eSIM Phones Become a New Trend, Diverging Paths for Huawei and vivo

![]() 10/28 2025

10/28 2025

![]() 663

663

The launch of iPhone Air signifies the official introduction of eSIM phones in China, prompting domestic phone manufacturers to scramble for layout (a more suitable term here could be 'market positioning' or simply 'market entry') market entry. An industry exploration into cardlessness and slimming is underway.

Original Tech Insights Frontier Tech Team

With the launch of Apple's China-bound iPhone Air, eSIM phones have officially arrived in China. As the first eSIM phone sold domestically, the China-bound iPhone Air faced numerous setbacks before its domestic release. Launched globally in September this year, it was delayed from entering the Chinese market due to the lack of commercial licenses for eSIM phone services from the three major carriers. On October 13, the Ministry of Industry and Information Technology approved China Unicom, China Mobile, and China Telecom to conduct commercial trials of eSIM phone services nationwide, officially ushering in the 'cardless era' for domestic smartphones.

After the three major carriers 'opened the floodgates', domestic phone manufacturers like Huawei and OPPO quickly responded, aiming to seize the new eSIM phone market. Just as the iPhone 7's removal of the 3.5mm headphone jack marked a watershed moment in the wireless audio transformation of smartphones, Apple has consistently served as a trendsetter in every global smartphone industry revolution. Currently, the iPhone Air's use of an eSIM card is primarily aimed at saving internal space and achieving a slimmer phone design. How will domestic phone manufacturers follow suit? Under the 'cardless era' trend, what changes will the domestic smartphone market undergo?

01

Huawei and OPPO Vie for the First eSIM Phone

The approval of commercial trials for eSIM phone services by the three major carriers can be seen as a significant turning point in the transition from physical SIM cards to electronic SIMs in domestic smartphones. Faced with this historic opportunity, leading domestic phone manufacturers have also sprung into action, vying for a foothold in the eSIM sector. Currently, among domestic phone manufacturers, OPPO is the first to take action. On the evening of October 16, at the OPPO Find X9 series product launch, Liu Zuohu, OPPO's Chief Product Officer, stated that the OPPO Find X9 Pro Satellite Communication Edition supports eSIM usage, making it the first domestic flagship model to do so.

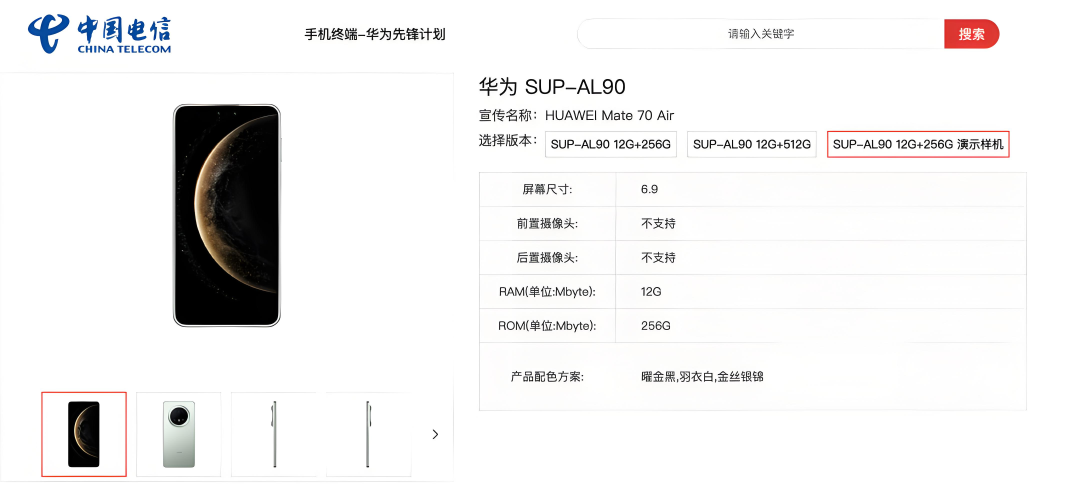

Notably, this model does not completely eliminate the physical SIM card slot but adopts a 'dual-slot compatible' design, catering to both eSIM enthusiasts and traditional users. This move is seen as a pragmatic strategy to balance technological innovation with market acceptance. The OPPO Find X9 Pro has a body thickness of 8.25mm and weighs approximately 224 grams, offering certain advantages in battery life, imaging, and other performance aspects. Huawei listed the new Huawei Mate 70 Air on the telecom terminal product library on October 21. The phone features a 6.9-inch screen with a 1920x1200 resolution, slightly larger than the iPhone Air's 6.5-inch model. It is reported that Huawei will release the Mate 80 in November. The launch of the Mate 70 Air at this juncture is seen as a response to Apple's iPhone Air, and market speculation suggests that this product is highly likely to be Huawei's first eSIM model.

