2025 Independent Automakers' 'Midterm Exam': Geely Relentlessly Pursues BYD

![]() 07/07 2025

07/07 2025

![]() 410

410

At the dawn of 2025, the Chinese automotive market erupted in a frenzy. Automakers not only announced lavish discounts but also engaged in fierce technological competition, with a constant stream of new models being introduced. Amidst this cutthroat environment, the performance of independent and new-force automakers garnered significant attention. Particularly, the top five independent automakers, as leaders in their segment, provide a glimpse into the broader automotive market trends through their sales figures.

Next, Chemeng.com delves into the specific sales performance of these top five independent automakers during the first half of 2025.

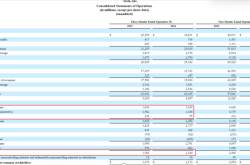

Specifically, in June, BYD maintained its top spot, selling a total of 382,585 units—virtually unchanged from the previous month but up 12% year-on-year. From January to June 2025, BYD's cumulative sales reached 2,145,954 units, marking a 33% year-on-year increase.

By brand, the Dynasty and Ocean networks collectively sold 342,737 units, a 2% decline from the previous month. Within this, the Dynasty network saw a 13.12% month-on-month drop, with double-digit declines observed in the Han, Song, Yuan, and other families. The Denza brand sold 15,783 units, with the Denza D9 and Denza N9 driving sales. The Equation Leopard brand sold 18,903 units, a staggering 605.3% year-on-year increase, with the Titan 3 accounting for 12,017 units or 64% of total sales. The Aurora brand sold 205 units, up 47% year-on-year. It is evident that amidst fierce competition, BYD's domestic market is facing pressure for growth, with its overall growth rate slowing. Conversely, BYD's overseas market is surging ahead, with 89,699 passenger cars and pickup trucks sold, representing a 229.8% year-on-year increase.

According to media reports, BYD has set an annual sales target of 5.5 million units for this year, including 4.7 million units for the domestic market, with a current completion rate of 46%. To achieve this target, BYD needs to sell at least 420,000 units per month. However, given that monthly sales in the first half of the year have yet to exceed 400,000 units, achieving this target presents a slight challenge.

In contrast to BYD, while Geely Auto still lags in sales, its growth momentum cannot be overlooked. Data reveals that Geely Auto sold 236,036 units in June, a 42% year-on-year increase, making it the automaker with the highest year-on-year growth rate among the top five independents. In the first six months of this year, Geely Auto sold a total of 1,409,180 units, up 47% year-on-year. Based on its robust first-half performance, Geely officially announced an 11% increase in its annual target from 2.71 million to 3 million units.

Behind this surge is Geely Auto's continuous breakthrough in new energy vehicle sales. In June, it sold 122,400 new energy vehicles, a 86% year-on-year increase, with a monthly penetration rate of 52%. By brand, Geely Galaxy sold 90,222 units, a 202% year-on-year increase, with models like Xingyuan, Galaxy E5, and Xingyao 8 becoming popular choices. The Lynk & Co brand sold 26,310 units, up 8% year-on-year, with the Lynk & Co 900 ranking among the top three full-size hybrid SUVs in sales. The Zeekr brand sold 16,720 units, with 90,740 units sold in the first six months, up 3% year-on-year. Additionally, Geely Auto's fuel vehicle sales remained strong, with a cumulative sales of 615,800 units in the first half of the year, including a 7% increase for the "China Star" high-end series.

Currently, Geely's annual target completion rate stands at 47%, achievable by selling an average of 260,000 units per month in the second half of the year. Upcoming models such as the Geely Galaxy A7, Geely Galaxy M9, Lynk & Co 10 EM-P, and Zeekr 9X will further enrich Geely's new energy product line. With this offensive in the new energy segment and a defensive stance in the fuel vehicle market, Geely Auto is poised to achieve its annual target of 3 million units. Industry insiders predict that, based on the conventional sales ratio of 45:55 for the first and second halves of the year, Geely could surpass 3.13 million units in total sales.

