Kangjia Group’s 'Age of Confusion': Years of Consecutive Losses, Insufficient Resilience for the 'King of Color TVs'?

![]() 08/16 2024

08/16 2024

![]() 438

438

Author|Xingxing

Source|Beiduo Finance

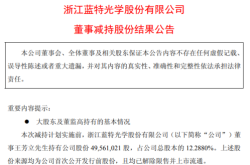

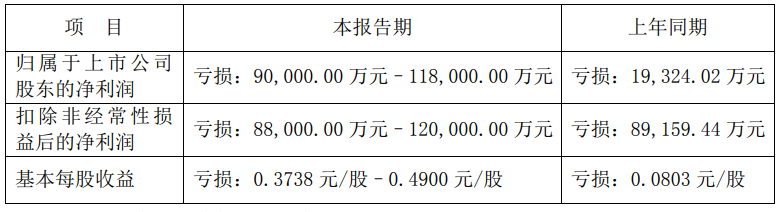

Recently, Konka Group Co., Ltd. (hereinafter referred to as 'Konka' or 'Konka Group', SZ:000016) released its 2024 semi-annual performance forecast, predicting that its net profit attributable to shareholders of listed companies for the first half of the year will be -900 million to -1.18 billion yuan; after deducting non-recurring items, the net profit will be -880 million to -1.2 billion yuan, and both losses have widened compared to the same period in 2023.

Konka Group, which once stood at the top of China's color TV sales, might not have anticipated that it would eventually fall behind comprehensively and even struggle with sluggish performance for an extended period. However, as the saying goes, 'Rome wasn't built in a day,' and Konka's 'dabbling' in multiple fields over the past decade has ultimately led to failure.

Transformation is challenging, and regaining peak performance is even more difficult. Today's home appliance industry is no longer Konka Group's 'comfort zone.' Continuously burning money is clearly not a sustainable strategy for long-term development. Instead, how the brand can nurture new growth opportunities is a question that this 44-year-old home appliance veteran should consider.

I. Market Downturn, Two Waves of Volatility in Capital Markets

Konka Group explained in its performance forecast that in the first half of this year, despite the decline in the domestic color TV market, its domestic color TV business revenue and gross profit increased year-on-year. However, due to limited room for cost reduction and intensifying competition, the color TV business remained in a loss-making state.

Meanwhile, as Konka Group's semiconductor business is still in the initial stages of industrialization and has not yet achieved large-scale and profitable output, combined with fluctuations in the prices of tradable financial assets, resulting in a change in fair value of approximately -171 million yuan and asset impairment provisions based on accounting policies, ultimately affecting the company's overall profit level.

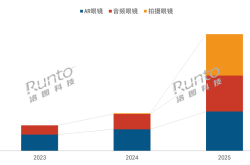

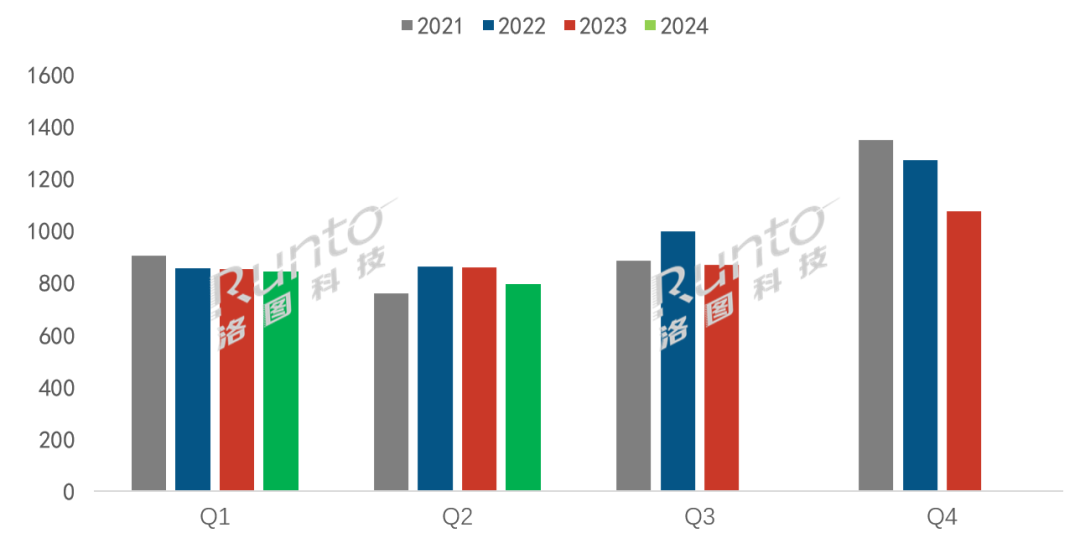

Indeed, the home appliance industry has performed poorly this year. Data from RUNTO's 'Monthly Brand Shipment Tracking of China's TV Market' shows that total brand unit shipments in the domestic TV market reached 16.39 million units, a 4.2% decrease from the same period in 2023, with a 7.5% decline in shipments in the second quarter alone.

