No buy for domestic cars! The world's largest automotive chip giant sees a 52% profit drop and lays off 14,000 employees

![]() 08/06 2024

08/06 2024

![]() 547

547

Automobiles require a significant number of chips. A typical gasoline-powered vehicle contains approximately 300-500 chips.

However, for new energy vehicles (NEVs), the number typically exceeds 1,000, with some highly intelligent NEVs requiring up to 2,000 or even 3,000 chips. As vehicles become increasingly intelligent, the demand for chips rises accordingly.

Currently, China's NEV industry is experiencing rapid growth, with a penetration rate exceeding 50%. Over 20 billion automotive chips are needed annually. Logically, chip manufacturers should be highly profitable.

However, the recent financial report from the world's largest automotive chip giant revealed disappointing results.

According to the report, revenue for the third fiscal quarter (Q2 2024) was €3.702 billion, representing a 2% sequential increase but a 9% year-over-year decrease. Net profit was €403 million, lower than the expected €447 million and a significant 52% drop year-over-year.

Perhaps due to these underwhelming results, Infineon has lost confidence in its future performance and announced plans to lay off 14,000 employees globally.

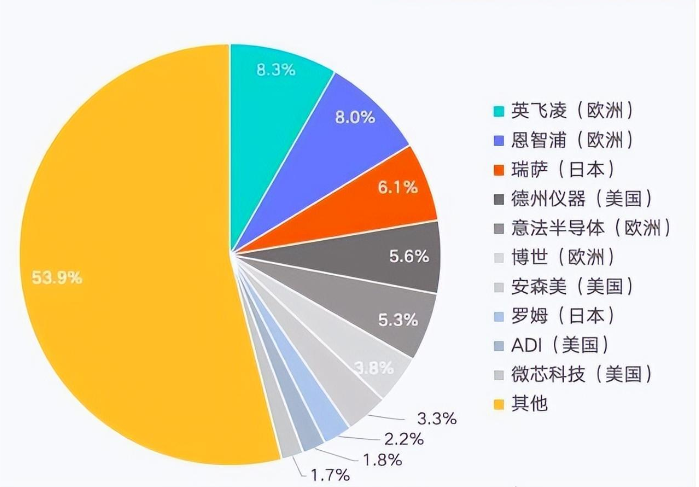

In terms of the global automotive chip market share, Infineon ranks first. For specific rankings, please refer to the above image, which is based on 2022 data and remains relevant.

In fact, Infineon is not alone in experiencing a performance decline. Other major automotive chip giants, such as NXP, ON Semiconductor, STMicroelectronics, and Texas Instruments, have also reported declining results in their latest fiscal quarters.

So, why have the performance of these automotive chip giants declined despite the increasing sales of NEVs?

On the one hand, the increase in domestic NEVs has led to an increased demand for automotive chips. However, domestic automakers do not necessarily turn to these international giants. Many domestic automakers are actively adopting domestic chips to increase self-sufficiency and reduce dependence on foreign suppliers.

For example, NIO is developing its own autonomous driving chips, Geely is developing smart cockpit chips, and automakers like BYD are developing various automotive chips to enhance self-sufficiency and reduce external dependencies.

Secondly, while NEVs require a large number of chips, not all of these chips address the needs traditionally served by automotive chip manufacturers. NEVs demand a wider range of chip types, which are often sourced from companies like Qualcomm and NVIDIA. As a result, traditional automotive chip manufacturers benefit less from this trend.

Going forward, we hope domestic automotive chip manufacturers will continue their efforts to increase self-sufficiency. Similarly, domestic automakers should strive to use domestic chips in their vehicles. With these efforts, we believe that foreign automotive chip giants will suffer even greater losses, while domestic automotive chips will rise alongside domestic automakers, reducing imports and dependencies.