Top-Tier Endorsements vs. Boss Cash-Outs: Breo’s Continuing Challenges

![]() 11/21 2025

11/21 2025

![]() 576

576

Breo, often hailed as the “leader in massage devices,” has faced significant headwinds in recent years. As the company released its third-quarter report for 2025, revealing losses exceeding 65 million yuan, the move by founder Ma Xuejun to cash out through stake reductions has drawn considerable attention. Simultaneously, the company’s strategy of securing endorsements from top celebrities in the entertainment and sports sectors creates a striking contrast. Will Breo manage to turn its fortunes around and escape this performance slump?

01. A Tale of Two Extremes

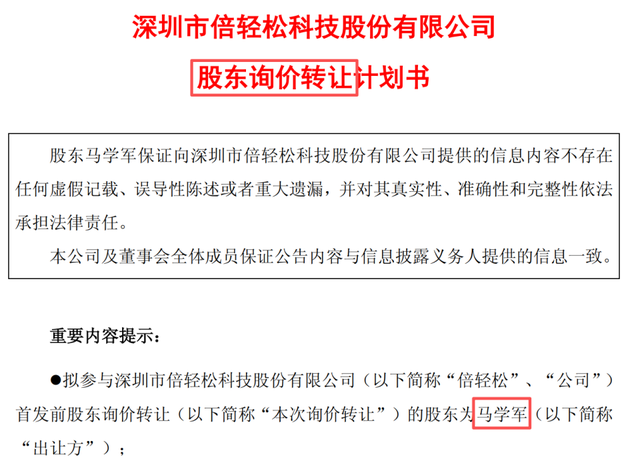

On the evening of November 14, Breo announced that its controlling shareholder and actual controller, Ma Xuejun, intends to reduce his stake by 2.5526 million shares, equivalent to 2.97% of the company’s total share capital, through a negotiated transfer prompted by “personal financial needs.” Based on the closing price, these shares hold a market value of approximately 78 million yuan.

This year has witnessed multiple stake reductions by major shareholders and executives at Breo:

In March, Ningbo Beisong, the company’s fourth-largest shareholder, announced a stake reduction, which was completed in July. In September, Wang Qiaoqing, a director and the third-largest shareholder, unveiled a stake reduction plan. According to the announcement, Wang's shareholding has dropped below 5%, with further reductions ongoing.

In comparison to previous stake reductions by shareholders, the nearly 3% reduction by the company’s largest shareholder and chairman, Ma Xuejun, stands out prominently. This move comes at a time when the company has just delivered a challenging performance report, making the significant stake reduction by the founder a clear bearish signal for investors.

According to Breo’s latest financial report, the revenue for the first three quarters of 2025 was 552 million yuan, marking a year-on-year decline of 34.07%. The net profit attributable to shareholders stood at -65.628 million yuan, a sharp drop of 600.98% compared to the same period last year. The adjusted net profit was -66.67 million yuan, plummeting by 826.41% year-on-year, with a net profit margin of -11.90%, indicating an 859.90% decline.

Such staggering declines place Breo among the worst performers among listed companies in the industry. What factors are contributing to this rapid profit decline?

Breo responded by stating, “Revenue has decreased compared to the same period last year, leading to a decline in gross profit. The efficiency of sales expense investment at the operational level has been insufficient, and fixed expenses and rigid costs have been difficult to adjust in the short term.” Clearly, escaping the performance slump remains a formidable challenge.

Following conventional business logic, when a company is under significant operational pressure, its leaders should project a positive and confident image to the outside world. Why, then, has Breo’s founder, Ma Xuejun, taken the opposite approach by reducing his stake at this critical juncture?

Additionally, in terms of social marketing, Breo has long relied on securing endorsements from top-tier celebrities. Past endorsers include Yi Yangqianxi and Xiao Zhan, both undeniable superstars in the entertainment industry. Breo’s ambitions seem to extend further, as it recently announced the signing of super-popular sports idol Sun Yingsha.

On October 31, Breo officially announced that table tennis world champion Sun Yingsha would serve as its global brand ambassador. This endorsement is a strategic move aimed at shaping the company’s professional and reliable brand identity. Breo believes that Sun Yingsha, as the world’s top-ranked table tennis player, embodies a “professional, reliable, and effective” champion image that aligns perfectly with the company’s “professional, reliable, and effective” technological brand image.

