Can Horizon Robotics Thrive Amidst Auto Industry Losses?

![]() 03/24 2025

03/24 2025

![]() 611

611

As the industry pacesetter, Horizon Robotics stands at a critical juncture, needing to capitalize on emerging opportunities.

By 2025, autonomous driving has evolved into a standard feature in new car models, with prices of vehicles equipped with such systems plummeting from the hundreds of thousands of yuan range.

BYD's aggressive SeaGull autonomous driving version, priced at 69,800 yuan, is closely followed by Chery's Ant Smart version at 65,900 yuan.

Almost overnight, autonomous driving has transitioned from a premium add-on to a basic option accessible to the masses.

This raises pertinent questions: Can autonomous driving systems generate profits? Can the cost of intelligent driving continue to decline?

Recently, Horizon Robotics, a robotics company and the leading supplier of ADAS in China, released its maiden financial report post-IPO.

Impressive Financial Report

Listed on October 24, 2024, Horizon Robotics became the first domestic autonomous driving-related stock in Hong Kong, raising over HK$5.4 billion and setting multiple milestones in Hong Kong stock history.

Over the past year, autonomous driving capabilities have become the focal point of new product launches by automakers, from new-energy vehicle startups to traditional automakers, all vying for dominance in this domain.

On February 10, with BYD announcing the widespread adoption of autonomous driving, Horizon Robotics, as the primary supplier, once again came into the spotlight. The Tian Shen Zhi Yan C autonomous driving solution utilizes Horizon Journey chips.

On BYD's new trajectory of fully popularizing autonomous driving, Horizon Robotics has emerged as the second-largest player after NVIDIA, and in terms of key sales models, Horizon Robotics is virtually on par with NVIDIA.

On March 21, Horizon Robotics unveiled its first financial report since going public, showcasing impressive results. Additionally, it was recently included in the Hang Seng Composite Index and Hang Seng TECH Index, becoming a significant indicator for Hong Kong stocks, reflecting the capital market's optimism towards Horizon Robotics.

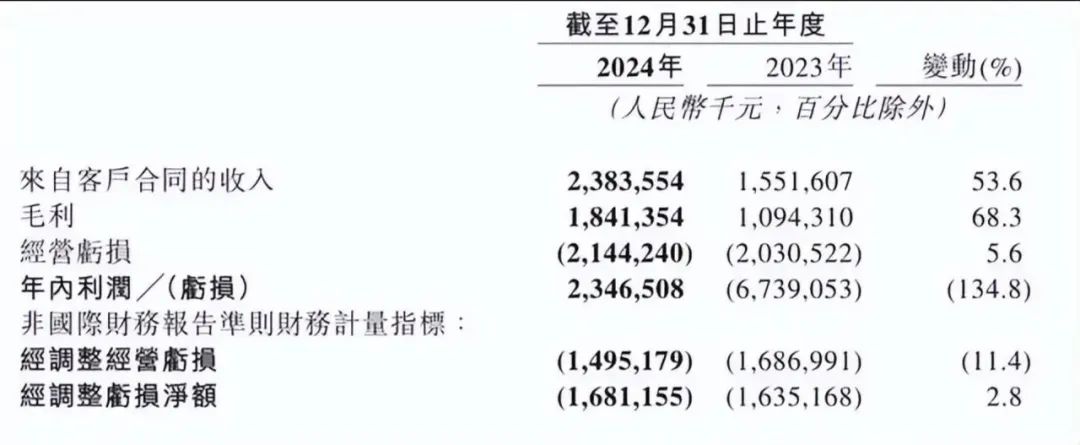

The financial report reveals that Horizon Robotics' revenue in 2024 was 2.384 billion yuan, a year-on-year increase of 53.6%, with a gross profit of 1.841 billion yuan, a year-on-year increase of 68.3%. The company delivered 2.9 million products throughout the year and secured orders from over 100 vehicle models.

Furthermore, as a versatile enterprise integrating hardware design and software development, Horizon Robotics' market share has been on a steady rise. In the domestic market, Horizon Robotics' share in Advanced Driver Assistance Systems (ADAS) has reached 40%, firmly securing the top spot.

As China's largest supplier of autonomous driving solutions, more than 170 mass-produced models are equipped with Horizon Robotics products, and this number continues to grow.

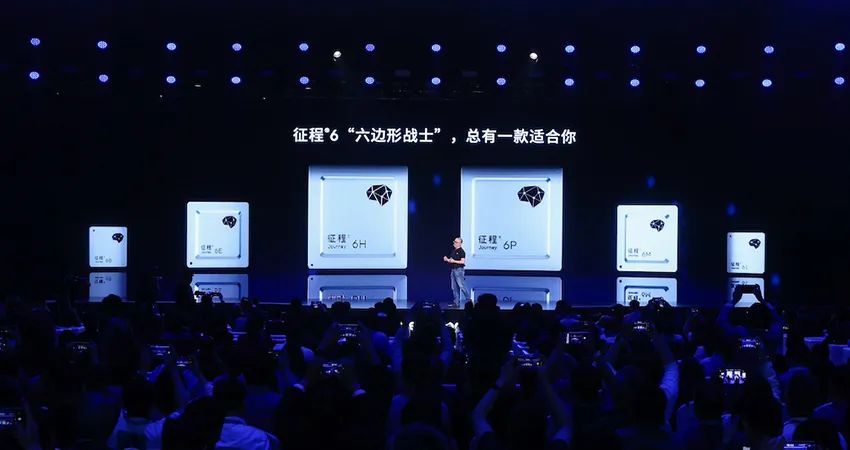

Especially following the launch of the Journey 6 series of chips, Horizon Robotics has been highly sought after by automakers.

