ByteDance Enters the AI Glasses Market: Can Longcheer Technology Turn Things Around with Doubao?

![]() 01/08 2026

01/08 2026

![]() 484

484

Source: Yuan Media Group

While the outside world is still debating whether AI glasses with a return rate as high as 40% can be considered a good business, internet giants and even backend ODM leaders have already placed their bets and accelerated their entry into the market.

Tianyancha shows that on January 5, leading AI glasses company Thunderbird Innovation completed over 1 billion yuan in Series D funding, led by China Mobile’s Lead Fund and CITIC Goldstone, with participation from institutions such as China Unicom’s Lianchuang Innovation Fund. This marks the first time China’s two major telecom operators have entered the smart glasses sector through strategic investment. Thunderbird Innovation founder Li Hongwei even revealed plans to potentially collaborate with operators on “recharge your phone bill, get free glasses” promotions to lower the purchase threshold for users.

Image Source: Tianyancha

Almost simultaneously, media reports exposed that ByteDance’s “Doubao” AI glasses are about to enter the shipping phase. The product is reportedly jointly developed by ByteDance and Longcheer Technology—Longcheer handles the underlying UI development, while ByteDance leads the upper-layer app development. R&D takes place at Longcheer’s Huizhou factory, with mass production handled by its Nanchang plant. After the news broke, ByteDance quickly responded, stating, “The rumors are not true. There is currently no clear sales plan.”

In the tech industry, official “denials” are sometimes not the end of the story but may be part of commercial negotiations or strategic positioning.

Previously, as internet giants like Xiaomi, Alibaba, and Baidu made high-profile moves into the sector, rumors of ByteDance entering the AI glasses market had already been circulating widely. Thus, rather than when ByteDance’s product will launch, the market is more focused on whether Longcheer Technology has truly secured ByteDance’s AI glasses order.

According to media reports, Longcheer Technology now requires a minimum order quantity of 1 million units for AI glasses. This suggests that, amid slowing growth in its main business, Longcheer hopes to stage a comeback through its AI glasses operations.

01

Partners Leak “Business Secrets”

Longcheer Technology is emerging as a significant player in the AI glasses market. The company’s financial results for the first three quarters of 2025 reveal notable shifts in its business structure.

Data shows that in the first three quarters of 2025, Longcheer Technology reported revenue of 31.332 billion yuan, down 10.28% year-on-year, while net profit attributable to shareholders rose 17.74% to 507 million yuan. In the third quarter alone, revenue fell 9.62% year-on-year to 11.424 billion yuan.

By business segment, smartphone revenue in the third quarter dropped 21.96% year-on-year to 7.682 billion yuan. Tablet revenue, however, surged 23.30% to 1.09 billion yuan, while AIoT product revenue jumped 47.17% to 2.282 billion yuan.

Clearly, the decline in smartphone revenue, a key revenue driver, has dragged down overall performance, while the AIoT segment, particularly AI glasses, has emerged as a growth engine.

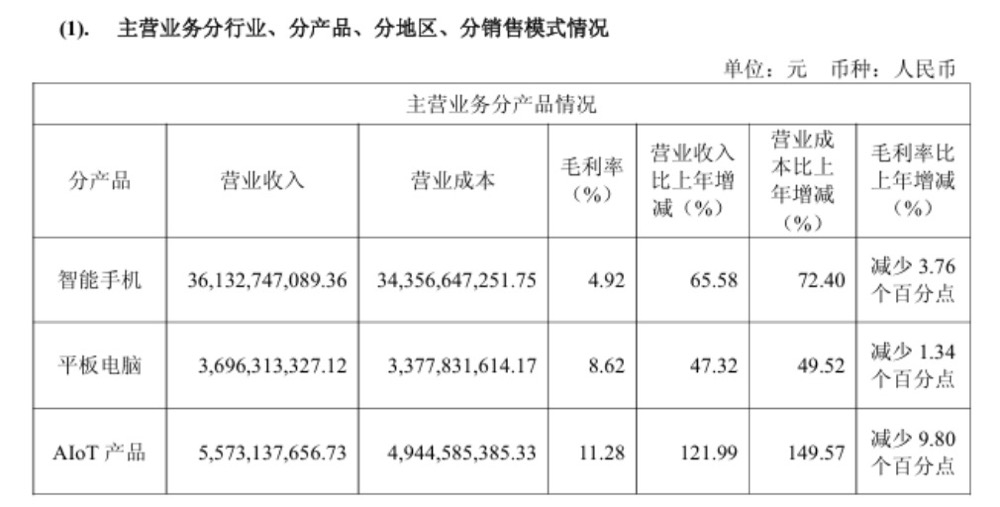

In addition to slowing revenue growth, gross margins in the core smartphone business remain under pressure.

