Gree Robots, Dong Mingzhu's 'Mysterious Mentor'

![]() 08/12 2024

08/12 2024

![]() 435

435

Author/Xie Chunsheng

Editor-in-Chief/Su Huai

"A company's strategy must be clear. It's not about doing whatever makes money."

Years ago, on a CCTV financial program, when Dong Mingzhu, Chairman of Gree Electric Appliances (000651.SZ), said these words of advice to Liu Yonghao, Chairman of New Hope Group (000876.SZ), she probably didn't know that one day she would lead Gree into the more lucrative field of robotics, venturing beyond its familiar territory of home appliances.

According to Tianyancha, in early August this year, Gree Hubei Xiaomi Yangtze River Industrial Fund Partnership (Limited Partnership) (hereinafter referred to as "Xiaomi Yangtze River Industrial Fund"), in which Zhuhai Gree Financial Investment Management Co., Ltd. (hereinafter referred to as "Gree Financial Investment") is a shareholder, updated its investment in Hunan Longshen Hydrogen Energy Technology Co., Ltd.

Gree Financial Investment is no stranger to the "Longshen" series, as just five years ago, it also bet on Longshen Robotics' strategic financing through Xiaomi Yangtze River Industrial Fund.

As an important industrial investment and capital operation platform under Gree, Gree Financial Investment has made direct or indirect investments in a wide range of fields in recent years, helping Gree gradually evolve from solely manufacturing air conditioners to a diversified layout encompassing mobile phones, automobiles, and robots. Especially in the robotics sector, Gree has made significant inroads and has received much attention from Dong Mingzhu.

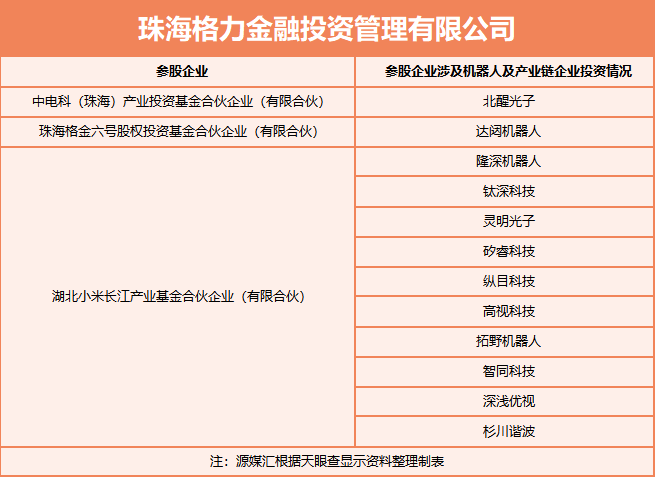

According to incomplete statistics from Yuanmeihui, as of 2023, Gree Financial Investment's portfolio companies involved in robotics and related industries totaled 12, covering humanoid robots, core components, etc.

In addition to investing, Gree is also personally betting on the robotics industry through in-house research and development, determined to overcome a long-standing bottleneck held by foreign capital. Years have passed, and the "magic tool" crafted by Gree with significant investment has not only helped automate its own production lines, but has also gradually penetrated into downstream industrial applications such as machinery manufacturing, automotive parts processing, home appliance manufacturing, and 3C.

However, behind the seemingly glorious achievements, Gree's "secret weapon" also has its own development constraints.

01

The Mysterious Robotics Business

Gree robots can be considered Dong Mingzhu's "mysterious mentor."

From past developments, although not much information has been disclosed about Gree's robotics business externally, glimpses can still be gained through scattered news and Dong Mingzhu's occasional remarks.

Some news reports on Gree robots

On July 22nd this year, Zhuhai Gree Intelligent Equipment Co., Ltd. (hereinafter referred to as "Gree Intelligent Equipment") signed a strategic partnership agreement with Omron Automation. The cooperation covers a wide range of fields, including rail transit, automobiles, electronics, photovoltaic lithium batteries, robot applications, automation engineering system integration, intelligent warehousing and logistics, etc., undoubtedly providing a boost to Gree Intelligent Equipment's further expansion in the industrial robotics field.

Shortly after the signing of the above cooperation, rumors emerged that Gree Intelligent Equipment was providing parts manufacturing equipment support to Tesla (NASDAQ: TSLA). Rumors of cooperation between Gree and Tesla have been circulating for a long time, with investors inquiring about it as early as 2020, but Gree did not respond directly, only stating that "the company will leverage its own advantages to actively cooperate with automotive companies and enter the new energy vehicle supply chain, energy storage, and battery manufacturing equipment fields." This response, however, only fueled further speculation.

The latest news, however, indicates that Gree has already developed industrial robots such as GR35, GR50E, and GRS20 for the lithium battery and photovoltaic sectors, the GR200 industrial robot for automotive parts die-casting, and the GRX5 collaborative robot for liquid dispensing stations, providing robotic automation solutions for the new energy vehicle parts manufacturing sector.

