享界S9上市,首先重创奥迪

![]() 08/08 2024

08/08 2024

![]() 529

529

After a price reduction of over 135,000 yuan compared to the pre-sale price, the launch of the Enjoy World S9 caused many 4S stores selling traditional luxury cars to cancel orders.

"In the evening, when I sent WeChat messages to potential customers, they all said they would no longer consider the Audi A6," said He Liang, who had noticed earlier this year that it was becoming increasingly difficult to meet his monthly sales targets for the Audi A6L. The final price of the 45TFSI all-wheel-drive version, the main model, was around 400,000 yuan after discounts exceeding 100,000 yuan at the dealership. This was 40,000 yuan cheaper than a similarly equipped Mercedes-Benz E-Class and 80,000 yuan cheaper than a BMW 5 Series, yet sales plummeted.

The decline in sales starting from June was particularly noticeable due to the impact of Huawei's HarmonyOS Intelligent Drive. On the one hand, the AITO M9, priced above 400,000 yuan, captured a significant share of the luxury sedan market. On the other hand, the anticipation of Huawei's first luxury sedan was so high that many AITO M9 owners were considering trading in their Audi A6Ls. At that time, the only bargaining chip He Liang had with potential buyers was that the estimated price of the Enjoy World S9, as stated by Yu Chengdong, was not cheap, expected to be between 450,000 and 550,000 yuan.

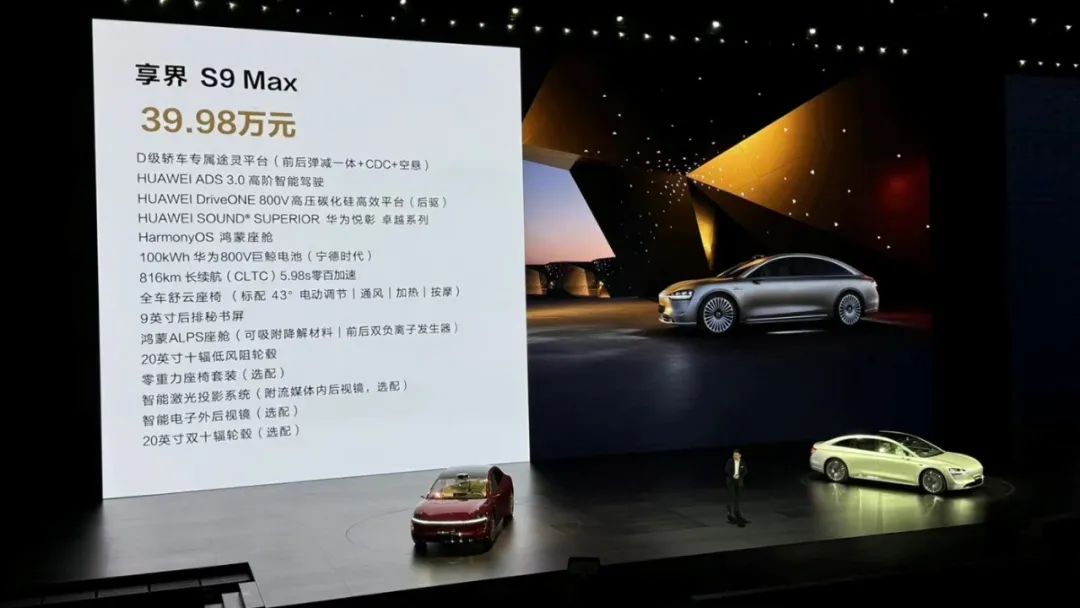

However, with the official announcement of the new car's price on August 6, if combined with a 15,000 yuan optional fund and a 20,000 yuan smart driving bonus, the rear-wheel-drive Max version was priced at 399,800 yuan, over 85,000 yuan lower than the previously estimated price. The all-wheel-drive Ultra version was priced at 449,800 yuan, a reduction of over 135,000 yuan. Furthermore, with the anticipated release of Huawei's Mate70 smartphone in October, He Liang's team lost confidence in the Audi A6L.

