“Fire and Ice” at Xiaomi: Rising Performance, Yet Tumbling Stock Price

![]() 11/21 2025

11/21 2025

![]() 427

427

Xiaomi Group's third-quarter (Q3) performance reached a record high, but its stock price took a nosedive.

What led to this stark contrast between a “fiery” performance and an “icy” stock market reception? Was it due to a broad market correction, investors' expectations, or persistent negative publicity?

As an internet-renowned brand, Xiaomi capitalizes on the personal brand of its founder, Lei Jun, enjoying unparalleled traffic advantages. However, since the launch of Xiaomi Auto, particularly after two major accidents, the company has found itself ensnared in two conflicting online public opinion spheres. The double-edged sword of traffic and brand identity is now swinging against Xiaomi.

Perhaps it's time for Xiaomi to rethink its approach to public communication.

Performance vs. Stock Price: A Tale of Two Extremes

From every angle, Xiaomi Group's Q3 2025 performance was exceptional, with multiple business segments achieving record highs.

Currently, the smartphone × AIoT (Artificial Intelligence of Things) segment remains the bedrock of Xiaomi's business. In Q3, it generated 84.1 billion yuan in revenue, marking a 1.6% year-on-year increase and the ninth consecutive quarter of growth. The segment's gross margin stood at 22.1%, up 1.3 percentage points from the previous year.

Within this segment, the smartphone business contributed 46 billion yuan in revenue, with shipments reaching 43.3 million units, a 0.5% year-on-year increase. According to third-party data, Xiaomi ranked second in smartphone sales in mainland China, capturing a 16.7% market share and maintaining a top-two position for six consecutive quarters. Globally, it ranked third with a 13.6% market share.

The IoT and lifestyle consumer products business generated 27.6 billion yuan in revenue, a 5.6% year-on-year increase, with a gross margin of 23.9%, up 3.2 percentage points from the previous year. As of September 30, its AIoT platform had connected over 1.036 billion IoT devices (excluding smartphones, tablets, and laptops), a 20.2% year-on-year increase.

In October, Xiaomi's smart home appliance factory officially commenced operations, becoming its third large-scale smart factory after the smartphone and automotive plants. This marks a significant milestone for its major appliance business. The factory's Phase I has a planned total investment of 2.5 billion yuan and a peak annual capacity of 7 million air conditioners.

Additionally, internet services revenue reached a record high of 9.4 billion yuan, a 10.8% year-on-year increase.

Notably, Xiaomi Group disclosed in its Q3 report that the average selling price (ASP) of smartphones dropped from 1,102.2 yuan to 1,062.8 yuan year-on-year, leading to a 3.1% decline in smartphone business revenue.

During the post-report conference call, Xiaomi Group executives engaged in a dialogue with analysts.

Regarding the rapidly rising memory prices, analysts expressed concerns about their impact on smartphone profitability. Company executives acknowledged that memory price hikes would significantly affect product gross margins, which could only be mitigated through price adjustments and internal cost absorption. "We possess the capability to offset cost increases and maintain the smartphone × AIoT segment's gross margin above 20%," they asserted.

Automobiles represent Lei Jun's "final entrepreneurial venture" and his ultimate reputation gamble. Xiaomi's automotive business did not fall short of expectations.

In Q3, the automotive and innovation business segment generated 29 billion yuan in revenue, a staggering 199.2% year-on-year increase, driven by both vehicle deliveries and ASP. Deliveries rose from 39,800 units to 108,800 units year-on-year, while ASP increased from 238,700 yuan to 260,100 yuan. The segment achieved its first quarterly operating profit.

Xiaomi Group stated during the earnings call that despite only 18 months since product delivery began, total deliveries have exceeded 400,000 units, with monthly deliveries surpassing 40,000 units in September and October. The company is set to exceed its annual delivery target of 350,000 units ahead of schedule.

