ByteDance's 'Fierce' Ascent Sends Tencent Music into an 'EMO' Tailspin

![]() 11/14 2025

11/14 2025

![]() 549

549

Despite strong financial performance, Tencent Music's stock price has plummeted—leaving the company in an 'EMO' state of affairs.

Tencent Music reported total revenue of 8.46 billion yuan for the third quarter, marking a 20.6% year-on-year increase, with net profit surging by 36% to 2.15 billion yuan. On the surface, the numbers appear robust, yet the stock market delivered a harsh rebuke: a sudden, steep decline erased over HK$26 billion in market value overnight. After years of navigating China's volatile A-share market, one word comes to mind: "profit-taking."

While the earnings report exceeded analyst expectations, it inadvertently turned the financial release into a litmus test for investor sentiment. The abrupt sell-off was unexpected, but it underscores a broader truth: the music industry landscape has fundamentally shifted. Tencent Music's growth narrative no longer guarantees sustained investor confidence, as capital flows may remain within the sector but increasingly bypass the company.

ByteDance's relentless expansion is quietly reshaping the entertainment industry's entrenched hierarchy.

The Era Has Changed, My Lord

For years, the music streaming market seemed impervious to disruption. Tencent Music dominated with over 70% of industry copyright procurement costs, trailed by NetEase Cloud Music (notorious for its "depression cloud" comment sections) and budget-focused platforms like Kuwu and Kugou. Since 2023, however, Tencent Music's monthly active users (MAUs) have declined for 11 consecutive quarters, with total online music service MAUs dropping from 576 million to 551 million (a 4.3% decline). Its three flagship apps—QQ Music, Kugou Music, and Kuwu Music—all reported MAU contractions. Where did the users disappear to? Disruptive newcomers.

This year, ByteDance's Spark Music and Tomato Music have witnessed explosive growth. By September, their MAUs reached 120 million and 38.23 million, respectively, doubling year-on-year.

Spark Music's ascent isn't built on exclusive copyrights but on short-video-driven music dissemination. Its "traffic-content-monetization" ecosystem has transformed it into a "hit song factory," where viral trends dictate success.