The significant decline in demand has become the biggest 'nightmare' for home appliance companies seeking to boost performance. To survive the industry's downturn, the key is to stand out in the competition for existing markets. Compared to Konka Group, which is mired in losses, its competitors in the same home appliance sector are clearly more confident.

According to TCL Electronics' (01070.HK) performance forecast, thanks to the company's active promotion of mid-to-high-end strategies and global operations, as well as the development of new businesses, its adjusted net profit for the first half of 2024 is expected to increase by 130% to 160% year-on-year, showing robust growth momentum.

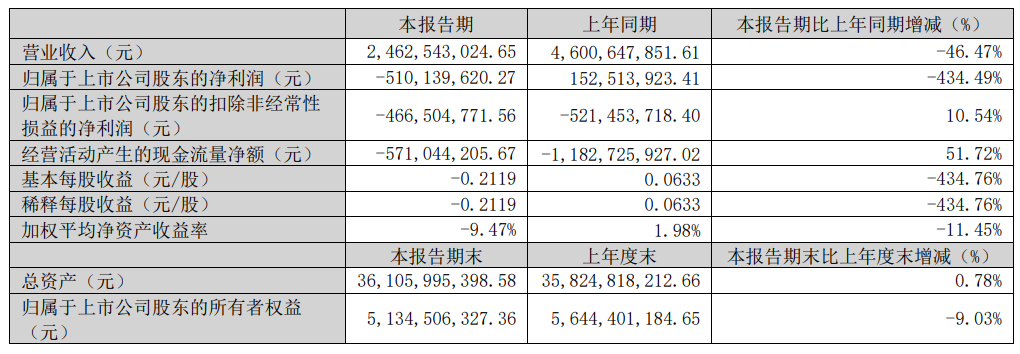

Hisense Visual Technology (000921.SZ) reported revenue of 12.702 billion yuan in Q1 2024, representing a 10.61% increase. In contrast, Konka's revenue and profit for the same period were 2.463 billion yuan and -510 million yuan, respectively, down 46.47% and 434.49% year-on-year; after deducting non-recurring items, the net profit increased slightly but remained in the red.

At that time, Konka Group could still attribute its weak revenue to the adjustment and optimization of non-core businesses with poor synergy with its main business, leading to a year-on-year decline in revenue scale. The significant drop in profit was related to changes in the accounting method for some equity interests in its affiliated and participating enterprises, resulting in significant investment gains.

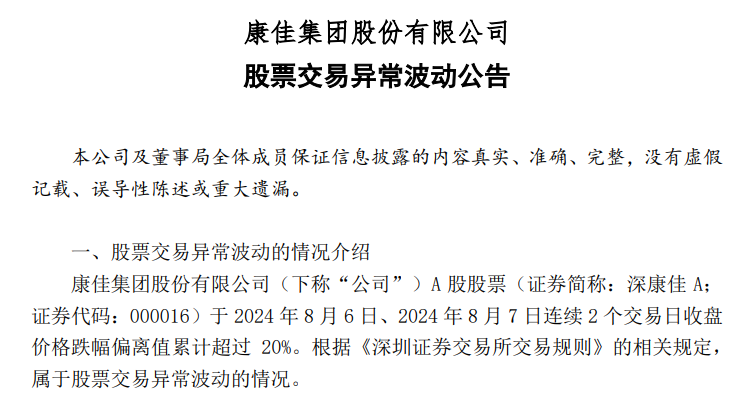

This interim performance forecast fully exposes Konka Group's hidden operational pain points. Unsatisfactory financial results have led to a wave of 'voting with their feet' in the capital markets. Just entering August, Konka has issued two announcements of abnormal fluctuations in stock trading, both due to cumulative closing price increases exceeding 20% over two consecutive trading days.

