Breaking News: NVIDIA Under Scrutiny: What's Behind the Investigation?

![]() 12/11 2024

12/11 2024

![]() 662

662

On December 9th afternoon, the State Administration for Market Regulation (SAMR) announced its decision to initiate an investigation into the American chipmaker NVIDIA, citing alleged violations of China's Anti-Monopoly Law and the SAMR's 2020 antitrust review decision approving NVIDIA's acquisition of Mellanox Technologies Ltd. with additional restrictive conditions (SAMR Announcement [2020] No. 16).

Let's delve into the background of this investigation.

Why Did NVIDIA Acquire Mellanox Technologies?

In 2020, NVIDIA officially announced the completion of its $7 billion acquisition of Mellanox Technologies Ltd., equivalent to approximately RMB 49.6 billion. This deal, first announced in March 2019, received regulatory approval from the US, EU, Mexico, and ultimately from SAMR in 2020, establishing NVIDIA's current leadership in solutions capabilities.

This was NVIDIA's largest acquisition ever, surpassing Intel and fortifying its competitive stance. NVIDIA explained the acquisition as a strategic move to combine its computational expertise with Mellanox's high-performance networking technology, offering customers enhanced performance, increased computational resource utilization, and reduced operational costs.

Founded in 1999, Mellanox, headquartered in Santa Clara, California, and Yokneam, Israel, is a leading provider of end-to-end connectivity solutions for servers and storage. With a focus on InfiniBand and Ethernet interconnection products, Mellanox acquired Voltaire, a renowned Infiniband switch vendor, in late 2010, strengthening its position in high-performance computing, cloud computing, data centers, enterprise computing, and storage markets.

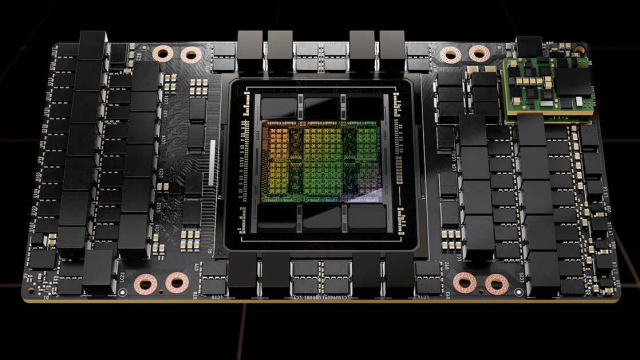

NVIDIA's dominance in the global GPU market combined with Mellanox's leadership in high-speed Ethernet cards and network interconnection devices would enable more efficient data extraction and rapid computational output, profoundly impacting supercomputing, artificial intelligence, and the internet market.

This synergy aimed to create a scenario where 1+1>2, positioning NVIDIA as a critical player in the global push towards developing AI industries and smart computing centers, which rely heavily on NVIDIA's GPU products, Mellanox's patents, and technological achievements.

Moreover, the indispensability of NVIDIA's GPUs is underscored by the fact that traditional cloud computing primarily uses CPUs, whereas smart computing centers rely on GPUs and other heterogeneous computing powers to handle large-scale, complex data analysis and intelligent decision-making tasks like large model training, image recognition, and speech recognition.

Currently, most countries developing AI industries cannot bypass NVIDIA.

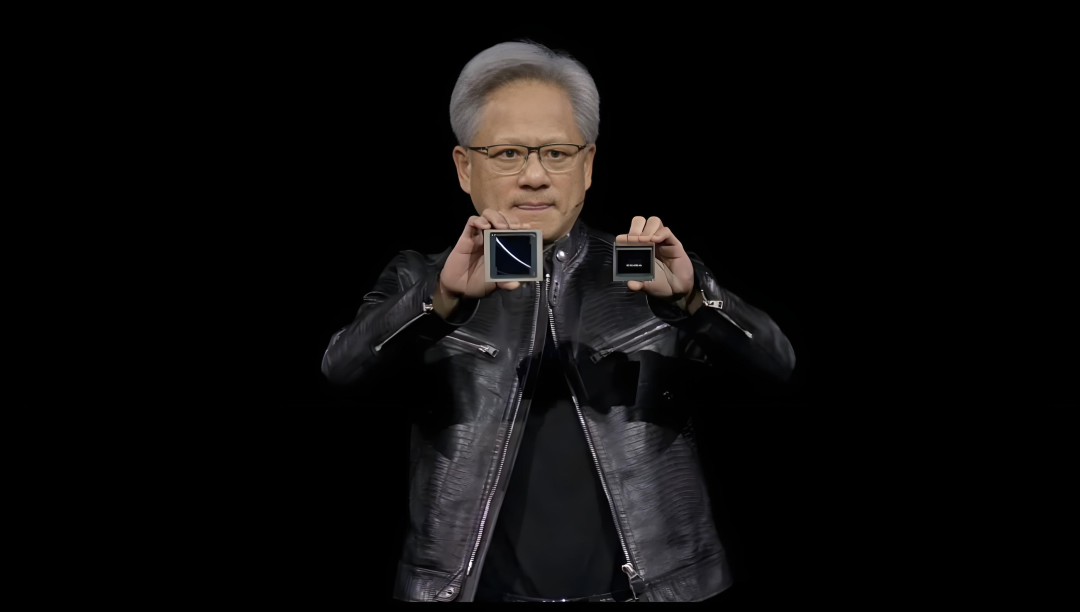

NVIDIA's CEO, Jen-Hsun Huang, has been actively engaged with government leaders and large internet and technology enterprises worldwide. Recently, Huang met with the Vietnamese Prime Minister, and NVIDIA plans to open an AI research and development center in Vietnam, collaborating with Viettel Group to promote AI technology. Additionally, NVIDIA acquired VinBrain, a medical AI startup, further strengthening its presence in Vietnam and Southeast Asia.