The entire press conference , Audi's injured world has been achieved

It's interesting that , Although the headlines in automotive media are all about Huawei's confrontation 56E、78S of , But in reality , Throughout the entire press conference ,余承东背后 of PPT中很少出现奥迪 of 身影,很多时候对比 of 是宝马、 Other brands such as Mercedes Benz and Maybach 。

There is a popular saying on the internet called “ Not mentioning a word , Every sentence is inseparable ”, This is a portrayal of a certain angle throughout the entire press conference 。

Yu Chengdong introduced the highlights of the Enjoy World S9 during the conference in his usual personal style. Although some of his statements were debatable, after watching the entire conference, a sales manager who had worked on the front lines of Audi sales for many years sent me a message saying, "Every few minutes, my heart skips a beat. Besides saying that gasoline cars don't have range anxiety and are more mature, I really don't know how to train sales consultants to sell the A6 anymore."

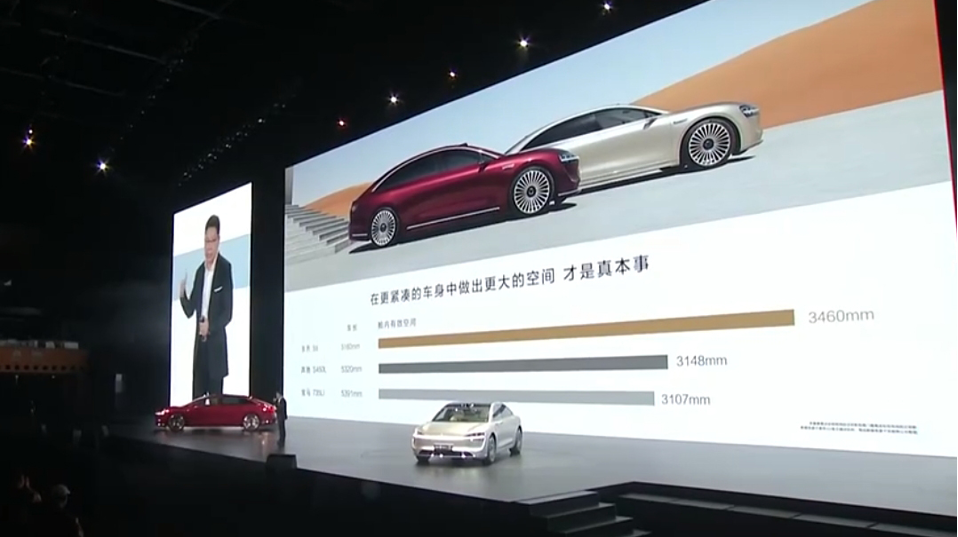

At the beginning, Yu Chengdong talked about the car's dimensions and space utilization. He then discussed the operating costs, highlighting the lowest power consumption of 13.2kWh/100km, which could save over 10,000 yuan annually compared to gasoline cars. This part lasted about 30 seconds, and later, when Zeng Yuqun from CATL took the stage, he even mentioned the possibility of earning money by feeding energy back into the grid.