II. Loss of Performance, 'The Big Three' Are No Longer What They Used to Be

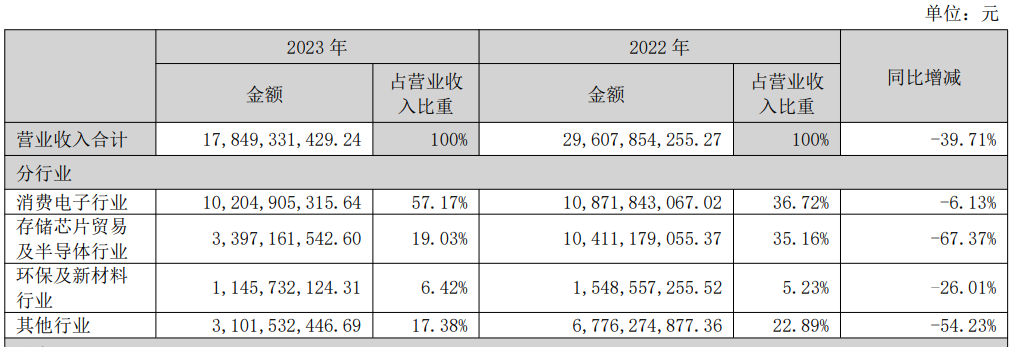

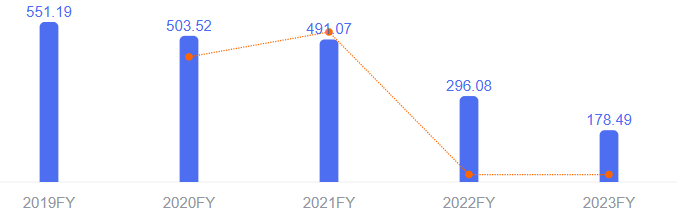

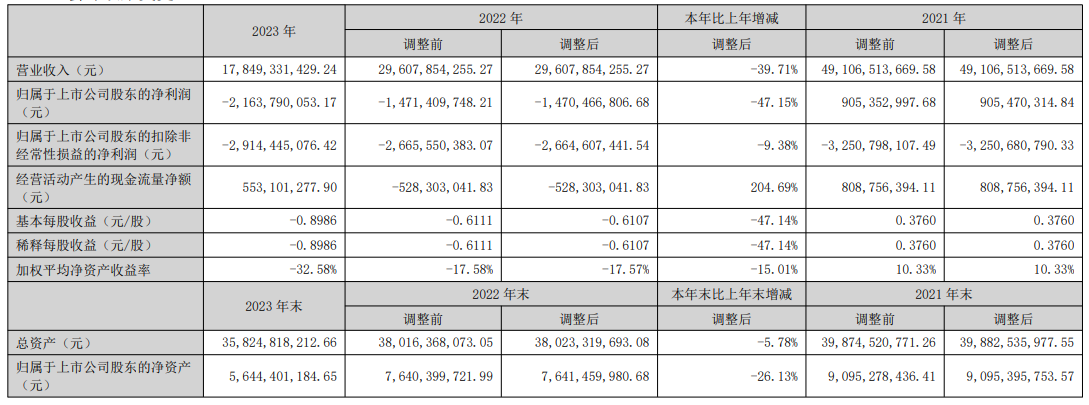

In fact, Konka Group has struggled with sluggish performance for a long time. The company's revenue in 2023 was 17.849 billion yuan, down 39.71% year-on-year; revenue from its core consumer electronics business was 10.205 billion yuan, down 6.13% year-on-year, with the gross margin for this business also declining 1.51 percentage points to 5.24%.

Tracing back, Konka Group's revenue began to decline after surpassing the 55 billion yuan mark in 2019. While the 8.65% decline in 2020 and the 2.47% decline in 2021 could be considered 'minor,' the company's revenue fell by 39.71% year-on-year in 2022, and this 'cliff-like drop' has continued until now.

Moreover, Konka Group's net profit attributable to shareholders in 2023 was -2.164 billion yuan, down 47.15% year-on-year; after deducting non-recurring items, the net profit was 2.914 billion yuan, down 9.38% year-on-year. Measured by net profit after deducting non-recurring items, Konka has been in a state of continuous losses since 2011, accumulating losses of over 13 billion yuan as of 2023.

