AI Glasses Priced at Up to a Thousand Yuan Each, Embodying Tech Giants' Dreams of Financial Success

![]() 01/07 2025

01/07 2025

![]() 564

564

While a low-price strategy can swiftly expand the market, AI glasses carry the promise of growth, and the fundamental motivation for manufacturers to enter this market lies in economic returns.

Content/Awen

Editor/Yong'e

Proofreader/Mangfu

Recently, ByteDance unveiled the Doubao visual understanding large model. Despite its functional introduction, its price garnered more attention, with an input cost of 0.003 yuan per thousand tokens, representing an 85% discount compared to the industry average.

This marks a continuation of the price war among general large models since May 2024, with "lower prices" becoming a standard feature for new product launches. Despite 2024 being hailed as the first year of AI commercialization, there has been no breakthrough application in the market, and the model end has been caught in a price war.

On the hardware front, the "Ray-Ban Meta" AI glasses, a collaboration between Meta and the Ray-Ban eyewear brand, have achieved a sales milestone of over one million pairs, with annual shipments projected to exceed 2 million. Seeing new hope in this terminal form, technology companies aiming to capitalize on the AI sector have queued up to enter the market.

According to incomplete statistics, giants such as Baidu, Huawei, ByteDance, Tencent, Xiaomi, Apple, Samsung, and others have either announced or are rumored to be preparing AI glasses, accelerating the exploration of large model applications in consumer scenarios.

Another research report highlights that AI smart glasses are currently recognized as the most cost-effective hardware implementation solution for AI in the industry, and 2024 marks a pivotal year in the field of AI smart glasses.

However, similar to the fate of AI assistants, AI glasses have not yet entered a full market development phase before hastily sparking a price war. Before AI glasses can generate revenue, manufacturers still need to exercise patience.

Part 1

Hundreds of glasses compete, not wanting to be just a Meta replacement

"Hey Meta, take a photo."

Typically, such conversations occur primarily on mobile phones, but Meta has successfully adapted this to glasses. Despite being named glasses, Ray-Ban Meta does not come with lenses for display. The most prominent features are five microphones and a 12-megapixel camera.

Users can activate the AI assistant built into the glasses through voice commands to complete tasks such as making phone calls, listening to music, translation, recognition, and taking photos.

From the perspective of interaction forms and product functions, Ray-Ban Meta does not deviate from the mainstream solutions in the current AI glasses market. AI glasses are broadly categorized into three types: no display, no color display, and with color display. Ray-Ban Meta can be considered a representative of AI glasses without a display, supporting audio functions and equipped with a camera. To view photos taken by the glasses, users need to open their phones.

Baidu's Duer AI glasses, ByteDance, Xiaomi, and other major companies all plan to follow this route, which is currently the most widely used and portable form of AI glasses, lightweight and suitable for various indoor and outdoor scenarios.

Startup companies seem to prefer the route with display screens, perhaps driven by a desire for differentiated competition with large companies by choosing to serve specific scenarios. For instance, Viture is primarily used for gaming, while ThunderBird and Xreal are geared towards movie watching. The display screen of Rokid Glasses can display question-and-answer results.

This type of entertainment AI glasses is relatively heavy and generally only suitable for indoor use due to low light transmittance and short battery life.

Although the overall functionality is relatively similar, players are unwilling to be mere replacements for Meta and are striving to establish their own differentiated advantages.

One of the selling points of AI glasses is that their weight is comparable to that of ordinary glasses, ensuring user comfort. Even a slight weight difference can impact the experience to some extent, so manufacturers are putting effort into reducing weight. For instance, both Ray-Ban Meta and Rokid glasses weigh 49 grams, while Baidu's Duer AI glasses weigh just 45 grams.

Beyond the physical difference brought by minor weight variations, the core competitive advantage of AI glasses should lie in the intelligent service experience, making the integration of large models one of the promotional highlights for manufacturers.

