After giving up on car manufacturing, Apple has now said goodbye to autonomous driving

![]() 10/15 2024

10/15 2024

![]() 692

692

Apple's car manufacturing project has gradually vanished, and now even its autonomous driving ambitions are on hold.

Recently, according to foreign media outlet MacRumors, the California Department of Motor Vehicles (DMV) revoked Apple's autonomous vehicle testing permit on September 27.

It's worth noting that the report specifically stated that Apple voluntarily requested the revocation of the testing permit. If Apple had not initiated the request, the permit would have remained valid until April of next year.

The fact that Apple couldn't even wait six months before taking action underscores that its "car manufacturing" project is winding down and approaching its inevitable conclusion.

This outcome was not difficult to predict. Back in late February of this year, media outlets reported that Apple internally announced the cancellation of the Apple Car project, with some employees shifting to the generative AI team.

After a decade-long project and billions of dollars invested, the car manufacturing endeavor ultimately amounted to nothing.

Why did Apple's foray into car manufacturing end so disastrously?

01 Apple's Car Manufacturing Journey Ends in Compromise

According to public records, Apple obtained a permit for autonomous vehicle testing from the California DMV in 2017 and established an autonomous fleet in the state to conduct technical tests and validations for its Apple Car autonomous driving system.

By 2023, the number of registered vehicles in its autonomous fleet had grown to over 60. According to the DMV's 2023 autonomous driving report, more than 50 of these vehicles were on the road, generating data and accumulating over 720,000 kilometers of test miles.

If everything had gone as planned, the testing permit would not have expired until April 30 next year. However, according to MacRumors, on September 25 this year, Apple applied to the California DMV to revoke the permit, which was formally approved on September 27.

Alphabetically, Apple is no longer listed

Upon reviewing the California DMV's records, we confirmed that Apple has indeed disappeared from the testing list.

Apple's decision to voluntarily request the revocation of the testing permit is a clear indication that the company's internal decision to cancel the Apple Car project in February is now being orderly concluded, with little chance of reversal.

From Titan to Apple Car, Apple's car manufacturing project has ultimately reached its end.

Looking back on Apple's car manufacturing history, it is a story of continuous compromise until it all came to nothing.

In 2014, Apple secretly launched an autonomous driving project, the precursor to its car manufacturing aspirations – the "Titan Project." At the time, reports indicated that over 1,000 automotive experts and engineers at Apple were secretly developing an electric vehicle with limited autonomous driving capabilities near the company's headquarters, extending their automotive research from software to hardware.

At this point, Apple's focus on "car manufacturing" was primarily on software, as evidenced in a letter to the U.S. Department of Transportation, which stated that Apple was dedicated to developing autonomous driving software technology rather than building complete vehicles like Tesla.

This direction began to shift around 2018.

Apple's autonomous driving test vehicle

As mentioned earlier, Apple obtained a permit for autonomous vehicle testing from the California DMV in 2017. However, despite three years of development by a team of over a thousand people, its autonomous driving technology remained at the demonstration stage, unable to expand its capabilities or achieve practical applications.

In 2018, the Titan project was taken over by Doug Field, former vice president of Mac hardware engineering at Apple, who also had a background in automotive companies like Ford and Tesla.

Field's appointment signaled a shift in Apple's car manufacturing ambitions from software to full-fledged vehicle design.

Apple's autonomous driving concept car

At that time, Apple set its sights high, aiming to design a vehicle with L5 autonomous driving capabilities. This goal was ambitious and alluring, given that the company that created the iPhone was capable of such lofty aspirations. The outside world eagerly anticipated seeing Apple create another miracle in the automotive industry.

Apple invested heavily in this project, maintaining a high level of commitment. In the fourth quarter of that year, iPhone sales unexpectedly plunged, and the company's primary revenue source from mobile phones was in trouble. Shortly thereafter, Apple acquired the autonomous driving startup Drive.ai and brought on board some of its engineers.

During this period, Elon Musk revealed that he had contacted Apple to discuss the possibility of acquiring Tesla, but Apple believed that building its own cars was more meaningful than acquiring and integrating an existing automotive company.

This revealed Apple's high expectations for its car manufacturing business. During this time, the project entered a stable phase, with consistent investments and research and development, but without any tangible production results.

