2024 AI Search Battleground: Three Factions Converge on Guangmingding | Year-End Review

![]() 01/08 2025

01/08 2025

![]() 627

627

As the year draws to a close, the AI search landscape is heating up once more, with industry giants making strategic moves.

In November, Tencent's Sogou Input Method unveiled AI search and AI quick check functions, alongside the AI intelligent workbench platform ima, which integrates search, reading, and writing capabilities. 360 also announced the evolution of 360 AI Search into Nano Search. Meanwhile, search giant Baidu launched a deep AI search engine product and opened a functional portal on the web.

In December, ByteDance first announced the launch of Doubao Desktop, aiming to capture the AI search market with a browser plugin. Subsequently, Ant Group's Alipay introduced the search product "Tan Yixia," emphasizing AI visual search capabilities.

Furthermore, Xiaohongshu, one of China's hottest social platforms, has been testing the AI search market, previously launching products like Sousoushu and Da Vinci within the platform, albeit with limited success.

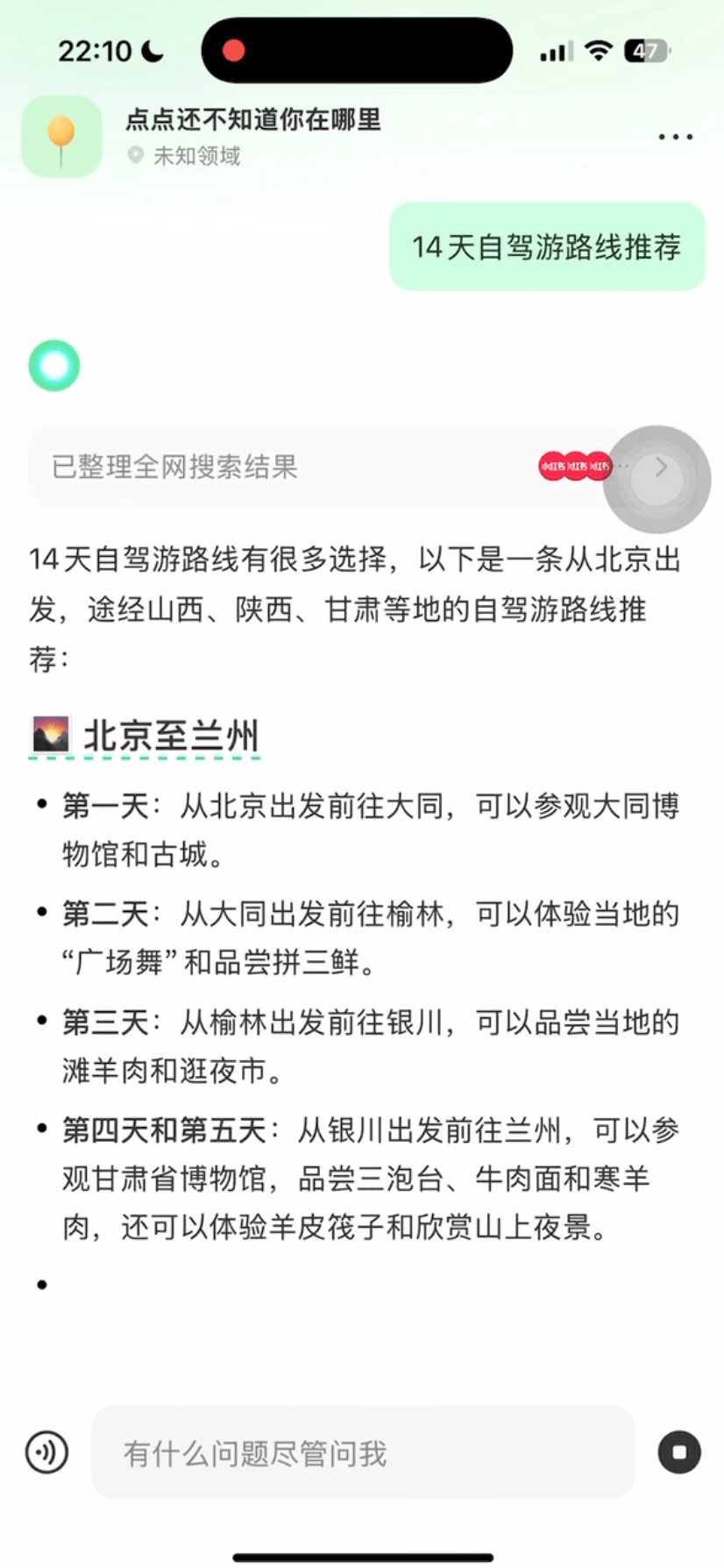

Recently, Xiaohongshu debuted an independent AI search product, Diandian, focusing on lifestyle-oriented searches. It is now available on major app stores. Within the platform, Xiaohongshu is also promoting the "Ask Diandian" product and has launched the "Ask Diandian While Outdoors" campaign.

2024 is considered the inaugural year of large-scale model application deployment, with AI search undoubtedly emerging as one of the key areas where companies are placing their bets.

According to incomplete statistics from Guangzhui Intelligence, there are over 16 AI search products in the form of independent AI browser plugins or apps. Additionally, more than 14 companies are currently involved in the AI search market, with over 23 products.

These enterprises include giants like BAT, ByteDance, and 360, as well as AI startups such as Baichuan Intelligence, Moon's Dark Side, and Zhipu Qingyan. Rapidly rising AI search engine startups like Meta AI are also part of this landscape.

Simultaneously, platforms like Zhihu, Meituan, and Bilibili have also attempted to launch AI search-related products and services within their ecosystems, such as Zhihu's Zhihu Zhida, Meituan's AI intelligent summary function for users, and Bilibili's AI search assistant.

In fact, an increasing number of apps have integrated AI search assistants that provide users with basic AI intelligent Q&A functions, including Kuaishou, Douyin, and WeChat.

It is evident that AI search applications are flourishing. Both independent AI search products and embedded AI search functions tried by various app platforms continuously offer users enhanced search experiences.

