Trouble ahead for NVIDIA?

![]() 09/24 2024

09/24 2024

![]() 664

664

This article is based on publicly available information and is intended solely for information exchange purposes and does not constitute investment advice.

As a bellwether of U.S. stocks, the share price of NVIDIA, the "first AI stock," has experienced significant volatility following the release of its latest earnings results.

AMD, a supplier of NVIDIA, has also been a standout AI leader in U.S. stocks over the past two years, with its share price once surging by over 13 times. However, within just six months this year, its share price has plummeted by over 60%.

NVIDIA vs AMD Share Price Trend Chart, Source: Wind

Currently, there are significant disagreements in the market regarding the outlook for AI stocks. One camp believes that AI has risen continuously for too long, with significant valuation bubbles, and expects significant corrections in the future. The other camp, however, maintains that AI is a long-term trend and cannot be judged solely based on short-term gains and losses, continuing to firmly believe in the "eternal rise" of AI.

So, how should we view this situation?

01

Signs of peaking in high-growth performance

On August 29, NVIDIA reported strong and above-expectations earnings results, accompanied by a $50 billion share repurchase plan, yet the market remained concerned. Media reports attributed the decline to the next quarter's guidance falling short of Wall Street's most optimistic expectations.

This might be a case of missing the forest for the trees. Upon closer examination of the latest earnings report, several core operating metrics point to signs of peaking in high-growth performance.

In the second fiscal quarter, revenue and net profit increased by 122% and 168% year-over-year, respectively, but quarter-over-quarter growth rates had already declined to 15% and 11.5%, marking the third consecutive quarter of declining growth rates. Third-quarter revenue guidance was $32.5 billion, representing just an 8% quarter-over-quarter increase. If NVIDIA's quarter-over-quarter growth rates continue to decline, year-over-year growth may drop to single digits by this time next year.

Turning to profitability, the second-quarter gross margin was 75.15%, and the net margin was 55.26%, both of which declined for the first time since the high-growth period in 2023. The third-quarter gross margin guidance stands at 74.4%, marking the second consecutive quarter of declining profitability, which has aroused market vigilance.

Against the backdrop of strong demand for AI chips, why is gross margin consistently declining? Is the period of supply-demand mismatch over? Or are competitors stepping up, forcing NVIDIA to lower prices? These questions have inevitably raised concerns and speculations in the market.

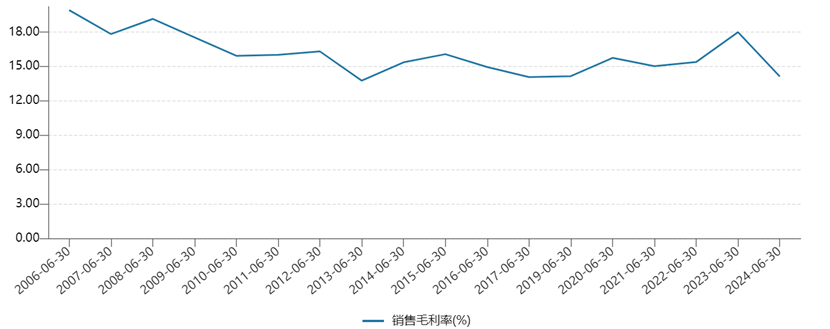

As for AMD, it has missed market expectations for two consecutive quarters, with its share price plunging by around 20% on the first trading day following each earnings report. A key indicator to note is that the latest gross margin of 11.23% is the lowest since its listing in 2009.

AMD Gross Margin Trend Chart, Source: Wind

Despite significant growth in AI business and a high level of enthusiasm in the AI sector, AMD's profitability has hit an all-time low. This suggests that AMD's high-growth performance is more akin to a short-term surge and may lack sustainability. This is also one of the core factors behind the sharp decline in AMD's share price, which peaked in March this year.

Judging from the performance of NVIDIA and AMD, two typical U.S. AI leaders, fundamentals may not drive significant further share price gains in the short term, and there is a certain probability that previous overly optimistic market pricing will be proven wrong, leading to the risk of continuous downward revisions in share prices.

02

The fragile side of high-growth logic

Stocks are long-term assets that not only reflect current fundamentals but also price future growth potential.

Returning to NVIDIA, what about its medium-to-long-term growth prospects?

