BMW leads the price hike, will China's auto price war "cool off"?

![]() 08/15 2024

08/15 2024

![]() 545

545

Author: Tianfeng

Source: Bowang Finance

Since 2024, the Chinese auto industry has staged a song of "ice and fire."

In the first half of the year, the price war in China's auto industry intensified, and it was expected that this trend would continue until the end of the year. However, at the beginning of the second half, leading companies stopped "lowering prices to maintain volume," and signs of a slowdown in the price war emerged.

On July 16, BMW was the first to withdraw from the price war, increasing the prices of the BMW X1, X3, 5 Series, and X5 by 5,000, 8,000, 10,000, and 20,000 yuan, respectively. Subsequently, joint venture brands such as GAC Toyota and Dongfeng Honda also raised prices.

Even more unusually, new energy vehicle makers, once seen as disruptors, have also followed the lead of traditional automakers and raised the prices of their products. For example, on August 14, Li Auto narrowed the benefits of ordering the L6, its main sales model, raising prices by 2,000 yuan compared to half a month ago and no longer offering free charging piles.

As we all know, price reductions are one of the most important means to stimulate auto sales. In the first half of this year, the price war in China's auto market was primarily due to some automakers hoping to trade volume for price, sacrificing profits to capture market share. Now, with automakers raising prices, it seems they are satisfied with their current sales and hope to maintain brand value and earn higher profits through higher prices.

However, it's important to note that whether automakers' pricing strategies will succeed largely depends on the market environment. Currently, China's auto market faces a significant oversupply problem and increasing competitive pressure. The cooling of the price war at the beginning of the second half of 2024 appears to be merely a one-sided, phased correction by some manufacturers.

01

The industry suddenly returns to "rationality" after the fiercest price war

In the post-pandemic era, price wars in China's auto industry have become commonplace. However, if we talk about the fiercest price war, the first half of 2024 stands out.

Image source: BYD

After the 2024 Chinese New Year, BYD launched 13 honor edition models, with the Qin PLUS Honor Edition priced as low as 79,800 yuan, promoting the slogan "electricity costs less than gasoline." Subsequently, automakers such as Changan, Wuling, and NIO followed suit, either by introducing cheaper entry-level models or reducing the prices of existing models.

According to data from the China Passenger Car Association (CPCA), in the first five months of 2024, 136 models in China's auto market experienced price reductions, exceeding 90% of the total price reductions in 2023 and the entire year of 2022.

Image source: Mysteel.com

Undeniably, the reason for the price reductions in new energy vehicles is the decline in upstream raw material prices. In the first half of 2024, the spot price of battery-grade lithium carbonate hovered around 100,000-110,000 yuan per ton, down about 80% from the historical high of 570,000 yuan per ton at the end of 2022. Considering that power batteries account for about 30%-40% of the cost of new energy vehicles, the plummeting upstream raw material prices naturally left more room for automakers to reduce prices.

However, it's important to note that the decline in upstream raw material prices directly results in increased profit margins for automakers. The reason why many automakers actively reduce prices and offer benefits is largely to expand their market influence.

According to CPCA data, in the first half of 2024, cumulative retail sales of passenger vehicles in China reached 9.841 million units, an increase of only 3.3% year-on-year. This indicates that the incremental dividends in China's passenger vehicle market have largely disappeared, and new energy automakers need to compete with traditional fuel vehicles for market share.

From a specific model perspective, low prices are indeed a powerful tool to attract consumers. For example, in recent years, sales of the ZEEKR brand have been sluggish. At the beginning of 2024, ZEEKR launched a new version of the ZEEKR 001 with a price reduction of 31,000 yuan and added standard features such as lidar, the Qualcomm Snapdragon 8295 chip, 800V high-voltage technology, and silicon carbide motors.

Due to its excellent cost-performance ratio, monthly sales of the new ZEEKR 001 have steadily increased, with a peak monthly sales volume of 14,400 units. Thanks to this, in the first half of 2024, ZEEKR sold 87,900 vehicles, an increase of 106% year-on-year.