From this perspective, it is not implausible that Gree is providing parts manufacturing equipment support to Tesla. However, partnering with giants is not uncommon for Gree; even during the pandemic, it partnered with JD.com Logistics (02618.HK) to develop anti-epidemic robots.

While Gree's robotics business appears to have impressive achievements, the specific scale and financial details of these partnerships remain unknown to the outside world. Based on Dong Mingzhu's usual style, if there were breakthroughs in the "numbers," she would surely flaunt them. However, over the years, Gree has rarely disclosed specific performance figures for its industrial robots, such as shipment volumes and revenue scales, often resorting to vague responses.

This may also indirectly verify that Gree's current application of robots is primarily focused on "self-developed and self-supplied." Some clues can be found in Gree's "per capita revenue generation."

02

The Driving Force Behind Increased Per Capita Revenue Generation

As young people's employment attitudes change, "recruitment difficulties" and "high labor costs" have become the top challenges for traditional manufacturing, especially for manufacturing enterprises of Gree's scale, which have an urgent demand for labor.

Data shows that from 2018 to 2023, Gree's total number of employees decreased from 88,900 to 72,400; among them, production personnel dropped sharply from 69,500 to 50,200, a decrease of about 28%.

In stark contrast to the decline in employee numbers, Gree's per capita revenue generation has shown rapid growth. According to calculations by Yuanmeihui, Gree's per capita revenue generation was approximately 2.2525 million yuan in 2018, rising to 2.8236 million yuan by 2023.

The increase in Gree's per capita revenue generation can largely be attributed to its early bet on the robotics business, which laid the foundation for automating its production lines.

To further understand Gree's robotics business and the degree of automation in its production lines, Yuanmeihui recently contacted the relevant person in charge of Gree Intelligent Equipment and sent an inquiry email to Gree's Secretary Deng Xiaobo, but had not received a response as of press time.

However, regarding the degree of automation in production lines, Kang Yan, Director of the Application Research Institute at Gree Electric Appliances Equipment Power Technology Research Institute, told Yuanmeihui: "(Gree's) newly built factories have a relatively high degree of automation and include demonstration dark factories." When asked if dark factories can operate 24 hours a day, Kang Yan said, "Some stations can achieve this."

So, does the improvement in the degree of automation in production lines have a significant impact on per capita revenue generation? An industry insider shared with Yuanmeihui: "I can provide some data to give you a deeper understanding of the changes. Taking the power battery production line as an example, for most users, the return on investment (ROI) period for our robotic products is roughly eight months, while the ROI period for the fully automated production line for square power battery connectors is six months. Based on publicly available data alone, under the same production capacity, the cost of the fully automated line is 1.8 million yuan less per year compared to a manual line."

Aerial view of Gree's Chengdu base

The insider also did a cost-benefit analysis for Yuanmeihui: "Customers have tried manual lines, and to achieve the same production capacity, at least 13 skilled workers are required. Since manual labor cannot match the pace of robots, two additional injection molding machines are also needed. The current cost of a single worker is approximately 85,000 to 95,000 yuan per year, and the hidden costs of recruitment and training due to employee turnover are not included. The cost of an injection molding machine is 350,000 yuan, so two machines would cost 700,000 yuan. Adding the cost of 12 workers, the total comes to around 1.8 million yuan."

While the ROI ratio of Gree's robots is unknown, application cases disclosed by Gree Intelligent Equipment in the home appliance industry show that 25 stamping automation lines implemented from 2013 to 2014 reduced staffing by 115 people, increased production capacity from an average monthly output of 5,963 tons to 8,850 tons, with an increase rate of 48.4%, and a per capita staff reduction investment of 46,000 yuan.

Take the workshop of Gree Changsha HVAC Refrigeration Equipment Co., Ltd. as another example. The entire line originally required 10 operators to function, but after introducing Gree's self-developed collaborative robots, only two operators are needed to complete the same tasks, with a production cycle of up to 10 times per minute.

This demonstrates that under the automation upgrade of "machines replacing humans," Gree's own production lines have not only significantly improved efficiency, shortened manufacturing cycles, and reduced production costs but have also enabled visual production management.

Behind cost reduction and efficiency enhancement, the robotics business is undoubtedly a critical success factor.

03

An Early Start, But a Late Arrival

Gree's robotics business has had a rocky journey so far.

Gree's involvement in robotics and automation can be traced back to 2012, when it comprehensively promoted automation upgrades to its production lines but encountered difficulties with upstream core equipment being held captive by foreign companies.

