Horizon Robotics' 2024 Financial Report Analysis: How Did the 'Front-Runner' in the Era of Intelligent Driving Equalization Achieve Its Success?

![]() 03/25 2025

03/25 2025

![]() 881

881

2025 marks a pivotal year for the widespread adoption of high-level autonomous driving (AD). As policies and regulations improve, technology costs decline, and consumer awareness rises, L2+ AD functions are transitioning from premium models to the mass market, heralding a global wave of "intelligent driving equalization."

Amidst this transformation, Chinese AD solution provider Horizon Robotics has emerged as a trailblazer, firmly securing the top spot in the domestic Original Equipment Manufacturer (OEM) ADAS (Advanced Driver Assistance System) market.

Image source: Horizon Robotics official

As Hong Kong's "first intelligent driving stock," Horizon Robotics is not only a key partner to automakers like BYD and Li Auto but also an industry benchmark for large-scale mass production, having shipped over 7.7 million units. Now, just nine years since its inception, the company is reshaping China's intelligent driving landscape with its "technology for all" strategy.

The 'Dual-wheel drive' fueled by software-hardware synergy and economies of scale

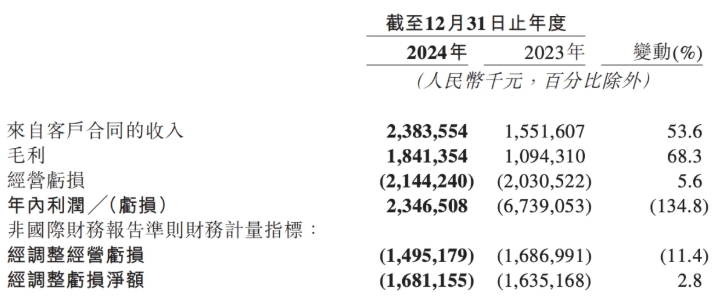

According to the financial report, Horizon Robotics generated revenue of RMB 2.384 billion in 2024, a year-on-year increase of 53.6%.

Specifically, the company's intelligent driving solution business raked in RMB 2.312 billion, up 57.2% from the previous year. Within this, product solution revenue amounted to RMB 664 million, a 31.2% year-on-year increase, while licensing and service revenue soared 70.9% year-on-year to RMB 1.647 billion.

This impressive growth is partly attributed to the surge in automakers' procurement of L2+ high-level intelligent driving solutions and partly validates the business logic of "software defining value."

Image source: Financial report

Simultaneously, Horizon Robotics further expanded its commercial mass production scale. Throughout the year, it delivered approximately 2.9 million product solutions, a 38% year-on-year increase, bringing the cumulative delivery volume to over 7.7 million units. The company secured contracts for over 100 models during the year, cumulatively totaling over 310 models, maintaining a leading position in intelligent driving solution deliveries in China.

With its mass production scale growing exponentially, Horizon Robotics has captured the top spot in China's OEM ADAS market, with a market share exceeding 40%. This signifies that at least 4 out of every 10 smart cars equipped with domestic ADAS systems rely on Horizon Robotics' intelligent driving solutions, underscoring its strong dominance in the market.

In the high-level intelligent driving market, Horizon Robotics ranks second among independent third-party autonomous driving solution providers in China, trailing only Huawei. However, by adopting an open ecosystem strategy, Horizon Robotics has attracted more collaborations with small and medium-sized automakers.

In 2025, with the successive delivery of high-level intelligent driving systems such as BYD's Tian Shen Zhi Yan C and Li Auto's AD Pro, both equipped with the Journey 6 series computing solution, the cumulative delivery volume of the Journey series is expected to exceed 10 million units.

It's worth noting that despite the continuous growth in revenue and delivery volume, Horizon Robotics' operating loss remains high at RMB 2.14 billion, with an adjusted net loss of RMB 1.68 billion, marking a slight narrowing compared to the loss of RMB 1.687 billion in 2023.

Overall, with revenue of RMB 2.384 billion and a 53.6% year-on-year growth rate in 2024, Horizon Robotics has consolidated its leading position in the domestic intelligent driving market. As the delivery volume surpasses 7.7 million units and the number of contracted models exceeds 310, it signifies that Horizon Robotics has moved beyond the initial stage of merely pursuing market share.

Competition barriers shift from 'common denominators' to ecological moats

With the cost reduction of the Journey 6 chip and the successful deployment of million-unit orders such as BYD's Tian Shen Zhi Yan C and Li Auto's AD Pro, Horizon Robotics' competitive strategy has evolved from focusing on the "performance common denominator" of early products to building an ecological moat driven by a closed loop of "data-algorithm-scenario."

This transformation is evident in the financial report: licensing and service revenue stood at RMB 1.647 billion, a 70.9% year-on-year increase, with a gross margin of 92.0%, up 3.0% year-on-year. This indicates that Horizon Robotics is successfully transforming its technological advantages into a sustainable business model.

Specifically, Horizon Robotics' technology ecosystem is progressing towards "software-hardware integration + full-stack openness."

