Xiaomi: Going All Out to Compete with iPhone! The 'More for the Same Price' Strategy Is Fully Implemented

![]() 09/28 2025

09/28 2025

![]() 618

618

Lei Jun's annual speech, an event that takes place regularly, was once again split into two distinct parts. In the first half, Lei Jun delivered his speech, while the second half was dedicated to Xiaomi's autumn product unveilings.

Although the overall structure was familiar, there were some significant differences this time around. ① Xiaomi released its new phone over a month earlier than it did last year. ② Last year, President Lu was the one who introduced the Xiaomi 15 at its launch event. This year, however, Lei Jun himself took to the stage.

You can find the recorded video of Lei Jun's annual speech on the Changqiao App (simply add the WeChat assistant dolphinR124 to get access instructions). This video also covers the speech portion. Dolphin Research will mainly focus on the latter half of the event, which includes Xiaomi's announcements of new products.

I. Key Highlights from Xiaomi's Autumn Launch Event

Overall, Xiaomi's autumn launch event was centered around three main areas: smartphones, IoT (Internet of Things) products, and automotive services.

1.1 Xiaomi Smartphones: The Main Attraction of the Event

The Xiaomi digital series has long been the symbol of the brand's premium flagship models. With national subsidies weakening and the basic version of the iPhone 17 adopting a 'value - for - money' strategy, Lei Jun personally presented the launch of the Xiaomi 17 series.

The key takeaways from the announcement of the Xiaomi 17 series are as follows: Apple is the primary competitor, and Xiaomi is directly benchmarking against it. Xiaomi skipped the 16 series and named its new flagship the 17 series (following last year's Xiaomi 15). This is in line with the iPhone 17's numerical strategy and is aimed at targeted positioning.

On one hand, Xiaomi significantly moved up the launch timeline of its smartphones, bringing it closer to the iPhone's release schedule. Previously, the Xiaomi 11 - 13 series were launched in December, while the 14 - 15 series made their debut in late October. This year, the event took place in late September (getting closer to the iPhone's release time in mid - to early September).

On the other hand, the Xiaomi 17 series will be available in Basic, Pro, and Pro Max versions, which closely follows the naming convention of the iPhone 17 series. During the event, performance comparisons heavily referenced iPhone data, such as processor performance and charging speed.

Before the event, Lei Jun teased on Weibo that the 'Xiaomi 17 Standard Edition would offer significant upgrades without increasing the price, while the Pro and Pro Max versions would target higher price tiers.' The announcements made during the event were in line with this description.

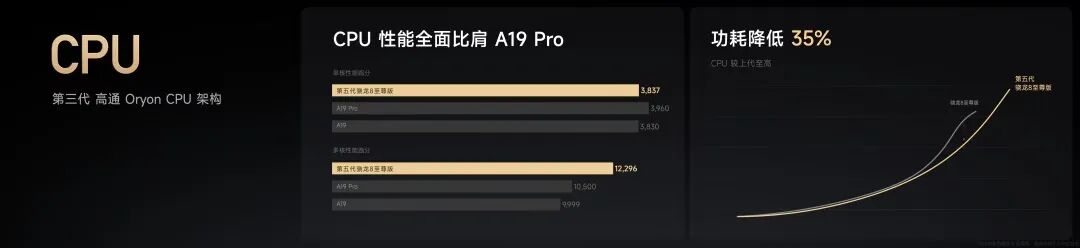

A comparison between the Xiaomi 17 series, Xiaomi 15 series, and iPhone 17 reveals the following:

① Xiaomi 17 Basic Edition: It delivers 'more for the same price.' The upgrades include improvements in the processor, screen quality, imaging system, and battery capacity. The starting price remains at 4,499 yuan.

② Xiaomi 17 Pro Edition: It introduces a 'Magic Back Screen' as a secondary display. Additional upgrades cover the processor, imaging system, and battery. The starting price has decreased by 300 yuan compared to last year's 15 Pro series.