Prior to 2023, NVIDIA's performance exhibited a relatively pronounced cyclical pattern, with net profit declining by 55% in fiscal year 2023 (January 30, 2022, to January 29, 2023), primarily driven by gaming and data center segments.

However, with the advent of AI, NVIDIA's data center business exploded, accounting for 80% of its total business in fiscal year 2024, while gaming, professional visualization, automotive, and other segments showed little improvement.

The surge in data center business is primarily fueled by the aggressive procurement of GPUs by tech giants like Microsoft and Meta to build computing power clusters, a critical infrastructure. However, this engine of growth faces significant risks.

Firstly, in terms of volume, sustained high-volume procurement of GPUs may not be realistic given the limited number of application scenarios.

This is similar to the construction of 5G base stations, where significant capital investments are required initially to procure components for construction. As the project progresses to the mid-stage, demand and procurement slow down. In the later stages, only maintenance and updates are required, and procurement costs can drop to zero.

The duration of the initial stage of AI infrastructure construction depends on the ability of purchasers to commercialize their investments. If downstream commercialization goes smoothly, it will drive increased upstream procurement with growing volumes. Conversely, if purchasers struggle to find viable business models to monetize their investments, upstream procurement could slow down significantly beyond expectations.

Currently, major U.S. tech giants have yet to find viable AI monetization paths, which has adversely affected their current performance and failed to form a closed-loop business logic. If this situation persists, the high-volume procurement of GPUs by these giants is unlikely to be sustained and could even decrease significantly. Secondly, in terms of pricing, it is almost inevitable that a price decline cycle will occur.

Since last year, NVIDIA's GPU prices have continued to rise. On the one hand, this is due to the sudden explosion of AI, leading to a severe supply-demand mismatch in the GPU market. However, with the easing of supply constraints this year, the situation is expected to improve.

On the other hand, the GPU market exhibits a monopoly structure dominated by NVIDIA. As of the end of the second quarter of 2024, NVIDIA held approximately 80% of the global GPU market share and an even higher 90% share in the AI chip market.

In the future, NVIDIA's data center business faces two major threats. Firstly, competition from tech giants like AMD and Huawei, particularly Huawei's Ascend 910B, which is making rapid progress in AI. Secondly, major U.S. tech giants are intent on reducing their heavy reliance on NVIDIA through in-house development. Since 2024, Microsoft has been developing a substitute for NVIDIA's ConnectX-7 network card to enhance the performance of its MaiaAI server chips and reduce its dependence on NVIDIA. Meta has announced that its second-generation in-house AI chip, Artemis, will be officially launched in 2024 and applied to data center inference tasks. Google, meanwhile, has launched its latest TPU chip, which differs from NVIDIA's traditional architecture and has garnered the favor of Apple, which has switched from NVIDIA's GPUs to TPUs for training large AI models.

Whether due to improving GPU supply-demand dynamics or NVIDIA's inability to maintain its high market share amidst intense competition, it is almost inevitable that the central price will decline. NVIDIA's declining gross margins in the latest and upcoming quarters may be partly attributed to softening price structures.

In conclusion, the logic behind NVIDIA's high-growth performance is relatively fragile, and its core engine business is likely to face the awkward situation of "rising volumes but falling prices" or even "falling volumes and prices" in the future.

03

Reversal of yen carry trades

NVIDIA's previous sharp surge in share price was not only fueled by sudden surges in fundamentals but also strongly supported by ample liquidity.

From early 2021 to July of this year, the USD/JPY exchange rate depreciated significantly from 100 to 162, with a cumulative decline of over 60%. This trend drove global investors to engage in yen carry trades on a massive scale.

