Former Executives Swarm to Robot Ventures: Will They Cross Paths with Old Employers?

![]() 12/28 2024

12/28 2024

![]() 694

694

By Leon

Edited by Hou Yu

Following new energy vehicles and large AI models, AI robots (embodied intelligence) are emerging as the next technological frontier.

Unlike industrial robotic arms and early bipedal robots, embodied intelligence generally refers to robots equipped with advanced AI models, encompassing humanoid and quadruped robots, offering new possibilities in various industries with the support of AIGC (Generative AI).

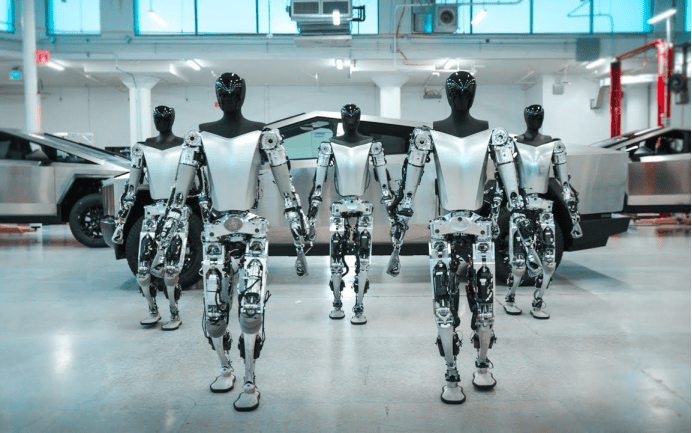

In 2024, Tesla's Optimus captivated audiences at a party by mixing drinks and telling jokes, showcasing significant improvements in anthropomorphic capabilities. Meanwhile, Unitree Robotics' robot dogs, equipped with high-performance electric drives and new visual language models, made appearances at multiple NVIDIA press conferences, boosting a series of robot industry-related stocks.

Suddenly, the robot sector has become a popular entrepreneurial field, attracting numerous former executives from technology companies.

Yu Chao, former head of Dreametech's humanoid robot business and director of the Innovation Robotics Research Institute, left the company mid-year to found Luming Robotics and secured angel round funding by late November. Investors include InnoAngel Fund and SenseTime Guoxiang Capital, with the specific investment amount undisclosed.

Coincidentally, Guo Renjie, former Executive President of Dreametech China, also departed at the end of the year to venture into the consumer robot industry. Guo Renjie is actively pursuing his first round of funding, which is nearly complete. Investors include IDG Capital, Matrix Partners China, ZhenFund, and Monolith, with a post-investment valuation of approximately 500 million yuan.

Expanding the timeline, Wu Peng, a partner and vice president of Dreametech, left the company in the second half of 2022 to found Keye Technology, which has received five rounds of funding. In the same year, Wang Shengle, co-founder and executive vice president of Dreametech, left to establish Xingmai Robotics, focusing on pool cleaning scenarios and securing two rounds of funding.

As a unicorn in the cleaning appliances industry with a multibillion-dollar market value, Dreametech has seen several executives depart to start their own businesses in just two years. Is the robot sector simply too enticing, or has the cleaning appliances market lost its ability to retain talent?

'Prodigy' Departs, Dreametech Struggles to Retain Talent

Rumors circulated in early November that Guo Renjie was about to leave Dreametech, which was largely confirmed by a photo on his social media. In the tech industry, Guo Renjie may not be a household name, but he is young and promising.

Born in 1997, Guo Renjie graduated from Xi'an Jiaotong University's Young Gifted Program (Energy and Power Engineering). Notable alumni include Gang Hua, CTO of Binlifang, and Hanqing Wu, former Chief Security Expert at Alibaba. After completing the Young Gifted Program, Guo Renjie earned a Master's degree in Financial Economics from the London School of Economics and Political Science and later served as Brand Director at P&G China.

Guo Renjie joined Dreametech in 2021 and quickly ascended, becoming the China Region Marketing Director, Deputy General Manager, and Executive President within three years. At just 27, he became a senior executive at a technology company. Upon joining, Guo Renjie reportedly pledged to Yu Hao, founder and CEO of Dreametech: "I will make Dreametech an industry leader within three months." And he delivered.

During Dreametech's rapid growth over three years, Guo Renjie led the transition from the Xiaomi ecosystem to an independent brand, built the China region marketing system, leveraged short video platforms for marketing, and promoted Dreametech's premiumization strategy, successfully distinguishing the brand in a highly competitive market.

At Dreametech's press conference in late May this year, Guo Renjie revealed key growth figures. In 2023, Dreametech sold over 2.4 million robotic vacuum cleaners globally, a year-on-year increase of 300%, with overseas revenue accounting for 65% of total revenue. In markets such as Germany, Italy, and Singapore, Dreametech had the highest market share in the first quarter of 2024.

'Currently, Dreametech is present in over 100 countries worldwide. We have broken away from the cost-effectiveness approach pursued by previous overseas enterprises, achieving the highest market share in each country at the highest price point,' Guo Renjie once said.

