Debut! 'Double 11' Smartphone Market - Full-Channel Weekly Sales Report

![]() 11/14 2025

11/14 2025

![]() 551

551

After navigating through the crucial initial sales surge of 'Double 11', the promotional activity transitioned into a relatively stable phase last week (from November 3rd to November 9th). The shift from this stable phase to periods of high sales volume puts brands' strategies for coordinating multiple products and brands to the test, with the overall market showing new patterns akin to waves.

Industry Characteristics: Stable Phase in the Fifth Week, Market Relatively Subdued

According to research conducted by AVC (All View Cloud), the domestic smartphone market recorded cumulative online and offline sales of 9.41 million units from November 3rd to November 9th, marking a 20.3% year-on-year decrease. During this stable sales phase of 'Double 11', combined with the market demand release on November 1st and some consumers' cautious spending due to expectations of price drops for the November 11th event as a whole, the market remained relatively subdued.

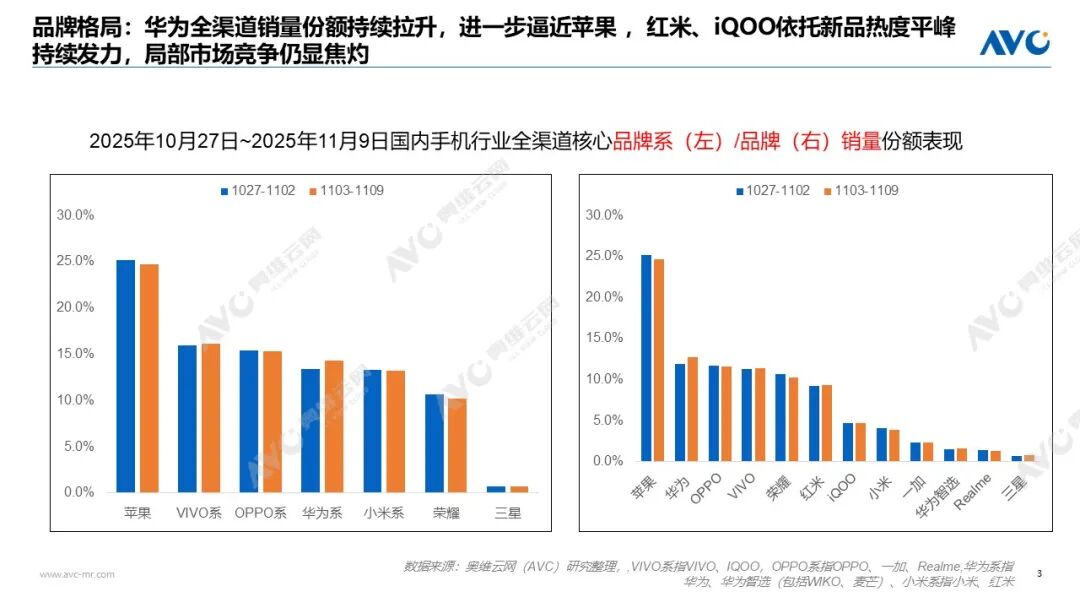

Competitive Performance: Huawei Closing in on Apple's Market Share, Redmi and IQOO Drive Sales with New Products, Standing Out During the Stable Phase

AVC research indicates that from November 3rd to November 9th, major brand groups maintained their rankings, with Huawei's group showing notable improvement. This was primarily driven by Huawei's main brand, with promotions for products such as the Mate 70 Pro and Pura 80 narrowing the gap with Apple. Meanwhile, Xiaomi's sub-brand Redmi and VIVO's sub-brand IQOO continued to fuel sales growth with their newly launched K90 series and NEO 11 series products, respectively, leading to favorable weekly retail share trends for these brands.

TOP Model Performance: Apple Products Dominate Top 6, Led by the 17 Series; Strong Demand Returns for Products in the 1,000-Yuan Price Range

AVC research reveals that from November 3rd to November 9th, Apple products, led by the iPhone 17 Pro Max and benefiting from significant upgrades this year, continued to dominate the market. Simultaneously, products in the 1,000-yuan price range, such as the OPPO A5X, Vivo Y50 (5G), Honor X70, and Nova 14, witnessed sustained strong demand. The impact of government subsidies gradually faded, with high-quality, cost-effective products making a resurgence.

New Product Performance: Apple's 17 Pro Max Maintains Top Position; Market Sees Alternating Trends Between 4K+ and 2.5K- Products; Stable Phase Tests Multi-Product Portfolio Sales Ability

AVC research shows that during the fifth week of Double 11 (from November 3rd to November 9th), Apple's 17 series new products maintained their top three positions. In the 4K+ market, products like the Xiaomi 17 Pro Max, VIVO X300, and OPPO Find X9 capitalized on strong initial sales momentum to stay ahead. Meanwhile, Huawei's Pura 80 stood out with an effective pricing strategy during the stable phase. In the 2.5K- market, new products like the Redmi K90, IQOO Neo 11, and OnePlus ACE 6 received positive market feedback due to the combined effects of new product launches and government subsidies, remaining popular in the fifth week and forming a dynamic rotation with 4K+ mainstay products.

As the week preceding the final node of Double 11, the period from November 3rd to November 9th serves as a crucial window for smartphone brands to adjust strategies and prepare. To stay informed about the full-cycle, full-channel market sales performance of 'Double 11' and see who ultimately emerges victorious, please continue to follow AVC's smartphone industry reports for the latest and most comprehensive insights into the domestic smartphone market!

Original content from AVC. Unauthorized copying, extraction, or use of this content by any institution or individual for purposes such as training AI large models is strictly prohibited.