OPPO and Huawei's forays into eSIM can be seen as two different approaches by domestic phone manufacturers in the context of the iPhone Air strongly associating eSIM with extreme slimness. OPPO focuses on showcasing eSIM capabilities and transitioning to new form factors, while Huawei follows a path more similar to Apple's. Just as Apple adopted a 'physical card + eSIM' hybrid mode in the 2018 iPhone XS series before launching the eSIM-only iPhone Air, OPPO's 'dual-slot compatible' strategy cleverly takes a transitional path: it allows the market to maintain a sense of security while beginning to experience the connection freedom and ecological synergy brought by eSIM as a fundamental communication technology. Huawei, on the other hand, may be exploring the balance between eSIM and slimness. Reportedly, the Huawei Mate 70 Air is its first Air model, launched shortly after Apple's iPhone Air, seen as a direct competition. Market speculation suggests that the Huawei Mate 70 Air is highly likely to be Huawei's first eSIM model. However, the model has not been officially released yet, and whether it will adopt eSIM, choose an eSIM-only or 'physical card + eSIM' hybrid mode remains to be seen with the release of more parameters. OPPO has seized the title of 'the first domestic phone supporting eSIM' ahead of Huawei. However, the OPPO Find X9 Pro Satellite Communication Edition will go on sale in November, and the Huawei Mate 70 Air has not officially debuted yet, with market speculation suggesting it may be released simultaneously with the Mate 80 series in November. Which of the two domestic manufacturers' different approaches better meets consumer needs may depend on subsequent market performance. OPPO and Huawei's actions can be seen as proactive explorations by leading phone manufacturers under the new technological trend. In the first half of this new trend, whoever can first establish a mature and stable user experience in the eSIM field will undoubtedly gain a first-mover advantage in the upcoming 'cardless era'. This is not just a competition of product features but also a comprehensive test of manufacturers' abilities to integrate software and hardware and build ecological services.

02

Domestic Manufacturers' Diverging Paths in 'Slimming Down'

