Estimated value exceeds the combined total of OPPO and vivo! Will Honor's IPO meet popular expectations?

![]() 08/13 2024

08/13 2024

![]() 577

577

Since Xiaomi's IPO, it has been six years since another Chinese smartphone company dared to aim for an IPO. The reasons behind this are intriguing! Despite being separated from Huawei for four years, Honor is determined to go public, and its estimated value has even surpassed the combined total of OPPO and vivo, leaving many netizens wondering, what makes Honor, which doesn't manufacture cars, so valuable?

01. Honor IPO: Bravely being ourselves!

On July 9, 2018, Xiaomi officially listed on the Hong Kong Stock Exchange, becoming the only listed company among domestic smartphone giants. Meanwhile, fellow top 5 giants Huawei, OPPO, and vivo have patiently waited, without any IPO plans for six years, until recently when Honor, which has spun off from Huawei, officially announced its path to an IPO. Its estimated value even surpassed the combined total of OPPO and vivo, raising questions among netizens about what makes Honor so valuable without involving in car manufacturing.

Based on public information and interviews with Honor CEO Zhao Ming, it appears that Honor is operating robustly with a cash flow of tens of billions, comparable to that of emerging automakers like NIO, XPeng, and Li Auto.

Zhao Ming emphasized, "To become an open and global company, we must gradually make our company public and increase transparency. We want Honor's management and all aspects to withstand scrutiny from professional institutions, the public, and investors."

Meanwhile, Honor has confirmed its intention to list in China, but it remains uncertain whether it will be on the A-share market or in Hong Kong. A positive sign is its estimated value of up to $45 billion. Many netizens may not realize the significance of this figure.

For example, Xiaomi's current market value is approximately HK$416.333 billion (around RMB 383.8 billion). Honor's estimated value is already close to RMB 323 billion, despite not being involved in automotive business and solely focusing on smart devices. This is truly remarkable!

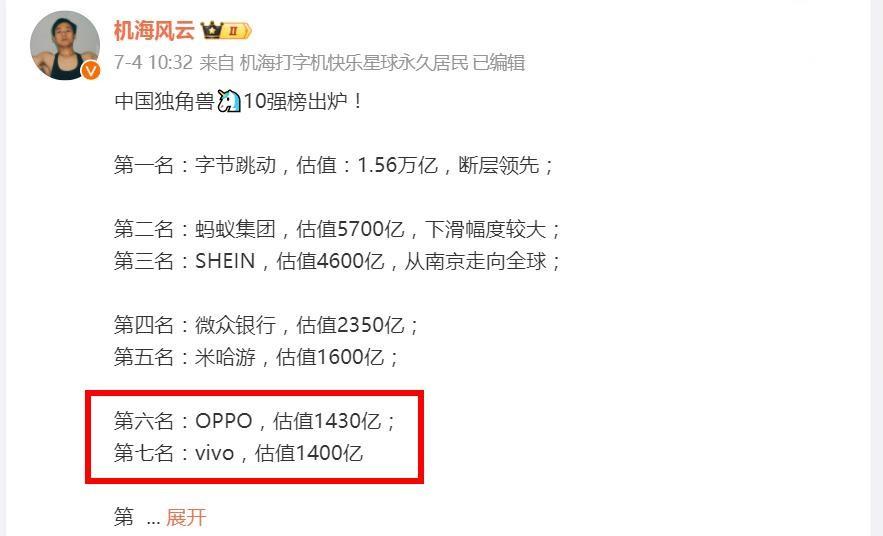

In comparison, OPPO's latest estimated value is RMB 143 billion, and vivo's is RMB 140 billion. The combined value of these two giants is only RMB 283 billion, lower than Honor's estimated value. This highlights the significant potential that Honor offers to the capital market.

