Cash Flow Rockets by 444.73%! Optical Behemoth Unveils Robust Revenue and Profit Growth in Q3 2025

![]() 10/31 2025

10/31 2025

![]() 525

525

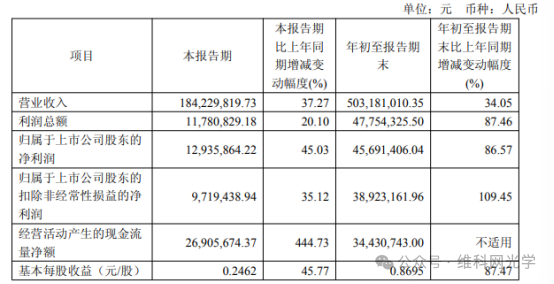

On October 31, Mao Lai Optics unveiled its financial report for the third quarter of 2025. During Q3 2025, the company clocked in revenue of 184 million yuan, marking a year-on-year surge of 37.27%. The net profit attributable to shareholders soared to 12.9359 million yuan, up 45.03% from the previous year. Meanwhile, the net profit after deducting non-recurring items stood at 9.7194 million yuan, reflecting a year-on-year increase of 35.12%.

Remarkably, in Q3 2025, the company's operating cash flow soared to 26.9057 million yuan, a staggering 444.73% increase year-on-year, signaling a substantial enhancement in its financial well-being.

For the first three quarters of 2025, the company's revenue reached 503 million yuan, up 34.05% year-on-year. The net profit attributable to shareholders climbed to 46 million yuan, a 86.57% increase from the previous year. Additionally, the net profit after deducting non-recurring items hit 39 million yuan, representing a year-on-year surge of 109.45%.

In its report, Mao Lai Optics attributed the performance fluctuations primarily to the expansion of sales volume during the period, which led to increased revenue and other gains.

Currently, Mao Lai Optics is zeroing in on emerging sectors and has deepened its strategic布局 (translated as "strategic deployment" for better cultural fit) in three core businesses. In the semiconductor arena, some semiconductor products have successfully transitioned from the R&D sample phase to mass production. With positive feedback from downstream markets and optimizations in production processes, the scale of collaboration between the company and certain customers has expanded significantly. The company has also successfully participated in the R&D production lines of their new products. Overseas demand for the company's semiconductor products remains robust; in the domestic market, driven by the trend of domestic substitution, downstream customers' demand for the company's semiconductor products is also on the rise, and the company has deeply engaged in the upgrading process of the domestic semiconductor industry.

In the life sciences domain, with the continuous expansion and deepening of the overseas subsidiary businesses' deployment, the company's product portfolio in the life sciences sector has become increasingly diverse. In the first half of 2025, the company actively engaged with new customers for sample deliveries. Once the relevant samples pass certification, the company's collaboration with new customers will shift from initial contact to in-depth partnership, injecting fresh impetus into subsequent business growth.

In the AR/VR inspection sector, as customer demand gradually transitions from the R&D stage to small-batch production, product demand in this area has surged. Through ongoing R&D and accumulation of industry experience, the company has successfully penetrated some production lines of new customers, assisting them in the inspection of optical functional modules for AR glasses. The company actively meets the business needs of downstream customers, with delivery efficiency in the first half of 2025 significantly improved compared to the same period last year, and revenue in this sector increased by 74.95% year-on-year.

The steady business development has also spurred Mao Lai Optics to actively gear up for capacity expansion. On October 16, during a research visit by nine institutions, including Fullgoal Fund, Mao Lai Optics stated that with the IPO-funded projects reaching their intended operational status and factories and equipment gradually coming online, the company's production capacity is being released in stages. In addition to the dedicated capacity expansion through convertible bonds, the company is leveraging its multi-base layout domestically and internationally to strive to raise its production value ceiling.

As of October 30, 2025, a total of 43 institutional investors have disclosed holding A-share shares of Mao Lai Optics, with a combined shareholding of 37.5362 million shares, accounting for 71.09% of the company's total share capital.

Among them, the top ten institutional investors include Nanjing Mao Lai Holdings Co., Ltd., Bank of Communications Co., Ltd. - Yongying Semiconductor Industry Smart Selection Mixed Securities Investment Fund, Industrial and Commercial Bank of China Limited - Noah Growth Mixed Securities Investment Fund, China Merchants Bank Co., Ltd. - Galaxy Innovation Growth Mixed Securities Investment Fund, Bank of China Limited - Noah Optimized Allocation Mixed Securities Investment Fund, China Merchants Bank Co., Ltd. - Southern CSI 1000 Exchange-Traded Open-End Index Securities Investment Fund, Industrial and Commercial Bank of China Limited - Jinxin Robust Strategy Flexible Allocation Mixed Initiated Securities Investment Fund, Hong Kong Central Clearing Ltd., Shanghai Pudong Development Bank Co., Ltd. - Debon Semiconductor Industry Mixed Initiated Securities Investment Fund, and Industrial and Commercial Bank of China Limited - Bosera Sci-Tech Innovation Board Three-Year Fixed Open-End Mixed Securities Investment Fund. The combined shareholding ratio of the top ten institutional investors reached 69.27%.

As of press time, Mao Lai Optics boasted a market value of 19.38 billion yuan.