issues with its vision system, necessitating the addition of lidar or other auxiliary equipment.

Tesla currently employs L2 or L2+ autonomous driving models, capable of handling most daily driving scenarios. However, L4 autonomous driving requires vehicles to park at specific locations without driver intervention, posing higher data demands and safety challenges for the end-to-end model.

In other words, L4 technology remains the primary route for Robotaxi at this stage, with companies possessing high-precision map qualifications enjoying certain advantages in the Robotaxi field.

3

Enhancing Awareness of Intelligent Driving

Despite the delays, the pie-making must continue. At last month's Tesla shareholder meeting, Musk was still outlining more details.

Tesla's Robotaxi operating model resembles a combination of Uber and Airbnb, with the company operating most of the vehicles while user-owned vehicles can join the Robotaxi fleet during idle times, potentially earning owners more per month than their car payments.

Crucially, Musk predicts that future Robotaxi revenue will account for 63% of Tesla's total commercial revenue, though shortly afterward, news of a delay to October emerged.

There are various reasons for Tesla's Robotaxi delay, including the rollout of FSD, prototype planning, and unresolved corner cases. One rumor is that Musk delayed the Robotaxi launch to give the project team more time to develop prototypes.

Although Apollo Go's recent attention stems from expanded operations, the core issue is a public opinion crisis fueled by widespread fear among the public.

In reality, the impact of autonomous driving on employment is currently minimal. The number of autonomous vehicles is very limited, such as Apollo Go's approximately 400 self-driving cars in Wuhan with limited order-taking capabilities and restricted driving ranges due to their electric nature.

According to the Wuhan Transportation Bureau, 29,400 ride-hailing vehicles operate daily in Wuhan, a significant difference. Considering Robotaxi's current order volume and ride mileage, consumers are primarily focused on experiencing the service rather than replacing traditional ride-hailing or taxi services.

While Apollo Go's large-scale fully autonomous operations in Wuhan may not mark a true commercial inflection point, it has a significant educational impact on consumers, enhancing their awareness and acceptance of intelligent driving, increasing the consideration of intelligent driving in passenger car purchases, and accelerating the penetration of high-level intelligent driving. Automakers relying on intelligent driving packages for profit must be overjoyed.

4

Conclusion

From a business model perspective, Baidu's cost control strategy in the Robotaxi field relies heavily on its experience in pre-installed mass production for passenger cars, optimizing computing power and algorithms to reduce costs, giving Baidu more room for cost control.

Guangzhou Automobile Group Capital, in collaboration with Didi, McKinsey, and others, conducted a survey revealing that the overall cost of modified self-driving taxis with safety drivers reached 1.07 million yuan, far exceeding the 0.81 million yuan for safety drivers plus pre-installed vehicles and the 0.43 million yuan for pre-installed vehicles without safety drivers.

Based on this survey, pre-installed vehicles without safety drivers are key to reducing Robotaxi costs. For Baidu, learning from Tesla involves two routes: one is independent vehicle production, which is currently unrealistic and can only be achieved through partnerships with automakers like Geely for L4 autonomous driving pre-installation mass production; the other is open social cooperation, allowing user-owned vehicles to join the Robotaxi fleet during idle times, similar to Zhou Hongyi's suggestion of selling/leasing Robotaxi vehicles to third parties.

However, for Baidu, large-scale pre-installation by OEMs is essential to reignite the flywheel, continuing the previous cooperation route. Even after Huawei, if Baidu focuses solely on being an intelligent driving service provider, traditional OEMs may be less concerned about the "soul debate."

Therefore, the importance of JiYue to Baidu is self-evident, or it could also bind more seed customers beyond JiYue.