Spotify: Another Surge? The Music Giant Delivers the Standard Answer

![]() 07/24 2024

07/24 2024

![]() 601

601

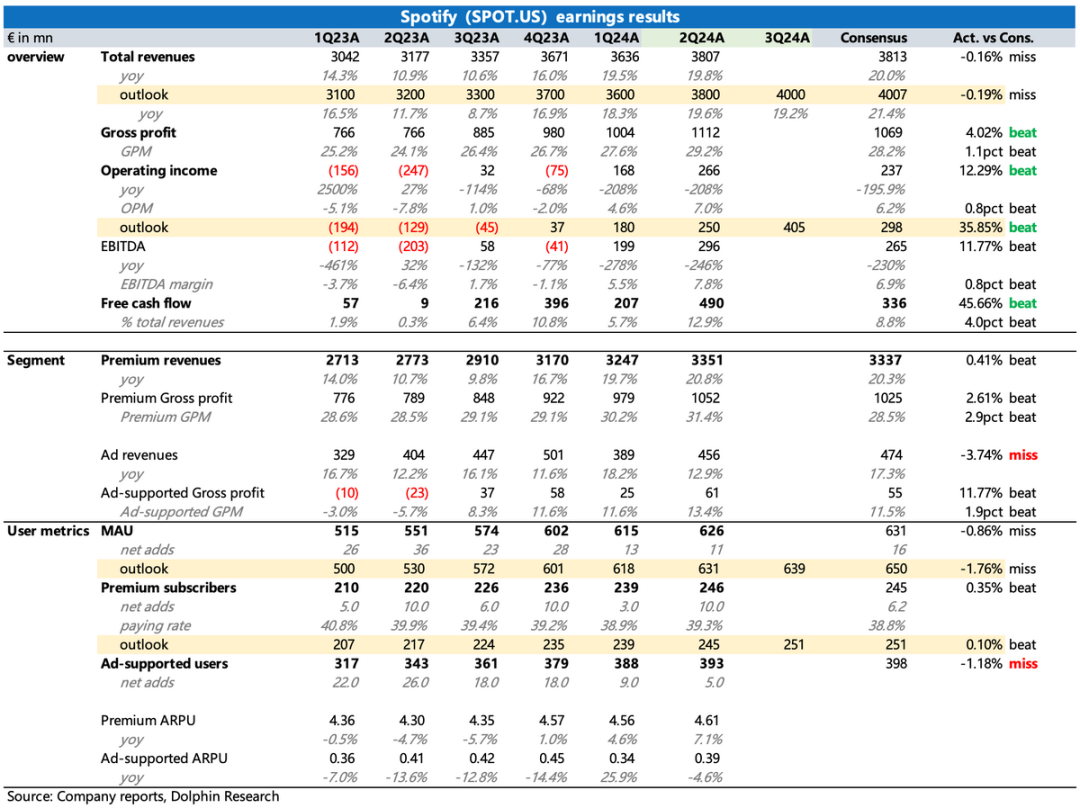

Spotify released its second-quarter earnings report before the U.S. market opened on July 23. Prior to the earnings report, the market's primary concern was the company's profit improvement, which has been the core logic behind Spotify's share price doubling since its first price hike in July last year. With the implicit price hike in June's bundled package, the market was not only focused on the impact of the price hike on gross margin expansion but also eagerly awaited more descriptions and clear guidance from management regarding user feedback on the new bundled package, actual optimization of content costs, and mid-to-long-term gross margin improvement targets. Let's dive into the core highlights of the earnings report:

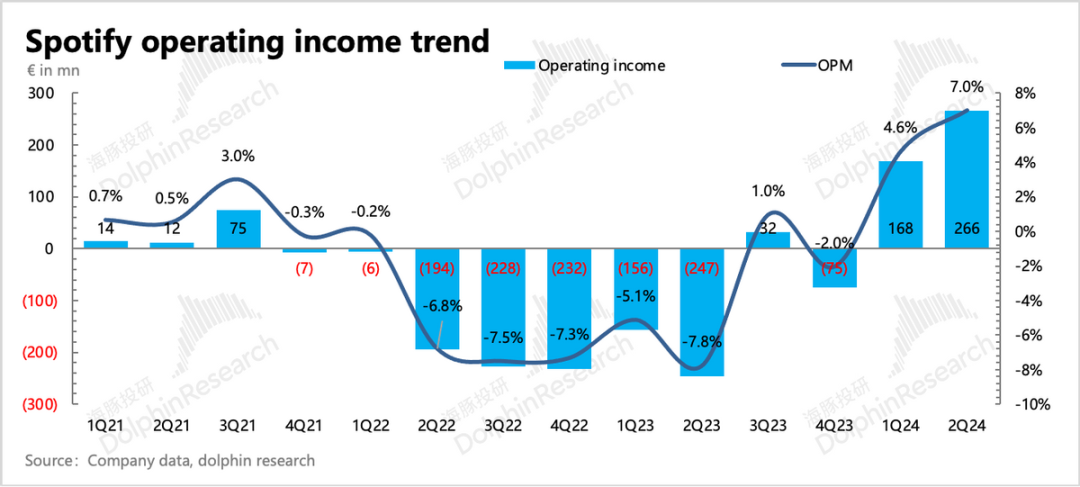

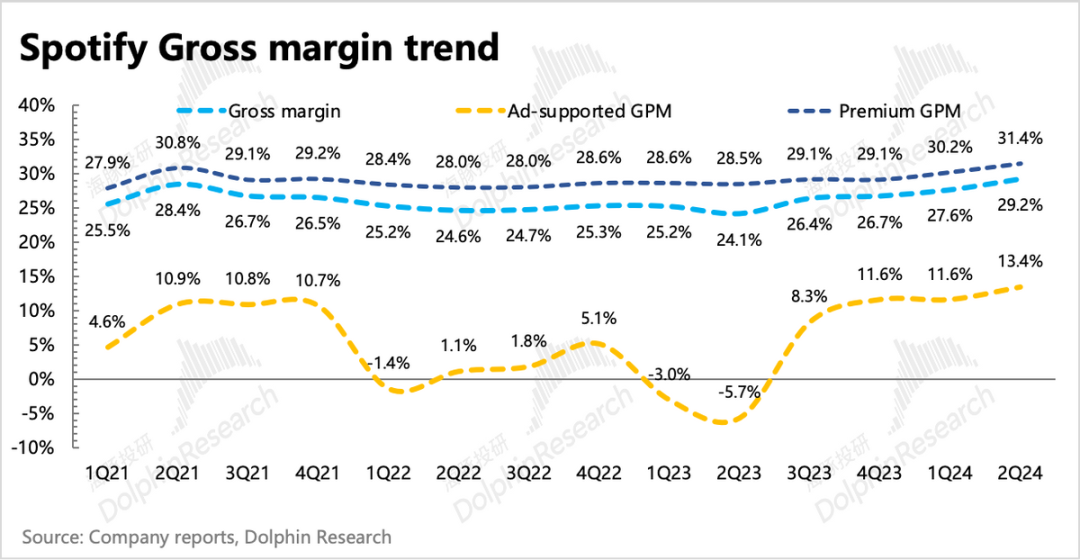

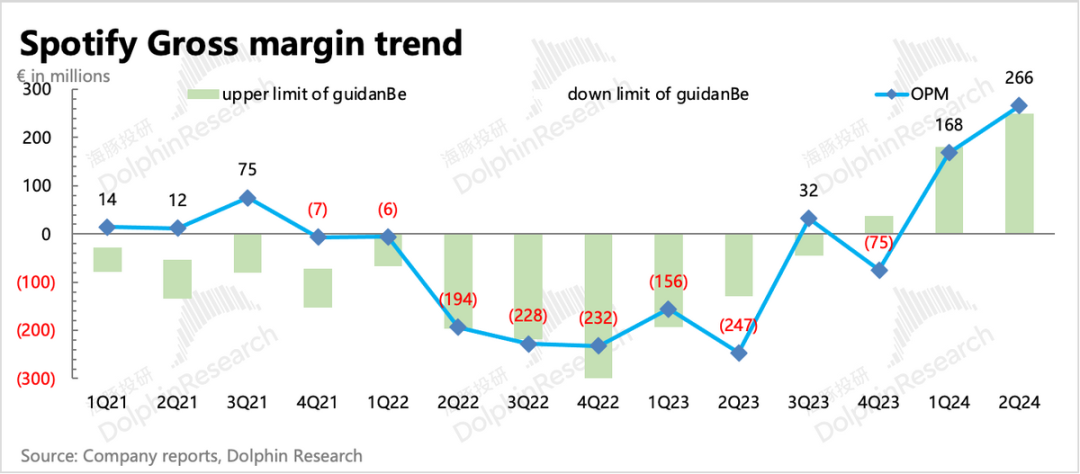

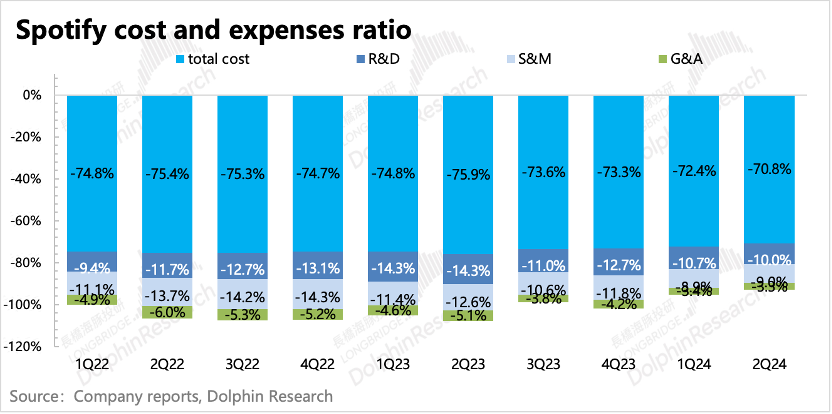

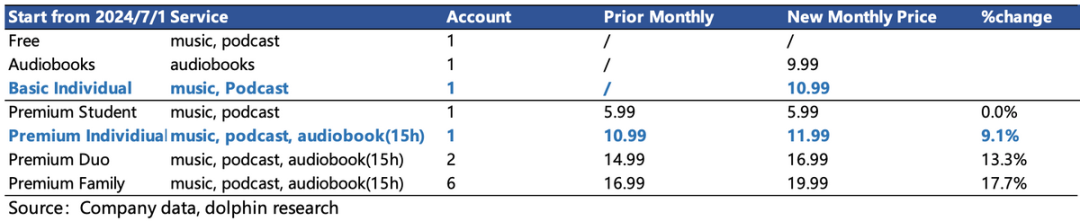

1. Responding to Expectations, Gross Margin Provides Positive Guidance: This Q2 earnings report somewhat addressed the market's expectations regarding profitability: Q2 earnings slightly exceeded expectations, and guidance for Q3 significantly exceeded expectations. Since operating expenses generally do not change much, Spotify's profit elasticity primarily comes from gross margin, which is largely influenced by content costs. By breaking down content costs, Dolphin Insights estimated that after adding audiobook costs, Q2 content costs accounted for a slightly lower proportion of subscription revenue, decreasing by 1pct. However, the "bundled package" was not fully implemented in Q2, indicating that even without it, Spotify has been subtly weakening the influence of the three major labels through algorithmic preferences and support for independent musicians. The company's positive guidance for Q3 implicitly reflects management's high confidence in user feedback and cost optimization from the bundled package. More insights can be gained from management's responses during the earnings call.

