"Southeast Asia's Little Tencent: From 'Rivals' to 'Friends', Will Sea Rise Again?

![]() 05/20 2024

05/20 2024

![]() 730

730

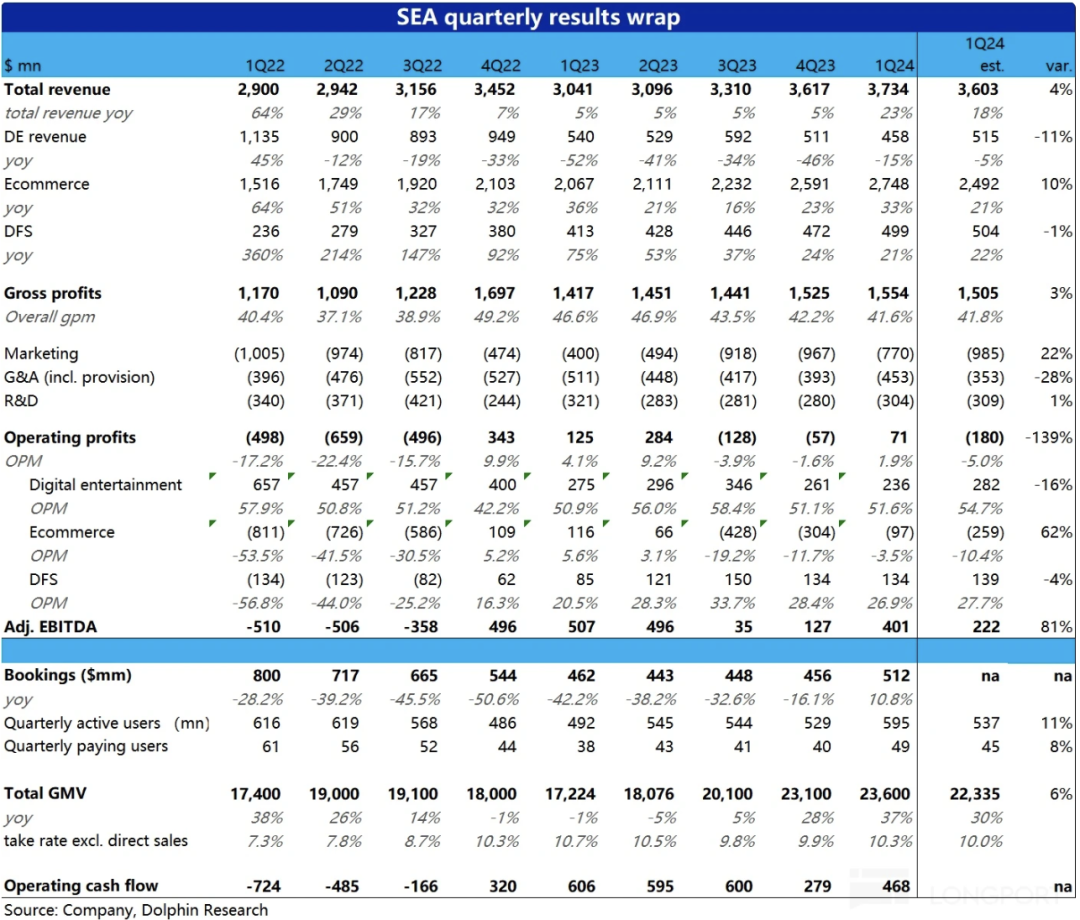

On the evening of May 14 before the U.S. stock market opened, Southeast Asia's Little Tencent, Sea, released its financial report for the first quarter of 2024. Driven by Shopee's business, which has significantly accelerated growth and narrowed losses, this quarter's performance was impressive. The key points are as follows:

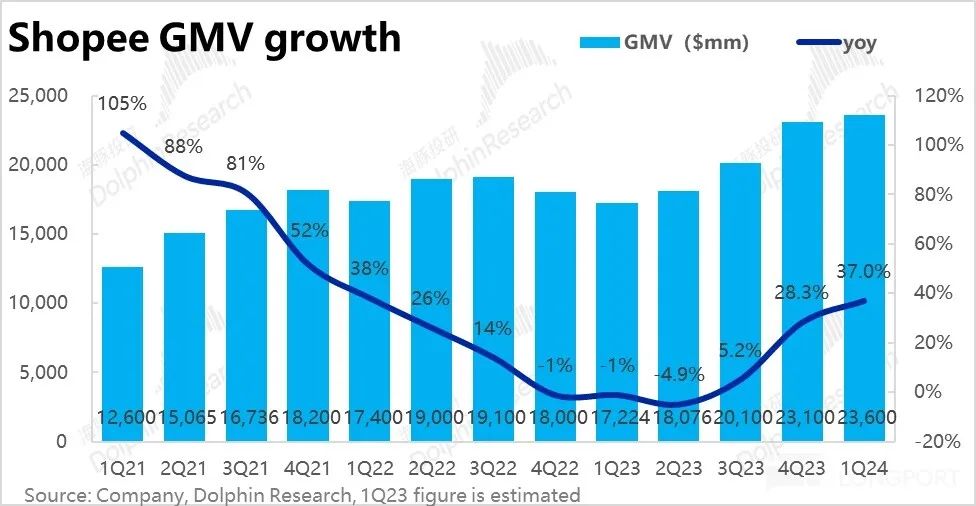

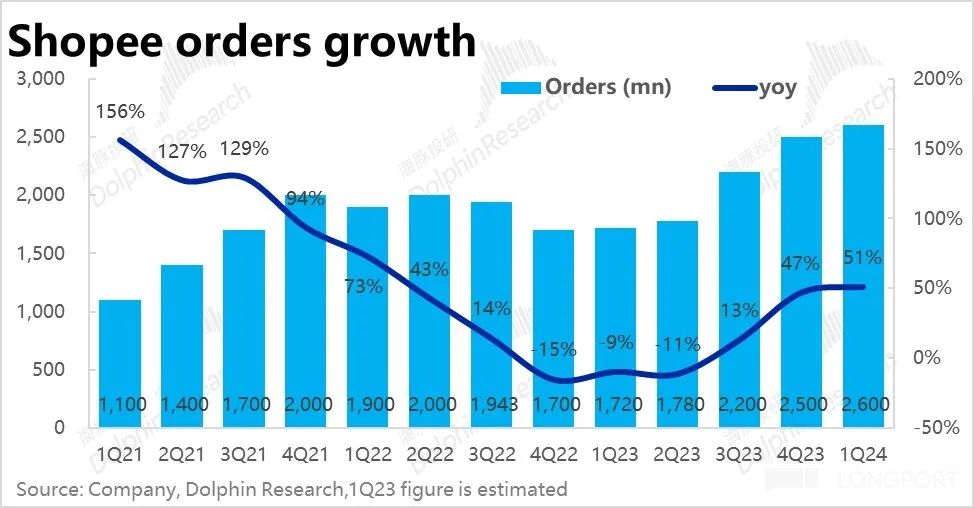

1. Shopee's e-commerce is accelerating and reducing losses, currently in a "honeymoon period": Following the recovery signs seen in the previous quarter, Shopee's growth momentum has further strengthened this quarter, with GMV year-on-year growth reaching 37%, a near 9pct quarter-on-quarter acceleration, significantly higher than the market's expected 30% growth. Even though expectations were not low, the actual performance was even stronger. However, the order volume growth rate was 51%, with a higher absolute growth rate, but the quarter-on-quarter acceleration was only 3pct, indicating that the acceleration in volume was not as strong as that in GMV, with a higher marginal contribution from the average order price.