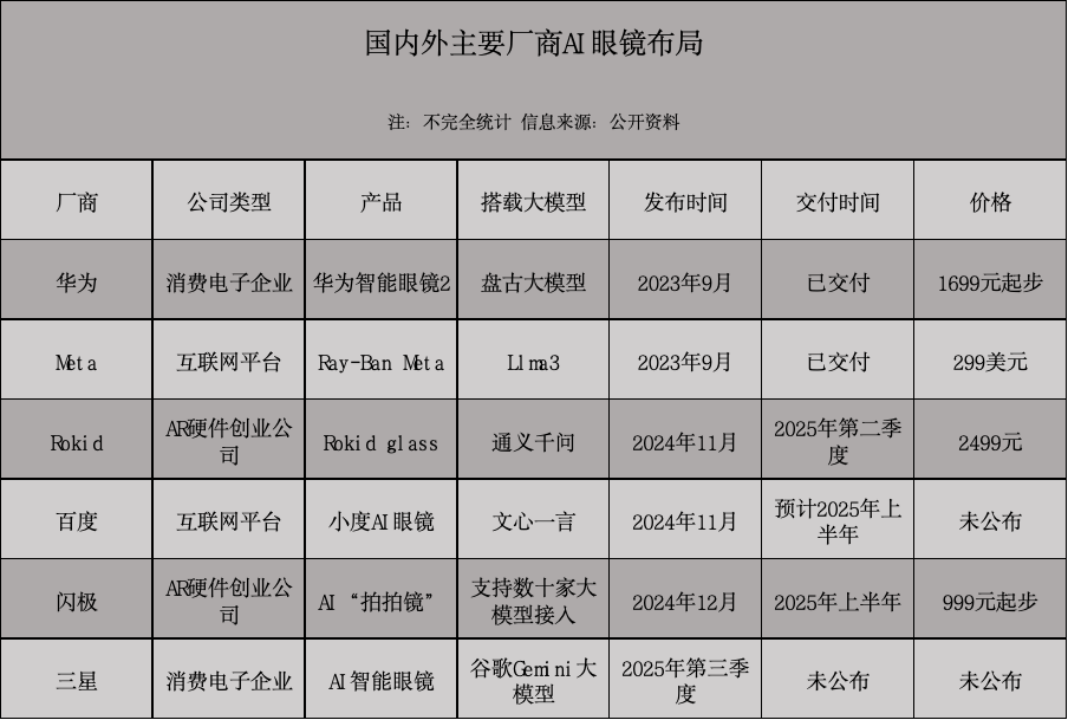

Ray-Ban Meta incorporates the large model Llama3, Duer AI glasses are equipped with ERNIE Bot, Rokid glasses integrate Alibaba's Tongyi Qianwen AI, Huawei Smart Glasses 2 are equipped with the Pangu large model, and future Samsung AI glasses may integrate Google's large model.

Despite the lively promotional hype and back-to-back AI glasses launches, only a few products have achieved large-scale delivery, with most remaining in the "announced but not released" stage. Manufacturers are eager to demonstrate their ability to launch AI glasses to preempt consumers' attention and compete for the potential market.

According to Xiaoniu Research data, global smart glasses sales in 2023 were 1.01 million units, and smart glasses shipments in the first quarter of 2024 increased by 217% year-on-year.

According to another research report on the smart glasses market by BIS Research, the smart glasses market size is expected to reach 106.778 billion yuan by 2029, with a compound annual growth rate of 18.56% during this period.

Part 2

What users want and what manufacturers can do

However, while newcomers smile, the old are left to weep. Currently, AI glasses are enjoying unprecedented popularity, in stark contrast to the neglect suffered by once-favored AR glasses.

In 2012, Google Glass made its debut, becoming the first player in the smart glasses field. However, three years later, Google Glass stopped being sold.

In February 2024, Apple's Vision Pro headset, which the company had been preparing for about seven years, was officially launched, combining XR mixed reality with AI. However, its market performance did not meet expectations. Currently, Vision Pro production has been significantly reduced and may even cease by the end of the year.

The reasons for the failure of these AR glasses in the mass consumer market are multifaceted. AR glasses are heavy, causing dizziness and eye fatigue after wearing them for just half an hour. Additionally, their high price deters consumers from trying them out.

The lack of users also leads to a lack of interest from developers, resulting in a scarcity of application ecosystems for AR glasses, further reducing usage frequency and plunging them into a vicious cycle.

In contrast, AI glasses have a broader range of usage scenarios, encompassing life, work, study, and more. For example, some AI glasses provide a photo-taking and question-answering function, where users only need to point the glasses at a question, and the AI glasses will provide the answer and solution process. Additionally, functions such as memos and teleprompters can appeal to working professionals.

From the current situation, the marketization path for AI glasses seems smoother than that for AR glasses. However, judging from the commercialization progress of large models, users have high expectations for AI-related products, and there are still many areas where AI glasses can be improved.

Like AR glasses, AI glasses also aim to replace mobile phones, allowing users to make calls, listen to music, take photos, translate, pay, and more without needing to pull out their phones. However, the premise is that the glasses must be connected to a phone to function.