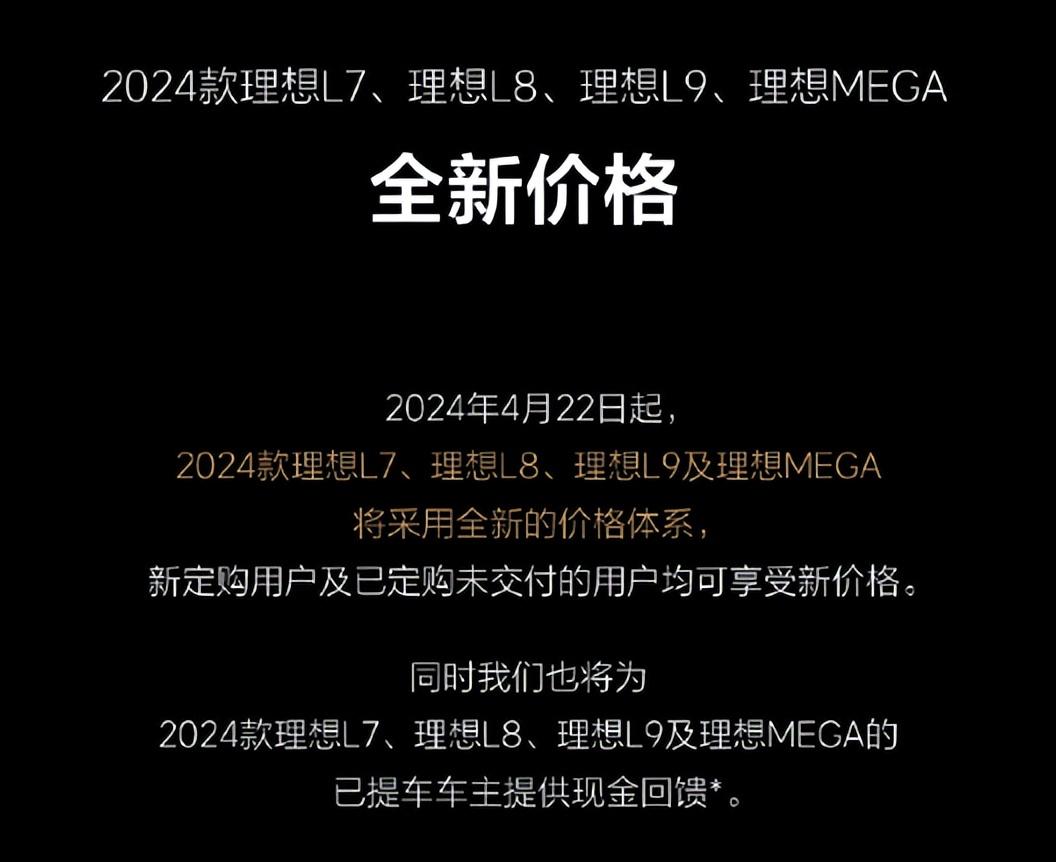

Image source: Li Auto

Similarly, in March 2024, Li Auto introduced updated versions of its L series models, with enhanced features but no price increase. However, order performance fell short of internal expectations. On April 22, Li Auto was forced to announce a price reduction of 18,000-20,000 yuan across its entire lineup, leading to an improvement in sales of the updated L series models.

It can be seen that in the first half of 2024, the price war in the new energy vehicle industry had intensified to a certain extent, with enhanced features no longer necessarily attracting consumers. Only price reductions could convince consumers to make purchases.

However, as mentioned at the beginning, it is quite unusual that at the beginning of the second half of 2024, automakers such as BMW, Honda, and Li Auto suddenly became "rational," reversing the price war and raising product prices. Against this backdrop, the price war in the auto industry showed signs of slowing down.

Considering that the auto market has not grown, why have these automakers proactively narrowed their preferential policies?

02

Low prices cause too much damage, traditional automakers lead the way in reversing the price war

Undeniably, low prices are indeed a powerful tool to attract consumers, but they are by no means a "mind-controlling drug" that compels consumers to make impulse purchases.

In the past few years, China's auto market has undergone its fourth major technological transformation. With advantages such as intelligence, excellent driving experience, and low operating costs, new energy vehicles have increasingly become the main theme of the industry, attracting consumers' attention.

Against this backdrop, sales of traditional fuel vehicle brands are gradually declining. Taking Honda as an example, its sales in the Chinese market from 2021 to 2023 were 1,561,500, 1,373,100, and 1,234,200 units, respectively, declining by 4.0%, 12.07%, and 10.12% year-on-year.

On the one hand, new energy vehicles offer more powerful features, and on the other hand, new energy automakers are also committed to capturing market share through price reductions. Traditional fuel vehicle brands that do not want to be eliminated cannot afford not to participate in the price war.