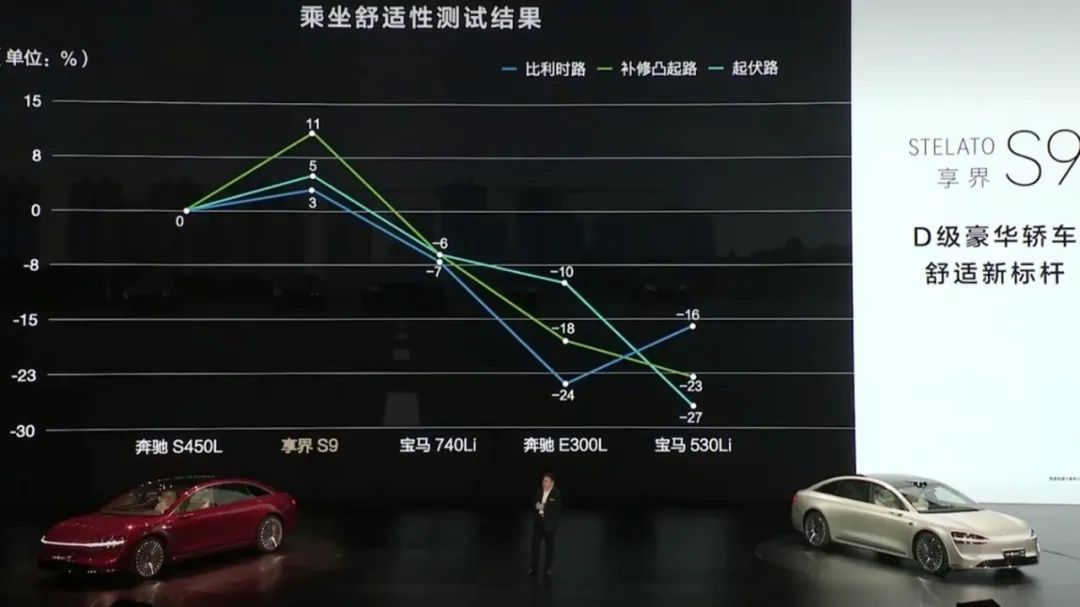

After that, he spent less than a minute talking about the design, emphasizing the technological feel and the quietness of the frameless doors. He then moved on to the car's colors, the evolution of the Touring chassis, new benchmarks in handling and control, comfort (such as the zero-gravity seats in the rear), technological features (including HUAWEI SOUND, HarmonyOS 4, XiaoYi Assistant, rear privacy, and ADS 3.0 Kunpeng), before ending with an explosive price announcement.

From a procedural perspective, this was a typical Huawei-style conference, starting with a comparison of essential features, followed by Huawei's exclusive and irreplaceable technologies, and ending with a price announcement. However, the result of this conference differed from most Huawei conferences, as most of Huawei's previous conferences ended with the message that "the price is not cheap," leading to online jokes about "not scamming the poor." But once Huawei offered a price far below expectations, it indicated a shift in their business strategy, moving away from testing the waters and towards leveraging their marketing and technological advantages to dominate the market.

The AITO M7, which Yu Chengdong praised as a revival in September 2023, is a prime example. Its price range was reduced from 319,800 to 379,800 yuan in 2022 to 249,800 to 329,800 yuan, a decrease of up to 70,000 yuan. The launch of the Enjoy World S9, however, has an even greater impact on consumers than the AITO M9.

There were also several aspects of the conference worth discussing and scrutinizing. In summary, Yu Chengdong appeared to be using more logic typically associated with family cars to promote the selling points of an executive-level luxury car. For example, he spent more time discussing space and cost savings rather than design or other aspects that could tell a compelling story.

This follows a typical cost-effective logic rather than one focused on increasing value and premium pricing. Nevertheless, the results were impressive. Just as the AITO M9 created the impression that customers could get a product that feels better than a Mercedes-Benz GLS for 500,000 yuan, the Enjoy World S9 now offers an experience superior to that of a Mercedes-Benz Maybach S-Class for just over 400,000 yuan.

Of course, it's no easy feat for a pure electric vehicle priced between 350,000 and 450,000 yuan to compete with Mercedes-Benz S-Class and BMW 7 Series priced at 1 million yuan, as well as the more affordable BMW 5 Series, Mercedes-Benz E-Class, and Audi A6L. However, given the establishment of HarmonyOS Intelligent Drive's four ecosystems, it's clear that the Enjoy World S9's main competitors are the 56E models, while the Mercedes-Benz S-Class and BMW 7 Series are left to Huawei's collaboration with JAC Motor's ZunJie brand.

As for Audi's suffering, it stems from humans' innate tendency to compare the bottom rung. This phenomenon has been frequently observed since 2023. Even before the launch of the new AITO M7 in September 2023, the L7 from Lixiang Auto had been steadily delivering over 10,000 units per month since April. In the same segment, the entry-level Audi Q5L's bare car price was once driven down to 280,000 yuan. Compared to the upward brand momentum of Mercedes-Benz and BMW in recent years, Audi has borne the brunt of the impact from new players.

Facing Huawei , Who can continue to survive in the luxury car market ?

With a length of 5160mm and a wheelbase of 3050mm, the Enjoy World S9's space is not as exaggerated as Yu Chengdong described. When compared to the Mercedes-Benz S-Class, which has a length of 5290mm and a wheelbase of 3216mm, offering a higher space utilization rate, the Enjoy World S9 falls short. However, when compared to lower-end C-segment sedans like the 2025 Audi A6L, which has a length of 5050mm and a wheelbase of 3024mm, the data suggests that the Audi A6L still holds an advantage in terms of dimensions.

Although the Audi A6L retains an advantage in terms of dimensions, the inherent space advantage of pure electric vehicles directly offsets Audi's core selling point in China: its elongated design. The same logic applies to the discussion of chassis and handling. Audi's ability to offer the best four-wheel-drive technology at a C-segment sedan price point is also negated by the competition.