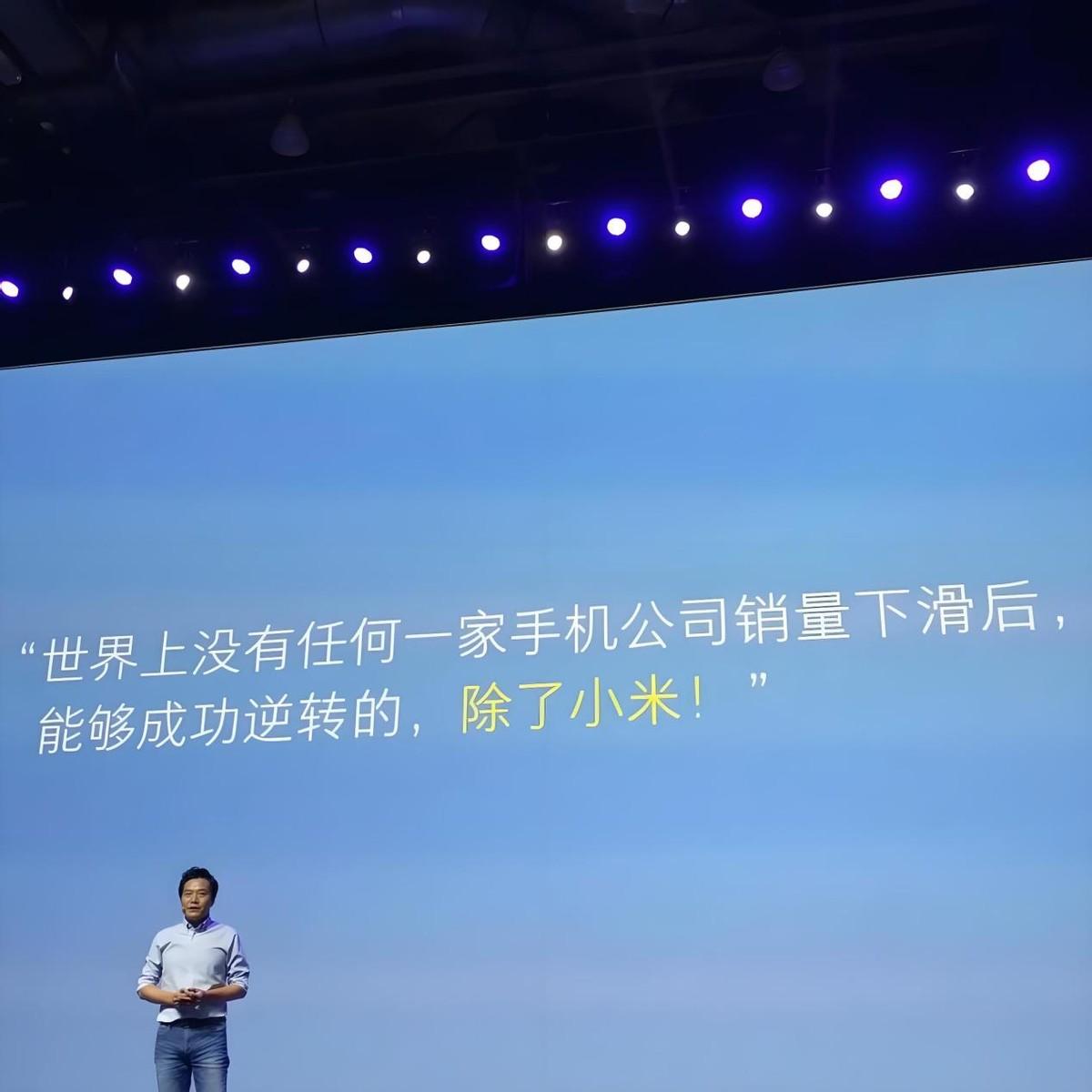

Of course, all estimates are based on performance expectations. A crucial reason for Honor's anticipation is its demonstration of a V-shaped recovery curve, similar to what Xiaomi achieved. Honor has rebounded strongly from a market share of just 3% to 17.1% in the first quarter of this year, regaining its position as the top player in China.

Although valuation is a dynamic figure, subject to change after the IPO, it already reflects Honor's enormous potential. Beyond the robust recovery in China, what underlying logic supports Honor's leading valuation system?

02. Could Honor become one of the top three global players?

According to Reuters, Honor aims to ship 100 million smartphones annually by 2026, a 75% increase from 2023, with the goal of becoming one of the top three global smartphone suppliers by 2028. Canalys data shows that Honor ranked seventh globally in smartphone sales in 2023, just behind vivo, a remarkable achievement considering its recovery is only three years old.

For Honor, the first layer of imagination comes from the incremental opportunities in overseas markets. Honor is already present in 100 countries and regions, with over 200 million devices connected globally and more than 45,000 experience stores and counters, creating an unbreakable channel barrier.

According to Counterpoint Research, Honor ranked fifth in the highly competitive European market in Q1 2024 with a 4% market share, up 67% year-on-year. Similarly, Canalys reports that Honor entered the top 5 in the Latin American market during the same period, with a staggering 293% growth.

Without surprise, Europe, Latin America, the Middle East, and even Africa will be key regions for Honor's overseas expansion. It is highly likely that Honor will maintain steady global market share growth.

For Honor, the second layer of imagination stems from its core competency as a technology company - technological research and development and commercial transformation capabilities.

Honor has successfully deployed MagicLM, its self-developed AI large model, on the client side of its smart devices. With 7 billion parameters, this model underscores Honor's technological prowess. Additionally, Honor has developed the Qinghai Lake battery, the 5G RF enhancement chip C1 with its matching tuning algorithm, even daring to challenge Huawei in terms of signal quality. These achievements demonstrate Honor's technological confidence.

In the second half of the smartphone era, it's crucial to have no weaknesses in addition to strengths. Recently, Honor hired Luo Wei, a former Huawei imaging expert, who led the team responsible for the globally renowned imaging capabilities of Huawei's P series. His addition may address shortcomings in Honor's flagship camera algorithms.

Rumors suggest that Honor will unveil its self-developed imaging architecture in Q4, highlighting its commitment to imaging. Honor's support for domestic suppliers like OmniVision (camera sensors) and BOE (display panels) also underscores its role in driving the domestic supply chain.

In an era where everyone emphasizes self-research and development, no company shies away from touting its achievements, even if they involve supply chain technologies repackaged as in-house innovations. Consumers must discern the difference between genuine self-research and mere claims.

