iFLYTEK ranks in the top 5! Is AI education the 'hope' for tablets?

![]() 12/03 2024

12/03 2024

![]() 639

639

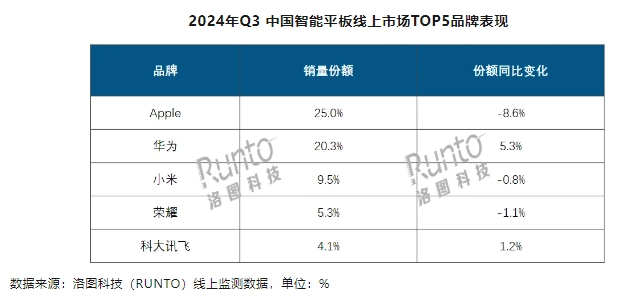

Recently, RDIO released the third-quarter 2024 sales report for China's online smart tablet market, with Apple, Huawei, and Xiaomi leading the pack, occupying the top three positions, followed closely by Honor in fourth place. Interestingly, iFLYTEK has pushed Lenovo out of the fifth spot, becoming the fifth-ranked vendor this quarter.

As the tablet market gradually recovers, consumer demand has also diversified. For example, iFLYTEK, which has entered the rankings for the first time, focuses more on education and AI compared to the other vendors, yet this single focus has garnered significant market attention.

(Image source: RDIO)

Facing a rapidly changing market, the focus of tablet vendors is becoming increasingly clear.

The traditional tablet market welcomes 'new players'

RDIO's report shows that the online market recorded total sales of 2.938 million units in the third quarter of 2024, accounting for approximately 41.2% of the overall market, with a year-on-year increase of 4.9%.

However, among the top five vendors, not all performed well. Apple, which ranked first, launched several iPad models this year, including the iPad Pro with the new M4 chip and the iPad mini A17 Pro, but its overall market share declined by a staggering 8.6%. Apple also recorded the largest decline among the top five vendors.

Xiaomi and Honor also saw significant declines. Xiaomi has slowed down its new product launches this year, with the Xiaomi Pad 7 series only officially unveiled recently at the Xiaomi 15 series launch event. Honor's launch schedule is similar, but considering that Honor still has multiple new products to be released, it is expected that the upcoming shopping festivals and year-end sales will be its main battleground.

(Image source: Xiaomi)

Among the three vendors with significant declines, Apple is the one that has put in the most effort with the least reward. Apple places great importance on its new products, but market feedback has not met expectations, especially since Apple Intelligence has not yet entered the Chinese mainland market, reducing the attractiveness of its new products. Xiaomi's main focus this year has been on the more affordable Redmi Pad, and the configuration of its main series is also less 'high-end,' which may be one of the reasons for losing interest among Xiaomi fans.

Huawei, which saw a significant increase, bet on new technologies this year, focusing on the HarmonyOS ecosystem and AI, injecting new vitality into the market. For example, the Mate Pad Pro is equipped with a new double-layered series-connected OLED technology that maintains high brightness for extended periods, with significantly improved screen lifespan and eye protection effects compared to previous generations.

(Image source: Huawei)

Surprisingly, iFLYTEK entered the rankings for the first time with a 4.2% market share and became the fastest-growing vendor among the top five, with a 1.2% share increase. Compared to professional and entertainment fields, iFLYTEK has been deeply involved in the education hardware market, introducing the Mars large model to support intelligent hardware education as early as 2022 and continuing to expand this year with the launch of the Lumie series, covering more low-priced markets.

Judging from the current market situation, many vendors are pursuing ultimate all-rounder products. For example, Apple's iPad Pro is indeed the most powerful tablet in terms of performance, but as a professional tool priced at tens of thousands of yuan, it is unlikely to be the first choice for mass consumers. On the other hand, iFLYTEK is doubling down on education + AI in its familiar field, creating a new path with a combination of strategies. It is foreseeable that vendors will also target the education sector and launch more competitive products to challenge iFLYTEK.

AI + education, the next trend in the tablet market?

Educational tablets can be traced back to 2005 with a product launched by the One Laptop Per Child project at MIT. This product was not released until 2012, and its e-ink screen and Linux-based Sugar operating system doomed it to never become a popular smart education hardware.

iFLYTEK launched its first hardware product focused on learning functions in 2018 and leveraged its advantage in speech recognition technology to develop real-time feedback for language learning through speech recognition. In the following years, iFLYTEK continued to iterate, such as the AI Learning Machine X1 series launched in 2019, which was the first to incorporate an AI large model for educational assistance.