As a result, the four main selling points of the Audi A6L – high cost-effectiveness, four-wheel drive, ample space, and strong brand reputation – are all covered by the Enjoy World S9.

Furthermore, with the Audi Q5L and now the Audi A6L facing competition, the decline of second-tier luxury brands is accelerating. According to data from the China Passenger Car Association (CPCA), Cadillac only managed to sell over 10,000 units in March and April of 2024, down from a high of 24,300 units in December 2023. While Lexus sales grew to 69,000 units from January to May, an increase of 28% year-on-year, this growth came at the expense of price cuts, with discounts of 50,000 to 60,000 yuan or more now common.

With SUVs already struggling and new energy vehicle models failing to gain customer recognition, it remains uncertain how long the Audi A6L can hold out against the Enjoy World S9. Currently, this is just the first step for Huawei's HarmonyOS Intelligent Drive into the luxury sedan market. There are two upcoming wildcards: the release of a new flagship smartphone and the launch of an extended-range version of the Enjoy World S9. In March 2024, Yu Chengdong hinted that the product roadmap for the Enjoy World S9 would prioritize the pure electric version before introducing an extended-range model. Given that the extended-range version has not yet been submitted for approval, an optimistic estimate is that it may hit the market by the end of this year.

In summary, second-tier luxury brands have largely been surpassed by Chinese newcomers, putting significant pressure on the Audi A6L. The next question is how the Mercedes-Benz E-Class and BMW 5 Series will respond to this competition.

Sales figures reveal the following trends in C-segment sales for Mercedes-Benz, BMW, and Audi since the beginning of 2024:

The Mercedes-Benz E-Class has maintained an average monthly sales volume of over 10,000 units, with a low of 8,345 units in January and a high of 15,200 units in June.

BMW 5 Series sales have generally been on the rise since its launch, officially exceeding 10,000 units in June.

Audi A6L sales have remained relatively stable compared to the same period in 2023, maintaining a high position within the industry. However, it is worth noting that the proportion of A6L sales within Audi's overall sales has increased from around 25% in the first half of 2023 to over 30%. In other words, the A6L has become one of Audi's few profitable models amidst overall sales challenges.

Whether Huawei can continue to break through in the luxury new energy vehicle segment remains to be seen, depending on two key challenges. According to statistics from Cui Dongshu, Secretary-General of the China Passenger Car Association, the trend of automotive consumption upgrading has continued from 2019 to the first half of 2024. Over five years, sales in the over-300,000-yuan market segment have grown from 1.67 million to 3 million units, driven primarily by new energy vehicles with 1.04 million additional sales, rather than by gasoline-powered vehicles. However, the corresponding data also shows that the market below 300,000 yuan is shrinking.

According to data from the "China Population Census Yearbook - 2020" released by the National Bureau of Statistics in 2022, 81.4% of households own cars priced below 200,000 yuan. Additionally, according to relevant statistics from authoritative institutions, after entering 2023, the market share of vehicles priced above 300,000 yuan in the overall automotive market has declined. The Xiangjie S9 and its competitors face fierce competition in an established market, and the R&D reserves and backup plans of Mercedes-Benz and BMW should not be underestimated.

For example, the BMW 5 Series and BMW i5 are expected to add ALC functionality in September, enabling autonomous entrance and exit from highway ramps, essentially completing the high-speed autonomous driving suite.

For example, the Mercedes-Benz E-Class officially announced in 2023 that the point-to-point L2+ highway autonomous driving assistance feature would be launched in 2024.

Both of these announcements follow a similar timeline and can be seen as a direct response to the Xiangjie S9.

Closing Remarks

It is evident that not many traditional luxury brands can withstand the rise of Chinese brands in the luxury car market.

The mere introduction of the pure electric version has already put pressure on Audi. With the subsequent launch of extended-range models, the competition for traditional fuel-powered vehicles will intensify even further. For another Chinese standout in this segment, NIO ET7, this development could also be a positive, as it could directly challenge the traditional perceptions of Mercedes-Benz, BMW, and others in the consumer market.

The current market landscape, dominated by traditional luxury brands such as Mercedes-Benz, BMW, Audi, Lexus, Cadillac, Volvo, and Lincoln, is unlikely to last much longer.