Lepin: Revenue and gross margin both fell short of expectations, can it turn around overseas?

![]() 08/16 2024

08/16 2024

![]() 644

644

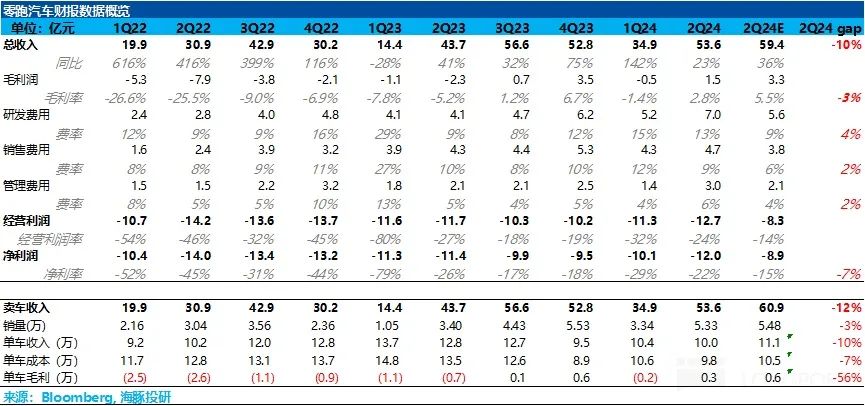

Lepin Automobile (9863.HK) released its second quarter 2024 financial report after the Hong Kong stock market closed on May 17, Beijing time. Let's look at the key information:

1. Both gross margin and revenue fell short of expectations in the second quarter due to lower unit prices: Unit prices continued to decline by RMB 4,000 sequentially compared to the previous quarter. Dolphin believes this is primarily due to the increased proportion of the lower-priced C10 pure electric version and the full impact of price reductions for 2024 models compared to older models being felt in the second quarter, resulting in a decline in unit prices.

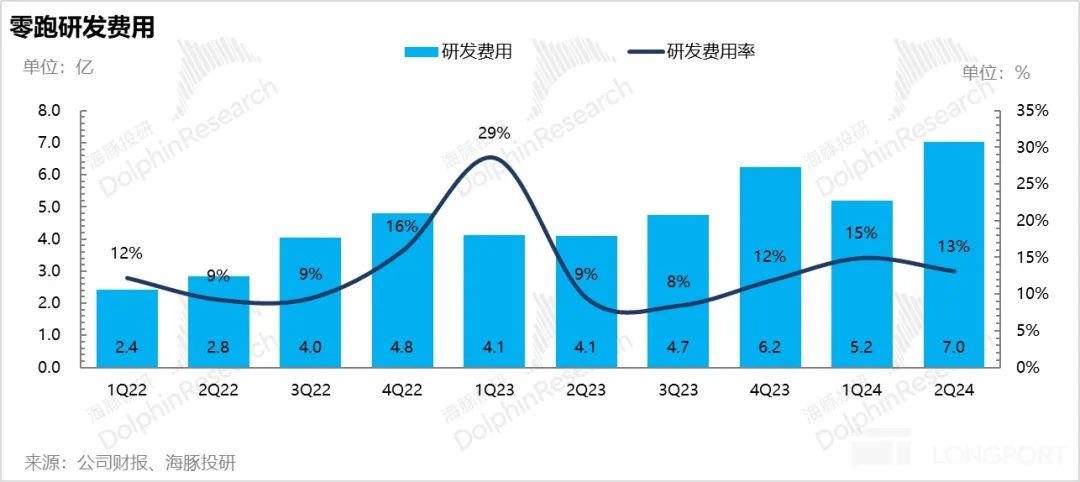

2. Operating expenses hit a new high, R&D expenses surged: Operating expenses hit a new high in the quarter, exceeding market expectations. Specifically, R&D expenses exceeded expectations the most, mainly due to increased investment in intelligent driving technology. Lepin has started developing an end-to-end large model intelligent driving system, increasing human resources, computing power, and equipment investments in this direction.

3. Operating profit declined sequentially and fell short of market expectations: In the second quarter, operating profit continued to decline sequentially to RMB -1.3 billion, significantly lower than market expectations of RMB -0.8 billion, due to lower-than-expected gross margin as unit prices continued to decline and higher-than-expected operating expenses due to surging R&D expenses.

4. Fortunately, the outlook is positive: Lepin expects sales in the third quarter to increase significantly compared to the second quarter, and expects gross margin to perform better in the second half of the year.

Lepin's second-quarter results did not meet investors' expectations, with both revenue and gross margin falling short of market projections. The core reason for this underperformance was lower unit prices.