③ Xiaomi 17 Pro Max Edition: This is a new addition to the series. It features a 6.9 - inch screen (the largest in the 17 series), which is the same size as the iPhone 17 Pro Max's screen. Priced at 5,999 yuan (while the iPhone 17 Pro Max is priced at 9,999 yuan), it is in the same price range as the iPhone 17 Basic Edition.

The introduction of the Pro Max model has expanded the price range of Xiaomi's digital series from 4,499 - 5,299 yuan to 4,499 - 5,999 yuan.

1.2 IoT Products: 'All - in - One' Updates

In addition to smartphones, Xiaomi's launch event introduced an 'all - in - one' lineup of IoT products. This includes the Xiaomi Pad 8 series, Xiaomi TV S Pro Mini LED 2026, Mijia Pro French Door Refrigerator with Micro Freshness (560L), Mijia Tri - Zone Washing Machine Pro, Xiaomi Router BE10000 Pro, Xiaomi Sound 2 Max, and Xiaomi Portable Bluetooth Speaker.

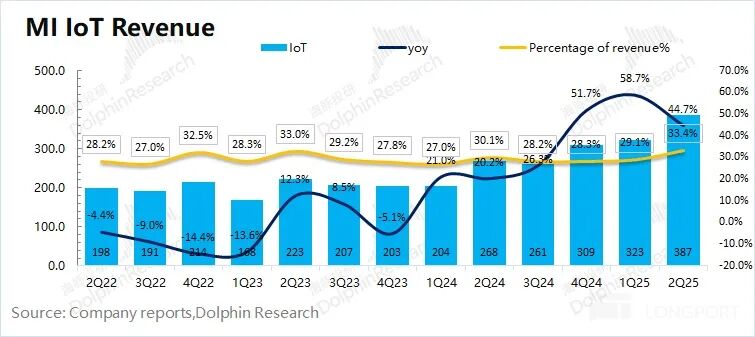

Driven by national subsidies, Xiaomi's IoT business experienced rapid growth starting in the fourth quarter of last year. However, the recent tightening or reduction of subsidies in some regions has had an impact on the market demand for IoT products. The launch of these new IoT products is aimed at reigniting growth in this sector.

1.3 Automotive Business: Personalized Customization

After multiple pre - YU7 launch events, this autumn event mainly focused on smartphones. As for automotive services, no new models were introduced, but a customization service was launched.

Custom Colors: Besides the initial nine colors available for the Xiaomi YU7, five additional colors have been introduced: Amethyst Purple, Racing Red, Twilight Rose, Matte Gold, and Bud Yellow. The company has partnered with BASF and PPG, two global automotive paint suppliers, with the goal of designing 100 colors within three years.

Custom Interiors: The service offers two custom interior options: Gentian Blue + Black Blue and Midnight Black + Fluorescent Yellow dual - tone interiors. Additional custom details include stitched seams, welcome lights, colored seatbelts, and craftsmanship elements like embroidered logos and exclusive door panel nameplates.

Other Customizations: 21 - inch forged dual - layer wheels, calipers, and ceramic badges.

The customization service has entered a one - year trial operation period. A maximum of 40 vehicles can be customized per month, starting with the Xiaomi YU7 Max and Xiaomi SU7 Ultra.

II. Post - Launch Perspectives on Xiaomi

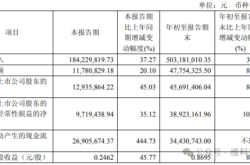

2.1 Current Performance of Xiaomi's Smartphone Business

Based on the launch of the Xiaomi 17 series, several observations can be made:

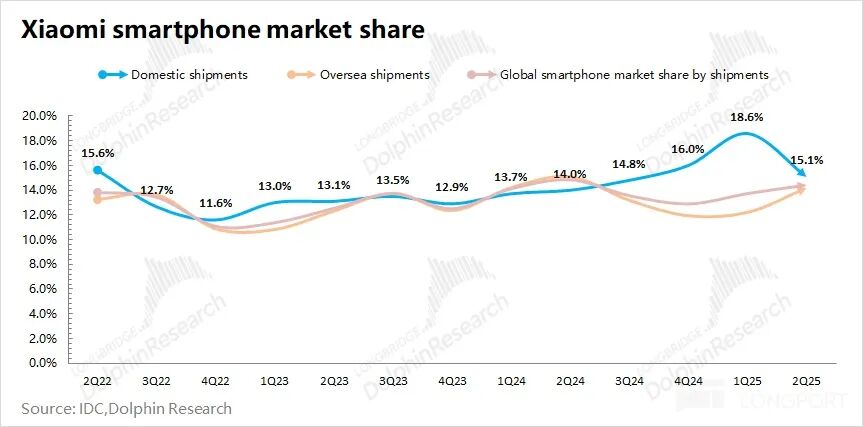

a) Domestic Market Pressure: Since the second half of last year, Xiaomi's market share has increased significantly, largely due to national subsidies. However, as the effects of these subsidies weaken, its domestic market share has started to decline.

b) iPhone 17's 'More for Same Price' Strategy Pays Off: Apple's iPhone 17 Basic Edition has upgraded its storage to 256GB while keeping the price at 5,999 yuan (down from 6,999 yuan for the iPhone 16's 256GB version last year). With national subsidies, the final price of the iPhone 17 Basic Edition drops to 5,499 yuan, which is close to the prices of mid - to high - end Android phones.

Apple's strategy is aimed at attracting high - value customers from Android rivals like Xiaomi, which is why Xiaomi decided to move up its launch timeline.

c) Tesla Benchmarking Success: Tesla has dominated the new energy vehicle market, and Xiaomi achieved success by benchmarking the SU7 against the Model 3 and the YU7 against the Model Y. Similarly, Apple's iPhone leads the smartphone market.

Drawing inspiration from its success in the automotive sector, Xiaomi launched Basic, Pro, and Pro Max editions of its smartphones to benchmark the iPhone. It priced the flagship Pro Max model at the same level as the iPhone Basic Edition. The Xiaomi 17 Pro Max offers superior specifications at the same price, directly competing with the iPhone 17 Basic Edition.

It's worth noting that all models in the Xiaomi 17 series are priced below 6,000 yuan, which complies with national subsidy requirements.

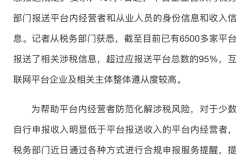

d) Self - Developed Chips: Xiaomi previously released the Xuanjie O1 chip, which was featured in the Xiaomi 15SP. However, market expectations for a new chip were not met, as the Xiaomi 17 series relies on the fifth - generation Snapdragon 8 Ultimate Edition processor. This indicates that there is still significant room for growth in Xiaomi's self - developed chip capabilities.

Overall, the launch of the Xiaomi 17 series ahead of Double 11 will benefit from seasonal promotions. However, the series lacks standout features, and the pricing concessions are relatively modest.

