From Huge Losses to the Dawn of Profitability: A History of Kingsoft Cloud's 'Survival'

![]() 11/21 2025

11/21 2025

![]() 584

584

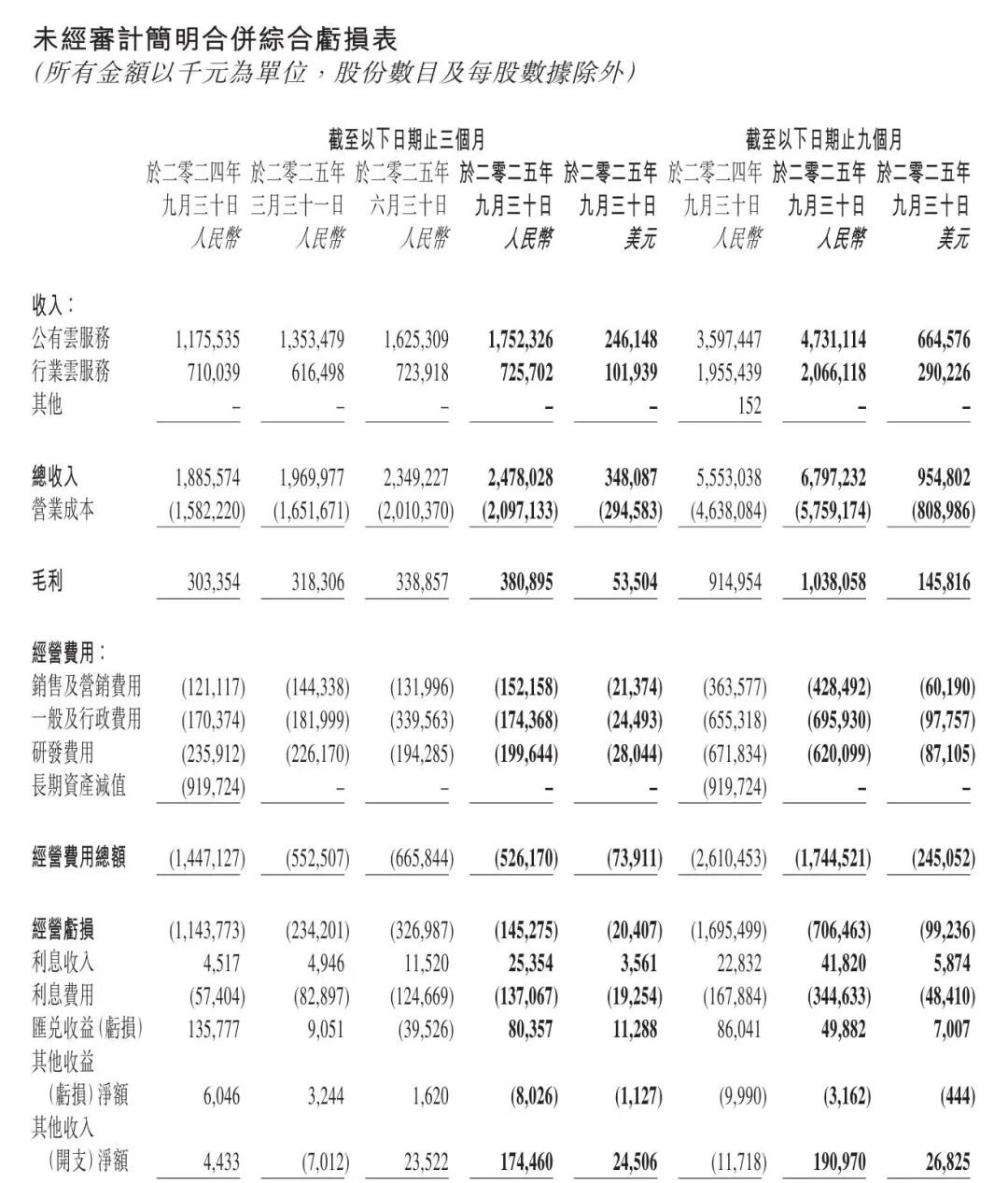

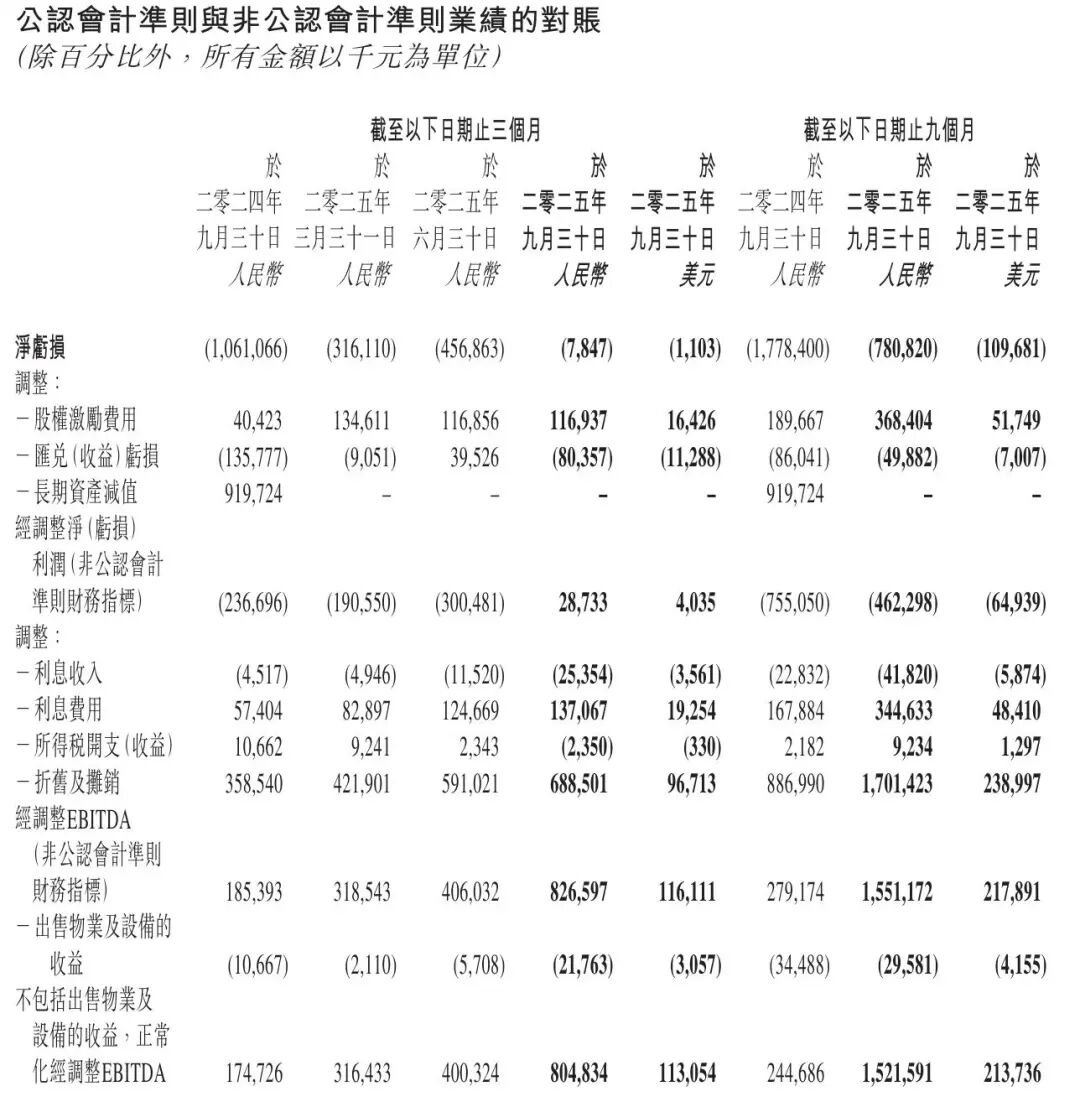

On November 19, 2025, Kingsoft Cloud released its third-quarter financial report for 2025, with key data drawing widespread market attention. The report showed that the company achieved an adjusted operating profit of 15.4 million yuan in the quarter, a significant milestone compared to the 140 million yuan operating loss in the same period last year and the 166 million yuan loss in the previous quarter. Financial data indicates that this positive transformation was primarily driven by strong growth in the artificial intelligence business and ongoing cost optimization.