Furthermore, more giants are entering the AI search fray. Unlike in-platform AI searches primarily launched by content platforms, these giants have a more comprehensive layout. Even ByteDance's Doubao Desktop directly targets the browser market.

Undoubtedly, the search battle in the AI era is fully underway.

We observe that the three major factions—led by internet giants, content production platforms, and AI startups—are aggressively attacking the AI search market. Behind their convergence on Guangmingding, the more significant goal is to seize a larger share of the lucrative search market.

Meanwhile, with the successive entry of many new players, the CCID Research Institute's "AI Search Industry Development Report" points out that the "oligopoly effect" in the traditional search market is gradually being disrupted.

Moreover, entering the second half of the year, more AI search products began transitioning to the 3.0 stage, gradually realizing multimodal and cross-scene content search and creation functions by integrating multimodal large model capabilities.

Therefore, it is clear that with the upgrading and iteration of large model capabilities, the product form of AI search is also continuously evolving. The ultimate product form in the future will transcend mere search, though it is still in an early stage and has not yet taken its final shape.

Multi-business Deployment: Giants Disrupt AI Search

The lucrative search business has piqued the interest of various internet giants, who have attempted to secure a slice of the pie.

For instance, ByteDance has successively launched Toutiao Search, Wukong Search, and Lightning Search, all of which ultimately failed. During the search engine war, Tencent was absent, and its later acquisition of Sogou was also lukewarm.

Ultimately, China's traditional search engine market formed a monopoly with Baidu.

However, for internet giants, the search business remains an elusive "white moon" that they persistently pursue. After all, compared to recommendation algorithms, search offers precise allocation, particularly for user engagement, with a conversion rate that is not comparable.

Now, the rise of the AI search market presents internet giants with another opportunity to compete in the search domain.

Among them, 360 was the first company to launch an AI search offensive.

In January, 360 AI Search was officially launched. As an AI-driven search engine, 360 AI Search garnered significant user attention in its early stages. In November, 360 upgraded 360 AI Search to Nano Search, building a comprehensive workflow centered on the core capabilities of "search, learn, write, create," where all content can be generated into videos.

