Geek+ IPO in Hong Kong: Pre-IPO Share Discount by Major Shareholder and Declining AMR Equipment Unit Prices

![]() 01/16 2025

01/16 2025

![]() 557

557

Autonomous mobile robots seamlessly navigate between shelves, autonomously setting routes to retrieve and place various goods based on diverse demand instructions. With the continuous advancement of autonomous mobile robots (AMRs), scenarios once confined to science fiction movies have become a reality, widely adopted in numerous large factories.

Recently, Beijing Geek+ Technology Co., Ltd. (hereinafter referred to as "Geek+"), a provider of AMR solutions, submitted its prospectus and plans to list on the main board of the Hong Kong stock market via an IPO. Morgan Stanley and CICC are acting as joint sponsors.

Despite being a leading company in the industry, Geek+ has yet to achieve profitability, and the sector continues to grapple with the risk of price reductions. Additionally, major shareholders sold their shares at a discount prior to the company's IPO. If the company fails to list within 18 months, a repurchase obligation will be triggered.

AMR Solution Global Leader, Yet Revenue Growth Declined in the First Half of 2024

Geek+ is a pioneering AMR solution provider.

AMR, or Autonomous Mobile Robot, refers to robots equipped with advanced sensors and algorithms, enabling them to navigate environments without human intervention. These robots are prevalent in logistics and warehouses, performing tasks such as material handling and inventory management.

Unlike Automated Guided Vehicles (AGVs), which rely on pre-programmed fixed work procedures, AMRs offer greater flexibility due to their enhanced perception capabilities and robust computing power. They ensure safe and adaptable operation in human-machine collaboration scenarios, akin to "driverless cars in warehouses".

As labor-intensive warehousing models face the risk of human error, and rising labor costs continue to escalate operating expenses, the growing demand for personalized products and shortened product life cycles necessitate enterprises to swiftly adapt to consumer preferences and adjust production volumes accordingly. This underscores the importance of real-time inventory management and flexible logistics.

Under the trend of warehouse automation, AMR solutions are particularly advantageous for industries such as e-commerce, characterized by rapid order fulfillment needs and high-volume, high-speed operations.

From 2019 to 2023, the global AMR solution market expanded from RMB 9.3 billion to RMB 36 billion, registering a compound annual growth rate of 40.3%.

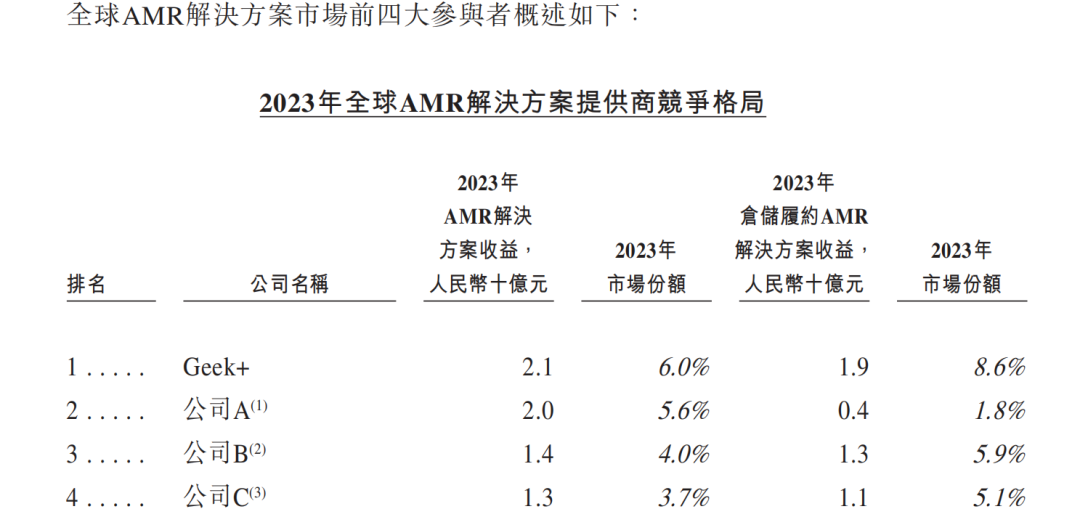

Geek+ stands as an industry leader. In terms of AMR solution revenue in 2023, Geek+ topped the list of global AMR solution providers with a market share of approximately 6.0%.