In 2013, unwilling to be held hostage, Gree announced its entry into high-end equipment and established the Automation Equipment Manufacturing Department (the predecessor of Gree Intelligent Equipment), developing its first 6-axis industrial robot, first AGV, first 5-axis CNC manipulator, and completing the construction and commissioning of the first phase of the Jida Base robot factory the same year.

After two years of exploration, in 2015, Gree Intelligent Equipment, with robotics as its core business, was officially established. That year, it also produced its 100th 8-kg 6-axis industrial robot and developed the first automatic assembly line for air conditioner electrical boxes.

In 2017, with the smart equipment business gradually stabilizing, Gree successively established separate robotics companies: Zhuhai Gree Robotics Co., Ltd. (hereinafter referred to as "Zhuhai Gree Robotics") and Gree Robotics (Luoyang) Co., Ltd. (hereinafter referred to as "Gree Luoyang Robotics"). However, from a financial perspective, Gree still grouped its robotics business under the smart equipment segment.

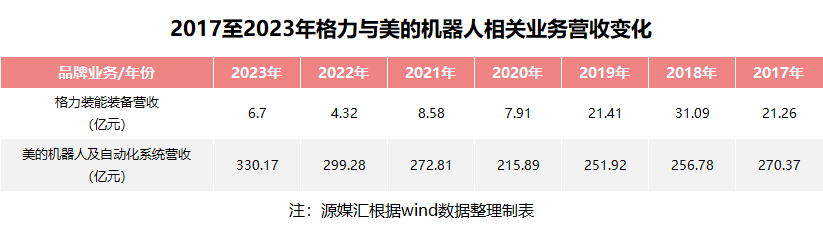

Perhaps benefiting from breakthroughs in the robotics business, Gree's smart equipment business achieved considerable results in the early years after the establishment of the two robotics companies. According to Wind data, Gree's smart equipment business generated revenues of 2.126 billion yuan, 3.109 billion yuan, and 2.141 billion yuan from 2017 to 2019, respectively. Strangely, however, after 2020, Gree's smart equipment business experienced a sharp decline, generating only 670 million yuan in revenue by 2023.

After Gree's smart equipment business fell behind in 2020, Midea Group (000333.SZ), another home appliance giant that had also deployed in the robotics sector around the same time, achieved considerable growth in its robotics and automation business and quickly rose to the forefront of the robotics industry.

In 2015, Midea officially began its layout in the robotics field by acquiring a 17.8% stake in domestic industrial robotics company Effort (688165.SH) for 178 million yuan, and subsequently jointly establishing Guangdong Yaskawa Midea Industrial Robot Co., Ltd. with global robotics giant Yaskawa Electric, while increasing its stake in KUKA, the German robotics leader hailed as one of the "Big Four" in the industry.

On November 26, 2022, after seven years of efforts and a significant investment, Midea finally realized its dream – officially announcing the completion of its full acquisition of KUKA's equity and its privatization and delisting. The privatized KUKA did not disappoint Midea. Financial reports show that in 2023, Midea generated revenue of 372.037 billion yuan, with its robotics and automation business, centered on KUKA, contributing 31.1 billion yuan, an increase of 12% year-on-year.

In contrast, Gree's smart equipment business, which has been operating for many years, has not only struggled with revenue growth but has also been embroiled in multiple contract disputes. As of August 8, 2024, Tianyancha shows that 79.5% of the 39 cases related to Gree Intelligent Equipment involved contract disputes.

Image source: Tianyancha

Furthermore, Yuanmeihui noticed that on June 5th of this year, the company was subject to its first enforcement action by the Xiangzhou District People's Court in Zhuhai, with an execution target of 394,000 yuan.

Image source: Tianyancha

Among the two robotics companies invested in by Gree Intelligent Equipment, Gree Luoyang Robotics, which had once announced plans to invest 15 billion yuan, is now listed as dissolved. However, Gree later responded that the company was still developing its robotics business.

While the remaining company, Zhuhai Gree Robotics, operates normally, it does not have a strong presence in the industry. When Yuanmeihui inquired about the development of Gree Robotics from several industry insiders, they all declined with the excuse of "not being familiar with it." "It's difficult to understand the specifics of self-developed, self-produced, and self-used products that are not for external use," said one person.

Unlike Midea's acquisition strategy in the robotics sector, Gree places more emphasis on "self-development, self-production, and self-use," which seems to align with Dong Mingzhu's usual operating style. Although Gree has invested in some robotics companies through Gree Financial Investment over the past few years, overall, its approach remains relatively conservative.

From a product perspective, Gree is currently involved in industrial robotics technologies such as servo motors, servo drives, and motion controllers, achieving full coverage of robot load capacities from 1kg to 600kg. Some products have also transitioned from internal use to external sales. However, compared to its peers, especially Midea, such achievements still pale in comparison.

Some images are quoted from the internet. Please inform us for deletion if there is any infringement.