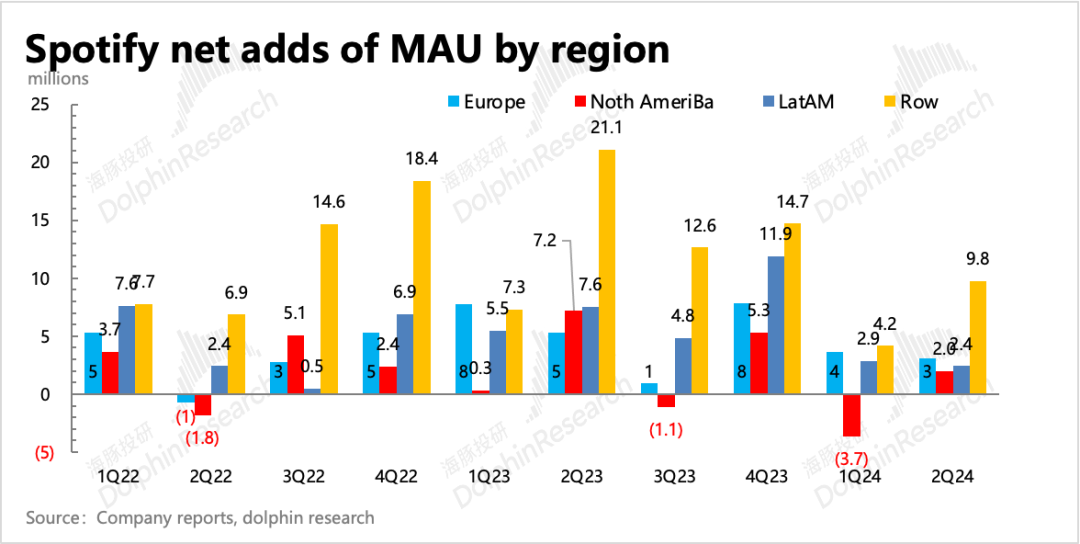

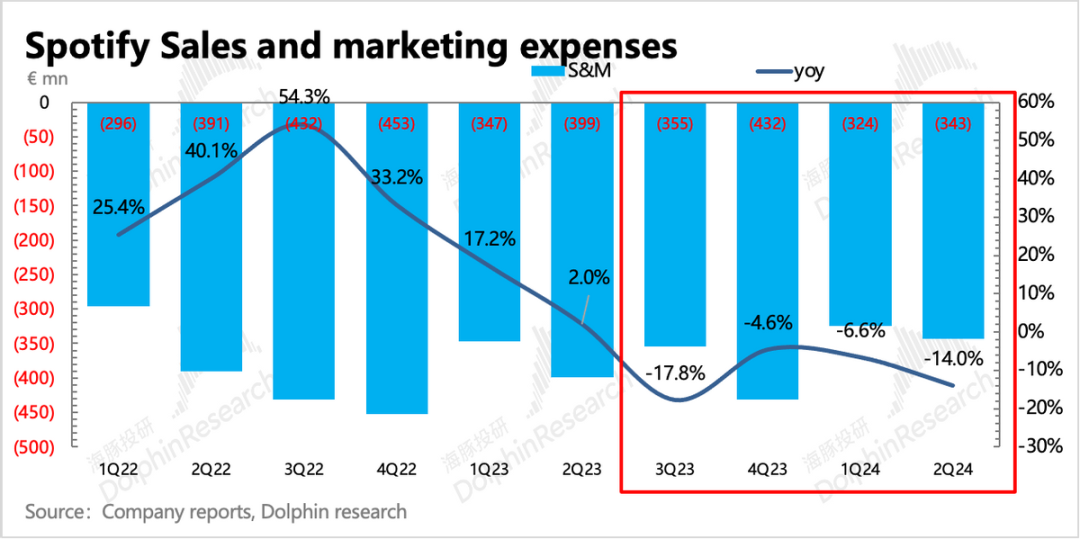

2. Mediocre User Acquisition? Partially Expected: MAU increased by 11 million in Q2, falling short of the original guidance of 16 million, and the outlook for Q3 was also below expectations. Unlike Netflix, Spotify has both paying and free ad-supported users, resulting in a total MAU of 626 million. Excluding China, Spotify's overall market share is very high, and user acquisition has entered a plateau phase. Regionally, more user growth potential lies in emerging regions, which requires increased marketing and promotion costs to stimulate demand. However, Spotify's sales expenses have declined year-on-year since the second half of last year, potentially impacting user acquisition in emerging markets and resulting in two consecutive quarters of MAU falling short of guidance. Nonetheless, third-party platforms have gradually disclosed MAU data over the past three months, so some of this negative impact has already been reflected in the share price.

3. Strong Subscriptions, Advertising Drags: The direct impact of mediocre user acquisition, especially in emerging regions, is dragging down advertising revenue. Both ad-supported users and advertising revenue fell short of expectations in Q2, with significantly slower growth rates. In contrast, the subscription user base, primarily in Europe and the U.S., grew steadily, and overall subscription revenue largely met expectations due to the price hike.

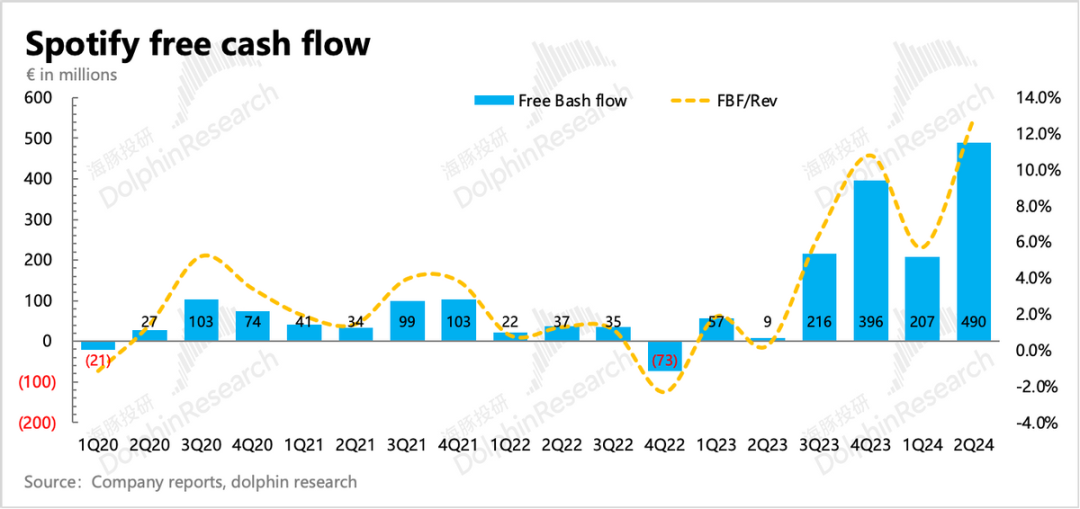

4. Improved Profitability Boosts Cash Flow: Improved profitability in the main business naturally leads to simultaneous improvements in cash flow. Spotify's free cash flow reached 490 million euros in Q2, a record high. The proportion of free cash flow to revenue also increased to 13%, up more than 6 percentage points from the previous quarter.

5. Financial Highlights

Dolphin Insights View: In two in-depth reports over a month ago, Dolphin Insights mainly mentioned a logical point: Due to Spotify's high market share and a competitive environment with non-trivial threats (limited exclusive content advantage), the key to lifting Spotify's valuation to the next level lies in slashing content distribution fees. When the long-standing rigid distribution ratio permanently declines, Spotify's valuation still has considerable room based on the current and future cost optimization expectations of Netflix and TME. Similarly, if short-term changes cannot be achieved, such as if the final solution for the bundled package is for Spotify to restore its original pricing system, then relying solely on short-term performance and share price stimulation from price hikes, without competitors following suit, may lead to user backlash, which translates to an unsafe valuation. However, amidst the legal tug-of-war with copyright associations, Spotify introduced an original-priced Basic plan to appease concerns (although we expect over half of users will default to renewing the bundled plan due to user habits and cost-effectiveness), and this controversy may not reach a conclusion soon.

