Ali's "Microsoftization" progress bar, loading...

![]() 03/22 2024

03/22 2024

![]() 868

868

By: She Zongming

In "Kafka on the Shore", Haruki Murakami writes:

After the storm, you won't remember how you survived, and you're not even sure if the storm has really ended. But one thing is certain: when you've gone through the storm, you're no longer the same person.

In recent years, Ali has been on the eyewall of the storm.

Trapped in the storm, Ali is trying to leap through it with a mighty leap.

The driving force is "change".

Ali has changed again and again.

It's too early to conclude whether Ali has gone through the storm.

But there's no doubt that Ali is no longer the Ali it once was.

Looking closely, Ali is "Microsoftizing".

Microsoft is tough, and its toughness lies in two points: cloud computing and AI.

Ali brought out Alibaba Cloud, driving down the price of public cloud; it showed off Tongyi Qianwen and invested in all the leading AI startups in China.

Microsoft has also been soft before, and its first move towards rejuvenation was "cutting".

Ali said: I can also shrink my battle lines. Hence, there was a series of divestitures.

According to the current popular TMT article title style, this is called "copying Microsoft's homework" or "crossing the river by feeling the stones of Microsoft".

The reality is there: Today's Ali is more "Microsoft-like" than yesterday's Ali.

01

If there were an award for the most "troublesome" company in the internet field, in recent years, the winner would probably be: Ali, Ali, Ali...

Especially in the past year, Ali has almost been a regular on hot searches:

In April last year, Ali initiated the company's largest organizational reform in history, with its organizational structure becoming "1+6+N".

One month later, Ali announced three IPO previews: Alibaba Cloud spin-off, Cainiao, and Hema initiating IPO plans.

Two months later, Ali announced a leadership change, with Joseph Tsai and Wu Yongming taking over as the Chairman and CEO of Alibaba's board respectively.

Five months later, Daniel Zhang officially handed over the reins, even resigning from his positions as Chairman and CEO of Alibaba Cloud, completely leaving Ali.

Seven months later, Ali decided not to proceed with the complete spin-off of Alibaba Cloud, and the Hema IPO plan was postponed.

Eight months later, Dai Shan stepped down from his position as the head of Taobao Group, and Wu Yongming took on three roles, concurrently serving as the CEO of Alibaba, Taobao Group, and Alibaba Cloud.

In March this year, Ali saw further changes:

On March 1st, Ali officially announced that Yu Yongfu had resigned as the Chairman of Alibaba's Local Life Group.

On March 18th, Ali again officially announced that Hema's founder Hou Yi had resigned as CEO and would retire.

On the same day, Ali Retail Link officially shut down, with its business merged with the 1688 website.

The frequency of changes, from "heavyweight" wholesale to "sudden" mass production, even confused the masters of Sichuan Opera face-changing.

People say that Ali is too fickle, but Ali sighs that others can't see through: I can stay the same, but can you weld the time progress bar to October 2021?

Yes, in the blink of an eye, October 2021 is already two and a half years ago.

Today, many people find it hard to imagine that two and a half years ago, Ali's market capitalization once exceeded $860 billion, ranking among the top 10 global companies, surpassing Tesla, TSMC, and NVIDIA couldn't even see its taillights.

Two and a half years ago, many people also found it hard to imagine that just two years later, Ali, which once had no rivals even with a telescope, would be hit by the news that its "market capitalization had been surpassed by Pinduoduo".

As the song goes in "Stealing Time": Time is something that catches people off guard, sunny days have wind, cloudy days have rain, fighting against the passage of time yet longing for the past, stealing away your youthful hair but leaving you behind.

Now people suddenly realize that the thief of time also has another name: "The Forty Thieves".

A grain of dust from time falling on the heads of many Chinese concept stocks is like a mountain.

Ali was trying to escape before the mountain was sealed, but the era said: Don't rush, let me perform a sandstorm for you.

02

Times have changed, and Ali must change.

Although Ali has undergone many changes, its main line is actually very clear.

Shrinking and focusing are its dual tracks.

Non-core businesses, step back.

Core businesses, focus, focus, and focus again.

So, how do you distinguish between core and non-core?

Jack Ma took out a ruler customized for the AI era.

Satya Nadella, the "chief designer" of Microsoft's rejuvenation, looked at it and thought: I'm familiar with this episode.

When playing the game of "Make Microsoft Great Again", Microsoft also superimposed this Buff.