According to data from JL Auto, in the first half of 2024, the discount rates for luxury models priced around 200,000 yuan, such as the Mercedes-Benz A-Class and BMW X1, were higher than 35% compared to their guide prices. The discount rates for mainstream mid-size sedans such as the BMW 3 Series, Audi A4L, and Mercedes-Benz C-Class also exceeded 25%.

However, traditional fuel vehicle brands have obviously underestimated the appeal of new energy vehicles to consumers. Despite price reductions, these brands have failed to expand their market influence as expected. Financial reports show that in the first half of 2024, sales of Mercedes-Benz, BMW, and Audi in China were 352,600, 360,000, and 320,400 units, respectively, declining by 6.5%, 5.4%, and 1.9% year-on-year.

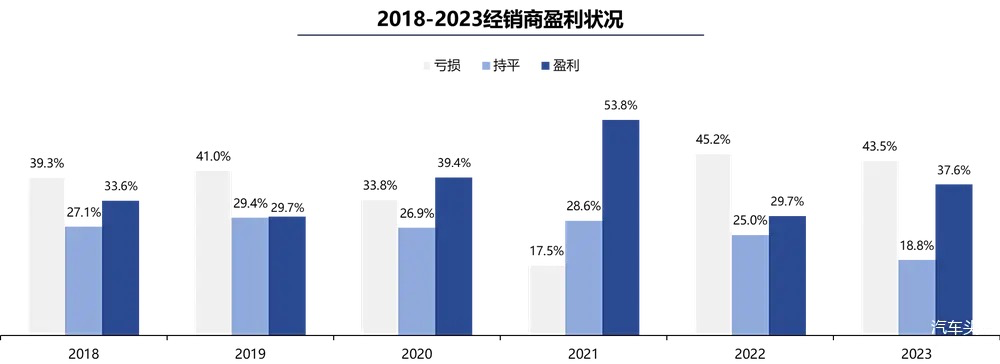

What is even more concerning for traditional fuel vehicle brands is that, relying heavily on dealers to reach consumers, significant price reductions have not only failed to stabilize the market but have also plunged downstream dealers into difficulties.

Image source: China Automobile Dealers Association

According to the "2023 National Auto Dealer Survival Status Survey Report" released by the China Automobile Dealers Association, 43.5% of auto dealers lost money in 2023, 18.8% broke even, and only 37.6% made a profit. Among them, Guanghui Auto, the largest dealer in terms of sales volume, has been suspended from trading due to financial difficulties and is on the verge of delisting.

Considering that traditional fuel vehicle brands lack direct sales channels, significant price reductions lead to dealer losses, which also threaten their own survival. If dealers are dragged down by the price war and go out of business, traditional fuel vehicle brands will face existential challenges.

Precisely because price reductions have not only failed to boost sales but have also put immense pressure on players in the upstream and downstream industrial chains, many traditional fuel vehicle brands have proactively withdrawn from the price war since July 2024.

However, it is important to note that since July 2024, not only traditional fuel vehicle brands have withdrawn from the price war, but new energy vehicle makers represented by Li Auto and NIO have also started to "raise prices." For example, in July 2024, NIO reduced the free battery swap credits offered through its Battery as a Service (BaaS) program from 4,000 yuan to 2,000 yuan. By the end of the month, some NIO models saw price increases of 3,000-5,000 yuan.

As "catfish," some new energy vehicle makers have stopped stirring up the auto industry and instead followed traditional automakers in withdrawing from the price war, possibly because they have already won over sales and become vested interests. Official data shows that in July 2024, NIO delivered 20,500 vehicles, marking the third consecutive month of deliveries exceeding 20,000 units. From January to July, NIO delivered a cumulative total of 107,900 vehicles, an increase of 43.85% year-on-year.

Image source: Li Auto

Similarly, as mentioned at the beginning, Li Auto has also started to narrow the preferential policies for the Li L6, largely based on the strong sales performance of the model. According to official data from Li Auto, as of the 32nd week of 2024 (August 5-11), Li Auto has consistently ranked first in sales among new energy vehicle brands in the Chinese market for 16 consecutive weeks, with the Li L6 being its most important sales contributor.

Considering that most new energy vehicle makers have not yet turned a profit, after achieving breakthroughs in sales, they naturally need to raise product prices to expand profit margins and boost investor confidence.

03

Oversupply remains a challenge, and the price war is far from over

Judging from the current situation, traditional automakers and new energy vehicle makers seem to have reached a tacit understanding on pricing. Maintaining a certain profit margin, traditional automakers cling to brand premiums, while new energy vehicle makers can capture consumers with their intelligence advantages. Both sides have ceased engaging in vicious price wars.