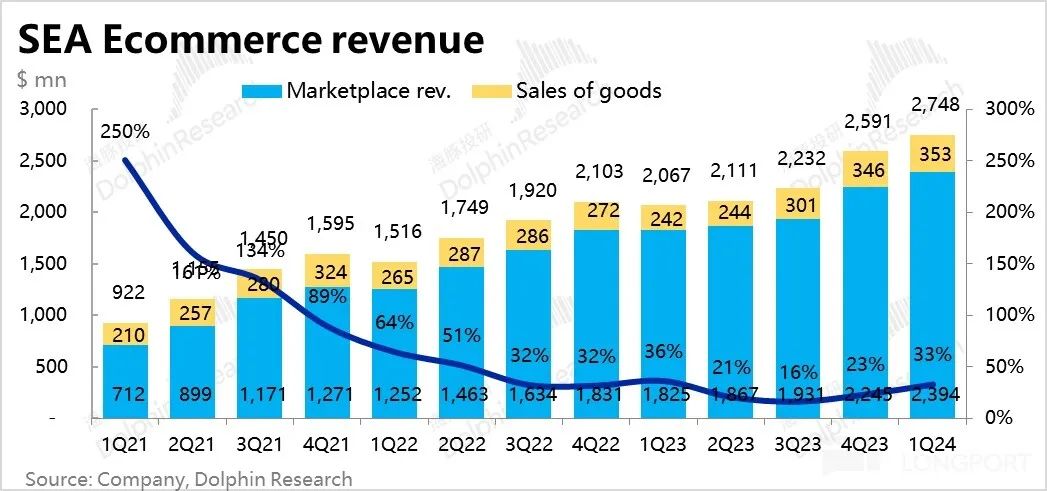

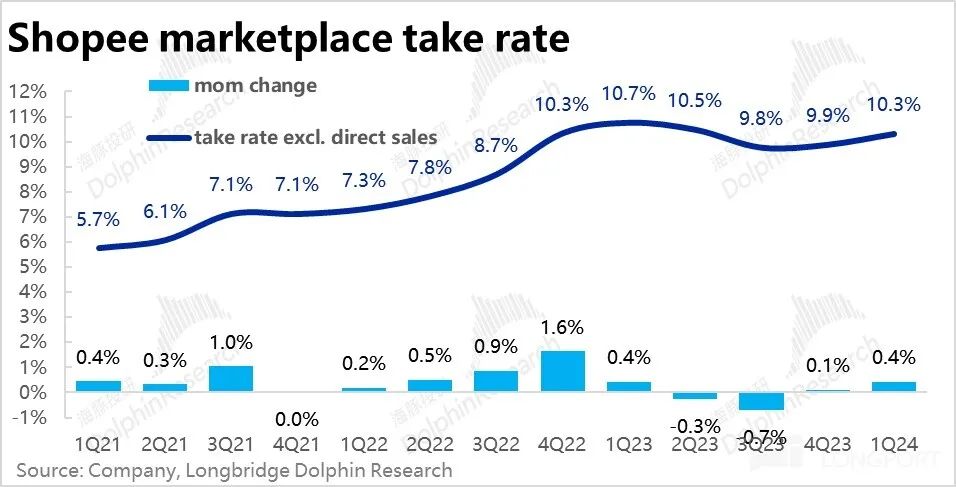

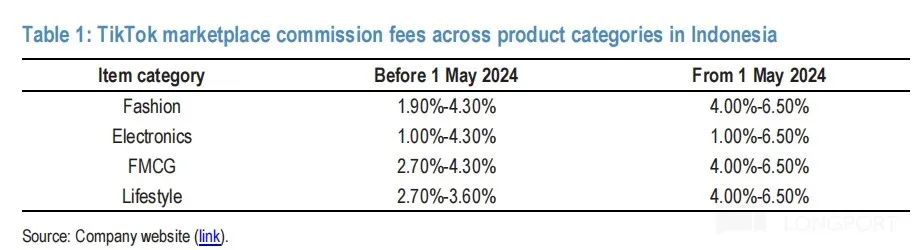

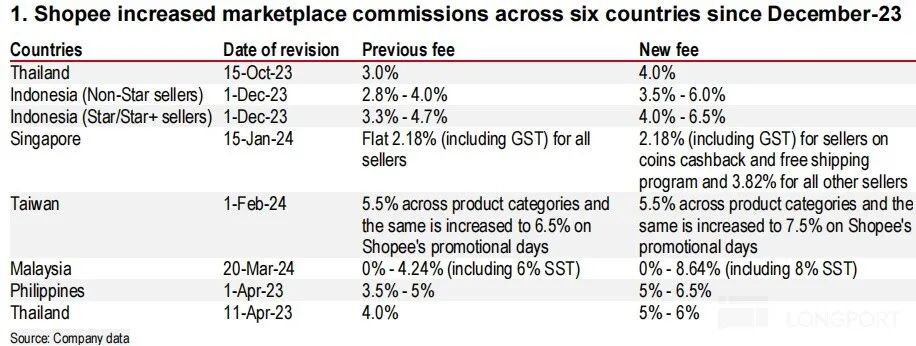

As for revenue, it increased by 33% year-on-year this quarter, significantly higher than the expected 21%. The quarter-on-quarter acceleration was 10pct, higher than the GMV increase, reflecting a further 0.4pct increase in the monetization rate quarter-on-quarter. Currently, leading e-commerce platforms in Southeast Asia such as Shopee, Tiktok, and Lazard are generally increasing their monetization, creating a good environment where competition is waning and everyone is making money together.