With no signs of mass production, Doug Field announced his resignation in September 2021, and the car manufacturing project underwent a leadership change, with Kevin Lynch, head of Apple Watch, taking over.

Kevin Lynch, head of Apple's car manufacturing project

The new leader set a deadline for the car manufacturing project: to launch a fully autonomous vehicle by 2025.

However, as the industry's understanding of autonomous driving deepened, the timeline for fully autonomous driving began to shift. Apple recognized this issue and, by the end of 2022, Bloomberg quoted insiders as saying that Apple had delayed the launch of its first new car by a year to 2026 and abandoned the L5 fully autonomous driving route, opting instead for a compromise that supported full autonomous driving only on highways. The price of each vehicle was also adjusted from over $120,000 to less than $100,000.

The compromises did not stop there. By January 2024, Apple again adjusted its car manufacturing direction, not only downgrading the vehicle's autonomous driving level from L4 to L2+, but also pushing back the final launch date from 2026 to 2028, a delay of two more years or four years in total.

Within Apple, this compromise marked the company's last-ditch effort. After a series of meetings, Kevin Lynch and Apple CEO Tim Cook issued an ultimatum: "Either complete the delivery or cancel the project altogether."

By this point, however, the competitive landscape in the smart car industry had already shifted significantly from what it was before. An L2+ smart car launching in 2028 would inevitably fall behind as soon as it hit the market.

Is it still necessary for Apple to manufacture cars?

No one expected an answer to this question within just a month:

The car manufacturing project was officially terminated. Some employees were transferred to the machine learning and AI department to work on generative AI projects, which are now more highly prioritized within Apple. Several hundred hardware and automotive engineers had the opportunity to apply for positions in other projects, and layoffs were also a possibility.

02 Why Did Apple's Decade-Long Car Manufacturing Dream End in Disarray?

In summary, the failure of Apple's car manufacturing project seemed destined from the start.

Firstly, when the Titan project was first established, the core team did not reach a consensus on how Apple should approach car manufacturing, leading to significant executive turmoil.

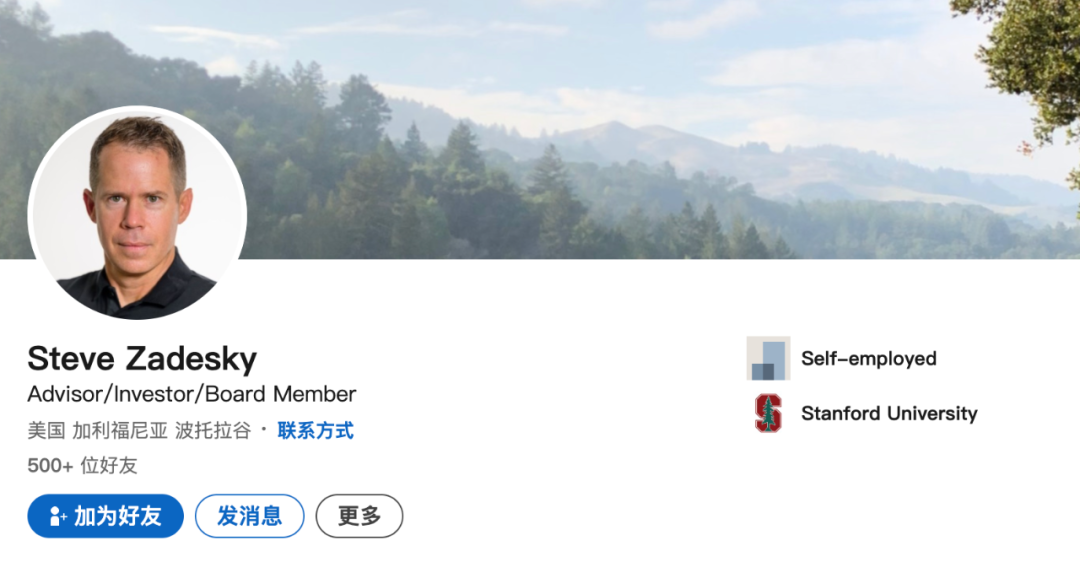

Steve Zadesky, one of the core members of the Titan project

Public information reveals that four key leaders were involved in the Titan project. Steve Zadesky favored full vehicle development with semi-autonomous driving capabilities, positioning Apple to compete with Tesla. In contrast, John Wright focused on software, aiming to disrupt the automotive landscape by creating fully autonomous vehicles without steering wheels.