For example, to answer a phone call, AI glasses need to be connected to a phone via Bluetooth. Photos or videos taken with AI glasses need to be stored on the phone. Before translation, the glasses first recognize images or text, process them via the phone's cloud through Bluetooth or WiFi, and then feedback the results to the glasses.

Furthermore, to reduce weight, most manufacturers have opted to omit the optical display module, meaning AI glasses can "hear but not see." With a phone nearby, AI glasses can function as a combination of headphones, cameras, translators, and other tech products; otherwise, they are no different from ordinary glasses.

Currently, AI glasses focus on software functionality, but their application effectiveness is limited by hardware. For AI glasses, hardware is the foundation, and the model is crucial to the user experience. However, the size of the model that can be accommodated depends on the quality of the processor and memory hard drive.

The size of glasses is limited, and current technological advancements restrict the quantity and size of hardware that can be "packed" inside, directly leading to AI glasses' inability to independently perform complex computing tasks and relying on phones as the hub for computing and data storage.

Many industries and products face an "impossible triangle" of "lightweight, functionality, and cost," and AI glasses are no exception. With current technology, the "impossible triangle" of "lightweight, functionality, and cost" means that AI glasses are more of an extension of phone functionality and cannot replace phones.

Whoever can be the first to break or balance this impossible triangle may create a blockbuster product.

Part 3

To make money, start with a price war

AI glasses are more inclined towards the C-end market, so "pleasing users" is particularly important, starting with making them affordable.

The first-generation Vision Pro was priced at up to $3,499, and the PICO 4 Ultra costs over 4,000 yuan, making it difficult for them to break into the mainstream market. Learning from past experiences, the AI glasses collaboration between Meta and Ray-Ban were launched with a consumer-friendly approach, priced at just $299, less than one-tenth of the price of Vision Pro.

As industry competition intensifies, price points will continue to drop. In May 2024, ThunderBird Innovations released the Air 2s AR glasses, priced at 2,698 yuan, which attracted many users. However, their latest AR glasses, the Air 3, released in late October, are priced at just 1,699 yuan.

Meanwhile, Shanji's newly launched AI "Pat-Pat Mirror" has a minimum price of only 999 yuan, and Li Weike's AI glasses are even cheaper at 699 yuan.

Duer AI glasses have not yet announced their price, only stating that they offer "more than their worth" and boasting industry-leading battery life and pixel quality. It is conservatively estimated that their pricing will be around 2,000 yuan.

Low prices are the industry mainstream. Taking smart audio glasses, a segmented product, as an example, online monitoring data from RDI shows that the average online market price for smart audio glasses in 2023 was 1,167.8 yuan. The 1,000-1,999 yuan price range accounted for the highest market share of 55.3%. The 400-699 yuan price range increased to 24.1%, up 14.7 percentage points year-on-year.

While a low-price strategy can swiftly expand the market, AI glasses carry the promise of growth, and the fundamental reason for manufacturers to enter this market lies in economic returns.

It would be ideal if they could sell explosively. Wang Huiwen, co-founder of Meituan, recently invested in the consumer-grade AR glasses company Viture, whose products have achieved cumulative sales of over 200 million yuan in overseas markets.

Even if they don't sell explosively, capital inflow is also beneficial. "AI+AR" glasses are a new variable in industry development. Since 2024, ThunderBird Innovations has completed three rounds of financing within six months, raising a cumulative total of over 500 million yuan. Rokid has been even more aggressive, securing nearly 500 million yuan and 100 million yuan in financing in January and September, respectively. To date, it has completed 13 rounds of financing, raising over 2 billion yuan in total.

Capital is flooding into the AI glasses sector, expecting to invest in the "dark horse" in the AI hardware field.

While domestic players are rushing to enter the market, the market landscape is beginning to differentiate. Leading player Meta is already planning a more premium Orion product, claiming to integrate AR and AI technology, support display functions, enable simple 3D gaming, and weigh 98 grams. It is reported that the production cost of each pair of glasses is approximately $10,000.

However, domestic manufacturers have not yet achieved large-scale production, and the real competition may focus on the second half of this year. By then, the market will provide the answer to whether this "hundred-glasses war" is a successful attempt at commercialization or just another bubble.

Presumably, Luo Yonghao, who comes with his own buffs and suddenly changed the direction of his product entrepreneurship, has also temporarily relieved some tension within the AI glasses sector.