The market had expected gross margin to recover sequentially to 5.5% in the second quarter due to improved model mix: The proportion of T03 compact cars declined (from 28% in Q1 to 25.4%), while the higher-priced, higher-margin C16 was launched in June, increasing its proportion by 1.7%. Additionally, increased sales led to lower manufacturing costs, which would drive an overall recovery in gross margin. However, the unit price in Q2 continued to decline compared to Q1. Dolphin believes there are two reasons for this:

1) The 2024 models were launched in March with lower prices compared to older models, but the full impact of these price reductions was only felt in Q2.

2) The proportion of the lower-priced mid-size SUV C10 increased, particularly the pure electric version of the C10, which saw the fastest sequential sales growth in Q2. This version has a lower price than the extended-range version, dragging down the average unit price.

Despite sequential sales growth and lower manufacturing costs in Q2, automotive gross margin still fell short of expectations due to the continued decline in unit prices.

Looking at the core operating profit, it also fell significantly short of expectations in Q2 due to both lower-than-expected gross margin and record-high operating expenses, all of which exceeded market projections. The largest increase in expenses was in R&D, primarily due to Lepin's increased investment in intelligent driving technology. Lepin has started developing an end-to-end large model intelligent driving system, increasing investments in human resources, computing power, and equipment in this direction.

Fortunately, Lepin's guidance for the third quarter indicates a significant increase in sales compared to the second quarter and expects gross margin to perform better in the second half of the year.

The current share price corresponds to a 2024 P/S multiple of 1.2-1.4x, down from 1.8-2x at the time of the first-quarter results. Although the second-quarter results fell short of expectations, the share price is expected to rebound somewhat. However, with expected improvements in gross margin and sales in the second half of the year, the valuation remains relatively reasonable for the year as a whole.

Dolphin believes that Lepin's medium- to long-term upside potential lies in its overseas expansion. Due to its model positioning (mainly priced between RMB 100,000 and RMB 200,000), pricing power in this segment is still dominated by BYD, and Lepin can only follow its pricing strategy. There may be a ceiling for domestic sales and gross margin growth (as evidenced by BYD's launch of the Glory Edition + DMI 5.0 models in Q2, which impacted Lepin's extended-range model sales).

Lepin's differentiating competitiveness lies primarily in its partnership with Stellantis. This partnership not only allows Lepin to leverage Stellantis' existing sales channels but also provides access to its well-known brand in high-risk policy and high-tariff markets like the US and Europe. Lepin can flexibly sell through SKD mode or utilize Stellantis' overseas factories for production and assembly, reducing trade barrier risks.

Lepin is currently developing models focused on the B-segment (between the T03 and C-segment). Given the European market's preference for compact cars, Dolphin believes these B-segment models are primarily targeted at overseas markets. Lepin expects overseas sales to contribute significantly to total sales in 2025 (projected overseas sales of 60,000-100,000 units).

Detailed Analysis Below

I. Gross Margin Fell Short of Expectations in Q2 Due to Lower Unit Prices

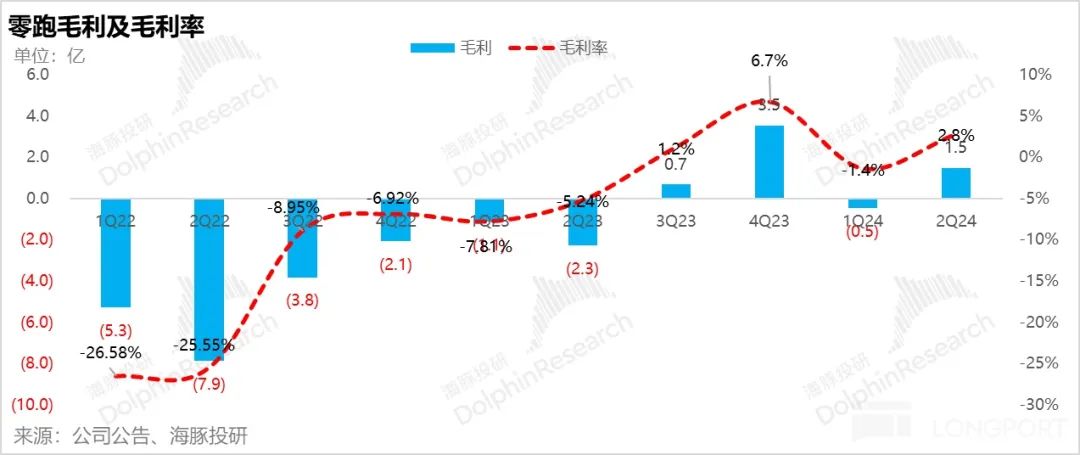

Investors were most concerned about Lepin's gross margin in its latest results. Despite expectations of a sequential recovery in gross margin in Q2, Lepin's actual gross margin was only 2.8%, falling short of market expectations of 5.5%. The problem lay in lower unit prices.