From 2023 to 2024, smartphone gross margins fell from 8.68% to 4.92%. While tablet and AIoT margins also declined, they remained significantly higher than smartphones—8.62% and 11.28%, respectively, in 2024.

Image Source: Longcheer Technology’s 2024 Annual Report

Against this backdrop, Longcheer’s shift toward the booming smart glasses sector is understandable. In fact, the market has seen explosive growth over the past year.

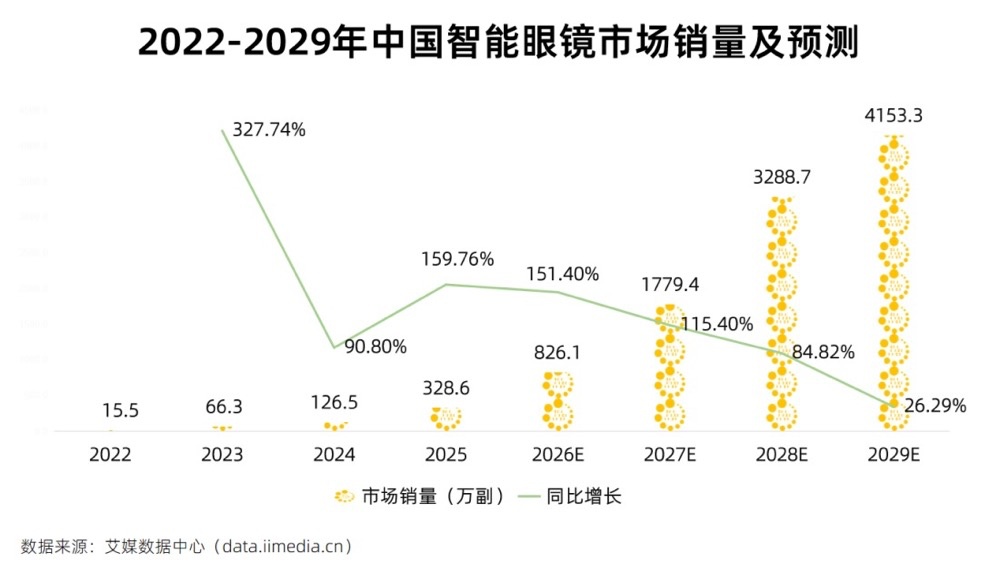

According to iiMedia Research, global smart glasses sales and market size surged by 350.82% and 110.72% year-on-year in 2025, reaching 13.448 million units and $12.58 billion, respectively. By 2029, these figures are expected to grow to 130 million units and $138.73 billion. China’s market, in particular, has seen rapid expansion.

In 2025, Chinese smart glasses sales and market size jumped by 159.76% and 139.02% year-on-year to 3.286 million units and 11.21 billion yuan, respectively. By 2029, these are projected to reach 41.533 million units and 119.11 billion yuan.

Image Source: iiMedia Research

This market shift has attracted numerous internet giants. In 2025, Xiaomi, Baidu, Alibaba (Kuake), and even new automotive player Li Auto launched their respective AI glasses, vying to become the new gateway for future smart terminals.

As an ODM leader, Longcheer Technology is determined not to miss out. The company has formed a clear strategy in the smart glasses space: deeply integrating into the supply chains of international top-tier clients, delivering products like charging cases and docks, and expanding into children’s glasses.

At the same time, Longcheer is focusing on technological breakthroughs in core areas of AI glasses, including human factors engineering, battery life, lightweight design, miniaturization of imaging hardware, and algorithms, while advancing pre-research for next-generation (N+1) products. This forward-looking technical reserve has laid the foundation for securing high-end AI glasses projects.

Thus, it is no surprise that Longcheer Technology has secured ByteDance’s AI glasses business. The company also hinted at this in its 2025 interim report: “We have newly undertaken mass production of AI glasses for a leading domestic internet client, gradually building manufacturing capabilities in the smart glasses category.”

Is ByteDance the “leading domestic internet client” mentioned? Yuan Media Group sought clarification from Longcheer Technology but received no response. While there is no direct evidence, another suspected ByteDance AI glasses supplier—HuiLun Crystal—may indirectly confirm the partnership.

On January 6, in response to inquiries about Doubao AI glasses, HuiLun Crystal stated: “The crystal oscillators used in ByteDance’s AI glasses are supplied exclusively by HuiLun Crystal. As their sole domestic supplier, we have formed a close ecological partnership with ByteDance and Longcheer.”

