Apple: iPhone Holds Steady at the 'C' Position; When Will AI Truly Shine?

![]() 10/31 2025

10/31 2025

![]() 467

467

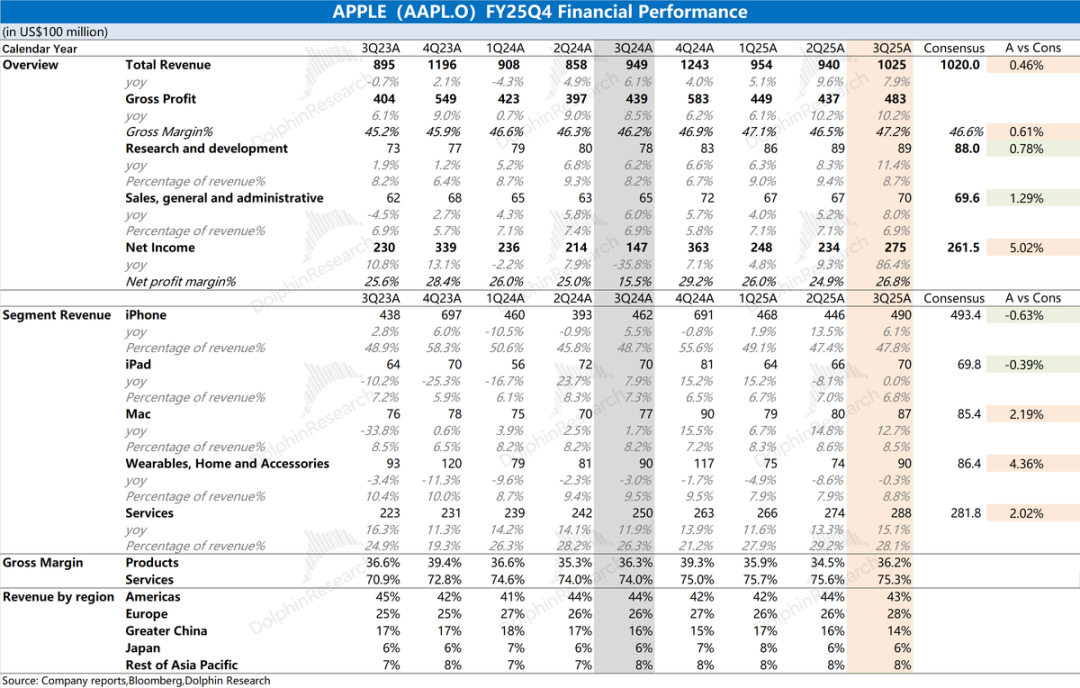

On the morning of October 31, 2025, Beijing time, following the close of the U.S. market, Apple (AAPL.O) released its financial results for the fourth quarter of 2025 (as of September 2025). Here are the key highlights:

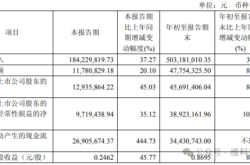

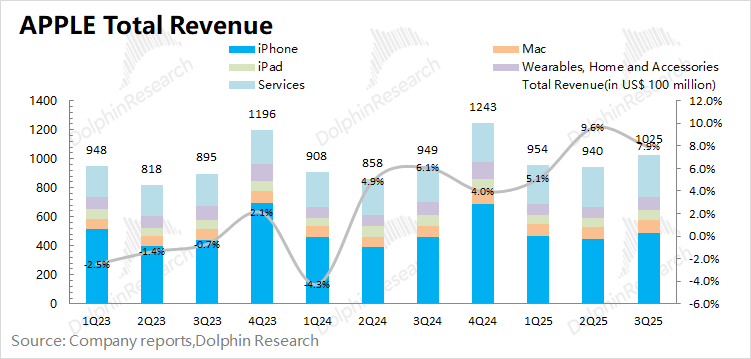

1. Overall Performance: This quarter, Apple generated $102.5 billion in revenue, marking a 7.9% year-over-year (YoY) increase and largely aligning with market expectations of $102 billion. The revenue growth was mainly propelled by the iPhone, Mac, and software services.