According to relevant data, its visits were 300,000 in March, reaching 246 million in September, and nearly 310 million by November—more than three times that of its main competitor, Perplexity AI, making it one of the world's most visited AI-native search engines.

Entering the second half of 2024, companies like Alibaba, Tencent, and ByteDance began exerting force in the AI search market. Compared to 360, these internet giants adopted a multi-line layout approach, launching AI search products in different scenario businesses.

In August this year, ByteDance launched an independent AI search app, Douyin Search.

According to the official introduction, Douyin Search differs from Baidu and Quark, which display content provided by website service providers, as it primarily showcases content created by bloggers, including short videos, images, and texts.

On the overall page, Douyin Search offers search channels for videos, users, products, live streams, etc., further refining search results. Simultaneously, Douyin Search features a video interface where users can watch short videos, live streams, long videos, and more.

However, user feedback suggests that experiencing Douyin Search is akin to browsing Douyin videos due to their high degree of similarity.

Besides Douyin Search, in December, ByteDance officially launched Doubao Desktop. Its overall layout resembles a browser, capable of independent AI searches and invoking Doubao AI search capabilities within other browsers in the form of browser plugins.

Doubao Desktop Browser Plugin in PC Browser

Additionally, Doubao Desktop provides numerous AI tools, offering users functions such as writing, image generation, video creation, AI reading companionship, and AI summarization.

Tencent and Alibaba have also conducted multi-line layouts similar to ByteDance, but compared to the latter, the former two tend to focus more on their core business scenarios and advantageous capabilities when deploying AI search businesses.

Currently, Tencent has four products with AI search capabilities, including Tencent WeChat, Tencent Sogou Input Method, Tencent Yuanbao, and Tencent ima. The first two integrate AI capabilities within the product, while the latter two are independent AI products.

Tencent Sogou Input Method launched and upgraded crucial functions such as AI search and AI quick check in November 2024, realizing "input is search" and providing intelligent reference information while chatting and writing in learning, office, and social scenarios.

Tencent WeChat has a built-in AI intelligent response function, where users can input keywords through the search box to view AI-summarized relevant content.

Tencent Yuanbao is an AI assistant whose AI search function allows users to initiate conversational queries and quickly provide precise answers through powerful models and search capabilities.

Tencent's significant foray into the AI search market is its bet on ima, which has the strongest search genes. The ima product originates from Tencent QQ Browser's team.

This is an AI intelligent workbench tailored for learning and office scenarios, with a knowledge base at its core. By constructing a knowledge base, users can choose different knowledge bases for Q&A based on various questions to obtain more precise, professional, and valuable answers. Additionally, another unique feature of ima is that it can retrieve materials based on the content of the entire WeChat public account ecosystem, effectively connecting the entire WeChat ecosystem in terms of backend data.

It is evident that Tencent's key scenarios in the AI search market are primarily aimed at the learning and office fields, focusing more on enhancing users' production and work efficiency. In contrast, Alibaba targets scenarios such as education, e-commerce, and daily life.

For instance, Alibaba's Quark AI emphasizes educational scenarios under general AI search. In November 2024, it comprehensively upgraded the "AI Search Questions" product, making the process of searching and solving questions faster and more efficient. It also allows users to utilize AI answer, AI writing, AI PPT, AI document summarization, and other functions anytime, anywhere.

AliExpress's newly launched AI-Native search engine Accio is a B2B search engine product focused on the e-commerce procurement field. It leverages AI to reshape procurement capabilities, providing one-stop AI "procurement consulting" services for overseas end-buyers such as small and medium business owners and entrepreneurs.

Furthermore, Ant Group's Alipay introduced Tan Yixia, which emphasizes AI visual search. By taking AI photos and recognizing images, users can gain new knowledge and inspiration for copywriting at any time.

Meanwhile, Alipay also launched an AI intelligent assistant app, Zhi Xiaobao, which connects users to the Alipay ecosystem and offers functions such as ordering meals and taxis, booking tickets and appointments, and querying nearby dining, entertainment, and more through conversational interaction. Simultaneously, "Zhi Xiaobao" features a scenario perception system that can intelligently recommend exclusive services based on users' usage habits and specific time and space.