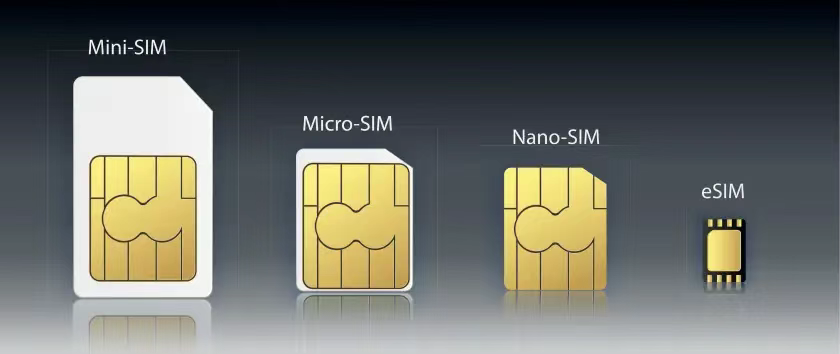

In market analysis, the mainstream view is that Apple's design strategy of eliminating physical SIM cards is primarily aimed at achieving the 'thinnest iPhone ever'. In fact, Apple has long been exploring phone slimness, and each of its major updates has triggered industry changes. In component design, Apple officially removed the 3.5mm headphone jack when launching the iPhone 7 and iPhone 7 Plus in 2016. Besides improving waterproof performance and promoting its true wireless Bluetooth earphones AirPods, a key reason was to make room for internal space and components, enhancing performance while reducing body thickness. This move initially faced skepticism from the market and other phone manufacturers, but time has shown that most mainstream phone manufacturers' mid-to-high-end models have also eliminated the headphone jack. Continuously reducing SIM card size is another measure Apple has taken to promote phone slimness. Apple first introduced the smaller Micro-SIM instead of the Mini-SIM in the iPhone 4. Then, to make the iPhone thinner and accommodate larger batteries and new components, it pioneered the use of the Nano-SIM card in the iPhone 5, further reducing the SIM card's size. Now, with the introduction of eSIM, it is clear that after minimizing the physical SIM card, Apple's next goal is to completely eliminate the SIM card slot. Currently, from its launch of the iPhone Air, it is evident that Apple's short-term goal in introducing eSIM cards is to assist in achieving extreme phone slimness.

Its newly launched iPhone Air weighs only 165 grams and has a thickness of 5.6 millimeters, making it Apple's thinnest and lightest smartphone to date. Just as Apple's removal of the headphone jack and reduction of SIM card size have brought industry changes, the launch of the Apple iPhone Air has sparked discussions on 'eliminating physical card slots' and 'extreme slimness'. Additionally, the application of eSIM in smartphones has to some extent expanded the operational space for slim phones. Against this backdrop, domestic phone manufacturers are also facing the choice of whether to follow suit with slimmer smartphone models. Although Lenovo phones are less prominent than Huawei, Xiaomi, OPPO, and Vivo in terms of brand recognition, Lenovo is at the forefront of this trend towards extreme slimness. The company announced that its moto X70 Air phone will be launched on October 31, featuring AI capabilities and a thickness of only 5.3mm, weighing 150 grams, making it even slimmer than Apple's iPhone Air. Notably, the Lenovo moto X70 Air does not adopt eSIM but retains the physical card slot design, supporting dual SIM dual standby. It even boldly states in its promotion that 'Air doesn't necessarily need eSIM'. However, this model uses the fourth-generation Snapdragon 7 processor, positioning it in the mid-range performance segment.

Huawei's launch of the new Mate 70 Air indicates its choice to actively follow the trend towards slimness. Unlike Huawei and Lenovo, another leading phone manufacturer, vivo, has chosen a different path. Recently, in an interview after the vivo X300 series launch, Huang Tao, vivo's Product Vice President, revealed that the company had extensively discussed and even created prototypes for ultra-thin Air-like products, even debating whether to categorize them under the X series or S series. However, they ultimately decided to abandon the project. Regarding the reasons for abandoning the Air project, vivo believes that such ultra-thin form factors struggle to ensure a complete user experience, especially severely limiting imaging capabilities, which contradicts vivo's principle of prioritizing user experience. Besides manufacturers with clear responses, some are hesitating in the direction of slimness. On September 10, shortly after the iPhone 17 launch, Xiaomi's Lu Weibing posted on Weibo, 'The iPhone 17 series has rearranged its product lineup, replacing the plus with Air,' and asked the public whether 'extreme slimness is the direction.' However, recently, a tech blogger revealed that a manufacturer is evaluating an eSIM slim flagship phone, expected to be the Xiaomi 17 Air, which the blogger claims will likely be released next year. If true, Xiaomi is choosing a path similar to Huawei's: slimness + eSIM. In fact, under the trend of eSIM technology eliminating physical card slot limitations, 'whether to pursue extreme slimness' has become an unavoidable strategic proposition for all phone manufacturers. This is far from a simple design choice; it profoundly relates to each company's technological accumulation and product direction selection. For some time to come, balancing slimness and functional completeness will remain a difficult decision that manufacturers must continuously face. A more ideal outcome would be to achieve both slimness and functional completeness.

