The Battle for Instant Retail Extends to Short Dramas

![]() 07/18 2025

07/18 2025

![]() 712

712

Amidst soaring traffic and intense user competition, short dramas have transformed from mere "marketing tools" into the central battleground for e-commerce retail platforms aiming to establish ecological barriers.

Original New Entropy, Great Entertainment Group

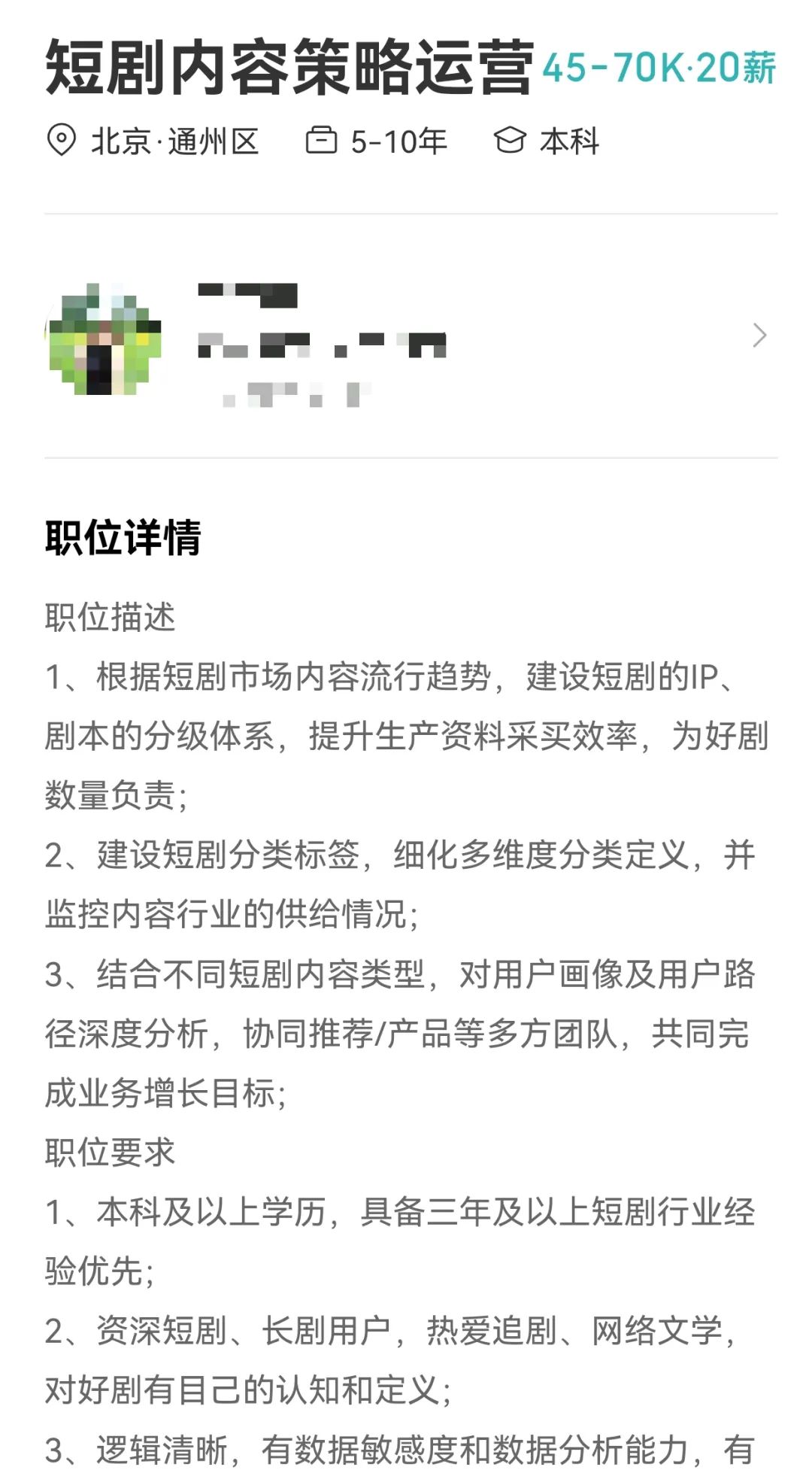

Following the rivalry among JD.com, Meituan, Taobao, and Pinduoduo in the instant retail space, short dramas may emerge as a new focal point for these major players. Recently, JD.com unexpectedly embarked on a recruitment drive for various short drama-related positions, including content strategy operations and content operations. According to job postings, to attract top industry talent, JD.com offers a monthly salary of 45K-70K (20-month salary system) for core positions, equating to an annual salary of 900,000-1.4 million yuan.