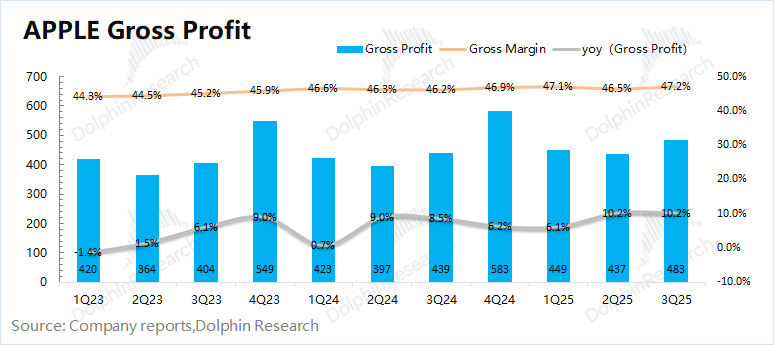

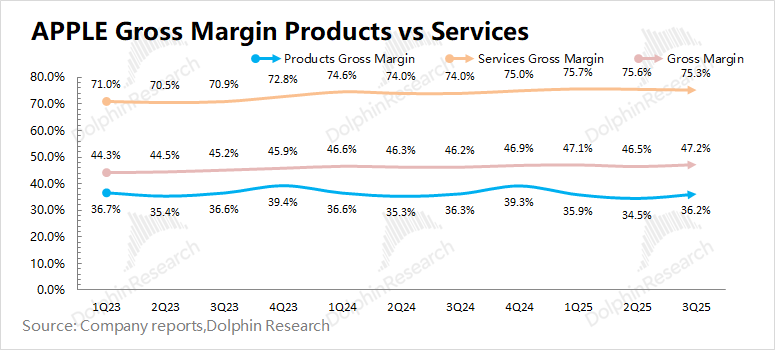

Apple's gross profit margin rose to 47.2%, up 1 percentage point YoY, outperforming the market consensus of 46.6%. The gross profit margin for software services improved to 75.3% YoY, while the hardware segment maintained a gross profit margin of 36.2% YoY.

2. iPhone: The iPhone division recorded $49 billion in revenue, a 6.1% YoY increase, slightly falling short of market expectations of $49.3 billion. The launch of the iPhone 17 series drove this growth. According to Dolphin Research, iPhone shipments grew by 4.6% YoY, with the average selling price (ASP) rising by 1.4%.

3. Other Hardware (Excluding iPhone): Mac revenue saw a 12.7% YoY increase, driven by strong sales of the MacBook Air across all regions, including double-digit growth in emerging markets. The iPad and other hardware businesses stabilized but remained relatively weak, impacted by the high base from last year's launches of the iPad Air and iPad Pro.

4. Software Services: Revenue reached $28.8 billion, surpassing market expectations of $28.2 billion. With a gross profit margin of 75.3%, software services contributed 28% of the total revenue but accounted for 45% of the gross profit.

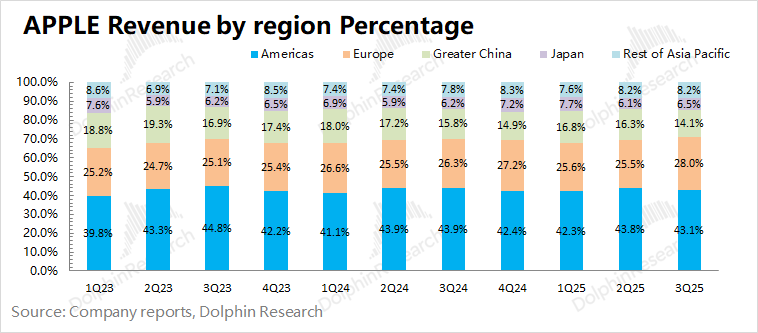

5. Regional Revenue: The Americas continued to be Apple's largest market, accounting for 43% of the revenue and experiencing a 6.1% YoY increase. Greater China was the only region to see a revenue decline (-3.6% YoY), affected by subsidy policies and delayed launches of the iPhone Air.