03

On the Eve of the Cardless Era, Opportunities and Challenges Coexist

Although eSIM plays a significant role in smartphone slimness, it currently cannot support the ambition of balancing extreme slimness and performance experience, as evidenced by the iPhone Air's sales situation. On October 22, the China-bound iPhone Air officially went on sale in China. However, compared to the market's enthusiastic response after the iPhone 17 series launch, the iPhone Air's market feedback has been less than ideal. Renowned Apple analyst Ming-Chi Kuo posted, 'iPhone Air demand is lower than expected, and the supply chain has already begun reducing shipments and capacity.' According to Kuo's analysis, supply chain capacity is generally expected to shrink by over 80% by Q1 2026, with some components with longer lead times estimated (this word seems out of place here, a more suitable term could be 'scheduled') scheduled to cease production by the end of 2025. This suggests that the existing Pro series and standard models already adequately meet the needs of most high-end users, making it difficult to find new market segments and positioning. This indicates that extreme slimness is not currently a mainstream consumer demand, especially given that the iPhone Air has compromised on certain performance aspects to achieve extreme slimness. Reportedly, to pursue a slimmer body, the iPhone Air has made certain compromises in battery life, imaging, speakers, and other aspects. Compared to slimness, these performance factors are actually what consumers pay more attention to.

Of course, the failure of the iPhone Air only indicates that the mere pursuit of extreme thinness and lightness does not align with the current consumer demand for mobile phones. Beyond thinness and lightness, eSIM undoubtedly holds even greater potential. For users, using eSIM eliminates the cumbersome process of finding a SIM ejector pin or cutting the SIM card when switching cards. Services such as online SIM activation and plan changes can be achieved 'seamlessly.' With the 'one number, multiple devices' capability, users can share communication services across devices like smartphones, smartwatches, and cars without changing their phone numbers. Additionally, during international roaming, eSIM can directly connect to local networks, offering a more convenient user experience. For mobile phone manufacturers, since eSIM no longer requires a separate SIM card slot and tray, it saves valuable space inside the phone. This space can be allocated to a larger battery, a more powerful motor, or other sensors, enabling manufacturers to produce higher-performance smartphones without increasing the existing phone's size. Furthermore, although the pursuit of extreme thinness and lightness is not necessary, the use of eSIM in foldable smartphones may offer even greater possibilities. Currently, foldable smartphones primarily focus on dimensions such as thin and light design, battery life, and AI capabilities in their promotional materials. The integration of eSIM can physically eliminate the need for a physical SIM card slot, freeing up more space for internal structural design and playing a positive role in achieving overall device thinness and lightness. This not only meets the stringent requirements for weight and thickness in foldable devices but also further drives mobile phone manufacturers' layout and exploration in the high-end market. However, despite the significant potential of eSIM smartphones, manufacturers are still in the early stages of exploration, and the true 'cardless era' is still some time away. According to data from the GSMA Association, the number of eSIM smartphone connections will reach 1 billion by the end of 2025 and rise to 6.9 billion by 2030. By then, eSIM smartphones will account for 76% of global smartphone connections, becoming the absolute mainstream standard. However, at present, eSIM is in its early stages of implementation, and its widespread adoption, which involves the transition from old to new SIM cards, still has a long way to go. On October 23, Ni Fei, President of ZTE's Terminal Business Division and President of Nubia Technology Co., Ltd., posted on social media that there are still many challenges in implementing eSIM: the online activation process is not fully streamlined, network coverage in remote areas is still being improved, costs are relatively high, and many users are even unclear about 'how to switch numbers with eSIM.'

Wang Peng, an associate researcher at the Beijing Academy of Social Sciences, also stated in an interview with Securities Times that eSIM will become the mainstream communication solution, but complete replacement will take time. Looking ahead, the widespread adoption of eSIM will be a gradual process that evolves from the Internet of Things (IoT) to the Internet of People (IoP), expanding from localized trials to global applications. During this process, mobile phone manufacturers should not merely serve as hardware providers but should also become key forces driving changes in user habits and building new connectivity ecosystems. Only when terminals, networks, and services truly integrate can the 'cardless era' transcend mere technological iteration and evolve into a high-level form centered on users, featuring seamless connectivity and intelligent responsiveness. For mobile phone manufacturers, this represents both a strategic opportunity to reshape the industry landscape and a deep competition centered on user experience. References: 36Kr, 'Huawei Mate 70 Air Suddenly Launched: Competing with iPhone Air?' Finet, 'iPhone Air Faces Cold Reception: Is the Thinnest iPhone Ever Unsellable?' CNMO Technology, 'Vivo Abandons Ultra-Thin Smartphone Exploration: Difficult to Provide a Good User Experience' National Business Daily, 'New Battle in Consumer Electronics: Huawei and OPPO Vie for eSIM-Enabled Smartphones, Ushering in a New Market for Smartphones'