▲Image/BOSS Direct Hire Screenshot

Industry insiders reveal that JD.com's recruitment of content strategy operators with an annual salary ceiling of 1.4 million yuan underscores its commitment to further breaking through business bottlenecks through short dramas. In fact, JD.com isn't the first to this game; Pinduoduo, Taobao, and Meituan have already ventured into the short drama market. In December 2023, Pinduoduo launched the "Duoduo Has Good Dramas Plan"; the same year, Taobao invested tens of millions of yuan and over 1 billion in traffic to support brand-customized dramas; Meituan has also frequently focused on brand-customized short dramas. From the beginning of the year to around 618, multiple short dramas co-produced by Meituan and Kuaishou have been successively launched. The seamless integration of e-commerce and content has positioned Meituan as an important pole in the short drama industry that cannot be ignored.

Certainly, JD.com hasn't been entirely absent from short dramas. During promotional periods like 618, JD.com also engages in short drama marketing, but the results have generally been mediocre. For instance, the widely disseminated project "Watch President Short Dramas, Grab Large Red Envelope Rain" embedded promotional information such as "scan the code to jump to the live broadcast room" and "the president is giving out red envelopes" in multiple plotlines. Users could switch to the live broadcast room in real-time while watching the drama, sparking heated discussions about the unappealing nature of QR codes in short dramas. In reality, as the "standard configuration" of the current e-commerce retail industry, Taobao and Pinduoduo have long regarded short dramas as strategic objectives. Meituan also frequently uses short dramas for marketing, and JD.com is now fully committed. It's evident that behind this collective strategic bet lies the e-commerce industry's quest for breakthroughs in the era of peak traffic.

Three Logics Behind Big Players' Bet on Short Dramas

In the short drama market, e-commerce giants like Taobao and Pinduoduo have taken the lead and are fiercely competing. From a strategic perspective, Pinduoduo adopts a CPM traffic sharing model, supporting high-quality short drama content through recommendation weighting, traffic sharing, and other mechanisms. The short drama section launched by Pinduoduo is listed in the secondary channel of "Duoduo Video", alongside "Live", "Follow", and "Recommend", focusing on free short dramas, directly targeting user engagement and activity. Alibaba also has a deep presence in the field of short dramas, but unlike Pinduoduo, Taobao excels at collaborating with popular IPs, celebrities, top brands, top influencers, and institutional partners to produce brand-customized dramas.

According to Taobao data, short dramas not only have lower customer acquisition costs but also demonstrate significant effects in acquiring new customers and breaking into new circles. For example, the high-quality short drama created by L'Oréal during last year's "Double 11" period garnered over 100 million views; Samsung's Spring Festival short drama had over 90% new customers, providing long-term grass-planting value. Many brands combine Taobao's promotional nodes to pre-plant "grass" through short dramas, directly driving conversion transactions. During the 2024 Spring Festival, Yanghe brand collaborated on a brand-customized short drama starring comedian Sun Yue. The integration of short dramas and live broadcasts exceeded expectations in total views, with a single-day GMV (Gross Merchandise Volume) of over 3.1 million yuan for special live broadcasts.

Meituan employs a similar approach to Taobao and has made notable achievements in customized dramas. Meituan's short dramas exhibit a distinctive "Meituan flavor", with themes primarily centered around food dramas and family dramas, making it convenient to embed Meituan promotional information in related scenes. For example, Meituan Flash Buy's customized short drama "After the Funeral, I Became the Undercover Boss of the Big Brother" recently ranked fifth on the weekly prosperity index of short dramas by DatanV and first on the brand playback list, becoming the only brand-customized drama to rank among the top tier.

▲Image/DatanV Technology

In fact, JD.com has already ventured into the short drama arena through various means. For example, it collaborates with short video platforms to create short dramas. Since the first half of last year, JD.com has also added short drama content to the recommended information stream on the "Stroll" page of the App homepage and announced an investment of 1 billion yuan in cash and 1 billion in traffic to attract a large number of high-quality original authors and institutions to settle in and provide high-quality short dramas for JD.com users. For JD.com, short dramas may no longer be a purely marketing tool but an entry point for content ecology and e-commerce conversion.

