Qiniu Cloud sustained losses of 757 million yuan: Decline in paying customers for core business, nearly 40% layoffs yet high sales costs

![]() 04/12 2024

04/12 2024

![]() 623

623

Harbor Business Observer - Shi Zifu

On March 18th, Qiniu Intelligent Technology Co., Ltd. (hereinafter referred to as Qiniu Cloud) submitted an application to the Hong Kong Stock Exchange, with co-sponsors including Shenyin Wanguo Hongyuan Hong Kong, BOCOM International, and Huatai International. Public information shows that the domestic operating entity of Qiniu Cloud is Shanghai Qiniu Information Technology Co., Ltd. It should be emphasized that this is not the first time Qiniu Cloud has submitted an application to the Hong Kong Stock Exchange. In June 2023, the company made its first attempt to list on the Hong Kong Stock Exchange. Earlier, in May 2021, Qiniu Cloud intended to list on NASDAQ and submitted a prospectus to the SEC, but it failed to list as planned. In September 2022, Qiniu Cloud withdrew its application for listing in the US.

01

Decline in MPaaS paying customers, significant fluctuations in net expansion rate

Founded in 2011, Qiniu Cloud provides one-stop scenario-based intelligent audio and video APaaS services. According to the official website, since its inception, Qiniu Cloud has focused on meeting online audio and video demands under the wave of digitization, delving into areas such as video-on-demand, interactive live streaming, real-time audio and video, and camera cloud, providing scenario-oriented audio and video services. Qiniu Cloud is primarily engaged in providing MPaaS products, APaaS solutions, and other services (including DPaaS solutions and other cloud services).

MPaaS products, a series of audio and video product solutions, include proprietary content delivery networks (QCDN), object storage platforms (Kodo), interactive live streaming products, and smart media data analysis platforms (Dora), mainly serving customers with strong development capabilities and flexible needs. APaaS solutions are scenario-based audio solutions based on Qiniu Cloud's MPaaS capabilities and utilizing the company's low-code platform, aiming to enable customers to quickly invoke different functions with minimal deployment and achieve business goals.

From 2021 to 2023 (hereinafter referred to as the reporting period), Qiniu Cloud's revenue from MPaaS business was 1.37 billion yuan, 875 million yuan, and 975 million yuan, respectively, accounting for 93.1%, 76.3%, and 73.1% of total revenue for the respective periods; revenue from APaaS was 24.901 million yuan, 194 million yuan, and 281 million yuan, respectively, accounting for 1.7%, 16.9%, and 21.1% of total revenue for the respective periods.

The remaining revenue mainly came from other sources, with realized revenue of 76.468 million yuan, 78.28 million yuan, and 78.125 million yuan, respectively, accounting for 5.2%, 6.8%, and 5.8% of total revenue for the respective periods. It is not difficult to see that during the reporting period, Qiniu Cloud's business structure underwent significant changes, with the proportion of MPaaS business declining from 90% of total revenue in 2021 to approximately 70% in 2023, and the proportion of APaaS business increasing from less than 2% in 2021 to approximately 20% in 2023.

Regarding the reasons for the business changes, Qiniu Cloud attributed it to the increase in video marketing revenue and, to a lesser extent, the increase in video internet revenue. In 2023, the average contribution of APaaS customers upgraded from MPaaS increased after the upgrade.

During the reporting period, the average contribution of Qiniu Cloud's APaaS paying customers was 18,879 yuan, 98,634 yuan, and 108,340 yuan, respectively. The growth was mainly due to the increasing demand for APaaS solutions by new APaaS users.

Changes in the business structure have led to significant fluctuations in Qiniu Cloud's total revenue. During the reporting period, Qiniu Cloud's total revenue was 1.471 billion yuan, 1.147 billion yuan, and 1.334 billion yuan, respectively. In 2022, the company's revenue decreased by 22.0% year-on-year; in 2023, the company's revenue increased by 16.3% year-on-year. However, despite the initial decline followed by an increase, Qiniu Cloud's revenue in 2023 has not yet recovered to the level of 2021.

Qiniu Cloud stated in its prospectus that the decrease in total revenue in 2022 was mainly due to the decrease in revenue generated by MPaaS products, partially offset by the increase in revenue from APaaS solutions (as the company continuously expanded its APaaS business in response to industry development and market demand).