In terms of form, besides the app, Zhi Xiaobao is also embedded in Alipay and can be experienced by pulling down the homepage of the Alipay app.

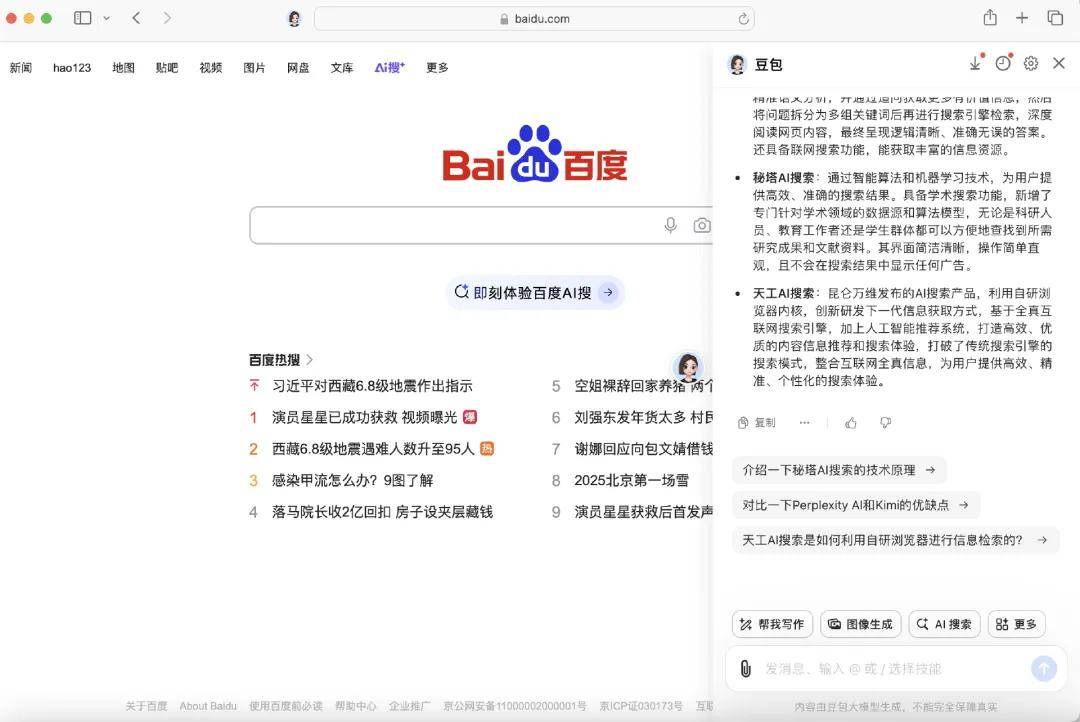

Compared to the active layouts of companies like Alibaba, ByteDance, and Tencent, Baidu, the king of the traditional search engine market, was somewhat late to the AI search market, launching its independent AI search product only in November.

Its competitive advantage lies in connecting more original PC user groups through the Baidu Browser web entry.

Of course, Baidu is also continuously increasing its efforts in the AI search market.

At Baidu's third-quarter earnings meeting, Chairman Robin Li revealed that AI functions on the Baidu App have covered nearly 70% of its monthly active users, and over 20% of search result pages on Baidu Search contain AI-generated content, a higher proportion than the 18% in the previous quarter.

Additionally, Baidu's management disclosed that about 20% of search results on Baidu Search are derived through generative AI technology. The data released in May of this year showed that this proportion was 11%.

Currently, the user base for AI search is rapidly expanding. According to a report by US consulting firm Gartner, by 2026, the usage of traditional search engines may decrease by 25%.

Today, internet giants are actively vying for the AI search market through multiple business lines and scenarios, undoubtedly bringing significant impacts to the traditional search engine market. Amidst these giants, do startups in the AI search market still have opportunities?

Key to Startup Survival: Rooting in Core Scenarios and Continuously Iterating Technological Capabilities

Content is the cornerstone of search.