Back in its heyday, Konka Group, founded in May 1980, was China's first Sino-foreign joint venture electronics enterprise after China's reform and opening-up, enjoying rapid development. Recognized as a 'Famous Trademark of China' in 1997, Konka surpassed Changhong the following year to become the brand with the highest domestic market share in color TVs.

Konka Group developed China's first high-definition digital TV in 1999. Media reports have mentioned that Konka TVs were used in Tiananmen Square and the CCTV studio to broadcast the 50th anniversary military parade. From 2003 to 2007, the brand ranked first in China's color TV sales for five consecutive years.

It is worth noting that Chen Weirong, the founder of Konka Group, was a classmate of Li Dongsheng, the founder of TCL Group, and Huang Hongsheng, the founder of Skyworth Group (00751.HK), at South China University of Technology. The three domestic brands under their leadership were once known as the 'Big Three of Color TVs,' with their combined output accounting for 40% of the national total.

Times have changed, and Konka Group's glory days are over, but the other two brands that once raced neck and neck with it continue to shine in the color TV industry. Skyworth Group reported revenue of 69.031 billion yuan in 2023, up 29.1% year-on-year, and plans to exceed 100 billion yuan in revenue by 2025.

TCL Corporation's TCL Technology also saw significant improvements in various performance indicators, with revenue increasing by 4.69% year-on-year to 174.367 billion yuan in 2023. Together with TCL Industry, which reported revenue of 120.32 billion yuan, they contributed nearly 300 billion yuan to TCL Corporation's main business, with an average annual growth rate of 18% over the past five years.

III. Strategic Instability, Brand Transformation Rushed but Unsuccessful

Why did the former 'King of Color TVs' fall so far behind in the competition? It all starts with Konka Group's strategic decisions.

In the late 1990s, to capture more market share, Konka chose to persist with a massive expansion policy despite market saturation, leading to overcapacity and high inventories, ultimately resorting to loss-making sales. After reporting a loss of 700 million yuan, founder Chen Weirong left Konka in 2001 to start his own business.

After Chen Weirong's departure, Konka Group, focused on topping sales charts, continued to engage in the industry's price war, offering significant discounts to boost sales. Simultaneously, it ventured into mobile phone development, signing high-profile celebrities like Maggie Cheung as brand ambassadors with hefty endorsement fees.

The combination of low-price strategies and marketing effects undoubtedly brought short-term success to Konka Group but also sowed the seeds of long-term troubles. In 2007, when many color TV brands began exploring new growth avenues, Konka, now under the control of real estate developer Overseas Chinese Town after Chen Weirong's departure, ventured into real estate development.

However, the high upfront investment required by the real estate industry failed to meet Konka Group's immediate funding needs. Not only were the investment results unsatisfactory, but internal disagreements emerged, with 42 senior management changes in 2015 alone, and color TV shipments lagged far behind competitors in the same industry.

Entering its thirties, Konka Group found itself in a state of confusion about transformation. According to numerous financial reports, Konka has proposed new development strategies periodically over the past decade. In 2014, it aimed to become 'China's first smart TV internet operation platform,' and in 2016, it embraced the slogan 'software + hardware.'

In 2017, Konka Group began planning to shed the single label of 'TV' and explore diversified development paths, adding 'investment holding + finance' while also mentioning concepts such as 'technology + industry + urbanization.' In 2018, to enter the semiconductor industry, Konka further proposed a '1234' transformation development strategy.

Industry insiders told the First Power Grid that corporate strategy is crucial to a company's holistic, long-term, and fundamental development. Over the past decade, during which the home appliance industry underwent dramatic changes, Konka's frequent strategic shifts reflect a lack of strategic resilience in its corporate development.

IV. Conclusion

Reviewing Konka Group's 2023 financial report, it announced that it would optimize resources to focus on its two main businesses of consumer electronics and semiconductors under the new development framework of 'One Axis, Two Wheels, and Three Drivers.' However, for now, Konka's semiconductor business has yet to achieve large-scale and profitable output, and there is still a long way to go before it can generate profits.

According to RUNTO data, Hisense, Xiaomi, TCL, and Skyworth collectively accounted for 79.0% of the market share at the end of 2023, establishing an absolute advantage in market size. It is also predicted that brand unit shipments in China's TV market will further decline to approximately 34.5 million units in 2024, a year-on-year decrease of about 5.6%.

All signs indicate that after taking a detour, Konka Group, which is returning to its old business, will find it challenging to break through in a highly competitive market with limited demand.