As of June 30, 2024, Geek+ had delivered approximately 46,000 AMRs to over 40 countries and regions worldwide.

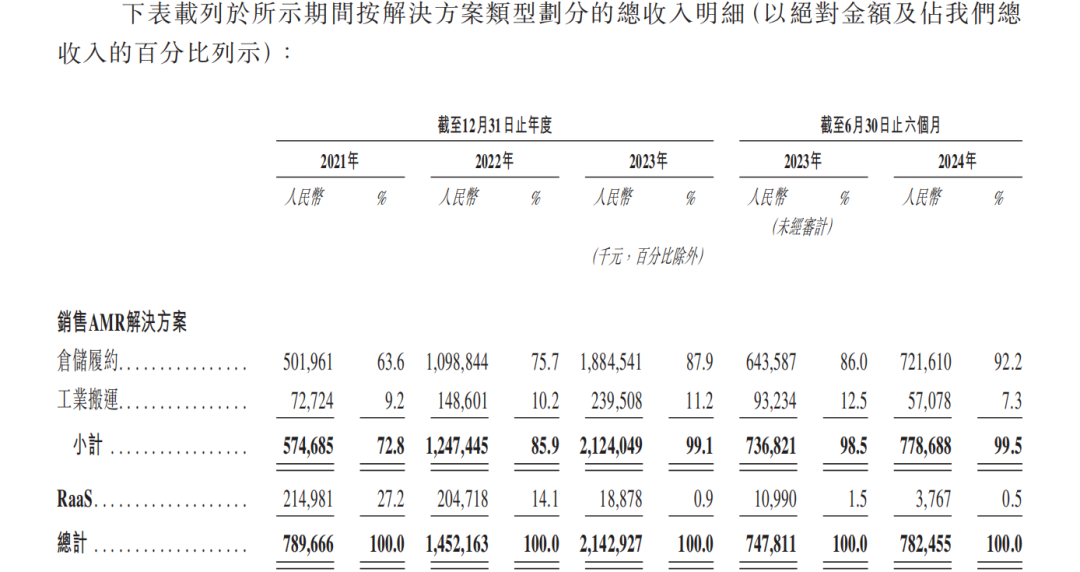

From 2021 to 2023, Geek+'s revenue amounted to RMB 790 million, RMB 1.452 billion, and RMB 2.143 billion, respectively, marking revenue increases of 83.90% and 47.57% in 2022 and 2023.

Over the same period, its net losses were RMB -1.05 billion, RMB -1.567 billion, and RMB -1.127 billion, respectively. Excluding the impact of share-based compensation, changes in the carrying value of redemption liabilities, etc., its adjusted net losses were RMB -763 million, RMB -815 million, and RMB -444 million, respectively.

However, in the first half of 2024, Geek+'s revenue growth rate declined significantly. Revenue for the period stood at RMB 782 million, a year-on-year increase of 4.63%; net loss was RMB -550 million, and adjusted net loss was RMB -194 million, with losses narrowing compared to the same period last year.

Geek+ attributed the decrease in revenue growth in the first half of 2024 to the company's reduction in its RaaS service business line, which led to a decrease in revenue generated, partially offsetting the revenue growth during the period. Previously, Geek+ provided RaaS services to customers, encompassing standardized robot leasing services and a comprehensive suite of operational support and management services, but has gradually scaled down related businesses in recent years.

Image source: Geek+ prospectus

Moreover, many customers, particularly those in e-commerce, retail, and logistics, tend to place orders towards the end of the calendar year. This seasonal ordering trend typically results in an increase in order volume in the fourth quarter, with the corresponding revenue usually recognized in the second half of the following year after project completion and customer acceptance. Additionally, cooperation with customers often enables the company to complete project acceptance before the end of the year, further reinforcing the seasonal revenue pattern.

