Apple's Q4 Revenue Soars to $102.4 Billion, After-Hours Trading Surges Over 5%, Secures $4 Trillion Market Cap

![]() 10/31 2025

10/31 2025

![]() 354

354

Apple hasn't even unleashed its full potential yet.

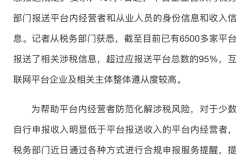

On October 31, Apple reported a remarkable performance for its fourth fiscal quarter, with revenue skyrocketing to $102.466 billion, marking a 7.9% year-over-year increase. Earnings per share stood at $1.85, a staggering 90.7% jump from the previous year.

Image Source: IT Home

The stock's reaction was even more dramatic. Initially, after-hours trading dipped by 3% following the earnings announcement. However, the tide quickly turned, with shares surging over 5% after Apple provided robust guidance for the fourth quarter. This reflects the market's confidence in Apple's long-term growth prospects.

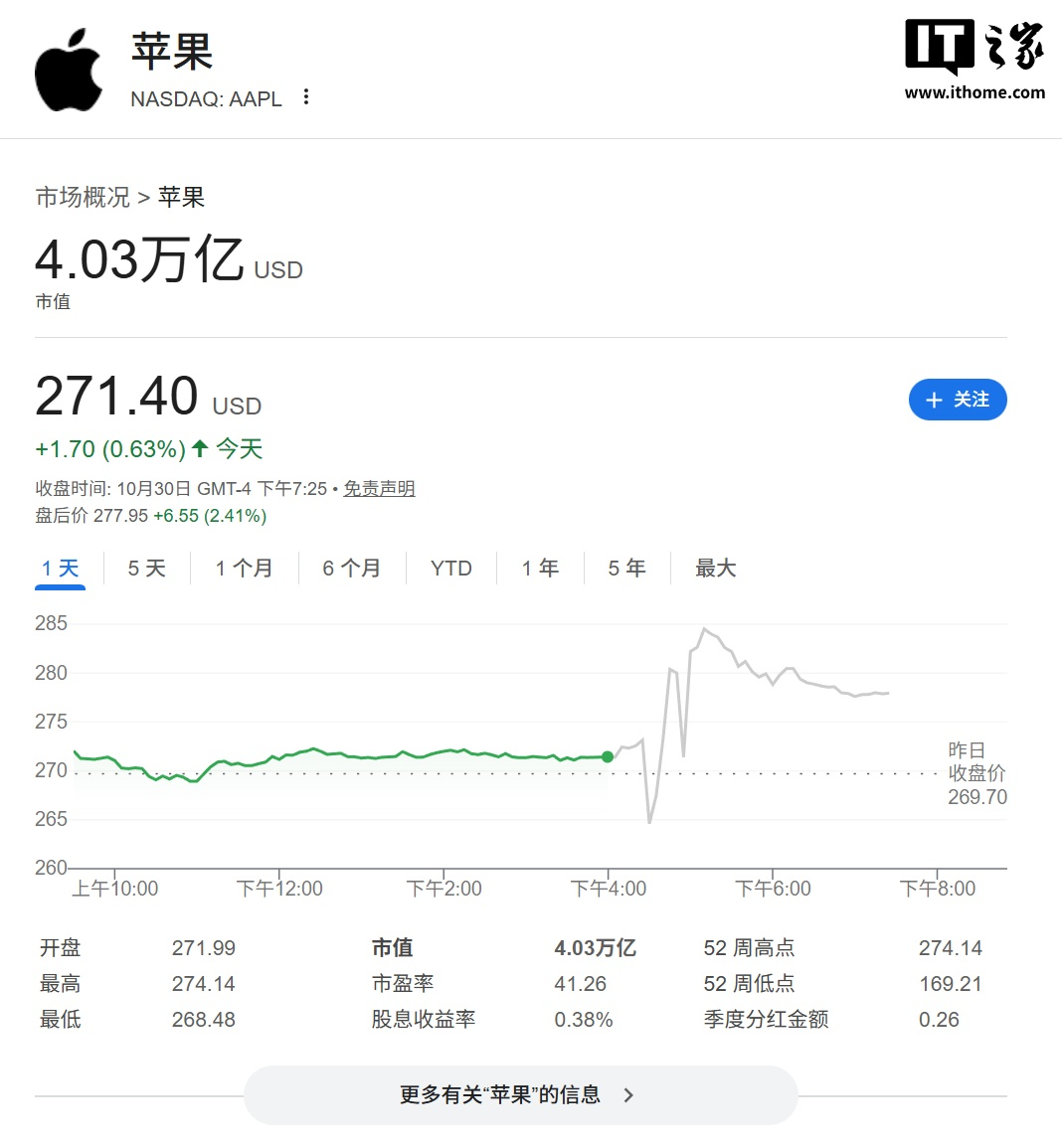

Who says hardware is a dying business? And who claims Apple's only strength lies in its ecosystem? From Xiaolei's perspective, the services business is Apple's hidden gem.

While everyone's eyes are glued to the iPhone, Apple's 'services' division is quietly raking in substantial profits. This segment, which includes the App Store, iCloud, Apple Pay, and more, saw revenue soar by 15.1% year-over-year to $28.75 billion, setting a new record for the third consecutive year. It's like making money effortlessly.

Image Source: Sina

CEO Tim Cook couldn't contain his excitement: "Our services ecosystem is thriving everywhere." Xiaolei likens it to the convenience store downstairs—not only does it sell bottled water, but it also handles package deliveries and sells lottery tickets, offering more and more ways to generate revenue.

JPMorgan analysts cut straight to the point: services revenue growth exceeded market expectations by 230 basis points. This indicates that despite users' complaints about Apple's high commissions, they continue to pay up in large numbers.

Of course, the iPhone remains the cornerstone of Apple's business. This quarter, iPhone sales revenue reached $49.025 billion, up 6.1% year-over-year. While the growth rate may seem to be slowing, the truth is that the iPhone 17 series had only been on the market for just over a week, so sales hadn't been fully accounted for yet.