Dreametech is not only popular overseas but also growing rapidly in the Chinese market. According to GfK data, in the first half of 2024, Dreametech's online market share in cleaning appliances reached 18%, ranking first in the industry. Meanwhile, its retail sales increased by 62% year-on-year and retail volume by 73%, far outpacing industry leader Ecovacs (which still holds the overall brand share lead).

Since its founding in 2017, it is remarkable that Dreametech has achieved premium development and maintained high growth in the saturated cleaning appliances market within just seven years. On the one hand, Yu Hao, a Tsinghua graduate, is also an academic star who led the team in developing Dreametech's signature technologies such as 'high-speed digital motors' and 'Dreametech bionic arms'. On the other hand, as a post-87s generation, Yu Hao dares to empower young talent, with Guo Renjie being a prime example.

Given Guo Renjie's impressive performance, why did he choose to step down from Dreametech before its IPO? It may be related to uncertainties about Dreametech's overall strategy. On multiple social platforms, self-proclaimed Dreametech employees claimed that Guo Renjie's departure was related to Yu Hao's management style, noting that while Yu Hao is willing to empower young people, he does not fully delegate authority, which hampered Guo Renjie's business progress. However, these claims have not been directly confirmed by The Wall Street Tech Eye.

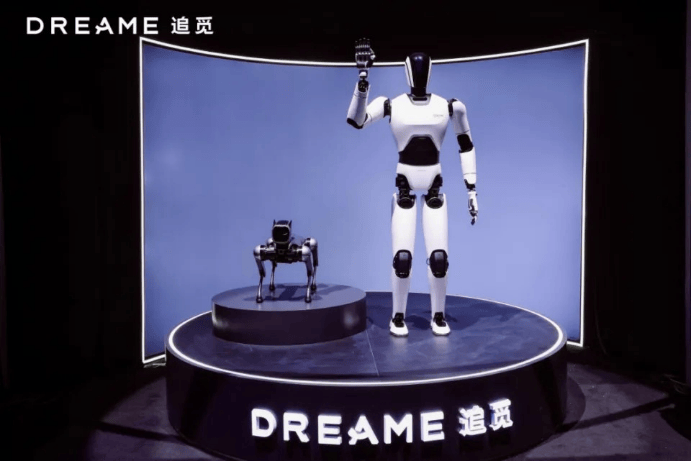

In fact, Dreametech is also involved in the robot industry, but the marketization of its self-developed products is currently stalled, lacking a long-term commitment. Perhaps Dreametech's indecisiveness about its robot business has led executives to choose to leave and start their own ventures.

Robot Track: Former Dreametech Executives Compete with Their Former Employer

Examining the background of Dreametech's founder, it is evident that Yu Hao is not content with just making robotic vacuum cleaners.

Yu Hao shone brightly during his studies at Tsinghua University, participating in the development of quadcopter drones, inventing the world's first tri-rotor drone, and founding the 'Sky Workshop' technology platform, which gathered a group of geeks, including the initial Dreametech team. Using aircraft technology to overcome motor speed limitations was a spark of inspiration born from Yu Hao's technical accumulation.

With a reserve of technology in aircraft and robots, Dreametech's perspective is not limited to the cleaning appliances field. 'Since its inception, Dreametech has set a vision to become a world-class technology enterprise. In the near future, Eame One can be applied in performance entertainment, scientific research and teaching, commercial services, and other fields. With additional accessories, it can also be used for patrol and survey operations in various industries,' Yu Hao said in a speech at the 2022 ROBOCON National University Robotics Contest.

From 2021 to 2023, Dreametech released several robot products, including the self-developed robot dog Eame One and a general humanoid robot. Yu Hao has also publicly stated, 'The next decade will be the best era for generalized robots.'

However, Dreametech's robot business is still at the exhibition stage with no follow-up mass production plans. Meanwhile, Dreametech seems to have shifted its focus from self-development to investment.

In August this year, Dreametech announced the establishment of a 11 billion yuan Dreametech Robotics Industry Venture Capital Fund with a 55% shareholding. It has already invested in the angel round of 'Magic Atom.' According to Qichacha, Magic Atom is a humanoid robot research and development company with a registered capital of 10 million yuan. Its products include general humanoid robots and bionic quadruped robots, covering industrial, commercial, and household scenarios. It is reported that Magic Atom plans to deliver hundreds of humanoid robots in the first quarter of 2025.

It should be noted that despite sharing the same direction, Dreametech has not invested in former employees' entrepreneurial projects. This suggests that former Dreametech executives may soon compete with their former employer in the robot market.

Can Anyone Seize the Huge Opportunity in Robots?

Dreametech may not be a large company, but it has already taken on the flavor of a 'Whampoa Military Academy.' Currently, three executives have left to pursue robot ventures. This track resembles the momentum of the early development of the new energy vehicle industry. So, is the robot trend easy to capitalize on?

From a market perspective, technology giants like Tesla have been laying the groundwork for AI robots for years and possess core technologies and vast resources. Tesla's Optimus has reached the industry's highest level of anthropomorphism, leaving competitors far behind.