The prospectus reveals that Geek+'s order volume increased by 30.51%, from RMB 1.037 billion in the six months ended June 30, 2023, to RMB 1.353 billion in the same period of 2024.

Sales Expense Ratio Far Exceeds R&D Expense Ratio, Indicating Potential Industry Challenges

It is noteworthy that although Geek+ ranked first among global AMR solution providers in 2023, its 6.0% market share led the second place by a mere 0.4 percentage points.

The market remains relatively fragmented, with the third and fourth places holding market shares of 4.0% and 3.7%, respectively. Coupled with the small share of leading enterprises, this indirectly suggests that the industry threshold or technical barriers are not insurmountable, and Geek+'s "first place" position lacks dominance.

Image source: Geek+ prospectus

Consequently, Geek+'s sales investment has consistently been relatively high in recent years.

During each period of the reporting period, the company's sales and marketing expenses amounted to RMB 349 million, RMB 456 million, RMB 509 million, and RMB 230 million, respectively, accounting for 44.2%, 31.4%, 23.8%, and 29.3% of revenue, respectively.

Employee compensation constituted over 60% of sales expenses in each period, totaling RMB 237 million, RMB 332 million, RMB 353 million, and RMB 165 million during the reporting period, respectively.

The prospectus indicates that as of June 30, 2024, Geek+'s sales and marketing team comprised 470 employees.

Roughly calculated, the average compensation for each sales employee in the first half of 2024 was approximately RMB 351,000. Meanwhile, the average compensation for 384 R&D employees in the first half of the year was approximately RMB 301,000.

In fact, the company's R&D expenses have consistently been lower than its sales expenses during the reporting period, and they have accelerated their decline since 2023. The R&D expenses for each period of the reporting period were RMB 340 million, RMB 437 million, RMB 380 million, and RMB 133 million, with R&D expense ratios of 43.0%, 30.1%, 17.7%, and 17.0%, respectively.

The reduction in R&D expenses was a significant factor in narrowing losses for the full year of 2023 and the first half of 2024. Another contributing factor was the improvement in gross margin.

As of the end of 2021, 2022, and 2023, and the six months ended June 30, 2023 and 2024, Geek+'s overall gross margins were 10.2%, 17.7%, 30.8%, 28.5%, and 32.1%, respectively. Among them, the gross margins of the warehouse fulfillment AMR solution were 33.6%, 36.6%, 39.0%, 36.6%, and 33.8%, respectively.

Although the company's overall gross margin increased due to the revenue growth in the warehouse fulfillment AMR solution, the gross margin of this business declined in the first half of 2024.

According to data from the China Warehousing and Distribution Association, from 2019 to 2022, the average price of AGV/AMR equipment decreased from RMB 184,900 to RMB 95,900, and is projected to decline further to RMB 56,600 by 2027. The average gross margin also dropped from 53.31% to 40.25%.

Data from the consulting firm Interact Analysis reveals that the average revenue per user (ARPU) of global mobile robots decreased by 3.1% in 2023, mirroring the decline observed in 2022.

Amid declining unit prices, the industry's outlook is also facing challenges. In 2024, the downstream industry market is sluggish, leading to a slowdown in the growth rate of the mobile robot sector. According to data from the GGII, sales of AMRs in the Chinese mobile robot market are anticipated to reach 39,500 units in 2024, representing a year-on-year increase of 10.64%, a sharp decline from the 98.33% growth rate recorded the previous year.

In January 2025, Interact Analysis released a research report stating that due to the impact of a series of macroeconomic factors on demand, it has revised downwards its forecast for the global mobile robot market in 2027 by 18%. Analysts noted that the current challenging economic environment has prompted manufacturers and retailers to delay their automation investment plans. Therefore, it is no longer anticipated that AMR deployment will experience rapid growth before 2027.