Past successful attempts may have also given JD.com confidence to delve deeper into the short drama arena. In fact, from the strategies of Taobao, Pinduoduo, Meituan, and JD.com regarding short dramas, it's clear to see the logic behind them. Firstly, traditional e-commerce and local life services are facing the dual pressures of "stagnant user growth + high customer acquisition costs". The cost of acquiring and retaining customers for Taobao, JD.com, Pinduoduo, and even Meituan is increasing. As the fastest-growing content form in current traffic, short dramas are becoming a key weapon for e-commerce platforms to resist user churn. Secondly, each platform converts short dramas into emotional links that attract users to stay immersed through the logic of content being traffic, and then constructs differentiated user retention strategies through the logic of content being sticky. Additionally, short dramas can create "immersive consumption scenarios" for products. For example, through a combination of content and algorithms, product recommendations are interspersed in the short drama information stream, realizing a closed loop of "watching dramas - planting grass - placing orders"; short dramas can also be used as a traffic lever for local life services, achieving an O2O closed loop through contextual implantation (such as price comparison functions and group purchase redirects).

▲Image/AI Creation

These three logics support each other: content marketing attracts traffic, user duration precipitates data, and data feeds back into precise conversion, ultimately forming a flywheel effect of "content-traffic-commerce". It's worth noting that the short drama strategies of these e-commerce retail platforms don't pursue direct profitability but realize indirect value by improving traffic efficiency (such as reducing customer acquisition costs and increasing repurchase rates). However, is the short drama truly a panacea for traffic anxiety?

Finding New Growth Through Short Dramas Isn't Easy

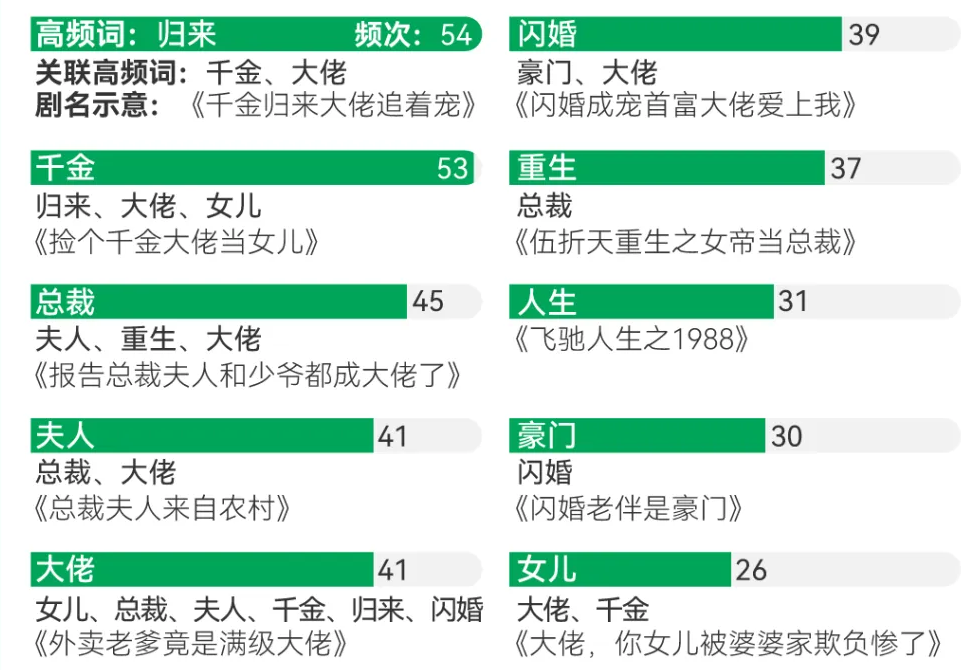

Currently, short dramas have become a major trend, hiding unlimited business opportunities. However, how to tap into the potential of short dramas remains a subject that requires in-depth research by major e-commerce retail giants. The core value of short dramas lies in their entertainment and narrative integrity, while the demands of e-commerce retail are to directly or indirectly promote sales conversion. This contradiction may lead to the following issues: Firstly, short dramas attract more users primarily because of their fast pace, short duration, and inherently enjoyable plots. Users' entertainment willingness is higher than their shopping willingness, and the abrupt implantation of hard advertisements or product links may cause some viewers to lose interest or even be disgusted. Additionally, 80% of branded short dramas focus on themes such as "time travel", "revenge", and "overbearing presidents", leading to user aesthetic fatigue. Homogeneity makes it difficult for brands to stand out in the market. The production of short dramas differs from traditional advertisements, requiring strong plot design, and the natural conflict between content creation and commercial goals may result in non-positive feedback.