This may provide Spotify with a crucial window to reduce content distribution fees, showcasing its platform dominance. Despite the flaw in user growth in this earnings report, Spotify largely met market expectations with its better-than-expected current and guidance profitability performance regarding the market's primary concerns. In the upcoming earnings call, analysts will likely try various tactics to elicit more feedback from management on the bundled package. In terms of valuation, Spotify's valuation is not low compared to similar tech stocks, and although it has adjusted recently, it is still above our previous conservative expectations and slightly below neutral expectations. However, due to this faster-than-expected profit improvement and the current pivotal juncture for Spotify's cost optimization logic to materialize, the share price is expected to remain relatively strong in the short term.

Detailed Earnings Review Below

I. Mediocre User Acquisition, Likely Due to Reduced Marketing

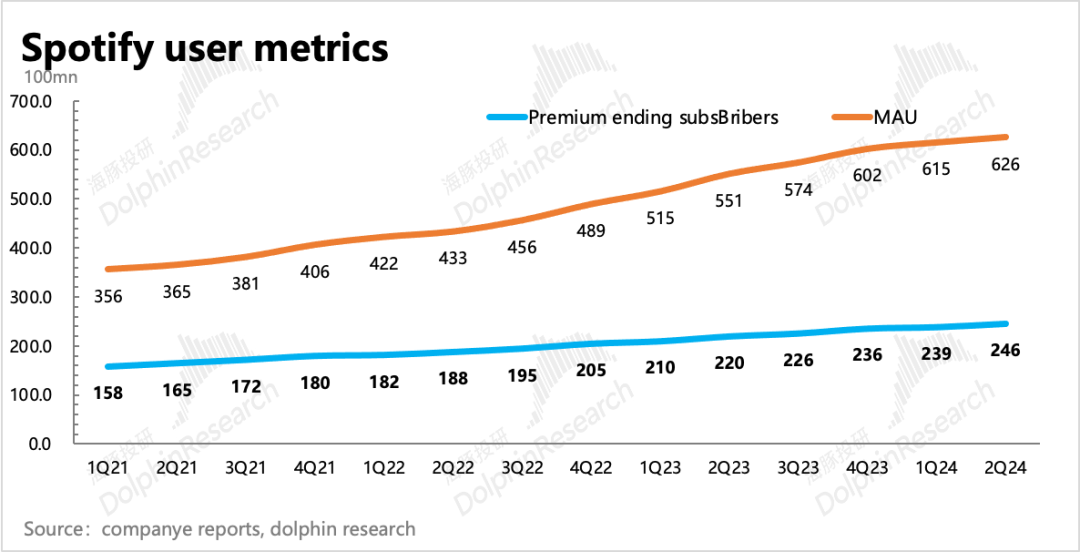

In Q2, Spotify acquired 11 million users, with an average monthly active user base of 626 million, with growth primarily from Europe and other regions, primarily Indonesia and Colombia based on third-party data. This aligns with the company's growth strategy over the past two years, focusing on user penetration in Asia and South America.

For two consecutive quarters, user acquisition fell short of guidance, which Dolphin Insights believes may be due to reduced marketing expenses over the past year. However, the pleasant surprise of gross margin improvement overshadowed the concern over user growth, and the market may have implicitly assumed that the music streaming market has entered a steady phase, thus paying more attention to Spotify's profitability.

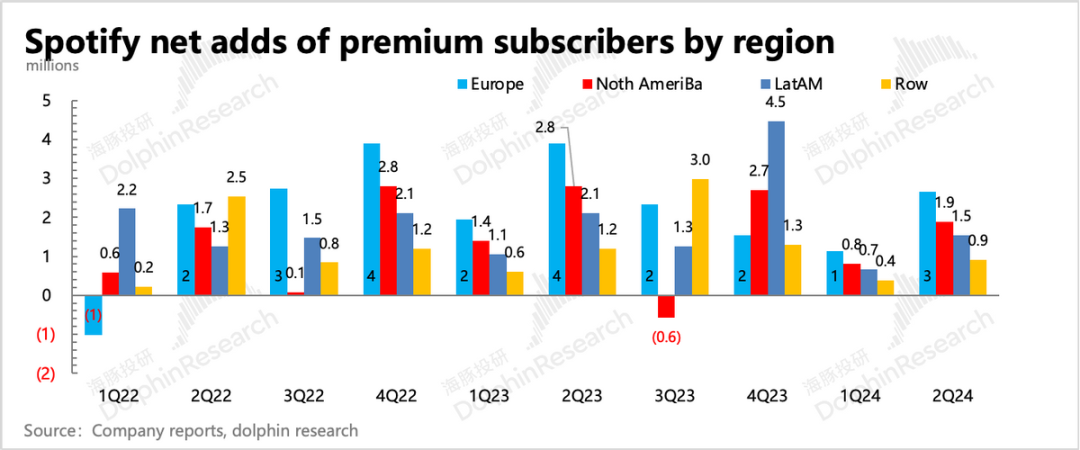

Conversely, paid subscriptions were more stable. And from the perspective of paid subscribers, Europe and the U.S. remained the main drivers, not only reflected in the growth of paid subscribers due to high conversion rates but also in their effective support for overall subscription revenue growth due to higher ARPU.