In the traditional PC era, all content was displayed through web pages, giving traditional search engines an edge. However, in the mobile internet era, the internet entry point shifted to apps, and app vendors strived to keep high-quality content within their platforms.

As a result, app content became isolated, and information was no longer "interconnected".

Therefore, at this stage, compared to traditional search engines, content production platforms possess a natural search advantage. Users can directly obtain the information they seek by searching within the platform. In the AI era, this advantage is gradually being amplified.

As content production platforms, whether it's Xiaohongshu, Kuaishou, Bilibili, Douyin, or others, they are all exploring the AI search market. Among them, Xiaohongshu, as one of the most aggressive players, has not only launched in-platform AI search products but also independently introduced the AI search product Diandian.

It is reported that Diandian, similar to Xiaohongshu in positioning, is an AI search product focused on lifestyle scenarios. Its core functions include automatically locating and pushing travel guides, answering questions about food and attractions, summarizing information from the entire network with AI, and providing video responses.

Relevant data shows that nearly 70% of Xiaohongshu's monthly active users engage in search behavior, and one-third of monthly active users go straight to search when opening Xiaohongshu.

The latest data reveals that in the fourth quarter of 2024, Xiaohongshu's daily average search volume (qv) surged to approximately 600 million. This marked a significant doubling from mid-2023, when the qv stood at 300 million.

Evidently, Xiaohongshu, a platform specializing in lifestyle recommendations, boasts a core advantage in content rich with authentic user experiences. Consequently, when developing AI search products, it leverages lifestyle scenarios as the entry point for AI search.

In the era of AI search, continually embedding oneself within the content scenarios of core applications emerges as a vital key to corporate survival. Additionally, the continuous iteration and upgrading of large model technological capabilities significantly impact user experience.

Meta AI, an early entrant in the domestic AI search market, has consistently focused on academic research scenarios. Previously, it garnered substantial user attention due to a copyright dispute with CNKI.

In recent version updates, MyTAT AI has continued to enhance its content in academic research. For instance, the scale of paper data has been expanded by sevenfold, and the index has been upgraded from abstracts to full texts, encompassing tens of millions of Open Access papers (including roughly 40% of SCI papers and top-tier journal papers such as "Nature" and "Science").

The newly introduced "Explanation" function resembles the point-reading feature in learning machines. If a sentence in a document proves obscure, users can click on it to receive relevant explanations. For papers in less common languages, MyTAT AI has trained translation models supporting 44 languages, effectively eliminating language barriers.

Furthermore, MyTAT AI allows users to customize data sources after uploading materials to the knowledge base. For example, when a user uploads nearly 2,000 papers to the "2024 ACL Conference Papers" topic, they can interact specifically, including asking questions, writing reviews, and taking notes.

Currently, in the practical implementation of AI search, internet giants primarily concentrate on scenarios such as productivity tools, education, and e-commerce. In contrast, mid-tier players and startups tend to focus more on vertical scenarios like daily life, academic research, financial investment, and so forth.

Kunlun Tech, another early domestic player in the AI search space, offers its Tiangong AI search, with financial investment and academic research as its core scenarios.

In November 2024, Kunlun Tech's Tiangong AI search updated to the latest version, comprehensively upgrading its multi-level analytical reasoning capabilities, offering professional AI search for financial investment and scientific research, and providing intelligent optimization for document AI reading analysis.

Simultaneously, it divides search into two categories: brief search and advanced search. Concise answers are presented in text segments, while advanced search displays all reference websites and the thinking process.

Apart from content production platforms and startups, there is also a group of players in the AI search space known as AI large model startups.

These companies primarily utilize AI dialogue assistants as the base platform and integrate AI search functions. Compared to others, they place greater emphasis on showcasing their large model technological capabilities.

In October 2024, Dark Side of the Moon officially launched the Kimi Explorer Edition, which stands out for its AI autonomous search capabilities, simulating human reasoning to provide higher-level answers. The underlying large model behind it is the mathematical model k0-math, launched simultaneously by Dark Side of the Moon, marking Kimi's first reasoning-enhanced model.