In addition, despite high investment, Shopee's business still incurred losses, but the amount of losses continued to narrow significantly. This quarter's operating profit loss was 0.97 billion, significantly less than the expected loss of 2.6 billion. Among them, the Southeast Asian market has turned a profit on an EBITDA basis. Overall, while growth has accelerated significantly, losses are still narrowing, making this the most "honeymoon" phase.

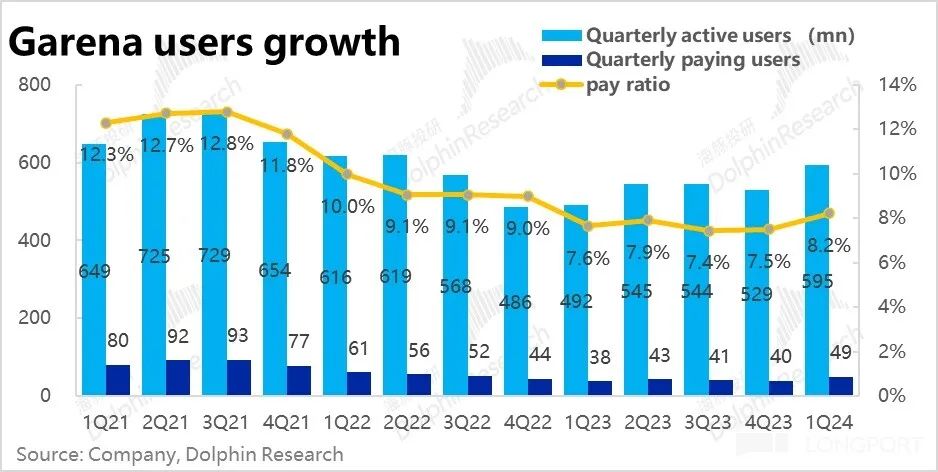

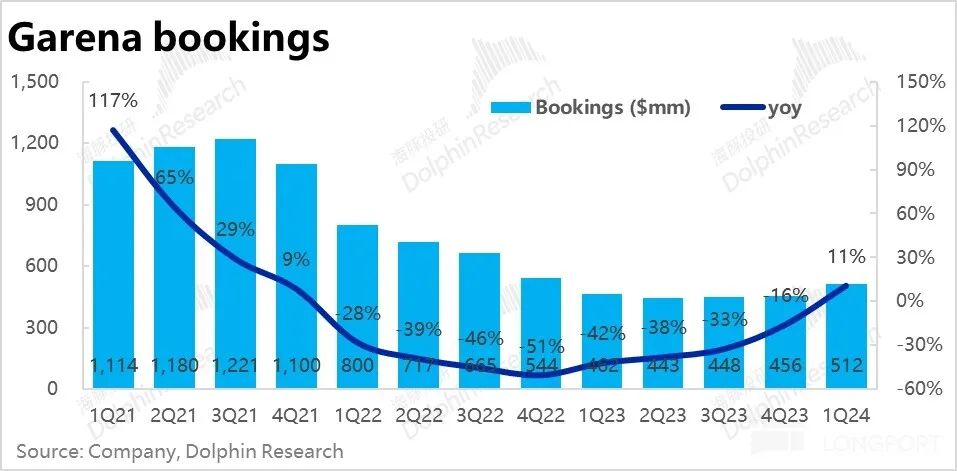

2. Is there finally a dawn for Garena's games? At first glance, Garena's GAAP revenue continued to decline by 15% year-on-year, 11% lower than market expectations. However, this is due to the impact of deferred revenue changes, and key metrics such as actual user data and revenue have shown signs of improvement.

Specifically, this quarter's active users increased by 66 million quarter-on-quarter, and paying users also increased by 9 million quarter-on-quarter. Revenue has finally stopped declining this quarter, with a year-on-year increase of 11%, and both new and old games should have contributed.