In addition, along with changes in revenue, certain key operating indicators of Qiniu Cloud's main business have also undergone certain changes. During the reporting period, the average contribution of Qiniu Cloud's MPaaS paying customers was 19,905 yuan, 10,420 yuan, and 10,537 yuan, respectively, and the net expansion rates of MPaaS paying customers' revenue were 133.3%, 63.9%, and 111.7%, respectively.

Regarding the decline in the average contribution of MPaaS customers in 2022, Qiniu Cloud stated in its prospectus that it was mainly due to the company activating the MPaaS registered user base through promotional packages, leading to a significant increase in the number of small and medium-sized customers, including individual developers, and an increase in the number of MPaaS customers; as well as a decrease in revenue from hardware-related businesses due to the impact of COVID-19. In 2022, the average contribution of MPaaS customers remained relatively stable compared to the previous year.

Furthermore, the net expansion rate of MPaaS customers' revenue also experienced a significant decline in 2022, mainly due to a customer retention rate of 72.5%; Qiniu Cloud's MPaaS revenue, especially hardware-related revenue, decreased due to the impact of COVID-19; and a decrease in demand from certain customers.

In 2022 and 2023, the net expansion rates of Qiniu Cloud's APaaS paying customers' revenue were 779.1% and 145.0%, respectively. The decline in this indicator was mainly due to the continued expansion of the APaaS business in 2023.

02

Sustained losses of 757 million yuan, nearly 40% layoffs yet high sales costs

While revenue declines, it should also be noted that Qiniu Cloud has been consistently in a state of loss.

During the reporting period, Qiniu Cloud incurred net losses of 220 million yuan, 213 million yuan, and 324 million yuan, respectively, with adjusted net losses of 106 million yuan, 119 million yuan, and 116 million yuan, respectively, and adjusted net loss rates of -7.2%, -10.3%, and -8.7%, respectively.

In addition to sustained losses, attention should also be paid to Qiniu Cloud's debt issues. At the end of each reporting period, Qiniu Cloud's net current liabilities were 2.601 billion yuan, 3.017 billion yuan, and 35.3 million yuan, respectively, and net liabilities were 2.238 billion yuan, 2.676 billion yuan, and 3.015 billion yuan, respectively.

The reasons for Qiniu Cloud's losses are related to the company's various cost expenditures.

During the track record period, the cash used for Qiniu Cloud's operating activities was primarily sales costs, including network and bandwidth costs, server and storage costs, sales and marketing expenses, administrative expenses, and research and development costs.

During the reporting period, the company's sales costs were 1.18 billion yuan, 919 million yuan, and 1.054 billion yuan, respectively; sales and marketing expenses were 193 million yuan, 148 million yuan, and 139 million yuan, respectively; administrative expenses were 120 million yuan, 111 million yuan, and 136 million yuan, respectively; and research and development costs were 143 million yuan, 129 million yuan, and 128 million yuan, respectively.

On the one hand, there are losses, and on the other hand, sales costs still appear to be high. What is worth noting is that Qiniu Cloud has actually undergone significant layoffs.

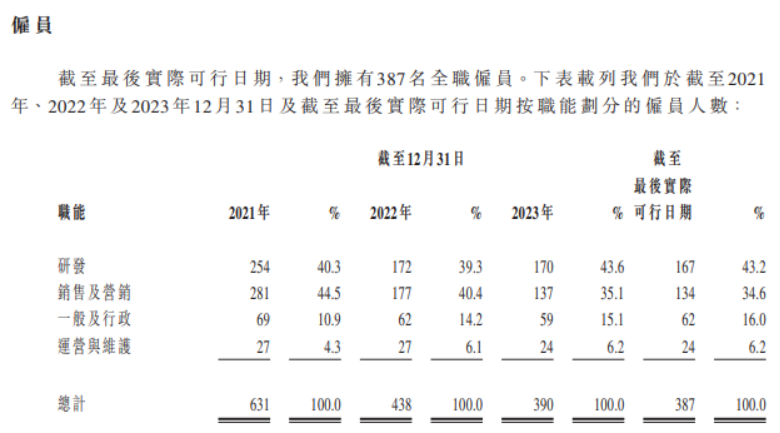

According to the prospectus, the number of employees at Qiniu Cloud during the reporting period was 631, 438, and 390, respectively, with the latest figure being 387. In other words, Qiniu Cloud has laid off a total of 241 employees in the past three years, representing a reduction of nearly 40% of its workforce, with a continuous decline in the number of R&D, sales and marketing, general, and administrative personnel.