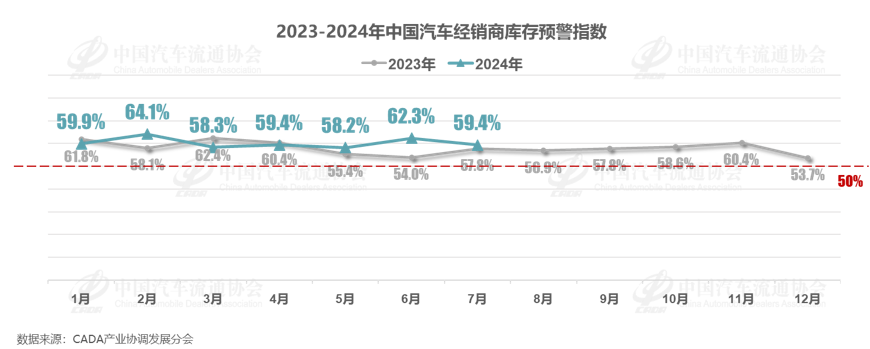

However, it's important to note that this may merely be a one-sided wishful thinking on the part of some brands. Overall, the inventory pressure in China's auto industry remains high, and a significant number of automakers are facing enormous shipping pressure. It is difficult to completely eliminate price wars.

Image source: CPCA

Data disclosed by CPCA shows that in July 2024, China's auto dealer inventory early warning index was 59.4%, up 1.6 percentage points year-on-year. Generally speaking, 50% is the Rongdu Line for the inventory early warning index. Below this level indicates a reasonable range, while above this level indicates limited downstream demand and significant upstream dealer inventory pressure. Since January 2024, China's auto dealer inventory early warning index has consistently been above 50%, which is a key driver of the intensifying price war.

Amid high dealer inventory early warning indexes, the slowdown in the price war in China's auto industry is partly due to leading automakers such as BMW, Honda, and Li Auto hoping to maintain brand value and profits. It is also because the industry has entered an adjustment phase.

The CPCA's outlook report on the national passenger car market notes that August 2024 only contains 22 working days, one day fewer than the previous year. Coupled with structural changes in the auto market growth, most enterprises have ample production capacity for their traditional models and choose to extend vacations during high temperatures, leading to a hiatus in the entire auto market.

Image source: BYD

As the scorching heat subsides and the wave of new car launches gradually picks up in the second half of the year, the price war in China's auto industry shows signs of resurging. For example, on July 29, 2024, BYD's FANGCHENGBAO brand announced a direct price reduction of 50,000 yuan across the BAO 5 lineup, lowering the entry price range to 239,800-302,800 yuan.

Image source: ZEEKR

Similarly, on August 13, ZEEKR launched the 2025 ZEEKR 001 and ZEEKR 007. While the price of the ZEEKR 001 remains unchanged, it now comes standard with self-developed intelligent driving technology. The ZEEKR 007 sees a maximum price reduction of 30,000 yuan and comes standard with lidar and dual Orin-X chips, upgraded with the self-developed HAOHAN intelligent driving system 2.0.

The reason why brands like BYD and ZEEKR continue to engage in price competition is largely due to the impending elimination rounds in the industry as market dividends disappear. Without sacrificing profits to capture market share, automakers will struggle to advance to the next stage of competition.

In March 2024, during a media interview, Zhu Huarong, the party secretary and chairman of Changan Automobile, stated that it is expected that in 2024, the top 10 automakers in terms of sales will account for approximately 85% of the market share. In the coming years, 80% of brands will cease operations. Meanwhile, He Xiaopeng, chairman and CEO of XPeng Motors, also declared during an interview that "China's new energy vehicle market has begun to enter elimination rounds."

From this perspective, the "cooling off" of the auto price war since the second half of 2024 does not necessarily mean the industry will return to rational development. Rather, it may simply be the result of a "conspiracy" among some automakers deeply affected by the price war, attempting to escape from the vicious competition during an industry adjustment period.

Considering the persistently high inventory pressure in China's auto industry and the gradual disappearance of market growth dividends, many new energy vehicle makers cannot afford to completely abandon price wars to expand their market influence and shift competitive pressures.

Therefore, the recent "cooling off" of the auto price war is reminiscent of the calm before the storm, perhaps brewing an even fiercer price war ahead.