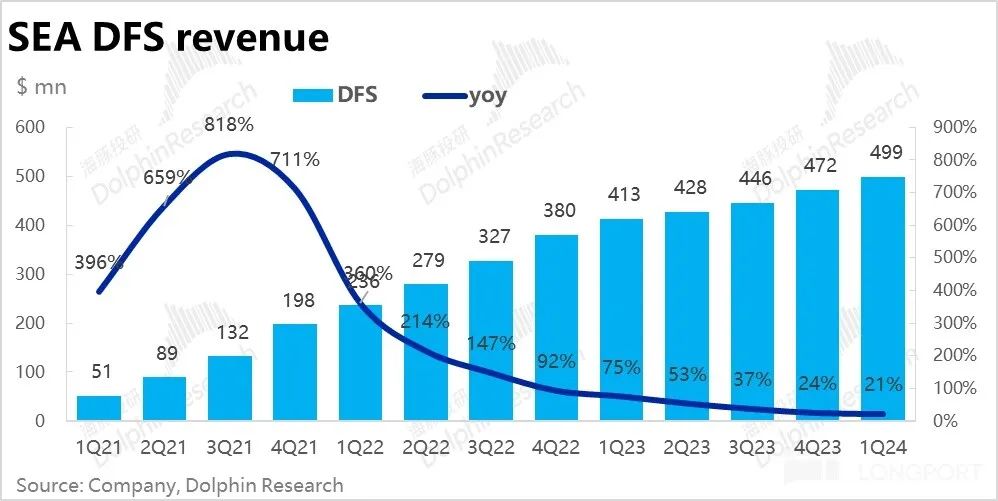

3. SeaMoney continues to grow steadily with high quality: This quarter, SeaMoney generated revenue of 460 million, with the growth rate continuing to trend down to 21%, roughly in line with market expectations. In terms of operating data, the company changed the disclosure of the loan size, which was 3.3 billion USD this quarter, an increase of 29% year-on-year. Of this, 2.7 billion is on-balance sheet and 600 million is off-balance sheet. The bad debt rate for overdue loans of more than 90 days was 1.4%, flat year-on-year. Overall, SeaMoney has maintained a good growth trend, with no significant fluctuations this quarter.

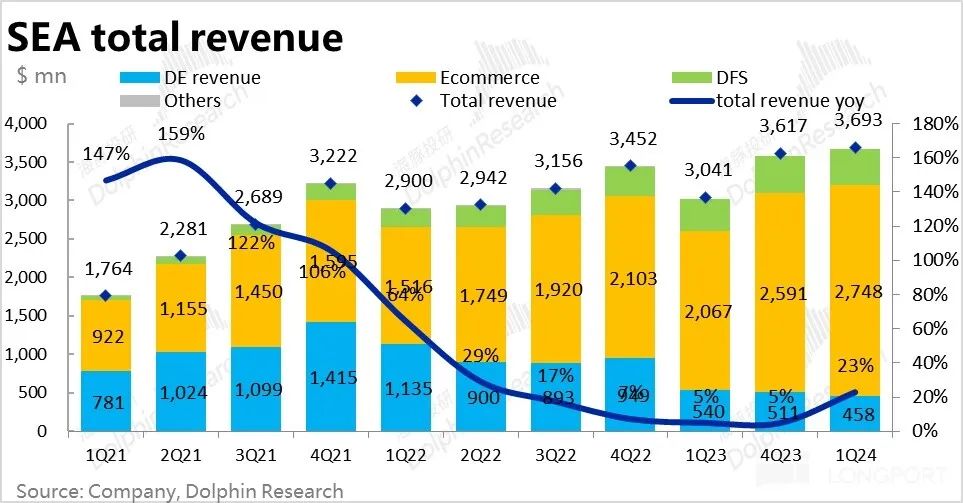

4. Overall performance - higher revenue than expected, less loss than expected: Due to the strong performance of the e-commerce segment, Sea achieved overall revenue of 3.69 billion this quarter, with year-on-year growth significantly increasing to 23%, 4% higher than expected.