2.2 Progress in Xiaomi's Automotive Business and Production Capacity

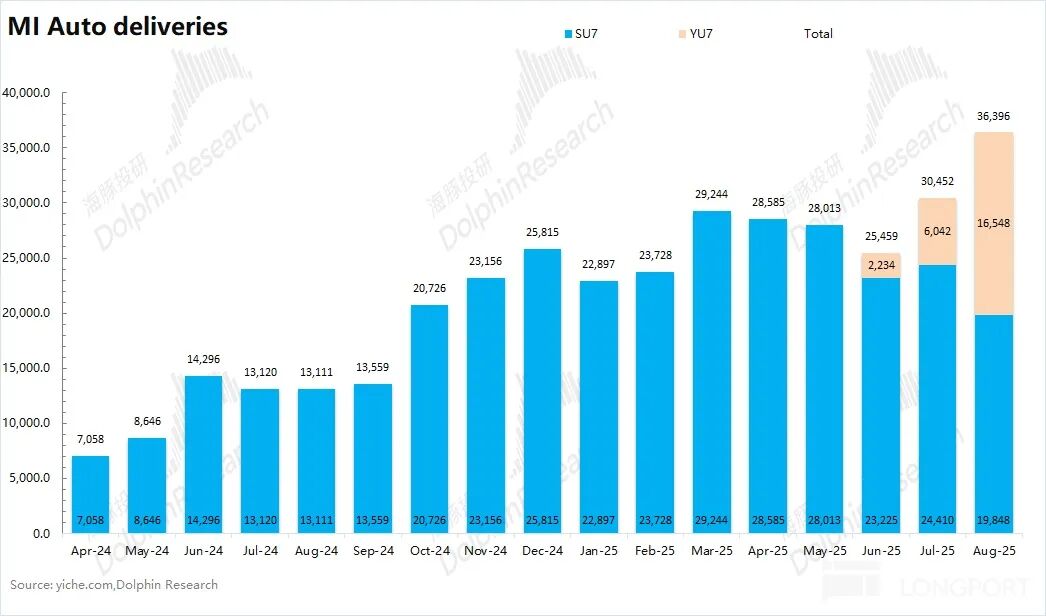

Another key area of focus is Xiaomi's automotive business. Although no new models were launched, recent monthly delivery figures suggest that the ramp - up at the Phase II factory is going smoothly.

Following the launch of the YU7 and the start of production at the Phase II factory, August sales of the Xiaomi YU7 reached 16,500 units, getting close to the monthly sales of the SU7. Combined, their monthly sales totaled 36,400 units.

Based on the ramp - up trends of the SU7 and the Phase I factory, Dolphin Research estimates that the capacity of the Phase II factory reached 2,000 units in July and over 8,000 units in August, with a monthly ramp - up exceeding 5,000 units—a very strong pace.

With the smooth ramp - up of the Phase II factory, Dolphin Research expects Xiaomi's vehicle deliveries in 2025 to surpass 400,000 units, and there will likely be supply shortages throughout the year. The activation of the future Phase III factory will depend on the progress of the next vehicle model.

- END -

// Reprint Authorization

This article is an original work by Dolphin Research. Reproduction requires authorization.

// Disclaimer and General Disclosure

This report is intended for general reference and comprehensive data purposes. It is meant for users of Dolphin Research and its affiliates to view and use as a data reference. It does not take into account the specific investment objectives, product preferences, risk tolerance, financial status, or unique needs of any individual receiving the report. Investors must consult independent professional advisors before making investment decisions based on this report. Any investment decisions made using or referring to the content in this report are undertaken at the investor's own risk. Dolphin Research assumes no liability for any direct or indirect consequences arising from the use of the data in this report. The information and data in this report are based on publicly available sources and are provided for reference only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, or completeness of the information and data.

The opinions or views expressed in this report are not solicitations or offers to buy or sell securities in any jurisdiction and do not constitute recommendations, inquiries, or endorsements for securities or related financial instruments. The information, tools, and data in this report are not intended for distribution to, or use by, individuals in jurisdictions where such distribution or use violates applicable laws or regulations or subjects Dolphin Research and/or its affiliates or subsidiaries to registration or licensing requirements.

This report reflects the personal views, insights, and analytical methods of the contributors and does not represent the stance of Dolphin Research and/or its affiliates.

This report is produced by Dolphin Research, and the copyright is reserved solely by Dolphin Research. No institution or individual may, without prior written consent from Dolphin Research, (i) reproduce, copy, duplicate, reprint, forward, or distribute in any form copies or reproductions, and/or (ii) directly or indirectly redistribute or transfer to unauthorized persons. Dolphin Research reserves all related rights.