This moment of dawn did not come easily. Looking back at Kingsoft Cloud's development since its establishment in 2012, we can't help but ask: What led this company, once ranked among the top three in China's public cloud market, to be trapped in a loss-making quagmire for over a decade? The 'Golden Age' of Rapid Expansion and the Hidden 'Structural Weaknesses'

Founded in 2012, Kingsoft Cloud emerged from Kingsoft Group and received early support from the Xiaomi ecosystem. As one of China's first-generation cloud computing companies, it boldly proposed and implemented the 'All in Cloud' strategy in 2014, betting all its resources on the cloud computing track. Its business focus was clearly placed on the IaaS layer, primarily providing basic resource services such as computing, storage, and CDN. Against the backdrop of the nascent cloud computing market at the time, focusing on IaaS was the most direct path to capture market share and quickly establish brand recognition.

Leveraging its deep technical accumulation in the gaming and video sectors, Kingsoft Cloud precisely targeted the two fastest-growing segments in the mobile internet wave. By providing services to leading internet companies such as ByteDance, Kuaishou, Bilibili, and iQiyi, Kingsoft Cloud's revenue experienced explosive growth. By 2017, Kingsoft Cloud had successfully ranked among the top three domestic public cloud service providers and went public on NASDAQ in May 2020, marking a high point in its development history.

However, behind the impressive revenue growth lay continuously expanding losses, primarily stemming from the inherent contradictions between its business model and market environment.

The essence of the IaaS model is 'digital real estate,' requiring substantial capital investment to build and maintain data centers, purchase servers, and network equipment. These massive fixed asset investments bring high depreciation and amortization costs, becoming the primary structural reason for eroding profits. Financial reports show that IDC costs and depreciation expenses have consistently been the main components of its operating costs.

Kingsoft Cloud's core business, particularly CDN technology, has relatively low technical barriers and severe product homogenization. As giants like Alibaba Cloud and Tencent Cloud entered the market, it quickly transformed from a blue ocean to a red ocean, with price wars becoming the norm. To maintain market share and retain top clients, Kingsoft Cloud had to engage in fierce price competition, resulting in extremely low or even negative gross margins for its CDN business, trapping it in a dilemma of 'increasing revenue without increasing profits.' Early rapid growth largely depended on a few top internet clients. For example, its financial reports once showed that the top 10 clients accounted for up to 45% of its revenue. This highly concentrated client structure, while bringing scale effects, also planted significant risks for subsequent performance fluctuations caused by client attrition or changing demands. Storm Approaches: The 'Darkest Hour' Under Strategic Misalignment and Market Compression

If the losses in the first stage were 'growth losses,' then the exacerbation of losses between 2022 and 2023 resulted from a combination of dramatic external environmental changes and internal strategic issues. This is the most crucial chapter in understanding Kingsoft Cloud's losses, as the company experienced a dual decline in performance and market position during this period.

The market environment faced by Kingsoft Cloud underwent fundamental changes, turning favorable winds into adverse ones.

