A 6 Million Yuan Bill Puts Cloud Security to the Test

![]() 11/14 2025

11/14 2025

![]() 598

598

Source | Benyuan Finance

Author | Li Youshan

As the global economy speeds up its digital transformation, intelligent clouds act as the “computing power bedrock,” perfectly catering to the explosive data growth demands of the digital economy. This sector has emerged as the fastest-growing segment and a hotbed of competition among leading companies and nations. Internationally, AWS, Microsoft Azure, and Google Cloud reign supreme, while domestically, Baidu Cloud, Alibaba Cloud, Huawei Cloud, and Oracle Cloud are swiftly catching up in niche markets.

In a recent public announcement, Shen Dou, head of Baidu Intelligent Cloud Business Group (ACG), underscored a long-term commitment to equipping enterprises with robust, cost-effective AI computing support to internalize AI capabilities.

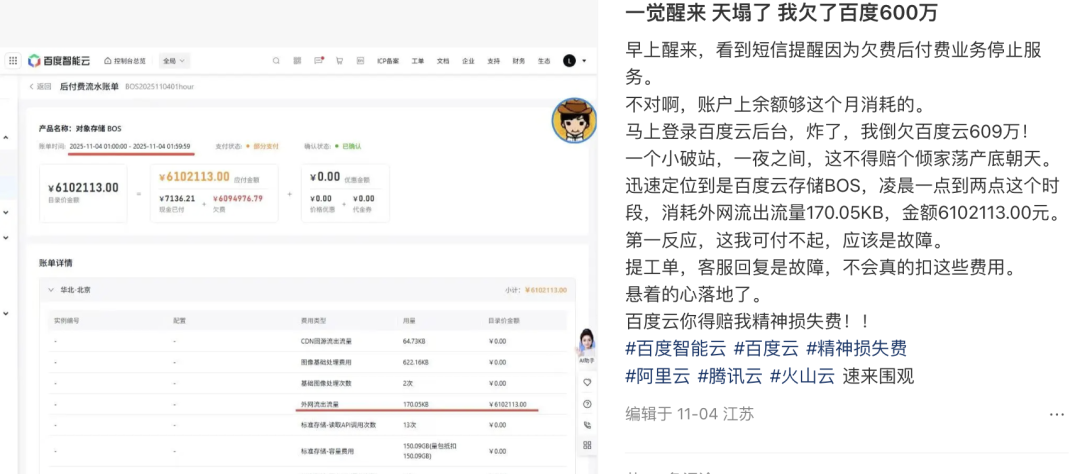

Shen repeatedly stressed the significance of “intelligence.” However, Zhang Yunjing, a small business owner who has been utilizing intelligent cloud services for five years, cautioned against blind cloud adoption and recounted a nerve-wracking incident on November 4: At midnight, his backend displayed a 250KB download traffic charge exceeding 20 million yuan, with the bill marked as “confirmed.” He promptly sought clarification.

Zhang found that many of his peers faced similarly outrageous bills: One website owner was presented with a staggering over 45.16 million yuan in arrears, accompanied by warnings of service suspension and data deletion after 15 days. Others encountered charges exceeding 6 million yuan for a mere 170.05KB of external traffic or over 90,000 yuan for 7.19MB, with some accounts showing arrears up to 100 million yuan.

In response, Baidu Intelligent Cloud swiftly issued a statement, attributing the anomalies to a financial system launch and clarifying that abnormal billing data was being rectified. Many users later reported that their bills had been corrected, with issues gradually resolved.

Despite the rapid official response, the incident heightened Zhang's concerns about cloud billing systems, as small companies cannot afford such financial surprises.

Critics argue that only blatant errors were detected, while minor overcharges might slip past the radar of average users, revealing significant management and technical flaws in Baidu Intelligent Cloud's financial billing testing and validation processes.

While cloud products enhance efficiency, inadequate data security can turn them into data leakage hotspots, sounding another alarm for cloud providers and users.

01

The Booming “Cloud Harvest”

Domestic intelligent cloud providers can be divided into two camps: internet giants (Alibaba Cloud, Tencent Cloud, Huawei Cloud, Baidu Intelligent Cloud) and telecom operators (China Telecom Cloud, China Mobile Cloud, China Unicom Cloud).

Among the internet players, Tencent entered the cloud market early, leveraging its QQ and QQ Space operations from 1999 to 2010 to accumulate cloud expertise. It formally launched CDN services in 2010, opened core services like cloud security in 2013, and established Tencent Cloud Computing Co., Ltd. in 2014, accelerating its pace.

Under Jack Ma's insistence, Alibaba founded Alibaba Cloud in 2009, developing the distributed “Apsara” operating system. It upgraded to Alibaba Cloud Intelligence in 2018, integrating cloud and AI capabilities.

Huawei established its Cloud Services Department in 2011, targeting enterprise markets in 2015 with elastic cloud servers and object storage, and formally launched Huawei Cloud in 2017 to enter the public cloud arena.

Industry insiders often describe Baidu Intelligent Cloud as “early but late to the game,” noting that its internal project initiation predates Alibaba and Tencent but lacked sustained investment.

Regardless of timing, Baidu Cloud gained prominence with Robin Li's 2012 keynote at Baidu World, “The Cloud Empowers Your Future,” announcing core cloud capabilities like storage, big data intelligence, and computing to reduce developer costs. In 2015, Baidu Open Cloud (predecessor to Baidu Intelligent Cloud) launched, forming an early “cloud-intelligence integration” model. By 2016, it accelerated efforts, rebranding “Baidu Cloud” to “Baidu Intelligent Cloud” in 2019 and unveiling 14 new products.