Dolphin Research's Overall Assessment: Steady Performance with Confidence-Boosting Guidance.

Apple's financial results largely met expectations, with revenue growth driven by the iPhone, Mac, and software services. Profit growth was enhanced by the absence of last year's €10 billion EU tax adjustment. Excluding this factor, the actual profit growth was around 10%.

Following the earnings announcement, Apple's stock initially dropped by 3% but rebounded to a 3% gain after management issued an optimistic forecast for the next quarter.

For the upcoming quarter, Apple anticipates: (1) Revenue to grow by 10-12% YoY (compared to the market consensus of 6%), with the iPhone driving double-digit growth; (2) A gross profit margin of 47-48% (compared to the consensus of 46.6%), partly due to reduced tariffs on China (from 20% to 10%).

The iPhone 17 series appears to be accelerating Apple's growth, achieving double-digit expansion once again.

[Based on U.S.-China negotiations: The U.S. plans to halve the existing "fentanyl tariffs" on Chinese goods from 20% to 10%.]

Additionally, two significant events from the previous quarter (the Google lawsuit and the fall event) concluded in September:

a) Google Lawsuit: The outcome was better than expected. While exclusive agreements with phone makers are prohibited, paid placements for the default search engine status remain permissible. Google continues to pay Apple over $20 billion annually for this privilege.

b) Fall Event: The iPhone 17 series introduced the Air model (replacing the Plus) and doubled the storage for the base model. Apple maintained incremental upgrades without any AI breakthroughs.

Stock Market Reaction: Apple's stock rose by 3% following the resolution of the Google lawsuit but fell by 3% after the fall event, reflecting market disappointment.

Although the fall event lacked AI surprises, the "more for less" strategy for the base iPhone models demonstrated sincerity. Priced at ¥5,999 (256GB), the iPhone 17 costs ¥5,499 after subsidies, effectively countering Android's mid-to-high-end competition.

Dolphin Research identifies both short-term and long-term drivers for Apple:

① Short-term: Focus on iPhone 17 shipments. The "more for less" approach is expected to boost sales, aligning with the strong guidance for the next quarter (the market expected around 3% YoY growth for the year).

② Long-term: AI progress. The market had hoped for AI announcements at the fall event, but none were made, causing the stock to dip. AI offers greater growth potential than iPhone refreshes. Clarity on AI breakthroughs or AI-centric next-gen products would be highly anticipated.

Overall, Apple's software risks have diminished, and it delivered solid financial results. The key focuses now are iPhone 17 shipments and AI progress.

Only AI breakthroughs can drive a significant breakthrough for Apple. The market still expects Apple to lead in on-device AI. Dolphin Research will share management commentary and detailed valuation analysis in the "Dynamic-Research" section of the Longbridge App.

Detailed Analysis Below

1. Overall Performance: Steady Progress

1.1 Revenue: Revenue for the fourth quarter of 2025 (3Q25) reached $102.5 billion, a 7.9% YoY increase, meeting market expectations of $102 billion. Growth was driven by the iPhone, Mac, and software services, while the iPad and wearables segments remained weak.

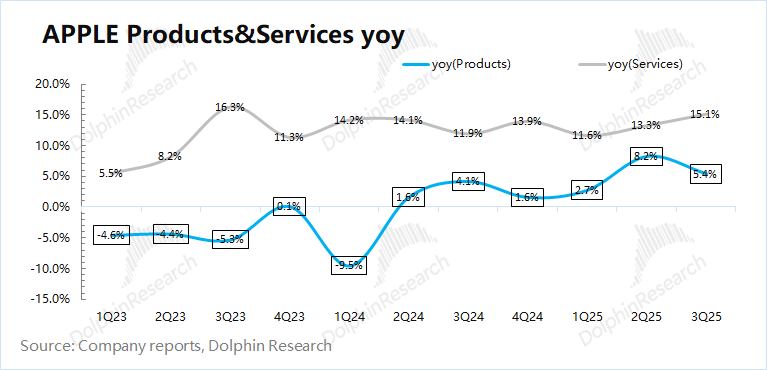

Hardware vs. Software:

① Hardware revenue grew by 5.4% YoY, sustained by growth in the iPhone and Mac segments, while the iPad and wearables stabilized.