Notably, Greater China was the only region worldwide to experience a decline. However, Cook remains unfazed. This quarter, revenue in Greater China hit $14.49 billion, down 3.6% year-over-year. On the surface, the situation looks grim, but Cook explained: "The delayed launch of the iPhone Air in China was the main reason."

That makes sense. For instance, everyone criticized this year's iPhone 17 Pro Max for its unappealing design, but when it came time to buy, many still opted for it.

Moreover, Cook stated bluntly: "We expect Greater China to return to growth next quarter." Xiaolei believes this isn't just empty rhetoric. While domestic brands are fiercely competing on affordability and AI features, Apple fans remain highly loyal to the ecosystem. As long as subsequent models deliver, a rebound shouldn't be difficult.

Image Source: Apple Official Website

Let's address the common criticism that Apple is lagging in AI. In reality, Apple hasn't bothered competing with Google or Microsoft in terms of model parameters. Instead, it has taken a more pragmatic approach: first, earn "AI admission fees" through its ecosystem.

The most obvious example is Google. To maintain its position as the default search engine in Safari, Google has to pay Apple billions of dollars every year.

And Apple isn't resting on its laurels either. Next year's revamped Siri is already in the works. More importantly, Apple is continuously bringing other AI partners into its ecosystem. Apple seems to understand: "I don't necessarily have to build the best AI myself, but I can integrate the best AIs and reap the profits."

Image Source: Sina

What truly inspires confidence is Cook's guidance for the next quarter: revenue growth is expected to reach 10%-12%, potentially setting a new single-quarter revenue record in company history. This suggests that Apple hasn't peaked yet; instead, it could surge to new heights next year.

Cook also emphasized that Apple is entering an "AI hardware cycle," with future new products set to drive a new wave of device upgrades and ecosystem revenue growth.

Ultimately, Apple's greatest and most formidable "moat" has never been a single breakthrough technology but rather the invisible web it has meticulously woven over a decade—its ecosystem. Switching from Apple to another brand requires far more than just buying a new phone. This stickiness is Apple's core competitive edge.

Today, Apple's market cap has firmly surpassed $4 trillion, making it the third company—after NVIDIA and Microsoft—to join this exclusive club. So, stop writing off Apple—they're too busy counting their money.