▲Image/The Paper·Data Class

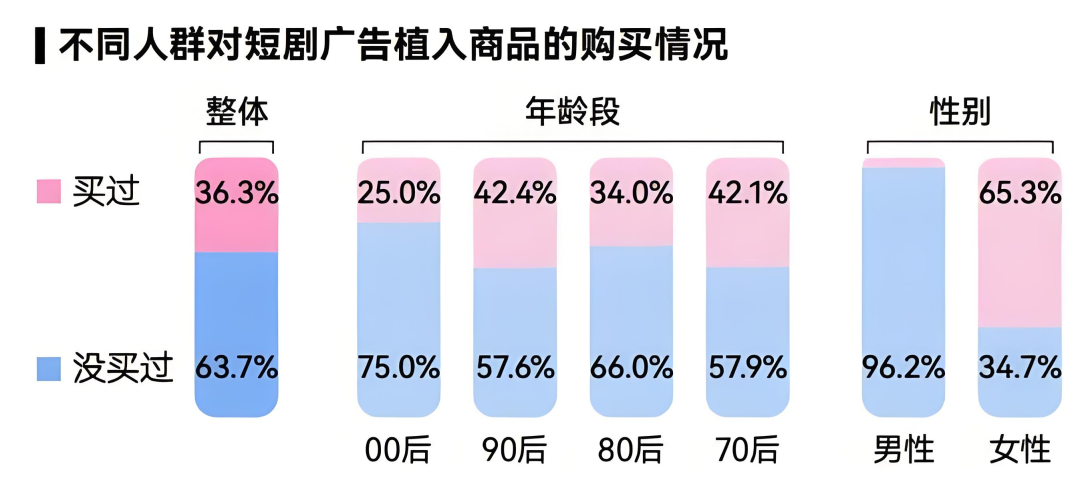

The core demand of short drama users is entertainment, not consumption decisions, which also leads to natural obstacles in the conversion chain. A recent survey jointly released by DT Business Observations and China Business News revealed that frontline users mostly watch short dramas during fragmented times such as commuting and before bedtime, making it difficult to form a deep motivation for consumption. Of course, referring to data from the China Internet Network Information Center, short drama users are mainly from cities below the third tier (accounting for 65.1%), while some e-commerce retail platforms target high-net-worth individuals in first-tier cities, which can result in a mismatch of user personas and low conversion efficiency. From a procedural perspective, the process from watching short dramas to completing a purchase involves "content attraction - interest generation - search and comparison - placing an order", with a high mid-way churn rate. According to the survey, over 60% of people have not purchased anything due to advertising implants in short dramas, and 96.2% of men have never placed an order. Some men who love watching short dramas said they pay more attention to the plot development and outcome when watching short dramas and do not care much about advertising implants.

▲Image/DT Business Observations

However, in comparison, women, post-90s, and post-70s have a higher proportion of purchasing related goods or services due to advertising implants in short dramas. In terms of categories, they are mostly high-frequency consumables with "light decision-making" such as household daily necessities, food and beverage, and beauty and personal care products. As long as the products meet demands, have appropriate prices, and have endorsements, people are willing to place orders and try them out. This is not favorable for JD.com, which focuses on 3C products. According to the survey, the reasons why people purchase the above categories after watching short dramas are firstly because "it's exactly what I need" and "the price is very favorable". The second reason is that the short dramas "clearly introduce the brand/product", "people believe in the recommendations of the short drama actors and team", and "there are comments recommending in the comment section", which means that there are both credible introductions and recommendations and a certain amount of public praise, providing a certain degree of persuasion for viewers to be willing to pay.