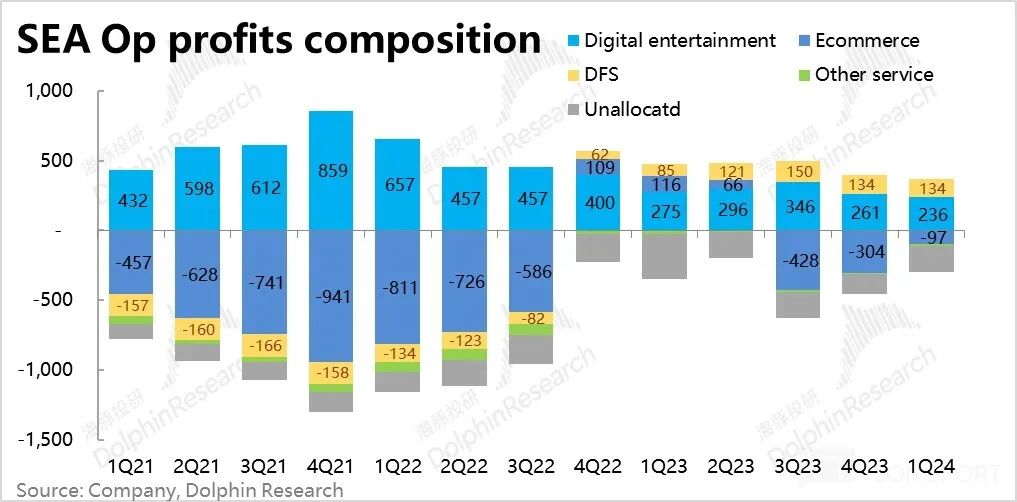

Although the operating profit of the gaming segment also declined by 14% year-on-year, below market expectations, the operating profit margin did not decline quarter-on-quarter, but was only affected by the decline in GAAP revenue. The DFS financial segment contributed a profit of 130 million, roughly flat quarter-on-quarter. Driven by the significantly reduced losses of Shopee, the group achieved an operating profit of $71 million, significantly better than the expected loss of 180 million.

In terms of expenses, the most notable is the significant contraction in marketing spending, with the expense ratio decreasing from nearly 27% to 21% quarter-on-quarter. The marketing expense ratio of the e-commerce segment decreased from 34% to 25%, reflecting a narrowing of competition and subsidies. Although the management and R&D expense ratios increased slightly quarter-on-quarter, the impact was not significant compared to the significant narrowing of marketing expenses.

Dolphin Investment Research Perspective:

This quarter, we can see that following the bonus period after Tiktok Shop was banned in Indonesia in the previous quarter, Shopee seized the window period to recover. This quarter, the firepower of the Southeast Asian e-commerce market continued to decline, and the previously rival head platforms in Southeast Asian e-commerce seem to have become tacit friends, entering a "honeymoon period" of jointly improving monetization and making profits together.

At the same time, the gaming segment, which had been weak previously, also showed signs of improvement in key operating metrics this quarter, with both active and paying users increasing significantly quarter-on-quarter, higher than the expected 8%~11%. Revenue finally stopped declining and grew by 11% year-on-year, indicating that the Garena gaming segment seems to have completed its bottoming out and begun to recover.

Therefore, overall, Sea is currently in a stage where both major business segments are recovering or further strengthening. While revenue is accelerating, profits are also improving, and the performance is obviously good. However, the market has already had relatively sufficient expectations for this, and the small fluctuation in share prices after the results is proof of this.

In addition, the company did not provide performance guidance this time, and the "rapidly changing" Southeast Asian e-commerce landscape is far from stable. It is indeed not easy to prospectively judge subsequent performance prospects, and more can only be done by closely monitoring high-frequency third-party statistical data and responding flexibly.

Detailed Interpretation of the Financial Report

I. Shopee Embraces Another Bonus Period, Strongly Leading Growth

Following the previous quarter, when Tiktok Shop was banned by the Indonesian government, Shopee's growth began to recover significantly. This quarter, Shopee's recovery momentum has further strengthened, with GMV year-on-year growth reaching 37%, a near 9pct quarter-on-quarter acceleration, also significantly higher than the market's expected 30% growth. Even though expectations were not low, the actual performance was even stronger.