② Software revenue grew by 15.1% YoY, accelerating after the resolution of the Google lawsuit reduced business risks.

Regional Breakdown: All regions saw YoY growth. The Americas (43.1% of revenue), Europe, and Greater China are the top markets.

The Americas grew by 6.1%; Europe accelerated to 15.2%. Greater China declined by 3.6% YoY (the only region to see a decline) due to delayed iPhone Air launches but is expected to rebound next quarter.

1.2 Gross Margin: The gross margin for the fourth quarter of 2025 was 47.2%, up 1 percentage point YoY (consensus: 46.6%), driven by software margin expansion and structural improvements.

Hardware vs. Software Margins:

Software margins remained high at 75.3%, the primary driver of overall margin growth. Hardware margins stayed at 36.2%, with tariff-related costs impacting approximately $1.1 billion. Excluding this, hardware margins would have been around 37.7%, up 1.4 percentage points YoY.

Reduced tariffs on China (from 20% to 10%) are expected to boost hardware margins in the next quarter.

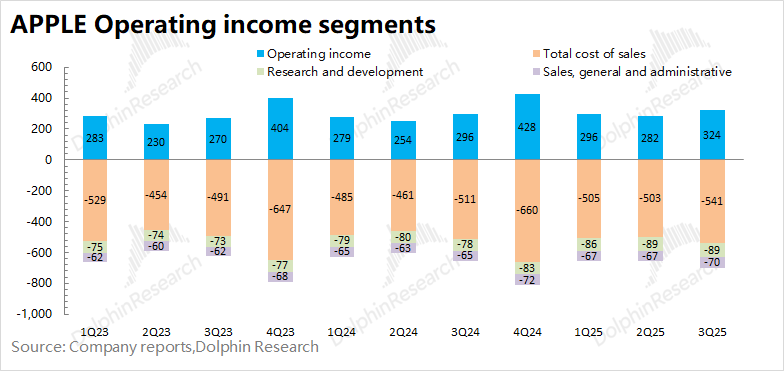

1.3 Operating Profit: Operating profit for the fourth quarter of 2025 reached $32.4 billion, a 9.6% YoY increase, driven by revenue growth and margin expansion.

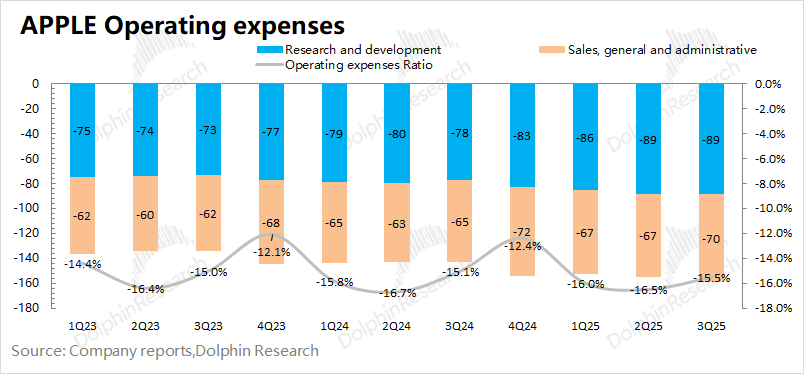

Operating expenses accounted for 15.5% of revenue, down 0.4 percentage points YoY. Sales and administrative costs remained stable, with increased R&D spending being the main driver.

Capital expenditures hit $12.7 billion for the fiscal year, a 34.5% YoY increase. Rising R&D and capital expenditures indicate heightened investment in AI and innovation. While no AI progress was announced, the market remains optimistic about Apple's on-device AI potential.