Labor shortages remain the primary driver of demand growth for mobile robots. However, high upfront costs, lack of interoperability, competition with fixed automation systems, as well as high inflation and rising interest rates, continue to pose significant obstacles to the widespread adoption of mobile robots. To overcome these hurdles, the industry is lowering the barrier for enterprises to adopt mobile robots by reducing prices and introducing robot-as-a-service (RaaS) and leasing models.

Geek+ did not directly disclose the gross margin of its RaaS business in the prospectus. However, based on the RaaS sales revenue and cost of sales provided in the prospectus, "Insight IPO" calculated that the gross margin of this business during each period of the reporting period was as low as -2.78%, -25.87%, -35.29%, and -108.76%, respectively.

Although Geek+ has gradually scaled down related businesses, under the pressure of industry dynamics, it is difficult for the company to remain unaffected.

Additionally, a substantial portion of Geek+'s sales revenue originates from regions outside mainland China. During each period of the reporting period, this proportion was 57.3%, 70.3%, 76.8%, and 78.7%, respectively. Given that the company primarily manufactures in China, it may face potential tariff risks from the United States (or Europe) in the future.

Valuation Exceeds RMB 15 Billion, with Major Shareholder Hurriedly Cashing Out

Geek+ boasts a founder with an impressive resume.

In July 2004, Zheng Yong, the company's founder, obtained a Master's degree in Management Science and Engineering from Tsinghua University. Following graduation, he served as an operations manager at various subsidiaries of ABB Ltd., a globally renowned electrical automation company, providing solutions in robotics, machinery, and factory automation. Later, he took on the role of plant manager at a subsidiary of Saint-Gobain, responsible for overseeing the overall operations of key production bases in China, encompassing engineering, quality control, and logistics.

In May 2013, Zheng Yong joined New Horizon Capital as a senior manager, responsible for post-investment management of portfolio companies and new investments in the TMT and robotics industries. In February 2015, he co-founded Geek+ with Li Hongbo, Liu Kai, and Chen Xi, all experts in the field of robotics and automatic control.

With a formidable team of founders and a presence in the highly imaginative industrial robotics industry, since its inception, Geek+ has attracted numerous investment institutions, securing 11 rounds of financing and raising a total of RMB 1.635 billion and USD 395 million, equivalent to approximately RMB 4.529 billion at the latest exchange rate. As of the end of 2022, the post-investment valuation had soared to RMB 15 billion.

The shareholder lineup is equally impressive, comprising Volcanics Capital, Gaorong Capital, Vertex Ventures China under Temasek, GGV Capital, Cloudwise Capital, Greater Bay Area Fund, China Internet Investment Fund, CIFI, Hefei Construction Investment, Ant Group, ABC Investment, Intel Asia Pacific, CICC Qichen, and numerous other institutions or companies.

However, since completing the E1 round of financing in December 2022, the company has not conducted any further financing.

From December 2023 to April 2024, Marcasite, a subsidiary of Warburg Pincus, transferred some of its shares in Geek+ to Qingdao Gaoxin under Luzhou Laojiao, Shanghai Yunyang under Ant Group, and Accelerator VI Ltd., realizing a total cash-out of approximately RMB 456 million at the exchange rate on the settlement date. However, the per-share prices were equivalent to RMB 6.90, RMB 6.21, and USD 0.87, respectively, nearly halving compared to the per-share price of RMB 13.13 during the E1 round of financing.

Currently, Marcasite remains the company's largest direct shareholder with a shareholding ratio of 11.86%. The five founders, in accordance with the unanimous action agreement and different voting rights provisions, collectively hold 21.70% of the shares but control 55.36% of the voting rights, jointly serving as the company's actual controllers.

Previously, Geek+ signed investment contracts and supplementary agreements with investors, stipulating that the redemption right would be restored on the date of withdrawal or denial of the company's application, or 18 months after the first submission of the application to the Stock Exchange (if the issuance has not been completed by then), whichever is earlier.

This implies that if the company fails to complete its listing within 18 months, the redemption condition for Geek+ will be triggered. The prospectus indicates that as of October 31, the company's redemption liabilities had increased to RMB 6.92 billion.