Unable to stand on its own - Kingsoft Cloud

![]() 12/03 2024

12/03 2024

![]() 885

885

Lei Jun is the chairman of Kingsoft Cloud, but after providing the strategic guidance of "All in Cloud" in 2014, he has left the company alone for nearly a decade. The development of Xiaomi has taken up too much of Lei Jun's attention.

The abandoned illegitimate son is also not favored by the secondary market, with its share price falling continuously. At its worst, it plummeted by over 84% from its issue price, resulting in heavy losses for investors, including Lei Jun.

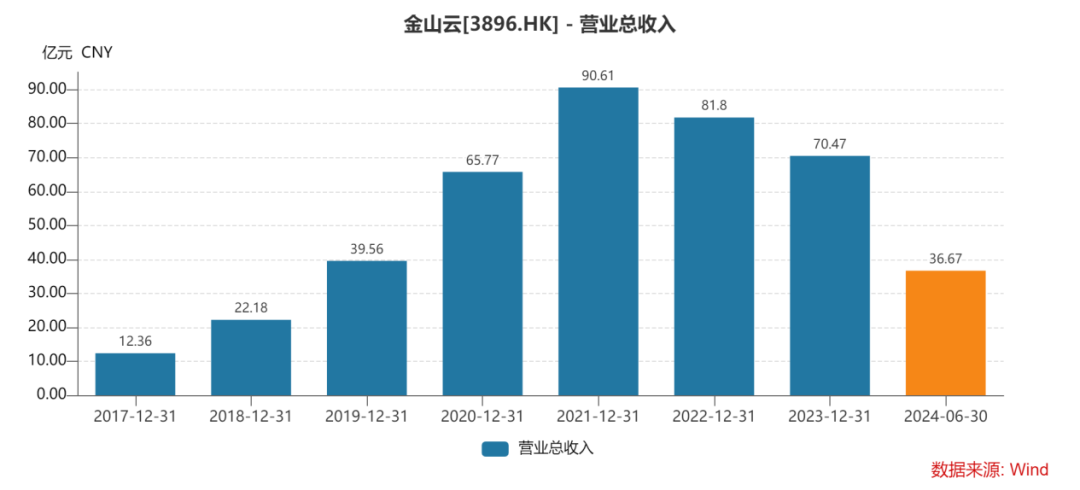

However, after years of being neglected, Kingsoft Cloud suddenly returned with a strong performance in both Hong Kong and US stock markets. The news is that the company achieved solid progress in revenue scale, profitability, and other aspects in the third quarter of this year.

More importantly, Xiaomi returned as the largest customer after five years, bringing a three-year cooperation agreement worth 9.5 billion yuan. This is equivalent to Kingsoft Cloud's annual revenue during its peak period.

Lei Jun's investment enthusiasm has finally come to Kingsoft Cloud, but can Kingsoft Cloud, relying on Lei Jun and Xiaomi, regain its glory?

I. Invaluable to Xiaomi

Kingsoft Cloud is a cloud computing enterprise under Kingsoft Group and a typical Lei Jun-affiliated company. The top three shareholders of the company are Kingsoft, Xiaomi Group, and Lei Jun individually, with a combined shareholding ratio of over 60%.

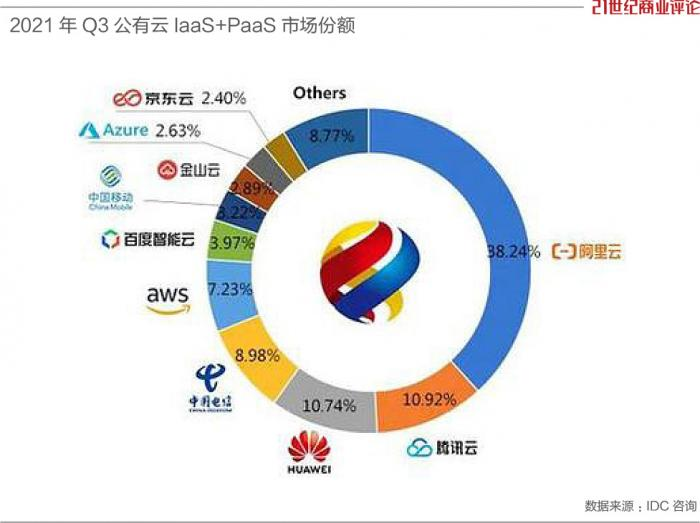

As early as 2012, when Kingsoft Cloud was established, Xiaomi became its first major customer. Relying on Kingsoft and Xiaomi, Kingsoft Cloud developed smoothly in its early stages and successfully ranked among the top three in China's public cloud IaaS market in 2017, capturing a 6.5% market share. It became China's largest independent cloud service provider in 2021.