Of course, Ali is not trying to replicate Microsoft within Ali. The "enterprise situation" is different, and the model cannot be copied directly.

But for Ali at this moment, if there is a global technology giant that is most worth benchmarking, it is undoubtedly Microsoft.

The reason is simple:

What Ali encountered in recent years is similar to what Microsoft encountered more than a decade ago;

What Microsoft has achieved now is precisely what Ali hopes to achieve in the future.

Imagine this scenario:

A few years ago, Ali sighed: I've been the big brother for many years, I just want to live well for 102 years.

Microsoft smiled slightly: Are you redder than Dawn? Are you more powerful than Microsoft?

Then it threw out a highlight moment transcript: As early as the turn of the century, Microsoft's market capitalization had exceeded $600 billion, making it the company with the highest market capitalization in the world.

At that time, Microsoft relied on the Windows system and Office software to dominate the market, and there was no rival to be found even with a lantern.

In recent years, Ali has been somewhat disappointed: It's only been two years, and its stock price has taken a discount on top of a discount compared to its peak.

Microsoft came to comfort: Look at me, wasn't I also fallen from the top floor to the B1 floor before? Along with humming: Even if fate makes you wander and wander, even if fate is full of twists and turns, even if fate terrifies you and makes life boring, don't cry, don't feel sad, and don't give up...

At that time, Microsoft had become another Nokia in the eyes of many people.

But now, the Microsoft that once dominated the industry has returned: It has once again taken the throne of the world's largest company by market capitalization.

From the absolute king of the PC internet era to an outdated giant in the mobile internet era, and now the leader in the AI era, Microsoft is simply awesome Plus.

After seeing Microsoft's "Rejuvenation Revelation", Ali said: Wang from West Wenhua Road also pays homage to the old master.

03

Since its establishment, Microsoft has gone through three CEOs: former world's richest man Bill Gates, current NBA Clippers owner Steve Ballmer, and Indian-origin CEO Satya Nadella.

The corresponding rise and fall trajectory of Microsoft is: prosperity, decline, and rejuvenation.

Nadella, who is considered the most undervalued CEO of the 2020s, managed to lead Microsoft back to the top under Nadella, even though Ballmer had successfully turned Microsoft from a king into a bronze.

The question arises: What did Nadella do to turn Microsoft from a has-been into the king of the AI era?

Microsoft threw out a secret manual, with eight words written on the title page: Changing with the times and responding to change with change.

Let's put it this way: Ten years ago, Microsoft was just a software giant, but now it is a computing engine giant; ten years ago, Microsoft's two major business pillars were Windows and Office, but now Microsoft's two calling cards are cloud computing and AI.

After taking over a mess, Nadella "reset" Microsoft after taking office. The标志性动作 was: implementing a "cloud-first" strategy and focusing on AI.

With significant investments in R&D and hard market penetration, Microsoft's cloud computing business grew rapidly and usurped Windows' strategic position. Today, Microsoft has become the second-largest cloud vendor globally, second only to Amazon.

Increasing investment in independent AI research and development and investing billions in OpenAI are Microsoft's footnotes in its AI efforts. The result is that Google's long-coveted generative AI first taste was snatched by its arch-rival Microsoft.

Looking at Ali, its moves on the chessboard also revolve around two points: cloud computing; AI.

Since this year, Ali has released many news, including:

1. At the 2024 Strategic Conference, Alibaba Cloud announced a price reduction for all cloud products, with an average price reduction of over 20%.

2. In February this year, based on the launch of multiple large model products, Ali open-sourced the Qwen 1.5 version.

3. Ali led the investment in popular AI startup Darkside of the Moon, and it also invested in Zhipu, Baichuan, Zero One, and MiniMax.

4. Ali launched an AI e-commerce product called "Huiwa", which can provide AIGC marketing assistance for merchants and influencers.

Lowering cloud service prices is leveraging price to drive scale - Ali, which has already ranked as the fourth-largest cloud service provider globally, has taken an all-or-nothing approach to expanding its market share.

Pushing its own AI large models and striving to build an AI-based service system, Ali has invested in all five leading large model startups in China with valuations exceeding $1 billion, making it the most active giant in AI investment in China, doing what Microsoft did before.

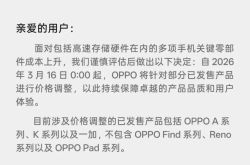

▲ Like Microsoft, Ali is willing to invest heavily in leading AI startups. Image source: Zhidongxi.