Breo also emphasized that this collaboration represents a “union of strengths,” further solidifying the company’s professional position in the smart massage sector. By leveraging Sun’s fan base, which consists largely of urban elites aged 25-35 and highly overlaps with Breo’s target audience, the company aims to achieve an efficient “brand awareness-to-consumption conversion” pathway.

On one hand, the company is facing substantial operational losses; on the other, its executives continue to cash out their stakes while signing new celebrity endorsers. Can Breo, mired in this “quagmire,” regain the confidence of the market and investors?

02. How Far Is the Brave New World?

A review of the situation reveals that the challenges facing Breo are evident and the difficulties are objective. Having identified its current “weaknesses,” the company theoretically has targeted areas for improvement. Let’s attempt to dissect Breo’s path to recovery.

In the first three quarters of 2025, Breo’s R&D investment was 43.69 million yuan, a year-on-year decrease of 6.3%. Reduced R&D spending directly impacts product innovation, a critical factor for product iteration efficiency and competitiveness. If Breo’s R&D investment does not improve in subsequent quarters, significant performance improvements may remain elusive.

As the saying goes, everything is interconnected. Without sufficient R&D innovation capabilities, it is challenging to create products with strong differentiated competitiveness, making it difficult to maintain a leading position in the fiercely competitive smart health consumer goods sector. Moreover, the massage device market includes traditional competitors like SKG, Osim, Panasonic, Philips, and Rongtai, as well as cross-border tech giants like Xiaomi.

For instance, Rongtai Health’s R&D investment once accounted for 6% of its revenue, with notable advancements in massage chair core technology upgrades. Osim boasts eight national-level technological innovation platforms, including CNAS-accredited laboratories, national enterprise technology centers, and the Traditional Chinese Medicine Intelligent Tuina Massage Health Research Institute. It has also recently been awarded the China Light Industry Intelligent Health Massage Equipment Key Laboratory honor.

Xiaomi, with its unique ecosystem spanning people, vehicles, and homes, wields significant brand influence and R&D innovation capabilities. Its massage device products benefit from intelligent features and cost-effectiveness, ensuring strong sales even as a non-core business, securing the seventh-highest sales ranking in the industry.

Of course, Breo has its strengths. It is arguably the industry leader in integrating traditional Chinese medicine theory with product design, and its high-end massage chair craftsmanship and materials are notable advantages.

These visible strengths are well-suited for showcasing and customer acquisition in offline stores. Consequently, Breo is accelerating its offline direct-sales store expansion. As of the first half of 2025, Breo operated 125 direct-sales stores globally and opened six “Easy Moment” stores in Shenzhen, Guangzhou, and Xi’an. In the second half of 2025, Breo plans to further increase the density of direct-sales stores in key cities like Guangzhou and Shenzhen.

However, whether the profit growth from offline stores can offset the company’s losses remains to be seen. Additionally, offline store expansion is a capital-intensive endeavor, with significant upfront costs that could strain Breo’s already tight cash flow. Thus, financing may be another hurdle Breo must overcome.

Fortunately, Breo is also striving to advance an integrated online-offline development model. To mitigate offline store costs, it continues to promote a complementary direct-sales and franchise model. Future overseas market expansion, particularly in Southeast Asia and the Middle East, may enhance its international growth narrative.

From a macro perspective, the massage device market remains unsaturated, presenting significant opportunities for brands like Breo. Some institutions project that China’s massage device market will reach 39.2 billion yuan by 2029. Research from Data Bridge Market Research indicates that the global massage device market was valued at 11.17 billion USD in 2024 and is expected to reach 24.83 billion USD by 2032, with a compound annual growth rate (CAGR) of 10.5%.

Will Breo be the last one standing?

Only time will tell.

References:

Sun Yingsha’s Endorsement Leads Breo’s New Development Era - Xinyang News Network

Financial Breakdown: Breo’s Net Profit for the First Three Quarters Reaches -65.628 Million Yuan, Compared to 13.0998 Million Yuan in the Same Period Last Year - East Money Research Center

Breo’s Actual Controller Joins Stake Reductions, Significant Losses in the Second Year After Listing, Stock Price Peaks Early - Feikan Finance

Just Half a Month After Announcing Sun Yingsha as Spokesperson, Breo’s Founder Ma Xuejun Cashes Out Nearly 3% - Yema Finance