iPhone 17 Unveils Its 'Performance Report': Why Are Chinese Consumers Shifting Away from Apple?

![]() 10/31 2025

10/31 2025

![]() 554

554

Apple Releases 'Performance Report' on Initial Sales of iPhone 17 Series

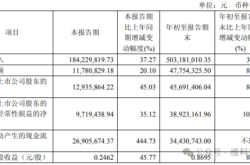

The financial report reveals that Apple's total net revenue for the fourth quarter of fiscal year 2025 reached $102.466 billion, marking an 8% year-over-year increase. Net profit soared to $27.466 billion, up by a staggering 86% from the previous year. Excluding non-GAAP adjustments, Apple's net profit for the quarter still saw a 10% year-over-year rise. Revenue from iPhones specifically amounted to $49.025 billion, a 6% increase compared to the same period last year.

Judging by revenue, net profit, and iPhone product revenue, Apple's performance in this quarter was indeed impressive. Influenced by the financial report, Apple's after-hours stock price surged by over 3%, breaking its 52-week high.

However, in the Greater China region, Apple's performance was not as robust. The financial report indicates that Apple's net revenue in Greater China for the fourth quarter of fiscal year 2025 was $14.493 billion, a 4% decline from $15.033 billion in the same period last year.

In previous years, Apple faced criticism for its 'incremental innovation.' Yet, this year's iPhone 17 series outperformed its predecessors, such as the iPhone 16, iPhone 15, and iPhone 14. Notably, the base model iPhone 17 saw its storage increased to 256GB, earning the moniker 'more for less.' The new orange color option also gave the iPhone 17 Pro/iPhone 17 Pro Max a distinctive look. On the first day of sales, scalpers resold the iPhone 17 Pro Max at a premium of up to 1,500 yuan.

The iPhone 17 series seemed to have a promising start in the Chinese market, but the final 'performance report' revealed a stark contrast, with revenue declining instead of increasing. Why are Chinese consumers shifting away from Apple phones?

Firstly, the phenomenon of premium pricing and rush buying was rare. On the first day of the iPhone 17 series' release, Guo Jing's Internet Circle observed from Apple's retail store in Suzhou Center that while some individuals were seen outside the store holding multiple iPhone 17 units and negotiating with potential buyers, most people remained inside the store, either waiting in line to pick up their iPhones or exploring the new products on display. The peak for queuing to buy iPhones was during the iPhone 6 era, which was dubbed the 'legendary phone.' Subsequent generations have seen a decline in such queuing phenomena.

On one hand, online purchasing options are readily available on platforms like Taobao, JD.com, and Pinduoduo. On the other hand, users can also try their luck on the App Store, although shipments may not commence until around mid-October. Users are not averse to waiting.

Therefore, one cannot simply rely on the initial frenzy of high-priced rush buying of the iPhone 17 Pro Max to gauge overall sales performance. Such individuals are a minority, and scalpers prey on impatient consumers. If users are willing to wait, such as for a month until shipments begin, they do not need to rush buy from scalpers at a premium. After the iPhone 17 Pro Max's release, the craze for premium pricing subsided quickly, and subsequent sales were relatively quiet. The initial rush buying does not accurately reflect the overall sales performance.

Secondly, spending five to six thousand yuan on a new phone is still considered somewhat 'extravagant.' Consumer spending power is closely tied to their disposable income. In the past, iPhones were popular because consumers had the financial means and were willing to spend. However, current consumers are more inclined to save money. Spending five to six thousand yuan on a new phone is still seen as a luxury for many.

For first-time Apple phone users, there may still be some 'surprise' factor with the new iPhone. However, for long-time iPhone users who upgrade generation after generation, the phones look similar, and the differences between new and old models are not significant. This is especially true for users upgrading from the previous iPhone 16 series. For them, the differences between the iPhone 17 and iPhone 16 are not substantial unless they particularly like the orange color option. Otherwise, the differentiation brought by the new phone is not strong enough to justify the upgrade.

When the iPhone 17 loses its novelty, and considering the cost of five to six thousand yuan for an upgrade, users may hesitate to spend that money.

The pricing range of the iPhone 17 itself acts as a barrier. Even if consumers think the iPhone 17 is a good product, if they lack the purchasing power, their desires remain unfulfilled, and they may ultimately settle for other phone brands.

In reality, the market environment for the iPhone 17 this time was very favorable. Competitors like Huawei, Xiaomi, OnePlus, Vivo, OPPO, and Samsung did not have products that could directly compete with the iPhone 17, significantly reducing its competition. However, even under these circumstances, the iPhone 17 did not sell as well as the iPhone 16.

It is not that Chinese users are rejecting Apple phones; rather, it is a matter of consumer segments and reach.

Unlike Apple, domestic phone manufacturers have a strong sense of the overall smartphone market. According to Guo Jing's Internet Circle observations, Xiaomi, OnePlus, and other phone manufacturers adopted two strategies this time: they still released top-tier flagship models, but they also accelerated the launch of their mid-range and low-end models with relatively affordable prices, such as the OnePlus 15 and OnePlus Ace 6, Xiaomi 17, and REDMI K90. Domestic phone manufacturers are more pragmatic, focusing on boosting sales regardless of market conditions.

Apple did not release a low-end model in the fall, and it cannot afford to lower prices shortly after launch, leading to a high-start, low-finish situation in terms of sales.

However, while Apple's hardware performance has been lackluster, its software remains strong.

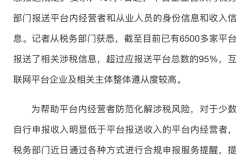

The financial report shows that Apple's net revenue from services for the fourth quarter of fiscal year 2025 was $28.75 billion, up by 15% year-over-year, making it the fastest-growing product category among all Apple segments. Apple's service revenue has surpassed the combined revenue of Macs, iPads, wearables, home products, and accessories, highlighting the strong revenue-generating capabilities of products like the App Store, Apple Pay, and Apple TV. For the entire fiscal year 2025, Apple's net revenue from services was $109.158 billion, surpassing $100 billion for the first time.

Tim Cook stated that the delayed launch of the iPhone Air in China was the 'primary reason' for the decline in revenue in the Greater China region. The iPhone Air, launched by Apple in the fall of 2025, was indeed 'eye-catching,' but pre-orders did not begin until October 17, with official sales starting on October 22.

The issue with the iPhone Air is that, to achieve the 'thinnest iPhone flagship ever,' it only supports eSIM and is incompatible with physical SIM cards. However, obtaining eSIM service in China is inconvenient, with the topic 'Why is it so hard to get eSIM?' even trending on social media. The high threshold for eSIM usage deterred some users. Unless they are die-hard Apple fans, users are unlikely to use it as their primary phone. Another issue with the iPhone Air is its short battery life, with a battery capacity of only 3,149mAh. If users rely on it as their primary phone, they will need to charge it frequently, which is inconvenient.

In fact, the discussion about 'demystifying Apple phones' has been ongoing in the domestic market for some time. However, due to the influence of the Apple ecosystem, the combination of iPhone + Mac + iPad + Apple Watch + AirPods provides the smoothest and most comfortable user experience for those who have used any Apple product. It is not a matter of whether users recognize Apple products but rather a necessity to stay within the Apple ecosystem for a seamless experience. However, using Apple products is also influenced by 'willingness to spend.'

The reality is that users either quietly make the purchase or stick with their old phones.

By Guo Jing, WeChat Public Account: Guo Jing's Internet Circle