The company's recent performance boom occurred during the pandemic. With the pandemic leading to increased demand for distributed office solutions, the complexity and instability of network structures increased significantly, driving up demand for CDN and related products.

CDN (Content Delivery Network) is a distributed server network system built on IaaS that can enhance internet speed and website stability. As a major domestic CDN service provider, Kingsoft Cloud benefited from the pandemic and achieved significant growth in performance.

Taking this opportunity, the company gradually reduced its dependence on major customers and sought independent growth, gradually breaking away from the shelter of the Lei Jun group.

From 2019 to 2022, the revenue share of the company's top five customers decreased from 65.7% to 50.6%. The revenue share of the largest customer decreased from 30.9% to 19.8%. During this period, the revenue share from Xiaomi and Kingsoft once fell to about 10%.

However, Kingsoft Cloud is not the only one trying to benefit from the pandemic. Internet giants have also started to invest heavily in cloud services. Compared to Tencent, Alibaba, and Huawei, Kingsoft Cloud, which lacks financial strength and protection from the Lei Jun group, saw its revenue shrink rapidly before the pandemic ended. Its market position fell from the top three to the fifth and is now classified as "others".

Just as the company was relegated to the margins, a white knight reappeared. Xiaomi returned as Kingsoft Cloud's largest customer after five years.

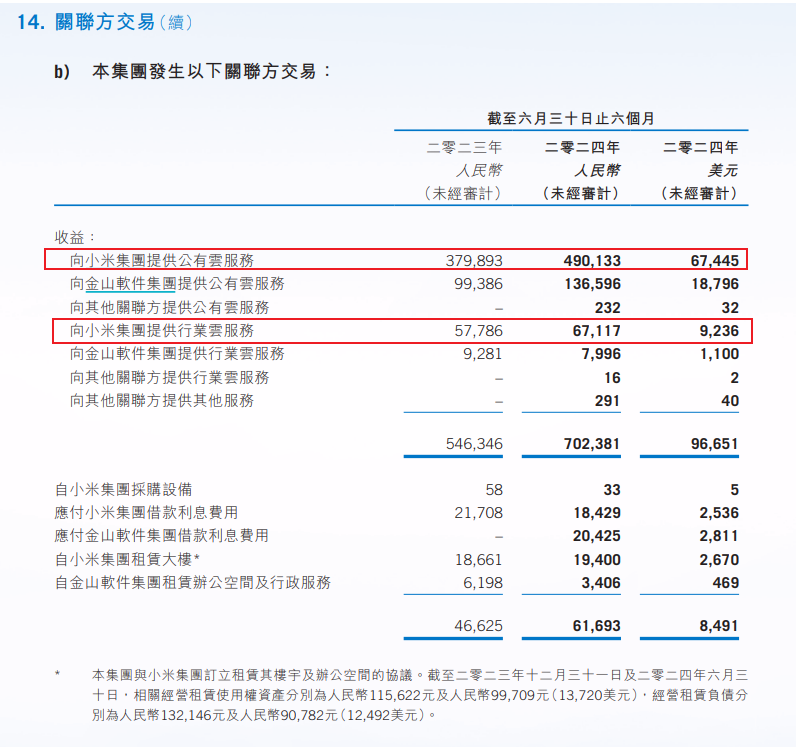

In the first half of this year, revenue from Xiaomi and Kingsoft accounted for over 700 million yuan, or 19.2% of Kingsoft Cloud's total revenue. Xiaomi alone accounted for 15% of this revenue.

With the growth of the automotive business, Kingsoft Cloud's differentiated positioning as an independent cloud service provider is crucial to Xiaomi's development.

To seek a second growth curve, Xiaomi has ventured into automotive manufacturing and developed large models for a better ecosystem experience. However, this means that to differentiate its brand, Xiaomi needs to avoid using Alibaba Cloud and Tencent Cloud, which have their own large models, and cannot use Huawei Cloud, which is integrated with Thalys' autonomous driving system.

Furthermore, as real-time interaction becomes the norm in Xiaomi's ecosystem encompassing cars, homes, and individuals, higher demands are placed on the generative capabilities of large models and cloud computing. Kingsoft Cloud, which has both insider connections and computing resources, has regained importance.

In Q3 of this year, Kingsoft Cloud's total revenue was 1.89 billion yuan, a year-on-year increase of 16%. Among this, revenue from Xiaomi and the Kingsoft ecosystem increased significantly by 36% year-on-year, becoming the main source of growth.