Firstly, AI robots are deeply integrated with large models, and the performance of these models relies heavily on computing power. Musk's AI company has completed a 6 billion dollar funding round and possesses a training cluster composed of over 100,000 NVIDIA H100/H200 graphics cards, with plans to increase this number to over 550,000 next year.

In comparison, as of the end of 2023, Tencent had approximately 50,000 H100 cards, Baidu had around 40,000, and Alibaba and ByteDance had 25,000 and 20,000, respectively. Considering that the US has restricted the export of NVIDIA AI computing graphics cards, even if domestic startups have the funds, it is difficult for them to procure large quantities. If they choose third-party open-source general large models, they may struggle with tuning or may not meet specific needs, limiting their potential.

Moreover, manufacturing robots is a complex engineering task that requires not only an 'AI brain' but also advanced manufacturing processes. For example, creating flexible fingers that can hold a glass without crushing it demands extremely high precision in hand joint design. A single robot may require different types of motors, often requiring custom solutions. With small order volumes, it is difficult for upstream supply chains to meet these demands, a problem that Tesla also encountered in the early stages of its robot development. Fortunately, China's upstream supply chains are highly adaptable and iterative, providing convenient opportunities for robot enterprises.

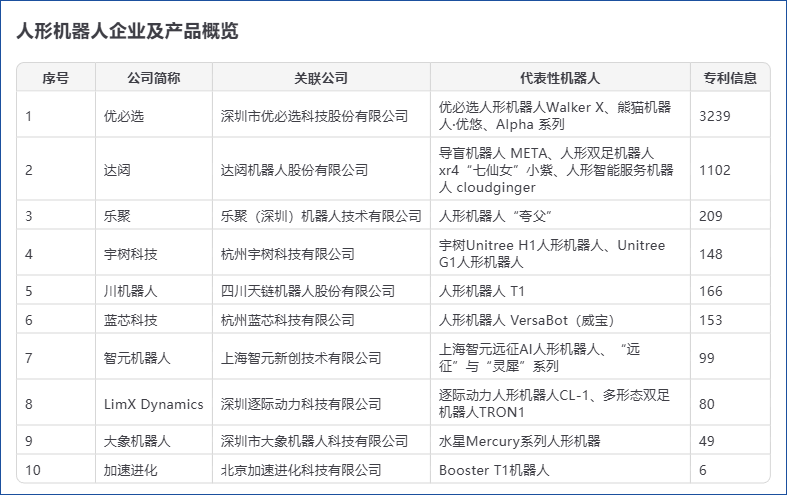

The competitive landscape for domestic robot enterprises is also taking shape. Unitree Robotics, which has gained significant attention this year, not only received endorsements from NVIDIA but also saw its all-terrain AI robot dog trend on social media, even gaining international fame. Elebot's humanoid robot 'Kuafu' was unveiled at the 2024 Huawei Developer Conference, equipped with the open-source HarmonyOS and the Pangu large model. It can walk smoothly, jump rapidly, and recognize and handle objects, making it promising in education, research, companionship, and care.

Faced with these established robot enterprises, newly entered startups will need to present more technological highlights and innovative application scenarios to attract investors' attention.

Recently, Li Feng of Frees Fund delivered a keynote speech titled 'The Development Trend and Investment Logic of Embodied Intelligence' at the 2024 T-EDGE Conference, revealing the most valuable AI robot and embodied intelligence projects in the eyes of investors: 'There are hotspots from both software and hardware perspectives. The software aspect focuses on AI technology-driven components, while the hardware aspect combines software with productization.'

Specifically, software refers to advanced large models, while hardware may encompass hot tracks such as glasses, headphones, and smart pet products. 'Embodied intelligence needs to be gradually improved and generalized in vertical scenarios. During this process, both software and hardware must iterate simultaneously,' Li Feng added.

Returning to Guo Renjie, his background as a member of the Young Gifted Program, the youngest executive president, and his achievements during his tenure at Dreametech are all accolades that capitalize on his potential. However, ultimately, it comes down to the project's prospects; otherwise, capital will promptly correct and stop losses.

In fact, it is not uncommon for young, academically accomplished entrepreneurs to experience setbacks. Li Yinan, also from the Young Gifted Program, saw his entrepreneurial ventures in electric bicycles (Niu) and new energy vehicles (Freelander) fail after shedding the 'Huawei heir' label. Qichacha shows that he is currently restricted from high consumption due to involvement in a case worth 650,100 yuan, which is regrettable. Currently, Guo Renjie is starting anew, and his new business is just beginning, with much uncertainty ahead.

However, it is certain that the next wave of AI will be led by embodied robots. Musk believes that by 2040, the number of humanoid robots may exceed that of humans, supporting Tesla to become a giant company with a market value exceeding 25 trillion dollars.

In this context, the government has unveiled a series of supportive policies, encompassing the '14th Five-Year Plan for the Development of the Robotics Industry' and the 'Implementation Plan for the "Robot+" Application Initiative.' These policies are aimed at fostering technological innovation, accelerating industrial upgrading, and enhancing international competitiveness within the robotics sector.