In 2022, iFLYTEK introduced the first AI Learning Machine T20 with a built-in Spark large model. On the one hand, it leverages the built-in large model technology to allow students to ask questions directly to the learning machine and receive intelligent answers. On the other hand, its built-in academic courses cover the K12 education stage, targeting the primary and secondary school student market.

(Image source: iFLYTEK)

Of course, iFLYTEK is not the only company focusing on the education market. As early as the fifth-generation iPad, Apple made it compatible with the Apple Pencil accessory and emphasized functions such as drawing and note-taking, collaborating with third-party developers to create various learning apps specifically for children and students. Data shows that entry-level iPads have become one of the most popular smart teaching aids in the U.S. market.

While Apple also values the role of the iPad in education, the entertainment aspect of the iPad cannot be ignored, making it difficult for parents to approve of its 'all-round' nature. Recent U.S. education market research has shown that many schools and educational institutions prefer to purchase Chromebooks instead of iPads because the former has weaker entertainment features, helping students focus more on learning.

(Image source: KDDI)

However, iFLYTEK's AI Learning Machine does not encounter the same issues as Apple's iPad. From a product perspective, iFLYTEK's AI Learning Machine basically does not involve any entertainment features, allowing students to focus on learning. More importantly, iFLYTEK's AI Learning Machine is not a traditional learning tablet or smart tablet that implants algorithms into a single software and uses a database to match answers for students. Instead, it can understand and learn the educational needs of users, providing one-on-one human answers.

During the recent 11.11 shopping festival, sales of iFLYTEK's AI Learning Machine increased by over 1000% year-on-year. The official sales report also revealed that iFLYTEK has been the sales champion in the learning machine category on JD.com and Tmall for two consecutive years, with total sales across all channels also increasing by over 100%.

However, this is only a small opening for tablets to explore emerging markets: According to statistics, the average expenditure on education by Chinese households accounts for 15%-20% of total consumption, and electronic learning tools are gradually becoming an important part of educational expenditure. This also indicates that vendors focused on developing entertainment-oriented or all-rounder tablets should consider making new attempts in specialized fields.

Tablet battle escalates: from hardware stacking to scenario-based cultivation

In the past, competition in the tablet market was mainly related to performance and experience, but these tactics seem to have lost their effectiveness this year. For example, Apple's new iPad Pro with the M4 chip is indeed powerful, and the optimization of iPadOS 18 basically meets the needs of most users. However, its high price and limited educational functions put it at a disadvantage in the rapidly growing educational segment. In contrast, domestic brands are not only more competitive in pricing but also make more refined optimizations tailored to local user needs. This situation has led to a weakening growth momentum for Apple, with its market share continuously being diluted.

The failure of Apple's hardware stacking tactics also reflects the current transformation of the tablet market: products tailored to specific scenarios are more suitable for consumers.

Just like iFLYTEK, its popularity has injected new variables into the entire market. Unlike other brands that try to balance efforts in multiple fields such as entertainment, office work, and education, iFLYTEK focuses on educational scenarios and meets the core needs of parents and students through functions such as error question analysis and personalized learning paths. From a functional perspective, iFLYTEK ingeniously introduced health features such as eye-care screens and posture reminders, making these tablets almost a 'standard configuration' for parents to choose for their children.

(Image source: iFLYTEK)

In fact, Huawei and Xiaomi also have their strategies. First, in terms of product coverage, the MatePad series has a comprehensive layout across different price segments, from entry-level products that emphasize portability to high-end tablets that serve mobile office and creative users, showing a high degree of market fit. Secondly, both Huawei and Xiaomi introduce AI functions in their tablets to enhance user productivity and experience. Huawei focuses on optimizing the creative processes of note-taking and drawing through AI technology, while Xiaomi enhances device collaboration and intelligent interaction through remote control of PCs and a full-ecosystem AI assistant.

From an overall trend perspective, the smart tablet market is transitioning from 'hardware competition' to 'scenario competition.' The iterative performance of hardware is no longer the sole focus for attracting users. Instead, how to integrate products into users' daily life scenarios and meet the needs of specific groups is becoming the core of brand competition. Whether it's Huawei's multi-scenario coverage, Apple's enhanced creative productivity, or iFLYTEK's deep cultivation in the education field, all show signs of this transformation. The question for vendors going forward may be how to create products that better fit the current consumer groups while leveraging their strengths.

Source: Leitech