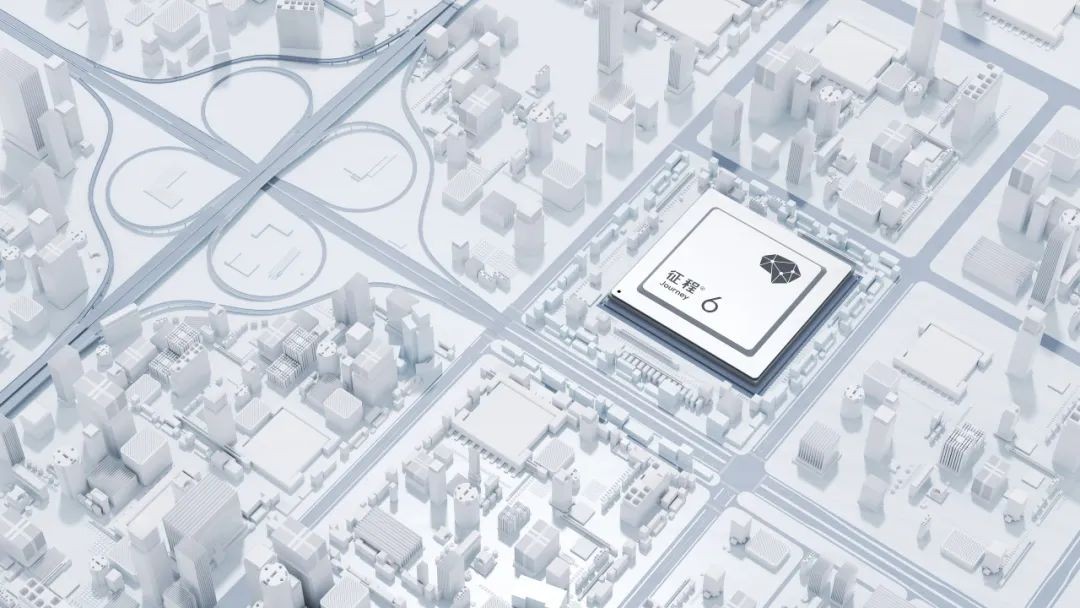

Image source: Horizon Robotics official

The Journey 6 series, as a unique line of computing solutions in China capable of meeting the mass production demands of "full-level" intelligent driving, offers flexible configurations for different intelligent driving scenarios. Across scenarios, it provides the optimal balance between performance and cost, significantly accelerating the implementation and application of intelligent driving across all scenarios. Furthermore, the launch of Journey 6 marks a crucial leap for Horizon Robotics in product R&D, transitioning from a single-point to a series approach.

HSD is an end-to-end VLA high-level intelligent driving system developed by Horizon Robotics based on full-stack software-hardware integration technology. The system offers users a seamless, mode-switch-free, and scenario-agnostic human-like experience, aiming to create safe and enjoyable intelligent driving journeys. Its comprehensive user experience ranks among the industry's best, with the first mass-produced collaborative model set to be delivered in the third quarter of 2025.

Currently, Horizon Robotics collaborates with industrial chain partners such as NavInfo and Zhixing Technology to provide automakers with full-stack support ranging from chips and domain controllers to algorithm development, effectively lowering the R&D threshold for automakers.

As the Journey 6 series sets industry standards with "full-level intelligent driving" and the HSD system redefines user experience with an end-to-end architecture, Horizon Robotics has constructed a three-dimensional barrier comprising "chip + algorithm + developer ecosystem," affirming its transition from a technology supplier to an ecosystem leader.

Approaching the 'tipping point' of 10 million deliveries and intelligent driving equalization

According to data from the Ministry of Industry and Information Technology, in the first half of 2024, the penetration rate of new vehicles with L2-level and above assisted driving in China's passenger car market reached 55.7%. It is estimated that by 2025, this penetration rate will climb to 65%.

The formation of an ecological barrier has equipped Horizon Robotics with the systematic capacity to achieve 10 million deliveries. As the industry penetration rate surpasses 55% and L2+ functions become standard in vehicles priced at RMB 100,000, the synergistic effects of its large-scale deliveries and "intelligent driving equalization" strategy will face a genuine test.

Against this backdrop, Horizon Robotics has adopted a prospective "three-step" strategy. The first step involves continuous expansion and pursuit of scale, with the cumulative delivery volume expected to exceed 10 million units by 2025, potentially making it the world's first intelligent driving solution provider to reach this milestone.

The second step entails delving deeper into high-level solutions. Its HSD solution is anticipated to enter mass production in the third quarter, potentially enabling automakers to achieve autonomous driving in all urban scenarios. The final step, which is a consensus in the industry, is to promote globalization.

Image source: Horizon Robotics official

However, amidst the persistent high R&D investments in high-level intelligent driving, Horizon Robotics must balance long-term technology investments with short-term profitability needs. Additionally, competitors like Huawei and Mobileye are intensifying their open ecosystems, which could reshape the industry landscape, indicating that Horizon Robotics still faces an uphill battle.

In conclusion, Horizon Robotics' 2024 performance report showcases not only a leap in revenue figures but also a paradigm shift for a Chinese technology enterprise, transitioning from "technology catching up" to "ecosystem definition."

As Tesla's FSD encounters "acclimatization issues" in China and Huawei's MDC expansion slows due to compliance challenges, Horizon Robotics is crafting the "Chinese solution" in the realm of intelligent driving with its unique approach of "underlying chip + open ecosystem."

In this competitive landscape, victory may hinge not on the leadership of a single technical indicator but on who can build a more inclusive innovation ecosystem. After all, the intelligent revolution in future automobiles has never been a solitary battle.

Source: Hong Kong Stocks Research Society