While Vietnam seeks to leverage NVIDIA's expertise in AI, NVIDIA aims to deepen its involvement in related industries abroad, consolidating its monopoly on core GPU products, thereby gaining pricing power and future opportunities in AI industry applications.

Conditional Approval from SAMR

NVIDIA's market dominance inevitably raises concerns about monopoly.

Four years ago, SAMR's approval of the acquisition was conditional, including stipulations that NVIDIA must not bundle its GPU accelerators and Mellanox high-speed network interconnection devices in any way, nor hinder customers from purchasing or using these products separately. Additionally, NVIDIA must not discriminate against customers purchasing these products separately in terms of service levels, prices, or software functions.

However, technological tensions have escalated in recent years.

On October 7, 2022, the US government updated its Export Administration Regulations with a "temporary rule," adding 31 Chinese entities to the "Unverified List" and escalating export controls on semiconductors to China, using the performance metrics of the NVIDIA A100 chip as a restrictive standard for high-performance computing chips exported to China. Specifically, high-performance computing chips subject to control were those meeting both of the following conditions:

- The I/O bandwidth transmission rate of the chip is greater than or equal to 600 Gbyte/s;

- The sum of the computational power calculated by multiplying the bit length of each operation of the 'Digital Processing Unit - Original Processing Unit' by TOPS is greater than or equal to 4800 TOPS.

Due to this policy, NVIDIA's A100 and H100 GPU accelerator chips could no longer be exported to China. Subsequently, NVIDIA introduced the A800 and H800 chips specifically for the Chinese mainland market, which retained powerful computational capabilities but limited communication speeds to comply with previous regulations. Since the implementation of the 2022 regulations, the demand for NVIDIA's dedicated chips for China has surged.

Then, on October 17, 2023, the US Department of Commerce announced plans to restrict the export of NVIDIA A800 and H800 chips to China, further limiting the computational power of chips of specific sizes to prevent circumventing restrictions using new 'Chiplet' technology methods.

On December 2, the US imposed new semiconductor export control measures against China, affecting 24 types of semiconductor manufacturing equipment and three software tools used for developing or producing semiconductors, as well as high-bandwidth memory (HBM). Additionally, 140 entities (including 136 Chinese companies, one Japanese company, one Singaporean company, and two Korean companies) were added to the control list, along with several key regulatory changes.

These policies have a broader scope than previous sanctions, particularly focusing on semiconductor manufacturing equipment, and impose unlawful unilateral sanctions and 'long-arm jurisdiction' on Chinese enterprises, dealing a significant blow to the globalized semiconductor industry.

The US Department of Commerce's Bureau of Industry and Security mentioned two main objectives: slowing down China's AI development and disrupting China's semiconductor development ecosystem.

It is evident that the US is employing every means to win the technological war, and we cannot remain passive.

Therefore, countermeasures are necessary. The Internet Society of China, China Semiconductor Industry Association, China Association of Automobile Manufacturers, and China Association of Communication Enterprises have voiced concerns, advising Chinese automakers to proceed with caution when procuring US chips to ensure the security and stability of the automotive supply chain.

Moreover, since NVIDIA's acquisition was approved conditionally, its differential product offerings to Chinese customers, regardless of the reason, clearly violate the initial conditions.

Furthermore, if NVIDIA monopolizes smart computing center solutions, it could face security risks such as remote attacks, leaks or contamination of GPU-associated software (NVIDIA's CUDA) corpora, and computational power leakage.

Thus, conducting investigations into NVIDIA is lawful and reasonable.

However, countermeasures are not intended to block all future cooperation but rather to express our determination to protect our semiconductor industry and emphasize the importance of normal business exchanges with US enterprises, exemplified by Apple's iPhones and Tesla's electric vehicles.

This situation may also present an opportunity for the domestic chip industry. Although we are lagging behind, the core of future AI computing power must remain in our hands, even if this is a long-term goal.

For NVIDIA, losing a significant market to comply with US policies will undoubtedly impact future earnings projections, overshadowing its share price.

Apart from the technological war and policy impacts, the AI industry itself is fraught with uncertainties. For more information on NVIDIA's future risks, click the link below for continued reading.

NVIDIA's Financial Results Are Good, but Why Can't They Support Overheated Stock Prices?

So, what are your thoughts on chips and NVIDIA? Feel free to discuss rationally in the comments section!

References: OFweek Electronics, AI Frontline, Chip List, Dashixiong Fun Bureau