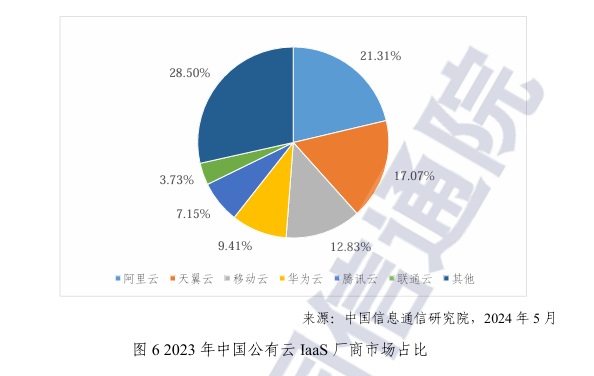

The Chinese cloud computing market landscape solidified, with competition entering a 'strangulation' phase. According to the China Academy of Information and Communications Technology's 'Cloud Computing White Paper (2024),' the top three giants—Alibaba Cloud, Huawei Cloud, and Tencent Cloud—along with the rapidly rising operator clouds (China Telecom Cloud, China Mobile Cloud, and China Unicom Cloud), collectively dominate the vast majority of the IaaS market share. These giants continuously squeeze the survival space of independent cloud providers through powerful ecosystems (such as Alibaba's 'Being Integrated' and Tencent's 'Thousand Sails Plan') and government-enterprise channel advantages. Kingsoft Cloud's once-proud 'neutral' label lost much of its appeal after the giants began touting 'being integrated' and moving toward openness, causing its market share to rapidly decline from the top three to the 'other' category.

Around 2022, influenced by macro factors such as the pandemic and industry regulations, the overall growth rate of the internet industry slowed down, and clients began to 'reduce costs and increase efficiency,' significantly cutting IT expenditures. This directly led to the loss of key clients for Kingsoft Cloud, such as ByteDance migrating part of its overseas business to AWS and Xiaomi collaborating with other cloud providers, dealing a heavy blow to its revenue. As cloud computing entered its second half, AI, edge computing, and cloud-native technologies became new technological vantage points. Kingsoft Cloud's initial layout (layout) in these emerging fields was relatively lagging, failing to promptly build new technological barriers and growth points, leaving it somewhat passive in the wave of technological iteration.

China Academy of Information and Communications Technology 'Cloud Computing White Paper (2024)'

Facing internal and external challenges, Kingsoft Cloud underwent a critical strategic transition in 2022. Mr. Zou Tao, a veteran from Kingsoft Software, took over as CEO, shifting the company's strategic focus from 'pursuing scale at all costs' to 'pursuing high-quality, sustainable development.'

To find new growth points, Kingsoft Cloud acquired enterprise IT service provider Camelot in August 2021, aiming to enhance its industry cloud service capabilities in finance, manufacturing, and other sectors. However, this acquisition did not meet expectations. Data shows that after a brief period of high growth in industry cloud revenue following the acquisition, its growth rate rapidly declined and even turned negative. This suggests that difficulties may have arisen during the integration process, and Camelot failed to become a strong pillar for reversing the loss-making situation as anticipated, possibly even increasing management and integration costs in the short term.

Combining the aforementioned internal and external factors, Kingsoft Cloud entered its most difficult period in 2022 and 2023. Financial data shows that the company's revenue decreased by 9.7% year-on-year in 2022 and continued to decline by 13.8% in 2023. Net losses also peaked in 2022. The massive losses during this period were the inevitable result of early structural issues, mid-term market deterioration, and late-stage strategic transformation pains.

Embracing AI: A Comeback and Qualitative Improvement in Profitability

Just as the market felt pessimistic about Kingsoft Cloud's prospects, an AI revolution sparked by large model technologies provided it with an opportunity for a comeback. This section will address the core question of 'why it achieved profitability in Q3 2025,' focusing on how Kingsoft Cloud successfully opened up a second growth curve by seizing the AI wave and ultimately achieved a fundamental improvement in profitability.

Since 2023, breakthroughs in generative AI and large model technologies have driven explosive demand for AI computing power, providing a once-in-a-lifetime historical opportunity for all cloud computing providers. Kingsoft Cloud responded swiftly, decisively shifting its strategic focus entirely to AI. Starting from the second half of 2023, the company significantly increased its investment in AI computing power infrastructure, building a comprehensive 'intelligent computing capability system' around computing power, storage, network, data, and platforms to provide underlying support for large model training and industrial applications.