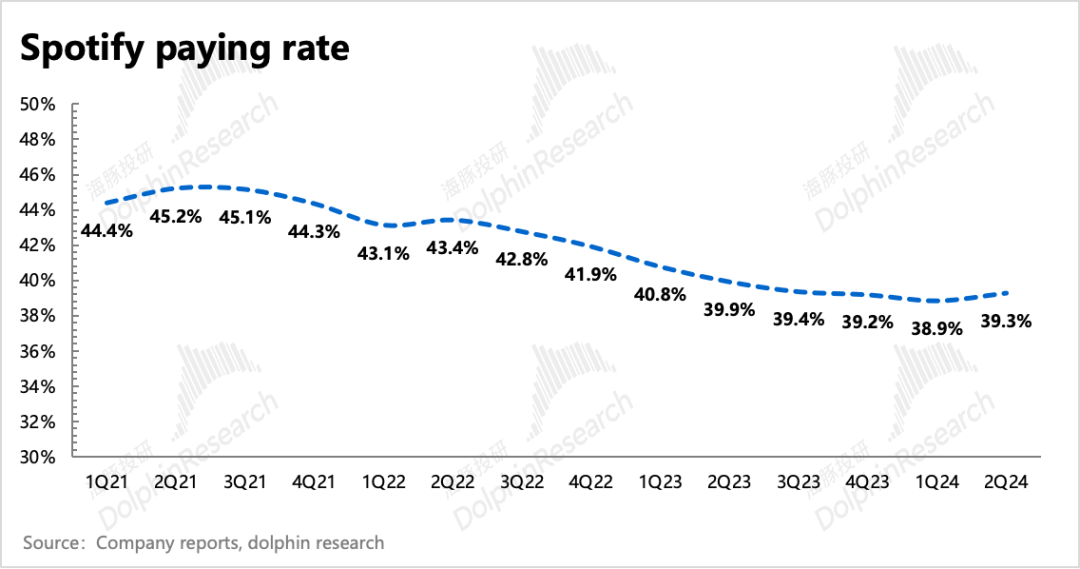

Therefore, Spotify's growth story is about earning profits from the European and American markets while attracting low-paying users in emerging developing countries through free ads, building a user base of over 600 million, and waiting for future paid conversions. As of Q2, of the 626 million users, 246 million were paid subscribers, with a pay rate of 39.3%, which has trended downward over the past three years. Although the main new users in recent years come from emerging markets, where paid conversion is more challenging than in Europe and the U.S., the potential for future paid conversions exists.

For Q3 guidance, the company expects MAU to increase by 13 million to 639 million, lower than the market's expected net increase of 19 million. However, the company's guidance for end-quarter subscribers of 251 million is broadly in line with market expectations. This reflects a situation where, despite market saturation (requiring investment in user education in emerging markets), Spotify can maintain subscription user growth through internal conversions from its 630 million user base, ensuring stable performance.

