vivo faces a dilemma: difficult to build a high-end image

![]() 08/13 2024

08/13 2024

![]() 593

593

In today's fiercely competitive mobile phone market, high-end products have become a major trend for domestic mobile phones. In recent years, vivo has focused on developing the high-end market, not only launching the X Fold3 series to join the competition in the foldable screen market but also releasing its first Ultra phone, attracting market attention.

Securities Star notes that simply launching new models is insufficient to support the company's high-end development. In the high-end market competition, vivo faces many challenges, such as increased difficulty in technological innovation breakthroughs and less distinct differentiated advantages.

As vivo has yet to successfully establish a high-end image, the company has encountered obstacles in its development in the Indian market. It must not only endure pressure from the local government but also maintain its hard-won position in the fiercely competitive market, making the situation even more challenging.

01

New products fail to meet consumer expectations

Since entering May, vivo has continuously launched new models across the X, S, and Y series, with subsidiary brand iQOO also taking action. The company even introduced its first Ultra phone, sparking heated debate in the mobile phone industry and selling its top-of-the-line version for RMB 7,999.

Securities Star notes that many users have reflected that the new models have failed to fully meet their expectations in some aspects. Furthermore, within less than three months of their launch, price reductions for multiple phones have attracted widespread attention both within and outside the industry.

The vivo S19 series was launched on May 30, 2024, comprising the vivo S19 standard edition and vivo S19 Pro. Focusing on portrait photography and battery life, the series went on sale officially on June 7. Depending on the configuration, the vivo S19 is priced between RMB 2,499 and RMB 3,999, while the vivo S19 Pro is priced between RMB 3,299 and RMB 3,999.

The phone experienced a price reduction just two months after its launch. On Taobao's official flagship store, the price of the 8GB+256GB version of the vivo S19 has now dropped to RMB 2,079, while the 8GB+256GB version of the vivo S19 Pro has fallen to RMB 2,879. Securities Star notes that on Pinduoduo's Hundred Billion Subsidy program, the price of the 8GB+256GB version of the vivo S19 Pro has plummeted by over RMB 600 to RMB 2,641.

In terms of reputation, reviews of the vivo S19 series are mixed. Some users believe its screen resolution is inferior to Huawei phones at the same price point, and its photography results are not as expected. However, other users praise its excellent battery life.

The vivo X100 Ultra, launched half a month earlier than the vivo S19 series, has also suffered significant price reductions. On May 13, 2024, vivo held the "New Blueprint for Imaging and X Series Product Launch Event," unveiling its first-ever Ultra phone, the vivo X100 Ultra, priced from RMB 6,499.

On May 28, 2024, the vivo X100 Ultra went on sale officially. Equipped with the third-generation Qualcomm Snapdragon 8+LPDDR5X+UFS 4.0 combination, featuring a multi-core architecture for rapid performance improvements, the phone achieved sales of RMB 500 million within just one hour of its launch.

As a highly anticipated product, the X100 Ultra also has notable drawbacks. Many reviewers have reported that the standard curvature of its curved screen and noticeable green edges significantly detract from its appearance. Additionally, the X100 Ultra lacks standout selling points beyond its telephoto capabilities, with features like IP69 rating and single-point ultrasonic fingerprint unlocking failing to establish unique differentiated advantages.

Currently, the vivo X100 Ultra has begun a price reduction, with its starting price now below RMB 6,000 at RMB 5,625.

02

Difficult to establish a high-end image

In today's fiercely competitive mobile phone market, high-end products have become a crucial strategy for manufacturers seeking development and breakthroughs, and vivo is no exception.

vivo began exploring the high-end route around 2018. At that time, it introduced the NEX series, which made bold innovations in design and technology applications, such as adopting a pop-up front camera and advanced in-screen fingerprint sensors, taking its first tentative steps into the high-end market. However, the development of the NEX series fell short of expectations. Although it achieved technological breakthroughs, market performance was unimpressive, leading vivo to officially discontinue the NEX series on October 20, 2020.

Subsequently, vivo gradually shifted its focus to the X series, continuously enhancing the high-end attributes of its products through collaborations with Zeiss to improve imaging capabilities and introducing self-developed chips to optimize performance. Simultaneously, vivo has increased investments in imaging functions, processor performance, and design to create high-end products with unique competitiveness.

Currently, vivo's X series encompasses various models, including the X100 series, X90 series, X Flip, and X Fold, each with distinct features. For instance, the X100 series is equipped with high-performance processors and advanced imaging technology, while the X Fold series offers foldable screen phones.

But can the X series support vivo's high-end development?