Baidu Intelligent Cloud achieved strategic prominence in May 2022 when Shen Dou received his second major KPI at Baidu: leading the cloud division. Previously known for framing Baidu's search business (“X+Y”), Shen now faced the challenge of breaking through Baidu's search ceiling and establishing intelligent cloud as a “second growth engine.”

Coinciding with AI's rapid expansion, Baidu differentiated itself through an “AI-native” positioning, carving a niche in competitive markets.

Baidu Intelligent Cloud's achievements are notable: Its 2025 financial report revealed that AI-driven business (including cloud services) surpassed 10 billion yuan in revenue, with a 36% year-over-year increase in the first half of 2025, including 27% growth in intelligent cloud revenue to 6.5 billion yuan.

Citing IDC data, Baidu claimed a 24.6% market share, topping China's AI public cloud services for six consecutive years. Notably, Alibaba Cloud tied for first place in the same report.

02

The Dual Challenges of Low Pricing and Ecosystem Development

Despite its booming growth, Baidu Intelligent Cloud has not fully overcome the “AI hype without profitability” dilemma, remaining a smaller portion of Baidu's overall business and struggling to overcome low pricing and ecosystem development hurdles to bolster Baidu's performance.

Breaking down intelligent cloud services into IaaS (infrastructure), PaaS (platform), and MaaS (model application) layers, IaaS dominates domestic cloud revenue as SMEs prioritize basic IT needs. In IDC's 2024 second-half China public cloud IaaS rankings, Alibaba Cloud led with 26%, followed by Huawei Cloud (13.4%) and Tencent Cloud (8.1%), while Baidu Intelligent Cloud fell outside the top five. This reflects Baidu's focus on PaaS+SaaS layers, where AI technology excels.

Omdia's “China AI Cloud Market, First Half of 2025” report, using “IaaS+PaaS+MaaS” revenue, ranked the top five AI cloud providers: Alibaba Cloud (35.8%), Volcano Engine (14.8%), Huawei Cloud (13.1%), Tencent Cloud (7%), and Baidu Cloud (6%), indicating Baidu Cloud has not yet reached first-tier status domestically.

Baidu Intelligent Cloud's rapid growth relies heavily on low pricing. Third-party models on its Qianfan platform were priced at 50% (DeepSeek-R1) and 30% (DeepSeek-V3) of official rates in 2025. Its self-developed Qianfan large models set industry lows, with 100 million tokens priced at 20 yuan during the 2025 Double 11 sale. In early 2025, Baidu made its ERNIE large model free, while prior comparisons showed Baidu Intelligent Cloud's basic RDS MySQL and Redis packages were significantly cheaper than Alibaba, Tencent, and Huawei's offerings.

Industry insiders note that some low-cost or free services conceal fees, such as ERNIE-Speed-8K's 5 yuan/million tokens charge post-deployment. This “low-cost base, premium upsell” model has drawn criticism for deceptive pricing. Low-cost add-ons have also sparked consumer disputes over false advertising.

Low pricing has sparked controversies. In February, Shen Dou claimed competitors faced high training and marketing costs, blaming “malicious price wars” for lower industry revenues compared to global peers. Volcano Engine President Tan Dai countered that Doubao's training costs were lower with healthy margins, attributing price reductions to technological innovation and dismissing Baidu's claims as unfounded.

Virtually all domestic cloud providers engage in price wars, including Baidu, making it difficult to assign blame. Shen's remarks were seen as a reflection of Baidu Intelligent Cloud's profitability pressures.

Compared to Alibaba Cloud, Tencent Cloud, and Huawei Cloud, Baidu Cloud lags in ecosystem and channel development.

While Alibaba leverages e-commerce and logistics with “Cloud-DingTalk” integration for rapid solution deployment, Baidu lacks prominence in e-commerce, live streaming, or finance. Its search and AI dominance have eroded, forcing intelligent cloud to rely on technical appeal, struggling to reach traditional enterprises.

Client structure is another weakness. Baidu's clients concentrate in autonomous driving and manufacturing, lacking Alibaba and Huawei Cloud's industry-wide coverage, weakening risk resistance if dependent sectors slow. Continuous investment in large models and computing infrastructure, coupled with low-price strategies, traps Baidu in a cycle of high costs and prolonged profitability, hindering a stable business model.

More pressing are longstanding brand image and user trust issues.

Baidu has invested heavily in R&D to build technical advantages and repair its reputation. Cloud clients prioritize security and credibility. However, 2025 saw data security controversies involving a vice president and abnormal billion-yuan bills, eroding trust in Baidu's management and technology and negatively impacting its brand.

At the World 2025 Conference, Li Yanhong showcased three achievements in ERNIE, Kunlunxin, and Apollo Go, reflecting long-term AI investment.

In search, Li claimed Baidu leads in AI transformation: “We've rebuilt search with AI, shifting from text-and-link results to rich media (images, videos) AI applications.”

User reception to AI-generated long-winded answers remains to be seen.

Baidu also announced “Luo Yonghao”-style persuasive digital human technology for industry-wide standardization. However, a live demo faltered when staff interaction with the “digital Luo Yonghao” blacked out, though a second attempt succeeded.

While technologically impressive, Baidu Intelligent Cloud and the broader Baidu Group must prioritize stability alongside profitability to sustain growth.

end