Behind this success lies Horizon Robotics' inclusive and open ecosystem. The company offers a variety of cooperation solutions encompassing chips, algorithms, and toolchains. Adhering to an open cooperation philosophy, Horizon Robotics connects multiple upstream and downstream industries such as automakers, hardware and software Tier 1 suppliers, ODMs, IDHs, chip manufacturers, map providers, and sensors.

For instance, when providing autonomous driving chips to an automaker, Horizon Robotics even assists in connecting the automaker with other camera and millimeter-wave radar suppliers to help establish a comprehensive autonomous driving hardware supply chain.

It is within this open ecological framework that Horizon Robotics has forged collaborations with over 200 upstream and downstream enterprises, continuously expanding its partner network.

On BYD's Tian Shen Zhi Yan C, both Horizon Robotics and NVIDIA serve as chip suppliers. This underscores Horizon Robotics' openness in its cooperation ecosystem and is the pivotal reason why it can surpass other autonomous driving chip suppliers, rivaling NVIDIA.

According to Horizon Robotics' announced goals, it aims to deliver over 2 million product solutions in 2025, achieving the full popularization of autonomous driving, and will also launch its first high-end mass-produced autonomous driving model, setting an industry benchmark in the era of autonomous driving popularization.

Risks and Opportunities

While Horizon Robotics appears poised for a promising future, it also faces its own set of challenges.

The first challenge stems from external forces. The current competition in autonomous driving is largely characterized by a spread of price wars among automakers. As these price wars intensify, the cost prices of automotive components have been continually compressed, with power batteries being the first to fall in the automotive industry.

As battery costs continue to decline, the loading cost of power batteries has repeatedly hit new lows. After the battery industry has squeezed out almost all excess, autonomous driving has become the next target for automakers to cut costs.

In 2024, models equipped with high-end autonomous driving systems were priced at least above 150,000 yuan, including those from new-energy vehicle startups. Yu Chengdong, Chairman of the BU of Huawei Intelligent Automobile Solutions, once emphasized in a live broadcast that it is impossible to turn a profit from high-end autonomous driving systems like HarmonyOS AODS in vehicles priced below 300,000 yuan.

A comprehensive autonomous driving solution encompasses multiple components such as sensing devices, chips, algorithms, and software. Notably, chips and algorithms are highly capital-intensive projects. The design, research and development, testing, tape-out, and mass production of an autonomous driving chip can cost billions of yuan.

Regarding algorithms, they represent even more costly investments. It involves writing software, which is then continuously calculated, iterated, and optimized by a computing center. The annual electricity cost for a 2000P computing center ranges from 80 million to 120 million yuan.

To reduce the price of autonomous driving systems, it can only rely on scale to spread costs, which implies that the price war will spill over from automakers to autonomous driving solution providers.

For Horizon Robotics, price wars pose an even greater test for its supply chain, given that its largest competitor is the world's largest chipmaker, NVIDIA.

As a supplier of autonomous driving chips, NVIDIA has long dominated the high-end market, forming an industrial moat epitomized by the Orin X chip. Almost all automakers opting for third-party chips have chosen this chip.

For Horizon Robotics to expand its market share in high-end autonomous driving, it must compete head-on with NVIDIA. The strategy is straightforward: whoever can provide a chip with superior cost-performance will capture the market.

The competition on cost brings us to Horizon Robotics' internal challenges. Behind its impressive revenue figures lie the losses that all autonomous driving enterprises cannot escape. Horizon Robotics' net loss in 2024 was 1.68 billion yuan.

The gross profit margin for hardware delivery, one of its core businesses, stands at 46.4%, making it challenging to achieve profitability in the short term. Simultaneously, to ensure product leadership, it is necessary to increase investment in research and development.

The financial report indicates that Horizon Robotics' research and development expenses in 2024 were 3.156 billion yuan, 1.3 times its revenue, far exceeding other autonomous driving R&D enterprises. Achieving break-even in 2025 currently seems daunting.

Previously, Yu Kai, the founder and CEO of Horizon Robotics, mentioned that 2025 might usher in an inflection point for profitability. However, the succession of autonomous driving conferences at the beginning of the year has escalated the competition to a deeper level.

For Horizon Robotics, this presents both a challenge and an opportunity. According to earlier predictions, it is anticipated that by the end of 2025, the penetration rate of Navigate on Autopilot (NOA) in passenger vehicles will increase to 20%, driving a scale increment of 35 billion yuan.

As mainstream automakers begin to fully promote autonomous driving, this parameter may surge significantly. Zhu Huarong, Chairman of Changan Automobile, stated that the penetration rate of autonomous driving in China's passenger vehicles could reach 80% by 2025.

Based on such predictions, the annual production of autonomous driving models will exceed 15 million, which undoubtedly represents a colossal opportunity for Horizon Robotics with a 40% market share.

Horizon Robotics' performance in 2024 showcases its technological leadership and commercialization capabilities in the field of autonomous driving. Nonetheless, the loss incurred by high research and development investment remains its primary shortcoming.

Moving forward, Horizon Robotics must spread costs through large-scale mass production, increase hardware gross profit margins, and capture the high-end autonomous driving market with advanced solutions such as HSD, striking a balance between revenue and profit.

Every shift in the automotive industry catalyzes the rapid ascension of related industrial chains. Over the past decade, the electrification of automobiles has fueled the rapid development of the electric vehicle industry, giving rise to industry leaders like CATL and BYD's Fudi Battery. Nowadays, the promotion of autonomous driving will once again reshape the industry landscape.

It is foreseeable that the victor in this battle for the popularization of autonomous driving will emerge as the CATL of the autonomous driving industry.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.