The successful implementation of the AI strategy has brought Kingsoft Cloud two powerful growth engines:

Financial data serves as the best proof, with AI-related business revenue showing astonishing growth. For example, in Q4 2024, its AI billing revenue increased nearly 500% year-on-year. By the latest Q3 2025, intelligent computing cloud billing revenue reached 782 million yuan, up nearly 120% year-on-year, accounting for 45% of public cloud revenue. This clearly indicates that AI has replaced traditional CDN business as the absolute core driving the public cloud segment back to high-speed growth. As the 'only strategic cloud platform in the Xiaomi-Kingsoft ecosystem,' Kingsoft Cloud has embraced unique ecological feedback opportunities in the AI era. With Xiaomi's deep layout (layout) in AI, smart vehicles, and Kingsoft Office's in WPS AI, demand for cloud services has surged. The Q3 2025 financial report shows that revenue from the Xiaomi-Kingsoft ecosystem reached 690 million yuan, up 84% year-on-year, with its proportion of total revenue rising to 28%. This stable and rapidly growing 'foundation' provides strong demand support and strategic certainty for Kingsoft Cloud's AI transformation.

The rise of AI business and the deepening of ecological synergy have ultimately triggered a qualitative improvement in Kingsoft Cloud's profitability. The turnaround to profitability in Q3 2025 is the result of multiple positive factors working together.

The increasing proportion of high-gross-margin AI computing power services in revenue has effectively offset the low-profit issue of traditional IaaS business. This has fundamentally improved the company's overall gross margin, allowing it to escape the dilemma of 'losing money to gain market share.'

The cost control and expense optimization strategies implemented since 2022 have finally borne fruit. The Q3 2025 financial report shows that while revenue increased by 31.4% year-on-year, total operating expenses decreased significantly by 63.6% year-on-year, substantially narrowing operating losses and paving the way for achieving positive adjusted operating profits.

The combination of strong AI revenue growth, stable ecological client demand, and continuous cost reduction and efficiency improvement ultimately propelled Kingsoft Cloud to complete a cross (leap) from quantitative to qualitative change in Q3 2025, achieving a milestone profitability turning point.

Challenges Remain Severe

Looking back at Kingsoft Cloud's turbulent development history, the root causes of its prolonged losses can be attributed to a complex narrative intertwined with inherent genetic factors, strategic path dependence, market deterioration, and transformation pains. Its ultimate 'survival' success, however, is a business revelation about 'trade-offs' and 'rebirth.'

Looking ahead, although Kingsoft Cloud has ushered in the dawn of profitability, challenges remain severe. The competition in the cloud computing market is far from over, and technological investment in the AI field remains a 'money-burning' game. Kingsoft Cloud's future will depend on its ability to continuously consolidate its first-mover advantage in AI computing power and translate it into long-term, sustainable profitability. This is not just a story about Kingsoft Cloud but a common question that all second-tier providers seeking to break through under the shadow of giants must consider and answer.

Under no circumstances shall the information or opinions expressed in this article constitute investment advice to any person.

References: Kingsoft Cloud (03896) - 2024 Annual Financial Report Kingsoft Cloud Q4 2024 Earnings Call Summary KINGSOFT CLOUD (KC) - Q1 2023 Quarterly Report Kingsoft Cloud: How to Break Through in the Cloud Computing Market Amidst Giant Competition? Kingsoft Cloud's Q3 Revenue Reaches 2.48 Billion Yuan: Up 31% Year-on-Year, Operating Loss of 145 Million Yuan Kingsoft Cloud Announces Unaudited Third Quarter 2025 Financial Results Kingsoft Cloud Development History, Main Business, and Performance Analysis 2023 Kingsoft Cloud Research Report The company provides IaaS cloud services to various vertical industries, strategically adjusting its business to focus on improving profitability Kingsoft Cloud's Dilemma: The End of the Industry Cloud Story, Diminishing Advantages of Independent Clouds Kingsoft Cloud's Q4 Revenue Increases by 30% Surpassing Industry Average, AI Revenue Up Nearly 500% Cloud Computing White Paper - China Academy of Information and Communications Technology Kingsoft Cloud's Q3 Revenue Reaches 2.48 Billion Yuan: Up 31% Year-on-Year, Operating Loss of 145 Million Yuan

▼

-END-