It is evident that Kingsoft Cloud's high growth in performance is almost entirely due to the support of Xiaomi and other affiliated companies.

After being neglected for nearly a decade, Kingsoft Cloud has regained importance. For Lei Jun, this is all for Xiaomi, as Kingsoft Cloud is indispensable to Xiaomi's current development. However, just because Kingsoft Cloud's value to Xiaomi has been amplified does not mean the same for investors. In the cloud services industry, Kingsoft Cloud is still a laggard.

II. Limited Intrinsic Value

Kingsoft Cloud's close relationship with Xiaomi and the Kingsoft ecosystem is its differentiated competitive advantage. However, in the fiercely competitive cloud services market, Kingsoft Cloud's independent market competitiveness is actually very limited.

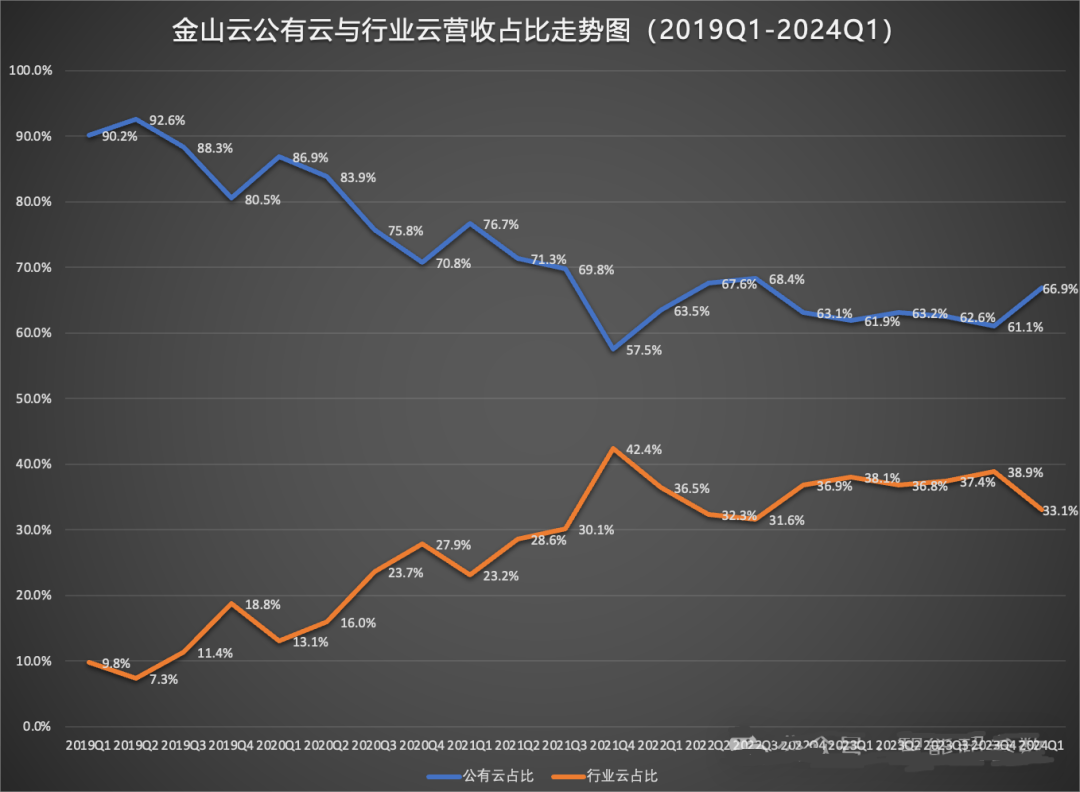

In terms of revenue, the company's income is mainly divided into two parts: public cloud and industry cloud. Among them, public cloud is the primary business, which is further divided into cloud computing, cloud storage, and cloud distribution. Cloud distribution is the largest segment, relying heavily on CDN for fast loading. Due to the lack of technical barriers in CDN, extensive deployment is often required to ensure user browsing speed, which incurs significant operational costs.