While consumers may not always have the expertise to distinguish, a reliable indicator is research and development investment. Honor's annual R&D investment as a percentage of revenue exceeds 10%, second only to Huawei among domestic smartphone brands.

Honor has invested heavily in AI research, with cumulative expenses exceeding RMB 10 billion, resulting in 2,100 AI patents and support for 600 AI intent categories. Honor holds over 20,000 global patents and has cross-licensing agreements with communication giants like Qualcomm and Nokia, demonstrating its hard technical strength in the global market.

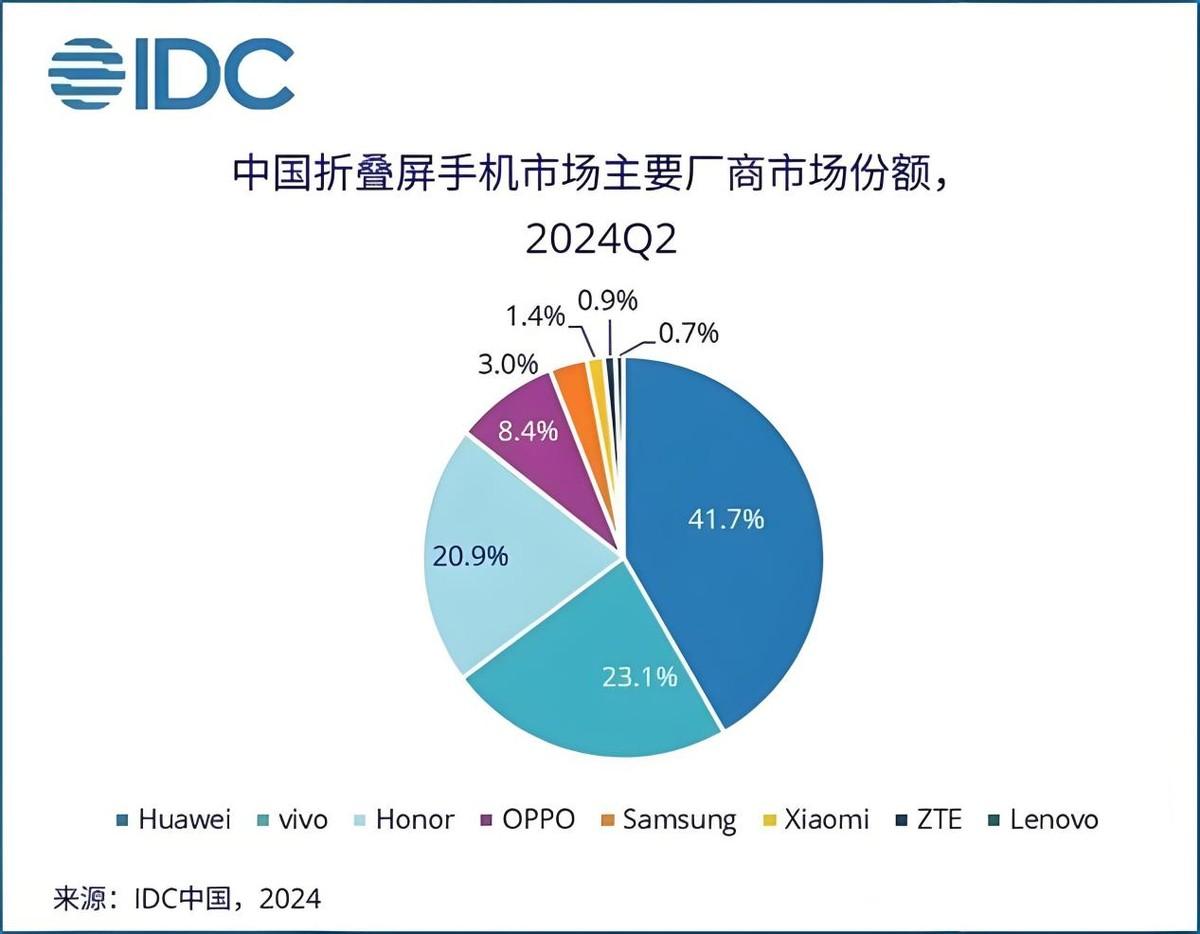

In the premium foldable smartphone segment, Honor has also made notable achievements. In Q2 2024, it captured nearly 21% of the Chinese foldable market, and its Magic V2 and V3 models led the industry towards extreme thinness, garnering widespread praise. While still trailing Huawei, Honor is showing promising potential.

Finally, focusing on its mobile phone business while strategically investing in AI, Zhao Ming has repeatedly emphasized that Honor will not enter the automotive industry. This means Honor avoids significant capital expenditures and has already achieved commercial closure with its existing hardware (phones, tablets, PCs, earbuds, IoT devices) and software (MagicUI, MagicLM). Its considerable profitability promises attractive returns.

Investing involves risks. This article analyzes Honor's comprehensive competitiveness objectively and subjectively and does not constitute investment advice.

Reference Materials: IDC, Canalys, Counterpoint Research, Reuters, Economics Learning Daily, Zhao Ming Interviews, Honor Official Website, etc.