Given Apple's "disruptive" nature, the company opted for high-level autonomous driving software development. Zadesky left the project in 2015, and Apple executive Bob Mansfield took over, implementing a software-focused strategy.

Subsequent changes in direction (and product compromises) led to frequent leadership changes. Over the course of a decade, the project went through four different leaders, with an average tenure of just two and a half years for each.

Two and a half years is undoubtedly a rushed timeline for developing a mature automotive product, especially considering that each new leader often negated the previous roadmap, making it difficult to maintain continuity in development efforts.

The constant overhauls meant that Apple remained stuck in the early stages of car manufacturing, investing heavily but making slow progress.

Secondly, Apple's goals were overly optimistic. In the early 2010s, the global autonomous driving trend was just taking shape. The industry was focused on storytelling and listening to those stories, and Apple's initial goal of achieving L5 autonomy and disrupting the automotive landscape was ambitious.

This goal remains an aspiration for the entire industry even today, and even Elon Musk can only offer an uncertain timeline of 2027.

Elon Musk's recently unveiled Cybercab, scheduled for release in 2027

Even Apple, with its track record of creating miracles, struggled to replicate that success in an unfamiliar field. During the testing of its autonomous driving system, there were multiple accident incidents.

These were internal issues for Apple, but looking at the broader context, the failure rate for developing and mass-producing smart cars in the United States is quite high.

Currently, aside from Tesla, most of the new U.S. automotive players, including Lucid and Rivian, have yet to achieve large-scale production capabilities. Many have even faced bankruptcy, like Fisker.

A significant factor is that post-industrialization, the United States faces challenges beyond labor costs. A more pressing issue is the difficulty in forming a complete, mature, and low-cost industrial chain for new industries.

Conversely, this is a key reason for the rapid development of China's electric and smart car industry in recent years, with Tesla playing a pivotal role and reaping significant benefits.

At this point, it's unlikely that we'll see Apple's envisioned closed ecosystem, stretching from mobile devices to autonomous driving and vehicles, come to fruition.

But that's okay – Apple laid out the blueprint, and domestic players are responsible for realizing it.

03 Apple Sets the Vision, Domestic Players Deliver

Autonomous driving and full vehicle development were the core components of Apple's wavering car manufacturing plans. Beyond that, Apple's well-established closed ecosystem based on iOS also garnered significant attention.

This ecosystem includes iOS's empowerment of smart cockpits, which, as discussed extensively in the past, offers boundless possibilities for the final form of Apple's mass-produced vehicles.

CarPlay integration

Before formally embarking on car manufacturing, Apple introduced the "iOS in the car" program in 2013, later renamed CarPlay, to enter the smart car market.

Similar products like Baidu CarLife, Huawei HiCar, Tencent AutoLink, and AliOS followed in Apple's footsteps.

CarPlay quickly established itself as a leading in-car system, with Apple revealing that over 80% of new vehicles sold globally in 2020 supported CarPlay. According to Haitong International data, by the end of 2021, CarPlay had partnered with over 70 automakers on 720 vehicle models.

Apple continues to upgrade CarPlay to better integrate with vehicle control and entertainment systems.

The popularity of this in-car smart system stems largely from its ability to connect mobile devices with in-car terminals, elevating the in-car ecosystem to a new level.

The potential for a closed ecosystem connection between iOS and in-car terminals is immense and unpredictable.

This vision has ultimately been realized by domestic players, specifically through Huawei's HarmonyOS, Geely's Flyme Auto, and up-and-coming Xiaomi Automobiles.

These three players share similar approaches to realizing a closed ecosystem, primarily by enabling interconnection between mobile devices (including other portable terminals) and in-car terminals (including some smart driving capabilities), with interoperability in ecological applications and mutual invocation of in-car/mobile computing power and sensors.

Through this ecological connectivity, a variety of imaginative atomic service capabilities can be combined.

In the end, while Apple did not disrupt the industry, the legacy of its previous endeavors has left both imagination and puzzles for the next era. Even as a stepping stone, Apple deserves respect.