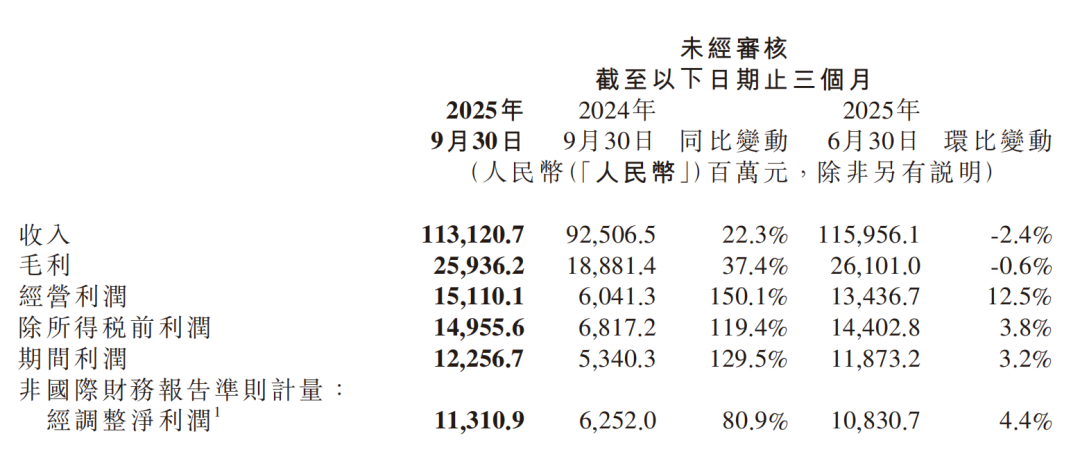

Driven by multiple businesses, Xiaomi Group achieved record-high Q3 performance, with revenue reaching 113.1 billion yuan, a 22.3% year-on-year increase, and adjusted net profit hitting 11.3 billion yuan, an 80.9% year-on-year surge.

However, the capital market responded differently.

Yesterday, Xiaomi Group-W (01810.HK) witnessed its stock price decline throughout the day, with a maximum intraday drop exceeding 5%, closing at HK$38.820 per share, a 4.81% decrease.

Since June, Xiaomi's stock price has generally trended downward, accumulating a 36.83% decline from its June peak of HK$61.450 per share.

Traffic and IP: A Double-Edged Sword

Xiaomi Group's soaring performance stands in stark contrast to its plunging stock price. Is this discrepancy attributable to market adjustments, investors' future expectations, or prolonged negative publicity? Making a precise judgment is challenging.

In the era of traffic, Xiaomi is one of the foremost beneficiaries, particularly through the personal brand of its founder, Lei Jun, who has emerged as China's most influential entrepreneur. He serves as Xiaomi's image ambassador and the "God of Thunder" to countless Mi fans.

Whether online or offline, Lei Jun's appeal rivals that of any top celebrity. Many consumers purchase Xiaomi products specifically because of him.

This deep integration of entrepreneurial brand identity and corporate brand has propelled Xiaomi's marketing success. Orders for Xiaomi Auto's two models within a day of their launch exceeded the annual sales of many new energy vehicle companies.

However, Lei Jun may not be in a jovial mood lately. Known for his gentle demeanor, he suddenly posted multiple emotional tweets on November 16, indicating genuine anger.

In the online realm, two opposing public opinion spheres exist around Xiaomi and Lei Jun. Devoted Mi fans revere his every word, while another group criticizes him harshly.

This divide became more pronounced after two major accidents involving Xiaomi Auto within six months.

On short video platforms, numerous videos mimic "Lei-style marketing," using Lei Jun's past product launch catchphrases to sell sweet potatoes and fruits. These appear more satirical than respectful.

Past marketing details have been scrutinized, magnified, and re-examined by netizens.

In response to online criticism, Lei Jun once stated that Xiaomi Auto is the most maligned automotive company and publicly called for industry-wide resistance against online water armies (organized groups that post positive comments to manipulate public opinion) and black PR (negative publicity campaigns).

Having reaped traffic dividends through its founder's brand identity, Xiaomi now seems to be suffering backlash.

Recently, multiple official media outlets questioned Xiaomi's business model and marketing strategies, a negative signal for the company.

Reports suggest that Wang Hua, Xiaomi Group's top PR executive, will be reassigned internally, ceasing his PR responsibilities. He joined Xiaomi in 2015, became PR department deputy general manager in late 2020, and group PR general manager in May 2021.

Whether this PR leadership adjustment will alter Xiaomi's future communication strategies remains uncertain.