II. Strong Subscriptions, Advertising Drags

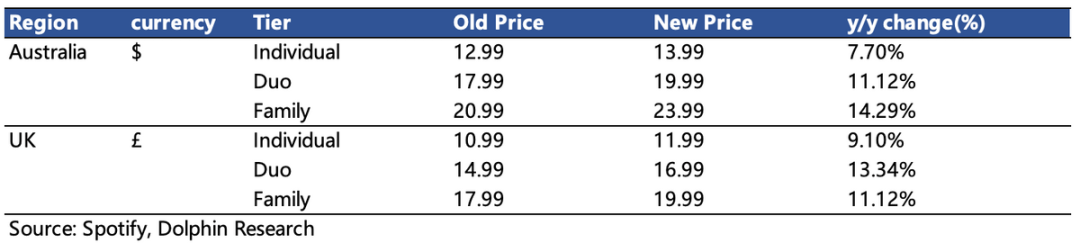

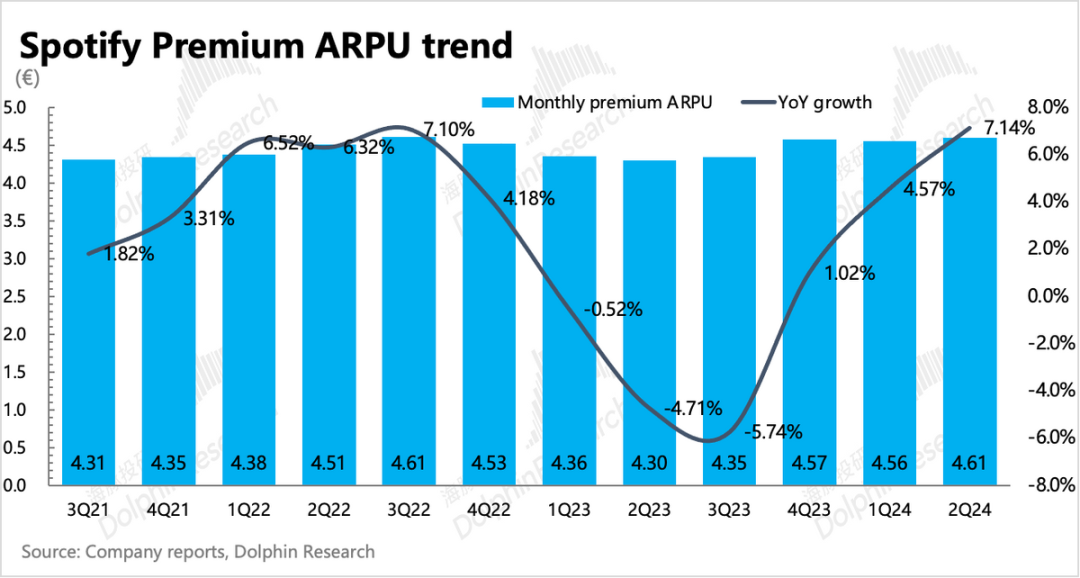

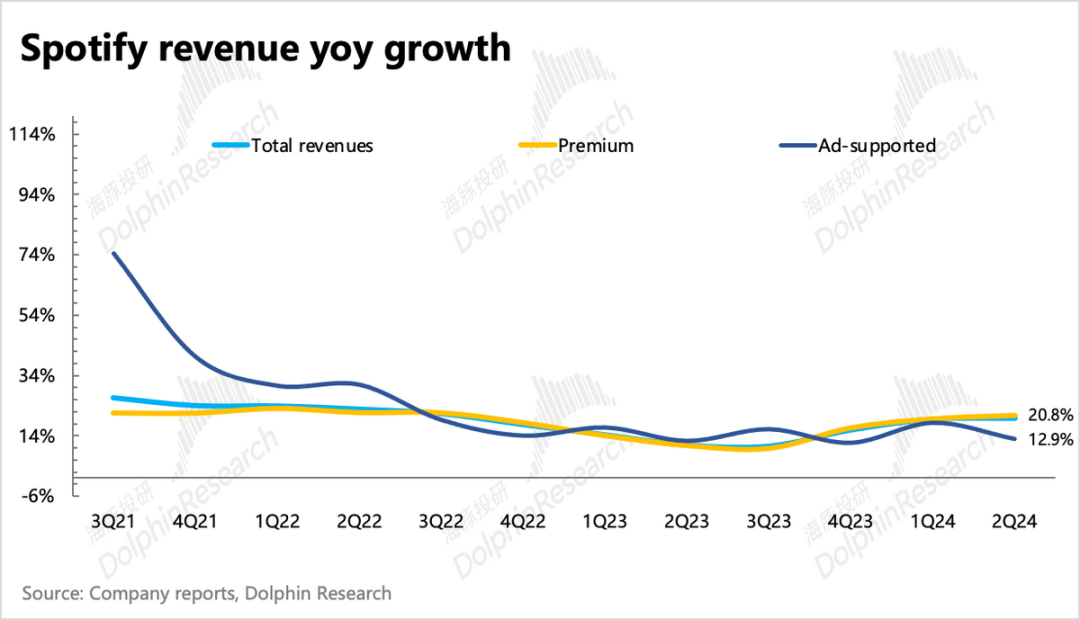

In terms of revenue, the difference in growth between free ad-supported users and paid subscribers led to varying business growth trends. Coupled with the impact of price hikes, subscription revenue growth remained stable at 20.8% in Q2, while advertising revenue slowed sharply to 13%. Since subscriptions account for 88% of Spotify's revenue, the slowdown in advertising did not significantly hinder overall revenue growth, which still followed the movement of subscription revenue. Looking ahead to Q3, the company guided for revenue of 4 billion euros, implying a year-on-year growth rate of 19.2%, primarily driven by price hikes (which also occurred in the U.K. and Australia following the U.S.). This is in line with market expectations and the management's previous short-to-medium-term guidance of "striving to maintain 20% revenue growth."

III. Gross Margin Exceeds Expectations, Cost Reduction on the Horizon Beyond Price Hikes

The highlight of the Q2 earnings report was profitability, particularly gross margin performance, which improved by 1.6pct compared to Q1. Although operating expenses were also compressed, their impact on profits was less significant compared to the nearly 70% cost component.