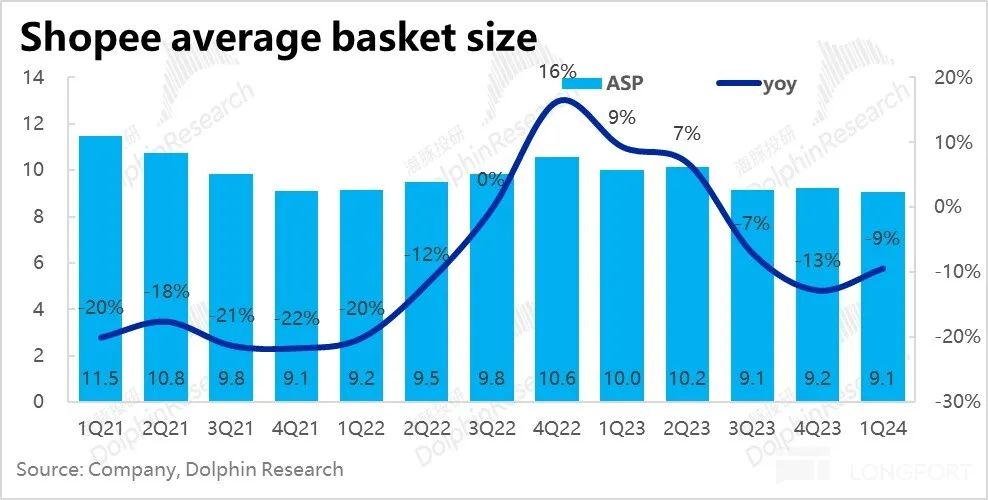

Breaking down the price and volume, this quarter's order volume growth rate was 51%, although the absolute growth rate was higher, the quarter-on-quarter acceleration was only 3pct, indicating that the acceleration in volume was not as strong as that in GMV, with a greater impact from price factors.

Although the average order price still declined year-on-year by 9% to $9.1, the decline narrowed by 4% due to the lower year-on-year base. Overall, it still reflects the main "price power" route of trading volume for price, but prices have already reflected a price recovery period where e-commerce competition has shaken hands.

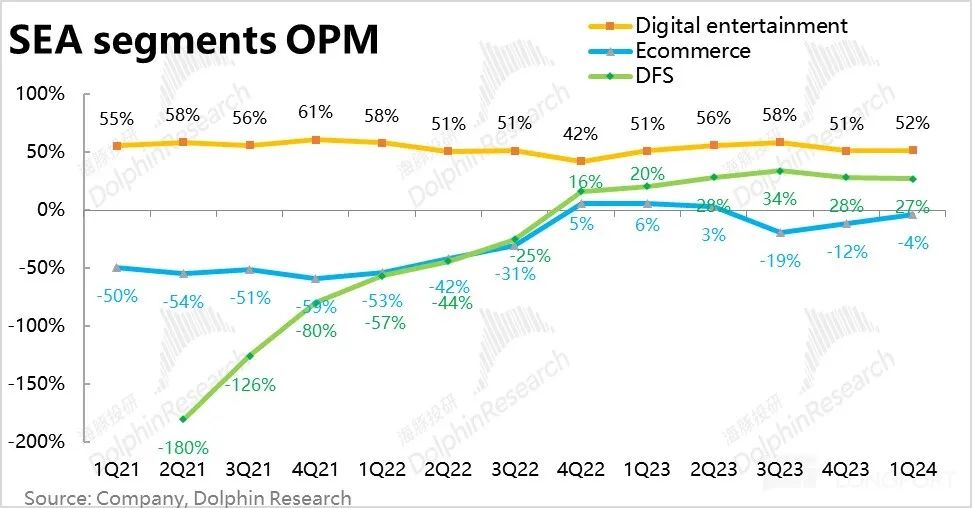

The acceleration in revenue was even stronger than GMV, with revenue increasing by 33% year-on-year this quarter, significantly higher than the expected 21%. The revenue growth rate accelerated by 10pct quarter-on-quarter, stronger than the 8.7pct increase in GMV. Behind this is a continued increase in the monetization rate.

According to our estimates, the platform's monetization rate continued to increase by approximately 0.4pct quarter-on-quarter to 10.3%. As we understand, both Tiktok Shop and Shopee have recently increased their monetization rates in Southeast Asian countries. Alibaba's latest financial report also indicated that Lazard's current focus is on improving monetization and reducing average losses per order. In other words, leading e-commerce platforms in Southeast Asia such as Shopee, Tiktok, and Lazard are working together to increase monetization, creating a good environment where competition is waning and everyone is making money together.

II. Players Return, Is There Finally a Dawn for Garena?

The Garena gaming segment, which has been dragging down the group, seems to have truly seen the dawn of a turnaround this quarter. At first glance, Garena's GAAP revenue continued to decline by 15% year-on-year, 11% lower than market expectations. But this is due to the impact of deferred revenue changes, and user data and revenue have already shown signs of improvement.