WisdomAI has also integrated AI search capabilities into its AI dialogue platform, WisdomAI Qingyan. It is reported to support the simultaneous reading of over 100 webpages. In response to user queries, Qingyan can search, read, and summarize over 100 webpages within seconds, requiring only 1‰ of the time it would take a human user. It supports multi-level reasoning thought chains and can tackle most challenging problems in daily life.

Moreover, WisdomAI Qingyan can collaborate with other WisdomAI tools. For instance, during online search and multi-level reasoning, it can invoke tools like Python to solve problems comprehensively.

It is evident that as domestic large model companies continue to introduce reasoning large models, AI search is increasingly equipped with reasoning and thinking capabilities. In this regard, these AI large model startups are undeniably at the forefront of the industry.

In the AI search space, large companies have fully entered the market. Under the pressure from these giants, the survival space for smaller companies and startups continues to shrink, yet it is not entirely bleak.

After all, future search scenarios will become more vertical, segmented, and specialized, with users' demand for professional search in specific fields continuously rising. This includes searching for disease diagnosis and treatment plans in the medical field and obtaining personalized learning suggestions and tutoring in the education sector.

If startups' AI search tools can concentrate on a particular industry, they will possess a strong competitive edge. By conducting intricate user intent analysis, they can not only furnish accurate information but also form a unique knowledge closed loop, enhancing user satisfaction.

Next-generation search transcends mere search

In 2024, the AI search market witnessed a fierce battle among giants. From internet behemoths to content production platforms and startups, all are continually increasing their investments in the AI search space and experimenting in diverse scenarios.

In fact, with the evolution of the AI search market, current user search habits have also undergone substantial changes.

On one hand, traditional text-based search is no longer predominant, with multi-modal searches such as voice search and visual search gaining popularity. With the advancement of multi-modal large models, interactive searches integrating voice, text, gestures, and expressions will gradually become the norm in the future.

A previous executive from 360 also stated that starting from late 2024, it will be the era of AI search engine 3.0, where AI search will enter a phase of multi-modal content creation engines and deep integration of multi-modality and cross-scenarios.

Zhou Xiaopeng, Vice President of Alibaba's Intelligent Information Business Group, once said that the core value of a search engine lies in connecting users with the information they seek. AI search reshapes the way information is obtained, bringing the distance between users and information closer to zero. This forms the cornerstone for the promising future of AI search.

More importantly, future AI search will no longer be confined to the existing search box model. Instead, it will deeply integrate with other AI tools, such as AI writing and AI painting, evolving into a comprehensive intelligent assistant that encompasses search, storage, integration, refinement, and creation.

For example, Tencent's ima, ByteDance's Doubao for PC, and 360's Nano Search, apart from offering basic AI search capabilities, also provide users with functions like AI creation, AI summarization, and image/video content generation.

Users can engage in deeper interactions with AI through natural language, directly obtaining high-quality information that has been organized and analyzed. They can even instruct AI to automatically generate reports, articles, and other content based on search results.

Concurrently, with the continuous enhancement of multi-device collaboration capabilities, AI search will transcend the boundaries between different devices, achieving seamless connection among mobile phones, tablets, PCs, smart homes, smart connected vehicles, and other devices. This will enable users to enjoy consistent and convenient search experiences across any device.

Undoubtedly, the rise of AI search will reshape the entire search industry's ecosystem. The "oligopoly effect" of the traditional search market is gradually eroding, with new players continuously entering the fray and market competition intensifying.

However, the current market structure of search engines, dominated by Baidu, remains unchanged.

According to the latest data from Statcounter, as of June 2024, Baidu held a 52.79% market share in China's search engine market, ranking first. Bing witnessed significant growth fueled by generative AI, capturing a 29.84% share. Sogou ranked third with a 7.49% share, while 360 Search occupied the fourth position with a 3.86% share.

Certainly, the relationship between AI search and traditional search is not one of simple replacement but rather a natural progression and evolution. It is anticipated that in the short term, AI search will divert some users from traditional search, gradually narrowing the market share gap between the two.