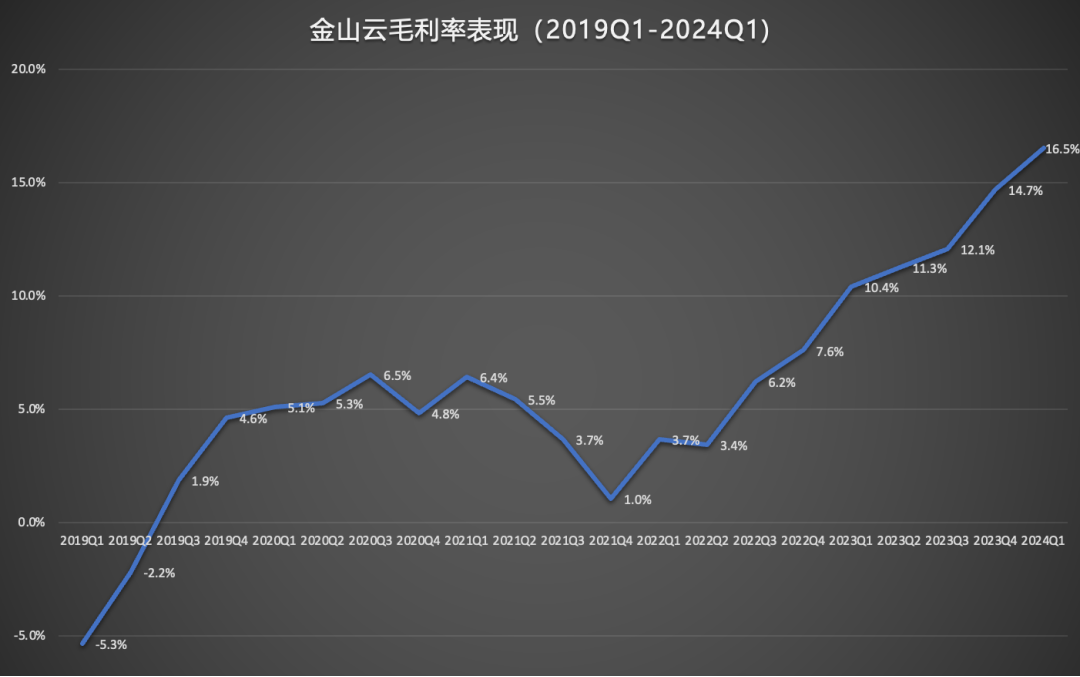

This model necessitates economies of scale to achieve cost advantages. Due to excessive initial investments, Kingsoft Cloud's operating costs accounted for over 94% of revenue in the past three years, preventing the company from achieving profitability for a long time. The company intended to endure through initial accumulation but was met with intensified losses due to price wars initiated by Alibaba Cloud.

In April 2023, Alibaba Cloud announced a price reduction of 15% to 50% across its core products. Other vendors followed suit, forcing Kingsoft Cloud to also engage in a price war, with some products seeing price reductions of over 50%.

However, the actual effects were not ideal. Compared to other large vendors, Kingsoft Cloud was at a significant disadvantage in terms of financial and operational scale. Long-term losses and insufficient profitability made it unrealistic to increase market share through low prices.

After realizing this, Kingsoft Cloud hoped to alleviate performance pressure through cost reduction and efficiency enhancement, reducing sales and marketing expenses by 100 million yuan and R&D expenses by 190 million yuan year-on-year. However, this backfired, as the reduction in R&D investment led to a loss of product differentiation.

The company intended to stabilize customers through price reductions, but the inability to sustain low prices and lack of product innovation resulted in a decline in the number of high-quality customers for Kingsoft Cloud's industry cloud services, from 382 in 2021 to 285 by the end of 2023.

Amid competition from large cloud service providers and insufficient financial and product strength, Kingsoft Cloud's market share continues to shift towards top vendors, further compressing its survival space.

In March of this year, Alibaba Cloud announced the largest price reduction in its history. This time, Kingsoft chose not to follow suit but instead returned to relying on major customers like Xiaomi, retreating to its comfort zone. However, with Xiaomi returning as the largest customer, Kingsoft Cloud seems to have returned to its origins as a mere appendage to major customers, lacking external growth.

For investors, the anticipated valuation story has shifted from high-speed growth through autonomous development in the vast external market to profit turnaround through internal transactions and cautious development.

III. Decreasing Investment Value

First, let's look at profitability.

Initially, Kingsoft Cloud's revenue mainly came from IaaS, which is essentially a heavy-asset-based resource leasing business. The higher the proportion of this business, the lower the revenue-generating ability.

To improve revenue, Kingsoft Cloud began transforming its business, gradually expanding its PaaS business while reducing investment in IaaS.

PaaS is a part of cloud services that embodies technical value. The company has injected corresponding AI functions into this business to increase product added value and actively reduced low-profit IaaS. This increase and decrease gradually improved the company's gross margin.

Source: Intelligent Hyperparameters

Through business transformation and contraction of loss-making projects, the company's profitability has improved. Continuous orders from Xiaomi and Kingsoft have also provided growth momentum for revenue. Based on this trend, Kingsoft Cloud seems close to achieving profit turnaround.