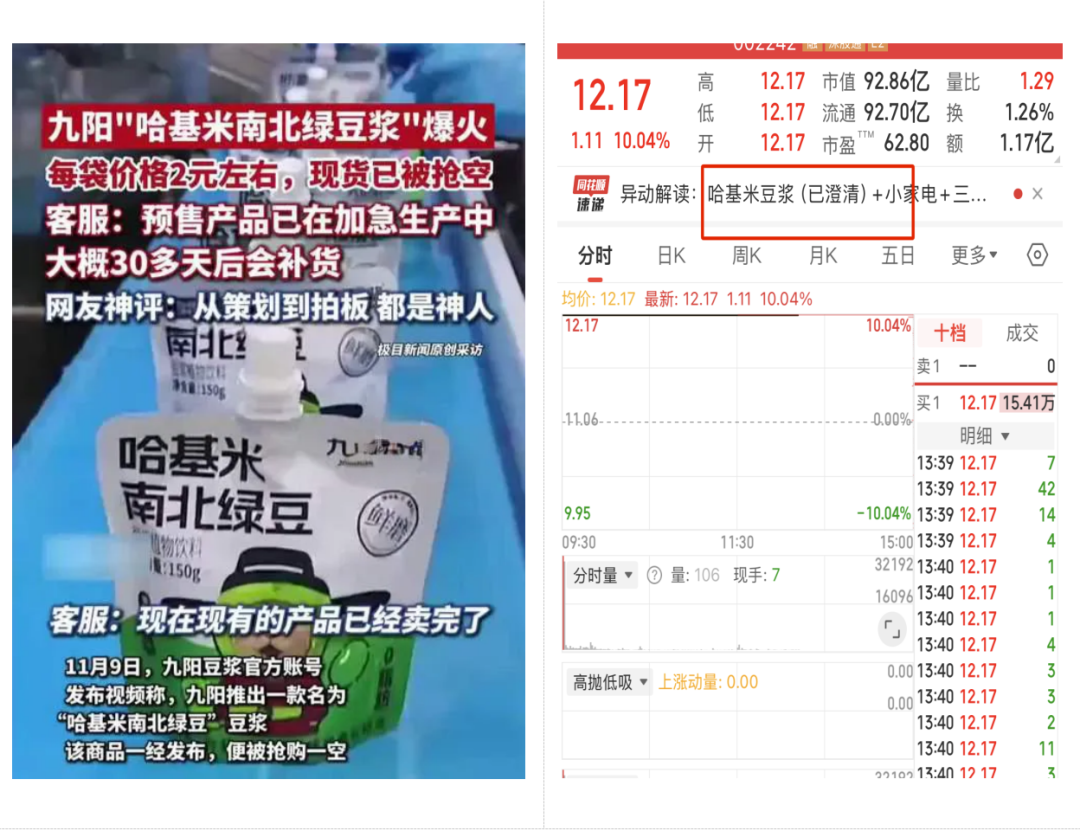

Frankly, if TikTok memes can sell out soy milk and trigger two daily trading limits for a listed company, channeling traffic to Spark Music is child's play.

This represents a lightweight, asset-light strategy starkly different from Tencent Music's—and, more critically, one that aligns with evolving entertainment market trends.

Consider the video platform evolution: initially, iQiyi, Youku, and Tencent Video competed fiercely for film and drama rights, but Bilibili carved out a niche with user-generated content (UGC) before Douyin (TikTok) dominated the sector. Could history repeat itself in music? Investors are betting it will.

The days of sitting glued to TVs or computers for long-form content are over, replaced by speed-reading classics, movie clips, and "20-minute world history" summaries.

Has the era changed, or have people? Perhaps both.

Entertainment products must now satisfy emotional needs and foster cultural exchange. NetEase Cloud Music's "EMO" culture and emotional resonance have turned comment sections into anonymous confession booths. When reminiscing about heartbreak, users revisit old songs and find kindred spirits below, lamenting, "Neither Buddha nor you betray me."

Absurd? Not really—human joys and sorrows are universal yet deeply personal.

Commercially, such behavior fosters extreme user loyalty. Every late-night "EMO" session fuels future engagement, offering value beyond music itself. Community culture is a formidable moat.

As TikTok memes and trends divert users, platforms need a second pillar beyond copyright libraries. NetEase Cloud Music has it; Tencent doesn't. While copyright libraries attract "old-school" fans of Jay Chou and Mayday, they fail to resonate with "young" fans seeking emotional connection and pop culture relevance.

"Old-school" fans may pay for nostalgia, but they're not the primary active users. The profit-MAU disconnect is thus understandable. It's not just the era changing—it's the audience.

Success and Failure Hinged on Copyright

The music streaming market faces dual pressures: internal homogenization and external encroachment.

Internally, homogeneous apps vie for users; externally, podcasts, audiobooks, and even "video-to-audio" apps encroach on auditory space. User habit shifts are rapid, but Tencent Music's high copyright costs and low user migration create a product loyalty mismatch.

Copyright isn't obsolete, but when users migrate to platforms like Douyin and Spark Music that bypass copyright restrictions through new scenarios, the threat becomes existential. This erodes Tencent's competitive moat, driving user loss. When platforms with massive user bases dictate upstream markets, the industry fundamentally shifts.

Tencent Music once relied on "exclusive copyrights + community operations," but Spark Music sidesteps the copyright red ocean, leveraging Douyin's 600 million DAU to redefine music engagement through "fragmented consumption + social sharing." When music shifts from "app-based listening" to "video-driven discovery," Kugou and Kuwu's "distribution channel" edge vanishes, while QQ Music's "premium" user base faces pressure from NetEase and Spark Music.

When "copyright hoarding" loses its edge, high costs become a burden.

Despite holding 90% of top copyrights (Universal, Warner), users complain of "grayed-out songs" (non-exclusive expirations) and overly "hot-song-dependent" algorithms lacking personalization. By 2025, QQ Music's "Daily Recommendations" accuracy fell to 62%, below NetEase's 75%. Without copyright as a moat, users vote with their feet.

High copyright costs and poor recommendations are like winking in the dark—users can't see your value, so they seek familiar content elsewhere. This drives traffic loss and capital market failure. Tencent's stock plunge is a long-overdue "value correction": in internet music's second half, no one leads forever on past glory.

Spark Music's rise isn't accidental—it's inevitable, driven by "technology disrupting experience" and "scenarios reshaping ecosystems."

Tencent Music's breakthrough may start by abandoning its "music empire" arrogance and truly understanding: users want a musical companion, not a copyright-stuffed player.