Taking the X100 series as an example, its core selling point is imaging technology, featuring a Zeiss triple camera system with a full focal length range, including a 50MP super-sensitive VCS bionic primary camera, a 64MP periscope telephoto lens, and an ultra-wide-angle lens.

It should be noted that competition in imaging technology is fierce. According to various sources, the domestic flagship mobile phone market will continue to compete vigorously in imaging technology in the second half of this year. Major flagship phones like Huawei Mate70, Honor Magic 7, and Xiaomi 15 series have all chosen OmniVision sensors as their core imaging configuration, marking another significant breakthrough in domestic mobile phone imaging technology. It is evident that it will not be easy for vivo to stand out in imaging technology.

Recognizing this, vivo has tried different approaches and targeted the foldable screen market.

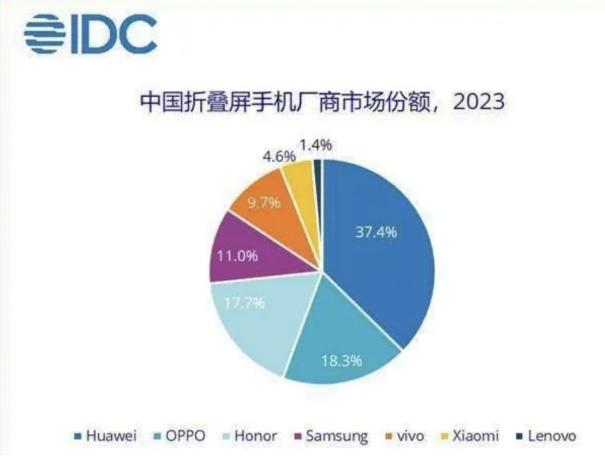

In recent years, foldable screen phones have regained public attention and become a "must-compete" area for mobile phone manufacturers. Securities Star's analysis reveals that vivo entered the foldable screen market relatively late. After Huawei, Xiaomi, and OPPO successively launched foldable phones, vivo belatedly joined the fray, introducing its first foldable phone, the vivo X Fold, in April 2022.

It should be noted that in the context of a relatively small global foldable screen market, it remains uncertain whether vivo, which has lost the early advantage, can firmly establish its position in this competitive landscape.

According to a report by TrendForce, global sales of foldable screen phones exceeded 15.9 million units in 2023, representing a 25% increase year-on-year and a market share of 1.4% among smartphones, indicating a modest market size.

In the domestic market, according to IDC research, Huawei ranks first with a market share of 37.4%, followed by OPPO, Honor, and Samsung in second, third, and fourth places, respectively. vivo ranks fifth with a market share of 9.7%.

03

Development hindered in the Indian market

Apart from its high-end strategy, vivo initiated a globalization strategy in 2014, successively expanding into markets such as India, Thailand, Indonesia, and the Philippines.

Among these markets, vivo's development in India has been particularly noteworthy. According to market research firm Counterpoint, vivo ranked second in India's smartphone market share in 2023 with a 17% share, second only to Samsung. In the first quarter of this year, vivo led the market with a 19.2% share, surpassing Xiaomi, Samsung, OPPO, and others.

Securities Star notes that Chinese mobile phone manufacturers face difficulties in India.

Since 2020, many Chinese companies like Xiaomi, OPPO, and vivo have struggled with "harassment" in India, first with over 200 Chinese mobile apps being banned and then with various reasons cited to target Chinese enterprises.

In late 2023, the detention of several senior executives from vivo India, including its interim CEO and CFO, garnered significant attention.

This year has also seen continuous negative news about the Indian market.

In mid-June, media reported that under pressure from the Indian government, vivo was considering transferring a 51% stake in its Indian subsidiary to Indian tech giant Tata Group to remain in the Indian market. If successful, vivo India Mobiles Private Limited would become a joint venture controlled by Tata Group.

According to the latest report by The Times of India, Apple has strongly opposed Tata Group's acquisition of vivo's mobile phone business in India. This incident sparked heated debate, with some netizens suggesting that Apple's opposition was not only due to conflicts of interest but also concerns that its own business in India could suffer a similar fate as vivo's.

Moreover, Securities Star notes that vivo has been overtaken by Xiaomi in the first position. According to Counterpoint data, in the second quarter of this year, the top three smartphone vendors in India were Xiaomi, vivo, and Samsung, with market shares of 18.9%, 18.8%, and 18.1%, respectively, placing vivo in second place.

For vivo, the company must not only contend with pressure from the Indian government but also seek breakthroughs in the fiercely competitive market to reclaim its top position. (This article was originally published on Securities Star by Li Ruohan)

- End -