Turning to Changan Auto, it sold 235,098 units in June, up 4% year-on-year, demonstrating steady growth. From January to June 2025, Changan Auto sold a total of 1,355,000 units, up 2% year-on-year, with a completion rate of 45%. To achieve its target in the second half of the year, Changan Auto needs to sell an average of 270,000 units per month.

By brand, Deep Blue sold 29,893 units in June, a 79% year-on-year increase, with the Deep Blue S05 and S07 driving sales, while S09 sales have gradually increased since its April launch. AITO sold a total of 10,153 units, up 117% year-on-year, maintaining sales above 10,000 units for four consecutive months. The three currently available models—11, 07, and 06—are the core drivers behind this sustained sales success. Changan Qiyuan sold a total of 38,771 units, up 156% year-on-year.

While these brand models have seen significant sales increases, there is still a gap compared to the hot-selling models from new-force automakers. Fortunately, Changan Auto has been making concerted efforts in recent years to diversify its new energy brand layout, leaving ample room for future growth.

In the first half of 2025, Chery Auto's sales hit an all-time high for the same period. Data indicates that in June, Chery Auto sold a total of 233,607 units, achieving double-digit growth both month-on-month and year-on-year. From January to June 2025, Chery Auto sold a cumulative total of 1,260,124 units, up 14.5% year-on-year.

In June, Chery Auto sold 71,582 new energy vehicles, a 59.6% year-on-year increase. This growth is fueled by the strong performance of its five brands. Among them, the Chery brand sold 138,077 units. The Starway and Jetour brands together sold 67,640 units. The iCAR brand sold 10,868 units, while the Zhijie brand sold 2,459 units, with cumulative sales of 44,929 units in the first half of the year, up 165.3% year-on-year.

Overseas, Chery Auto exported a total of 106,330 units in June, up 9.6% year-on-year. From January to June 2025, Chery Auto exported 550,270 units, up 3.3% year-on-year, maintaining its position as the top exporter among Chinese automakers.

Overall, Chery Auto's five major brands are showcasing their respective strengths and continuously striving to enhance the company's market competitiveness. Following the intensive launch of new models in the first half of the year, models such as the Chery Fengyun A9L, Chery iCAR 05, and Chery Fengyun T11 will also be introduced to consumers in the second half. These new models will not only enrich the product line but also further boost Chery's market performance.

Great Wall Motor's sales exhibited a trend of steady growth. In June, it sold a total of 110,690 units, up 13% year-on-year, including 36,400 new energy vehicles. In the first six months of this year, Great Wall Motor sold a cumulative total of 569,789 units, up 2% year-on-year, with 160,400 new energy vehicles sold cumulatively.

Specifically by brand, the Haval brand sold 62,396 units in June, up 30.73% year-on-year, with the second-generation Haval Xiaolong and Haval Menglong being popular choices, and the "one-price" model having a significant impact. The WEY brand exceeded 10,000 units in monthly sales again, up 246.95% year-on-year. The Tank brand sold 21,571 units, with the Tank 300 contributing 13,455 units. The Ora brand sold 3,283 units, while Great Wall Pickup sold a total of 13,213 units.

Overall, while Great Wall Motor's market performance may not rival that of leading domestic automakers, it remains consistently steady.

Summary:

In summary, during the first half of 2025, the top five independent automakers each showcased their unique sales highlights. While BYD's Dynasty and Ocean networks remain its core markets, the proportion of high-end brands still needs enhancing. Geely Auto's Galaxy brand models are all popular choices. Changan's Deep Blue brand is also making continuous efforts. Chery's five major brands each have their strengths and continue to unleash growth momentum. Great Wall Motor's Haval and Tank brands are also recovering steadily. Notably, while BYD holds a significant lead in the new energy field, the other four top automakers are accelerating their pursuit. In the second half of the year, the top five independent automakers will successively introduce several new models into the market. The evolution of the market landscape will undoubtedly be worth anticipating.

(Pictures sourced from the internet. Please delete if there is any infringement.)