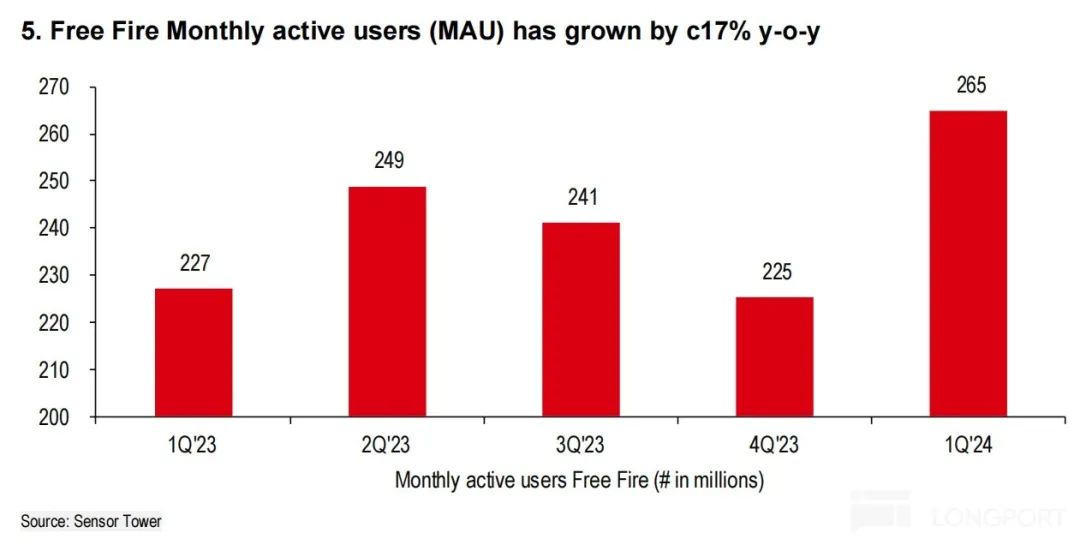

Specifically, this quarter's active users increased by 66 million quarter-on-quarter, and paying users also increased by 9 million quarter-on-quarter, reflecting a trend of user return. According to Sensor Tower, the monthly active user count of its flagship product Free Fire increased by 40 million quarter-on-quarter.

Therefore, the most crucial revenue finally stopped declining this quarter, with a year-on-year increase of 11%. Both core old products and new games should have contributed.

III. SeaMoney's Growth Slows, but Remains Stable

This quarter, SeaMoney generated revenue of 460 million, with the growth rate continuing to trend down to 21%, roughly in line with market expectations. In terms of operating data, the company changed the disclosure of the loan size, which was 3.3 billion USD this quarter, an increase of 29% year-on-year. Of this, 2.7 billion is on-balance sheet and 600 million is off-balance sheet. The bad debt rate for overdue loans of more than 90 days was 1.4%, flat year-on-year.

Overall, the SeaMoney business remains stable and healthy.

IV. E-commerce Segment Increases Revenue and Reduces Losses, Other Segments Maintain Stable Profits

To summarize, in terms of growth, with some easing of industry-wide competition, Shopee has delivered strong growth through investment in live streaming and fulfillment, continuing to lead the group. The Garena gaming segment has finally shown signs of user and revenue recovery, while SeaMoney continues to maintain a high-quality growth trend.

In terms of profitability, although the crucial e-commerce segment is still incurring losses due to high investment this quarter, the magnitude has narrowed significantly. This quarter's operating profit loss was 0.97 billion, significantly less than the expected loss of 2.6 billion. While growth has accelerated significantly, losses are still narrowing, making this the most "honeymoon" phase.

Due to the year-on-year decline in GAAP revenue, the gaming segment's operating profit also declined by 14% year-on-year, below market expectations. However, the operating profit margin did not decline quarter-on-quarter, which is not a major issue given the improvement in actual operating data.

The DFS financial segment contributed a profit of 130 million, roughly flat quarter-on-quarter, with a slight decline in profit margin, slightly missing expectations.

V. Overall Performance: Higher Revenue, Less Loss

Due to the strong performance of the e-commerce segment, Sea achieved overall revenue of 3.69 billion this quarter, with year-on-year growth significantly increasing to 23%, 4% higher than expected.

At the gross profit level, although the gross margin of the Garena segment is still declining due to investment in new games, under the support of the e-commerce and financial segments, the group's overall gross margin remained roughly flat at 42% quarter-on-quarter. Due to revenue exceeding expectations, the final gross profit value was also 3% stronger than expected.