As of the end of each reporting period, Qiniu Cloud recorded net operating cash outflows of 91.5 million yuan, 71.3 million yuan, and 3.8 million yuan, respectively, showing continuous outflows, with the company's cash and cash equivalents at the end of the year being 286 million yuan, 187 million yuan, and 166 million yuan, respectively.

03

Close ties with Alibaba, overlapping customers and suppliers

Due to profitability issues, the consistently loss-making Qiniu Cloud is also heavily dependent on external financing. Since its inception, Qiniu Cloud has completed six rounds of financing, including well-known star capital.

According to Tianyancha, Qiniu Cloud completed its initial A-round financing of several million yuan from Matrix Partners in 2011; in 2013 and 2014, Qiniu Cloud completed B-round and C-round financing, respectively, with transaction amounts in the tens of millions of US dollars, with investors including Qiming Venture Partners, Matrix Partners, and CBC Capital.

In 2016 and 2017, Qiniu Cloud's D-round and E-round financing transactions amounted to 100 million US dollars and 1 billion yuan, respectively. D-round investors included Harvest Investment, Fangguang Investment, Zhangjiang Torch Venture Capital, and Ausin Venture Capital, while E-round investors included Yunfeng Fund and Alibaba.

In 2020, Qiniu Cloud's F-round financing reached 1 billion yuan.

According to the prospectus, as of the latest practical date, Taobao China holds approximately 17.69% of Qiniu Cloud's issued share capital. In addition, Qiniu Cloud mentioned that the company provides PaaS solution services to Alibaba Cloud and procures cloud services and electronic equipment from Alibaba Cloud Computing.

In 2021, Qiniu Cloud provided MPaaS to customer/supplier group D (Taobao China) with a transaction amount of 30.927 million yuan, accounting for 2.1% of total revenue for the period. In 2022, Qiniu Cloud provided servers, storage, and technical services to customer/supplier group D, with a transaction amount of 73.064 million yuan, accounting for 8.7% of total revenue for the year.

In 2021 and 2022, customer/supplier group D was Qiniu Cloud's largest supplier, from which Qiniu Cloud purchased network and bandwidth as well as server and storage services for its business. In that year, Qiniu Cloud's transactions with the largest supplier were 478 million yuan and 136 million yuan, respectively, accounting for 36.1% and 16.3% of total purchases for the respective periods.

In addition to its close ties with Alibaba, Qiniu Cloud also has overlapping customers and suppliers.

During the reporting period, Qiniu Cloud's sales amounts to overlapping customer/supplier groups D, I, J, and G were 51.283 million yuan, 116 million yuan, and 252 million yuan, respectively, accounting for 3.5%, 10.1%, and 18.9% of total revenue for the respective periods; procurement amounts from overlapping customer/supplier groups D, I, J, and G were 514 million yuan, 290 million yuan, and 143 million yuan, respectively, accounting for 38.8%, 34.7%, and 14.6% of total procurement costs for the respective periods.

Although it is evident that Qiniu Cloud intends to adjust the procurement amounts and proportions to overlapping customers/suppliers, as of 2023, more than 10% of procurement amounts still came from overlapping customers/suppliers.

Regarding related transactions with Alibaba, Qiniu Cloud stated that the company has entered into a framework agreement with Alibaba Cloud Computing on June 15, 2023 to regulate the company's sales to and procurement from Alibaba Cloud Computing after listing. The initial term of this framework agreement will expire on December 31, 2025.

At the same time, Qiniu Cloud also stated that all sales or purchases from overlapping customers/suppliers are conducted in the ordinary course of business based on general commercial terms and on a fair basis. Except for customer/supplier group D, these overlapping customers/suppliers are independent third parties, and none of the directors, shareholders, etc., have any interests in the overlapping customers/suppliers. (Produced by Harbor Finance)