Image Source: HuiLun Crystal’s Official Post

Following news of its involvement in ByteDance’s AI glasses OEM, Longcheer Technology’s stock price hit the daily limit on January 5 and continued to rise over the next two trading days. By the close on January 8, the stock stood at 48.66 yuan per share, up 1.38% for the day, with a market capitalization of 22.886 billion yuan.

02

OEM Giants Pivot to the “Next iPhone”

Longcheer Technology is not the only manufacturing giant betting on AI glasses. On this new track, a full-scale competition among OEM firms has quietly begun.

Apple supply chain leaders are flocking to the AI glasses sector, each with high-profile partnerships. For example, Luxshare Precision provides in-depth ODM R&D and manufacturing support for Alibaba’s Kuake AI Glasses S1 series. After its launch, the product sold out immediately, with Luxshare leading the production ramp-up.

Additionally, Luxshare has established dedicated optical factories in Wuxi and Kunshan, using fully automated production lines to support mass production of lightweight waveguide lenses. It also supplies core components for XREAL’s Project Aura, a collaboration with Google.

Blueglass Technology, leveraging its expertise in glass, ceramics, metals, and composite materials, has transitioned from a “structural component supplier” to a “co-creator of AI-edge hardware,” becoming a key driver of lightweight design and complete machine assembly (complete device assembly) for AI glasses.

Unlike Luxshare, Blueglass adopts a “equity + industrial fund” model, deepening its partnership with AI glasses maker Rokid. Together, they launched the Rokid AI Glasses, weighing just 49 grams, offering a near-regular-glasses wearing experience. Based on strong past sales, Rokid has set a 2026 shipment target of 1 million units, making Blueglass a clear beneficiary as the exclusive supplier.

Blueglass also collaborates with multiple leading domestic and international clients to develop AI-edge hardware, including smart glasses, smartwatches, and smart rings, covering the entire supply chain from structural components and modules to complete device assembly.

Goertek, relying on its closed-loop capabilities across “optics-acoustics-structure-manufacturing,” has established systemic advantages. It exclusively manufactures Li Auto’s Livis AI Glasses, provides one-stop solutions for Xiaomi’s AI Glasses (from optical components to complete devices), and serves as the OEM for Meta’s first AI glasses with a display and multiple XREAL AR glasses.

Notably, Longcheer’s rival, Huaqin Technology, is also actively expanding in the smart wearables sector. Reports suggest Huaqin has become the exclusive manufacturer for Meta’s “AR Watch,” which uses myoelectric technology to precisely control AR glasses by monitoring electrical signal changes in wrist muscles, representing a frontier exploration of next-gen interaction methods.

These OEM giants’ collective pivot reflects their pursuit of the “next iPhone.” With smartphone growth slowing, AI glasses are seen as the next trillion-dollar market in consumer electronics.

03

When Will the “Impossible Trinity” Be Broken?

Despite rapid growth, the AI glasses industry faces significant challenges. The core dilemma lies in the “impossible trinity”—the difficulty of simultaneously optimizing performance, weight, and battery life.

While waveguide and microdisplay technologies are relatively mature, the image quality they deliver still falls short of user expectations for ultimate display performance. In terms of display technology, the industry has not fully resolved the dizziness caused by wearing smart glasses. Since 3D images rely on binocular disparity for depth perception, but optical imaging has a fixed depth, the mismatch between disparity and depth triggers dizziness.

Industry experts generally agree that the smart glasses sector is still in its early stages. Some even argue that for smart glasses to become a mainstream gateway, they must undergo at least one more round of deep technological and industrial iteration, requiring another 5 to 10 years of development.

This pessimistic outlook is not unfounded, as user data reveals. According to industry media citing platform statistics, AI glasses have a return rate of about 30% on JD.com and Tmall, and as high as 40–50% on Douyin, far exceeding typical consumer electronics products and exposing fundamental flaws in user experience.

User feedback centers on several key pain points: discomfort during prolonged wear (pressing on the nose bridge after just one hour), strong functional substitutability (photography inferior to smartphones, audio quality worse than professional headphones), and difficult post-sales repairs (fragile lenses and temples with complex maintenance).

These pain points stem from the aforementioned “impossible trinity.” Manufacturers often face trade-offs: pursuing lightweight design may sacrifice battery capacity, reducing battery life, while enhancing display capabilities (e.g., full-color displays) increases weight.

Nevertheless, the market remains optimistic about the future of AI glasses.

For Longcheer Technology to replicate its past smartphone success with AI glasses, its success hinges on whether it can help partner companies bridge the gap from “tech novelty” to “daily necessity.” This is the core to realizing AI glasses’ promise as the “next super terminal.”

Some images sourced online. Please notify us for removal if any copyright infringement occurs.