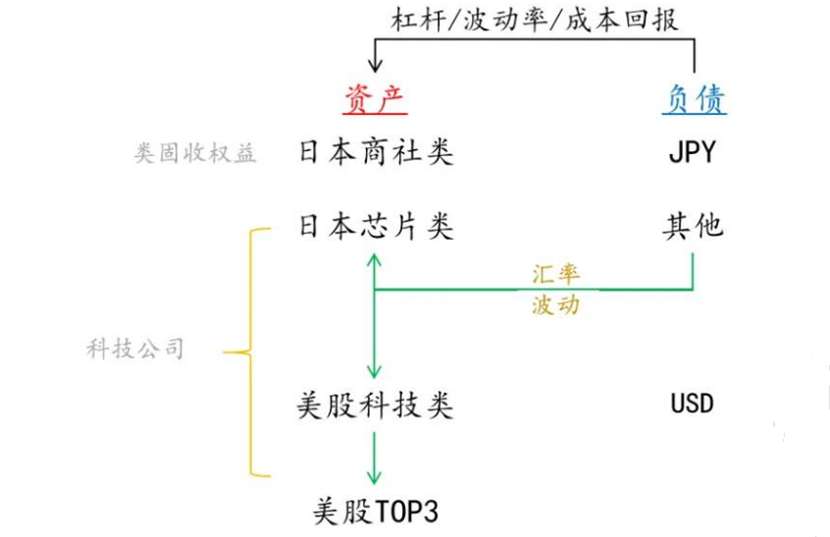

Global investors borrowed yen at zero interest rates and invested the proceeds primarily in two directions. One was in leading Japanese trading houses, with Warren Buffett investing in Japan's top five trading houses by issuing yen-denominated bonds and fully hedging against yen exchange rate risks. Additionally, Japanese tech stocks, particularly those related to AI, such as Tokyo Electron, gained favor.

Asset Side of Yen Carry Trades, Source: Northeast Securities

Beyond Japan, yen carry trade funds primarily flowed to the U.S., concentrating on AI tech leaders like NVIDIA and SMCI. These stocks fit the criteria of high yields, low volatility, and high leverage. More broadly, carry trade currencies provided significant funding and leverage for U.S. stocks, resulting in gains far exceeding corporate after-tax profit growth this year.

On July 11, the USD/JPY exchange rate reversed, embarking on a significant appreciation cycle, with a cumulative appreciation of 12% so far and room for further gains. On the one hand, the Federal Reserve's rate cut in September is all but certain, officially entering a rate-cutting cycle. Meanwhile, Japan has entered a rate-hiking cycle due to high inflation and may hike rates again this year. On the other hand, the yen's previous sharp depreciation provides momentum for appreciation.

This also signals a reversal of yen carry trades. Consequently, the critical driver supporting the surge in U.S. AI leaders is also facing reversal risks. This is one of the significant factors behind the sharp declines in tech giants led by NVIDIA since July 11.

On August 5, as the yen appreciated significantly, the Nikkei 225 plunged 12%, partly due to a frenzy of deleveraging by global carry traders who bought back yen. This triggered panic in the U.S. stock market, with NVIDIA's share price briefly plummeting by 14% that day. This performance underscores the pivotal role of yen carry trades in the U.S. stock market.

Apart from fundamentals and liquidity, U.S. AI leaders must also contend with macroeconomic risks posed by a potential U.S. economic recession. Insights can be gleaned from employment data disclosed by the Department of Labor.

In August this year, U.S. nonfarm payrolls fell short of market expectations, with previous months' figures being significantly revised downwards. From April to August, the U.S. added an average of just 135,000 nonfarm jobs per month, below the 2019 average of 166,000. Furthermore, while the U3 unemployment rate fell to 4.2% in August, the broader U6 unemployment rate rose to 7.9%, marking a three-year high. The official "Samuelson Index" rose from 0.53 to 0.57, indicating increasing marginal pressure in the job market.

Currently, it is certain that the U.S. economy is slowing down, but there is considerable disagreement in the market regarding whether a recession will follow. This situation requires continuous monitoring. One possible evolutionary path is a spiral downturn in tech stocks led by AI, in sync with the U.S. economy.

Over the past year, the emergence of AI has fueled market optimism that it will improve productivity and support a new cycle of economic expansion. This optimism, coupled with full pricing of the rate-cutting cycle, has fueled a countercyclical surge in U.S. stocks and contributed to countercyclical expansion in the U.S. economy (asset prices significantly influence the economic behavior of U.S. residents and businesses, serving as a good indicator of economic strength).

In conclusion, we have never witnessed a single company dominating an industrial revolution, especially at the most fundamental level while reaping exorbitant profits – this defies the laws of economics. Exorbitant infrastructure prices are unlikely to foster a thriving business application ecosystem. Only when one whale falls can myriad creatures thrive. Therefore, NVIDIA's troubles stem not only from the business realm but also from the invisible hand of regulation, which may already be in motion beyond our field of vision. Consequently, we believe that in the medium term, NVIDIA faces significant challenges amid the resonance of multiple factors.