Wu Yongming, who took over as Ali's CEO on September 12th last year, said in an open letter to all Ali employees that they would reshape business strategic priorities based on two strategic focuses: user-first and AI-driven. On this basis, Ali will increase strategic investment in three types of businesses: one is technology-driven internet platform businesses, the second is AI-driven technology businesses, and the third is a global commercial network. Nadella, who is also a tech guy and a pragmatist, may have a deep understanding of this.

Microsoft is using AI to reshape all its businesses, integrating GPT-4-powered new Copilot into Office, Windows 11, and Edge, leading the commercial landing pace of generative AI.

Ali is also integrating Tongyi Qianwen into all its products, whether it's Ma Yun's AI e-commerce or DingTalk's first integration of an intelligent PaaS base, demonstrating Ali's determination to reinvent itself with AI.

Microsoft invests in large model startups OpenAI and Mistral AI, partly for computing power, allowing Microsoft Azure to bind the computing power cluster needs of large model companies with its own cloud services.

Ali's investment in leading domestic large model startups is also to provide computing power support, aiming to achieve a double harvest of AI investment and cloud service expansion.

04

When successful, expand the scale; when struggling, shrink the battle lines.

During the Ballmer era, Microsoft expanded its business lines quite a bit: acquiring Nokia, launching Windows Phone, and making autonomous driving hardware.

For a while, it did whatever Apple did: Apple launched iPod, and it launched Zune; Apple launched iPad, and it launched Surface tablets; Apple pushed iOS devices, and it pushed Windows Phone... Its main focus was: "If Apple has it, I want it too".

The result was that while the pie got bigger and bigger, it also got thinner and thinner, with many burning a big hole in the pocket and dragging down overall performance.

Microsoft initially had a large family and could afford it, but after a while, it had to cut its losses.

During the Nadella era, he came in with a slash: mobile business, no; Nokia Lumia devices, cut off - even though a lot of money had been invested in them.

Most courageous was Nadella's decisive push for "de-Windowsization" - knowing that Microsoft had centered all its businesses around Windows for many years, Nadella constantly lowered Windows' priority, and in 2018, he simply dismantled Microsoft's previous core Windows department.

It's easy to say "cutting off one's own arm," but it's still an arm. Who wouldn't feel pain when cutting off flesh?

Ali's reshaping of business strategic priorities naturally corresponds to "giving up".

Anchoring on cloud computing + AI and building cloud e-commerce and AI e-commerce has become Ali's main adjustment direction.

Wu Yongming said that 1688, Idle Fish, DingTalk, and Quark are Ali's four strategic-level innovative businesses.

The direction of these four businesses is obvious:

1688 and Idle Fish, both with e-commerce genes and sinking attributes, are suitable for the present.

DingTalk, a To B business + AI, is responsible for the implementation of generative AI.

Quark, catering to young people, is also a future-oriented business.

To take, one must give up. At the crossroads of fate, one cannot have it both ways.

In February this year, Joseph Tsai said at Ali's financial report meeting that there are still some traditional physical retail businesses on Ali's balance sheet, and it makes sense for Ali to exit.

In the nine months since the start of fiscal year 2024, Ali has exited $1.7 billion in non-core assets, including reducing its stake in XPeng Motors worth $314 million.

Previously, adjusting Hema from an independent segment to a sub-business segment under a business group was also a withdrawal.

Recently, news of Hema's leadership change has caused quite a stir, and rumors of Hema selling itself to RT-Mart have also spread widely.

On this matter, I don't think it's that new retail is no longer viable - the essence of new retail is the fresh play of "supermarket + catering" + "online + offline" scenario integration + full-chain digitization, rather than high quality and high prices under the KA (key account-led) model. Ali is not incompatible with new retail practices, as large domestic supermarkets have learned this, but it cannot accommodate new retail being synonymous with consumption upgrades.

Accurately speaking, it's not that Ali can't accommodate it, but reality can't. Otherwise, Ma Yun wouldn't have called for a "return to Taobao".

But regardless, Ali's adjustment of burdensome businesses in non-core business circles is inevitable.

05

Ali's taking and giving up is also Microsoft's past advance and retreat.

Facts have proven that Microsoft advanced through retreat: Microsoft, NVIDIA, and OpenAI have become the top winners in the AI era, and their cloud services have also shown a strong upward trend under the blessing of AI.

It's still too early to say whether Ali can pick up Microsoft's