Certainly, as a new marketing channel, the traffic and novel form of short dramas have injected new vitality into the e-commerce retail industry. However, for Taobao, JD.com, Meituan, and Pinduoduo, they also need to showcase their unique abilities and devise different strategies.

Differentiation in Short Dramas Becomes the Key to the "Ecological War"

In recent years, the e-commerce retail industry has shifted from a "price war" to a "content war" and an "ecological war". Platforms no longer compete solely on low prices but on content production capabilities and in-depth user understanding. With traffic peaking and fierce user competition, short dramas have transformed from "marketing tools" into the central battleground for e-commerce retail platforms aiming to establish ecological barriers. Giants like Taobao, Pinduoduo, Meituan, and JD.com have reshaped the competition logic of "content-traffic-commerce" through differentiated strategies, which has become the key to breaking the deadlock. Facing the current situation where 80% of short dramas focus on themes such as "overbearing presidents" and "revenge", platforms can break through through theme innovation and value guidance. For example, Taobao previously launched the workplace inspirational drama "Work, BOSS!", embedding Proya products in the plot of "workers' revenge", which not only avoids vulgarity but also strengthens the brand's youthful image.

▲Image/Screenshot of Taobao Short Drama

This self-produced drama stands out for its exceptional quality and distinctive style. It boasts the advantage of directly boosting platform purchases and increasing GMV, yet it also imposes a ceiling on short dramas, making it challenging to produce a blockbuster hit. Essentially, this brand-tailored short drama is an elongated advertisement, differing vastly from the commercial logic of traditional short dramas, which makes it difficult to retain users on the platform. Conversely, Pinduoduo's short dramas embrace a rustic and refreshing vibe, with varying quality levels. Most are mini-program dramas featuring direct and engaging highlights that swiftly capture users' attention. This approach effectively increases user dwell time, enhances user loyalty, and attracts new users to the platform.

While free short dramas may not directly translate into GMV, they indirectly capture users' attention amidst fierce competition among major e-commerce platforms. In essence, it's about "stealing users' time." The longer users engage with us, the less likely they are to place orders with our competitors. Additionally, through strategic activities, we can issue coupons to further bolster the platform's GMV. Meituan has seamlessly integrated short drama marketing with user retention. Last March, Meituan introduced a dedicated "Theater" section within the "Video" tab, launching numerous free short dramas, primarily reruns. Prior to major promotions or events, Meituan also leverages short drama marketing. Notably, Meituan has showcased numerous standout short drama events, such as last year's annual report that fused AI with short dramas, and family and food-themed short dramas that embedded Meituan takeout red envelopes, group-buying coupons, and other viewing perks, thereby shortening the marketing conversion path for merchant discounts.  ▲Photo/Weibo Screenshot

▲Photo/Weibo Screenshot

Comparatively, JD.com's high-quality user base and the short drama audience exhibit a strong disconnect. The short drama marketing campaign during this year's 618 shopping festival also fell short of expectations. For instance, the widely promoted "Watch CEO Short Dramas and Grab Large Red Envelope Rains" allowed users to watch dramas while simultaneously jumping to live streaming rooms to participate in massive red envelope rains and 50% off flash sales. This initiative sparked heated debates among netizens regarding the aesthetics of the short drama QR codes. The crux of the short drama ecosystem battle lies in e-commerce platforms' ultimate quest to compete for "user attention pricing power." Pinduoduo dominates the lower-tier market with vast content, Taobao caters to high-net-worth users with brand-customized dramas, and Meituan connects local life with scenario-based content. For JD.com, finding a balance between "quality genes" and "mass content" will determine its success in this new battleground. While there is no definitive answer to this war, one rule remains constant: those who can strike the perfect balance between entertainment and commerciality, and establish an emotional connection between content value and user value, will emerge victorious in the "people-goods-scene" reshaped by short dramas. Future competition will not only hinge on content quality but also encompass a comprehensive evaluation of ecosystem coordination ability, technological innovation speed, and the depth of user engagement.

References:

- DT Business Observer, "Short Drama Implantation, Unable to Leverage 96.4% of Straight Men's Wallets"

- Sci-Tech Innovation Board Daily, "After Alibaba and Pinduoduo, JD.com Enters the Short Drama Market!"

- E-commerce Pro, "JD.com Enters the Short Drama Industry, Liu Qiangdong Offers Millions in Annual Salary to Snatch Talents"

- END -