However, at the operational level, the company still faces certain challenges. For example, while revenue increased by 16.0% year-on-year in the third quarter of this year, operating costs also increased by a double-digit percentage. Operating losses expanded from 810 million yuan in the same period last year to 1.14 billion yuan. Cash on hand decreased from 1.84 billion yuan at the end of the previous quarter to 1.62 billion yuan. More importantly, the company's free cash flow remained negative.

These data indicate that Kingsoft Cloud must continuously increase investment to maintain its ability to accept orders from major customers like Xiaomi. While revenue grows, costs also expand, and the company still lacks autonomous profitability. There is still some distance before it can achieve a profit turnaround.

Next, let's look at revenue growth ability.

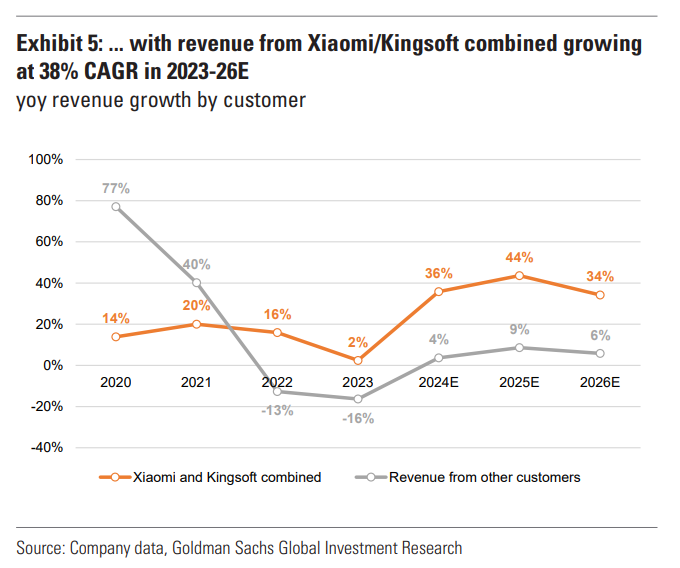

Recently, Kingsoft Cloud signed new framework agreements with Kingsoft and Xiaomi. The agreement with Kingsoft increased procurement from over 200 million yuan in 2024 to 469 million yuan in 2025, 597 million yuan in 2026, and 775 million yuan in 2027. The agreement with Xiaomi, with a procurement value of 859 million yuan as of September this year, is expected to triple to 2.3098 billion yuan in 2025, 3.138 billion yuan in 2026, and 4.035 billion yuan in 2027.

Based on these agreements, Goldman Sachs predicts that the combined revenue from Xiaomi and Kingsoft to Kingsoft Cloud will increase from the current approximately 20% of total revenue to 30% by 2026. From 2023 to 2026, this revenue is expected to grow at a compound annual growth rate of 38% within the company.

However, it should be noted that a significant portion of Kingsoft Cloud's revenue comes from third-party customers. Affected by the current economic environment and expectations, these customers have started to reduce their IT budgets, and the decision-making cycle for incremental demand has also extended, leading to a slowdown in the overall demand growth for cloud services.

Since the first half of 2021, the year-on-year growth rate of public cloud IaaS+PaaS has dropped from nearly 50% to 12%. In particular, the demand for IaaS infrastructure has slowed to single-digit growth, performing very weakly.

The weakness in demand from third-party customers means that the approximately 70% of Kingsoft Cloud's revenue is not only failing to help achieve high growth but may even become a drag. Goldman Sachs predicts that the compound annual growth rate of Kingsoft Cloud's revenue from third-party customers will be only 6% over the next three years.

Over the next three years, about 30% of total revenue will grow at a rate of 38%, while about 70% will grow at a rate of 6%. This translates to an annual growth rate of less than 20%. After a surge, the company's Hong Kong stock valuation is currently around 1.8x price-to-sales ratio, which is not significantly different from the predicted growth rate. The largest catalyst has already been reflected in the stock price.

From a long-term investment perspective, the business model of relying on major customers makes it difficult for Kingsoft Cloud to have long-term investment value. Companies that rely solely on related parties for survival often fail to achieve sustained growth, especially considering that Xiaomi itself is also cyclical.

Conclusion

When Kingsoft Cloud went public, it told a story of a growth stock.

Even though startup internet companies may incur consecutive years of losses due to excessive promotional and R&D expenses, they can still become highly profitable in the future due to their rapid revenue growth and high market share. Lei Jun also believed in this development logic, which is why he issued the strategic demand of "All in Cloud".

However, the logic of a growth stock no longer holds when Xiaomi returns as the largest customer. Even if the industry choice is correct, Kingsoft Cloud's unfavorable industry position and lack of a healthy growth trajectory mean that its value is currently only significant to Xiaomi.