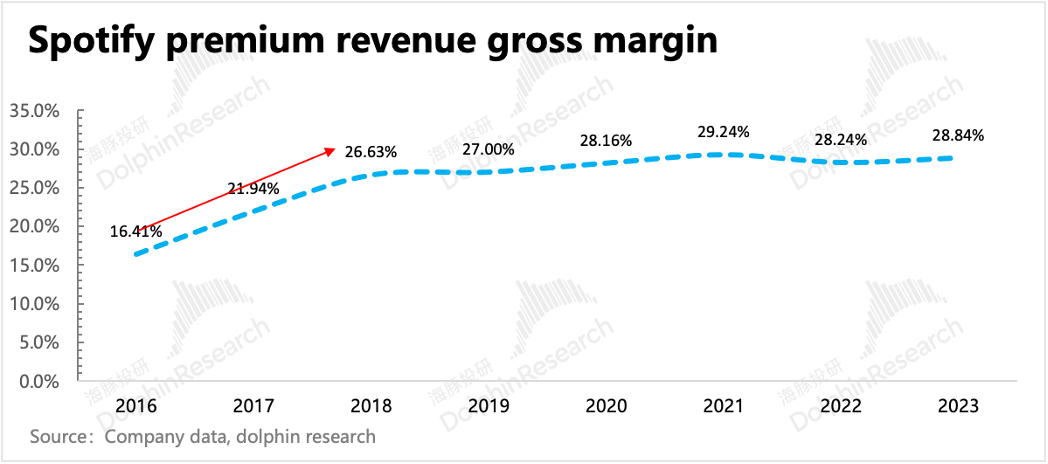

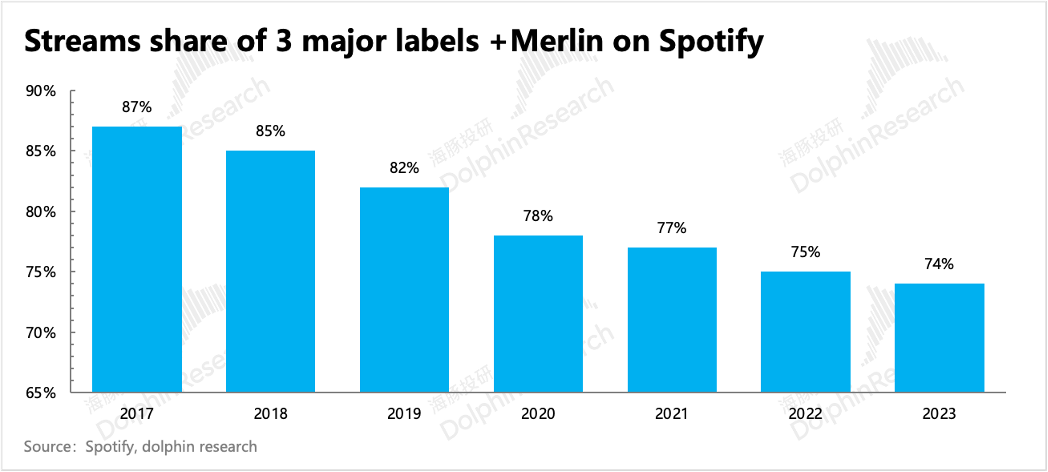

Among costs, the rigid copyright content cost is the most challenging and accounts for the largest proportion, while the amortization cost of actual proprietary content is very low. Whether there is room for compression depends on Spotify's commercial negotiations with upstream content providers. In "Why is Spotify Bold Enough to Raise Prices Higher Than Apple Music?," Dolphin Insights discussed the development of the music industry and changes in industrial chain profit-sharing ratios. Historically, profit-sharing ratios have not been absolutely rigid, and Spotify has twice reduced the profit-sharing ratios of the three major labels.

As Spotify's traffic continues to grow, the number of excellent works from small and medium-sized labels and independent musicians increases, and as a platform, Spotify has the ability to control traffic distribution through algorithms. Over the past few years, the playback share of the three major labels on Spotify has gradually decreased. Therefore, when the balance of power in the industrial chain shifts in favor of Spotify, the rigid profit-sharing ratio may no longer be rigid.

In fact, by breaking down Q2 cost items, Dolphin Insights estimated that the proportion of content copyright costs to total revenue decreased by approximately 1.3pct. Even after adding audiobook costs, the cost proportion decreased, indicating that, on the one hand, the price hike had an effect, and on the other hand, content costs also showed a further slowdown in growth from a low base, indirectly suggesting a loosening of profit-sharing ratios. Beyond natural content cost optimization, Spotify's June bundled package actively accelerated the optimization pace. For a detailed analysis, refer to Dolphin Insights' "Spotify Deep Dive: How Many Tencent Musics is it Worth?" The final conclusion is that through the bundled package, the cost shared by content providers decreased by 16%, and Spotify's gross margin is expected to increase by 1.5-3pct (corresponding to 50%-100% acceptance of the $1 music and audiobook bundled package).

Lastly, improved profitability in the main business also led to simultaneous improvements in cash flow. Spotify's free cash flow reached 490 million euros in Q2, a record high. The proportion of free cash flow to revenue also increased to 13%, up more than 6 percentage points from the previous quarter.