Apart from FSD, Tesla actually has another trump card

![]() 08/08 2024

08/08 2024

![]() 592

592

Regarding Tesla's upcoming trump card in the Chinese market, apart from the yet-to-be-implemented FSD, Tesla holds another good card, which is its official insurance business.

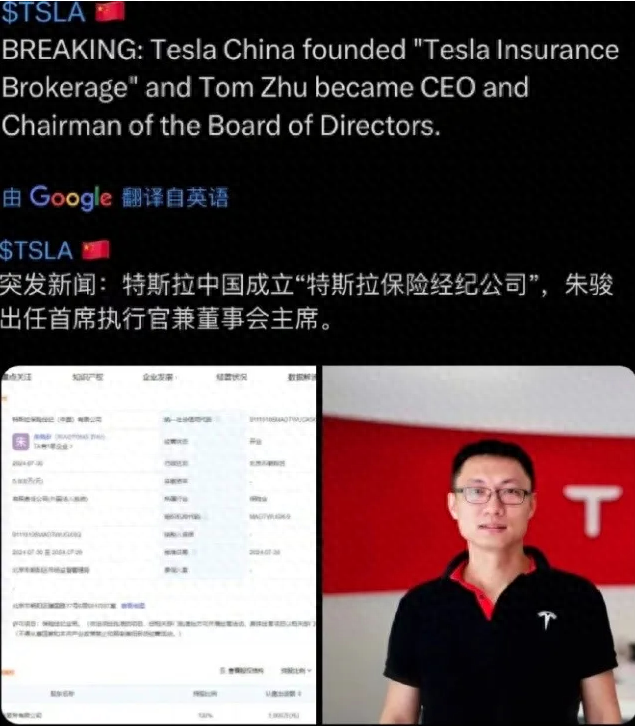

Furthermore, Tesla Insurance Brokerage Co., Ltd. was officially established at the end of July, with Zhu Xiaotong serving as the legal representative. In the automotive market, Tesla is not actually the first automaker to venture into this field, as BYD had already paved the way before.

With the increase in insurance premiums, insurance costs have become a significant pain point for many new energy vehicle users. Many netizens have joked about how while charging saves money on fuel, insurance premiums keep rising.

Moreover, what frustrates electric vehicle owners and seems illogical is that electric vehicles often come equipped with more advanced and outstanding intelligent assisted driving systems, making them less prone to routine accidents compared to gasoline vehicles of the same class. Despite having significantly higher levels of intelligent driving capabilities, resulting in fewer accidents during routine parking or dead-end parking, or even lower probabilities of minor rear-end collisions, electric vehicles theoretically should experience fewer insurance claims. However, their insurance premiums are still higher than those of traditional gasoline vehicles.

This is primarily because insurance companies have their own calculation methods. They have discovered that the heart of new energy vehicles—batteries and electric motors—tend to have relatively high repair costs, especially for batteries. In the event of an accident causing battery pack damage, the cost of "replacement instead of repair" can be extremely high. Consequently, insurance companies' costs during claims settlements also increase correspondingly. Insurance companies generally do not have bargaining power, so in the event of an accident, the claims for new energy vehicles tend to be higher compared to gasoline vehicles.

Furthermore, new energy vehicles often have a relatively high zero-to-parts ratio (the ratio of parts prices to the overall vehicle price). This means that if a vehicle is damaged, repair costs will also increase. Additionally, new energy vehicles experience rapid technological advancements, leading to higher depreciation rates. As technology progresses, the residual value of older models may decline rapidly, which also affects insurance premium pricing.

Behind this issue lies a significant business opportunity, and some automakers can no longer sit idly by. For instance, BYD directly entered the insurance market by launching its official insurance business, allowing customers to purchase insurance alongside their vehicles. After all, who understands a vehicle better than the automaker itself? Backed by vast amounts of data, BYD's insurance premiums are reportedly around 20% lower than market rates, providing tangible benefits to consumers.

As the leader in China's electric vehicle industry, if Tesla can revolutionize auto insurance through its official entry, it will undoubtedly enhance user loyalty. This move is also likely to prompt other automaker giants to follow suit. What are your thoughts on automakers directly participating in the insurance business?