2) Unit Prices Continued to Decline Sequentially!

a) Average unit price was only RMB 100,000, down RMB 4,000 sequentially from the previous quarter

The average unit price in Q2 was only RMB 100,000, lower than market expectations of RMB 111,000. Market participants had anticipated an improvement in model mix, with a decline in the proportion of T03 compact cars (from 28% in Q1 to 25.4%) and an increase in the proportion of the higher-priced, higher-margin C16 (launched in June, increasing its proportion by 1.7%), leading to a recovery in average unit prices. However, average unit prices continued to decline in Q2 compared to Q1. Dolphin believes there are two reasons for this:

1) The 2024 models were launched in March with lower prices compared to older models, but the full impact of these price reductions was only felt in Q2. The higher-priced, higher-margin C16, which started delivering in June, had not yet contributed significantly to Q2 and is expected to improve average unit prices in the second half of the year.

2) The proportion of the lower-priced mid-size SUV C10 increased, particularly the pure electric version of the C10, which saw the fastest sequential sales growth in Q2. Its lower price compared to the extended-range version dragged down the average unit price.

b) Increased sales drove down average unit manufacturing costs:

Average unit manufacturing cost was RMB 98,000 in Q2, down RMB 8,000 sequentially from RMB 106,000 in the previous quarter.

The decline in manufacturing costs was due to increased sales from the Q1 trough, with Q2 sales up 59% sequentially. Higher capacity utilization reduced average unit manufacturing costs. Additionally, the increased proportion of the lower-priced, lower-cost C10 contributed to the decline in average unit manufacturing costs.

c) Gross margin turned positive but fell short of expectations

Average unit prices declined by about RMB 4,000, while average unit costs declined by about RMB 8,000, resulting in a positive gross margin for the quarter but still falling short of market expectations of 5.5%.

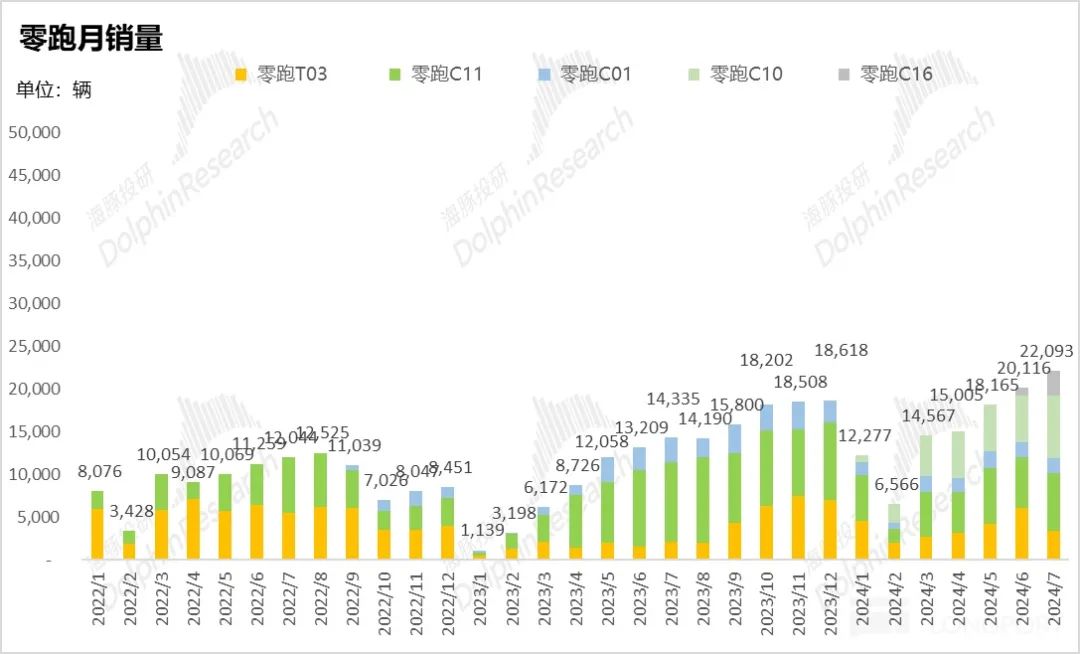

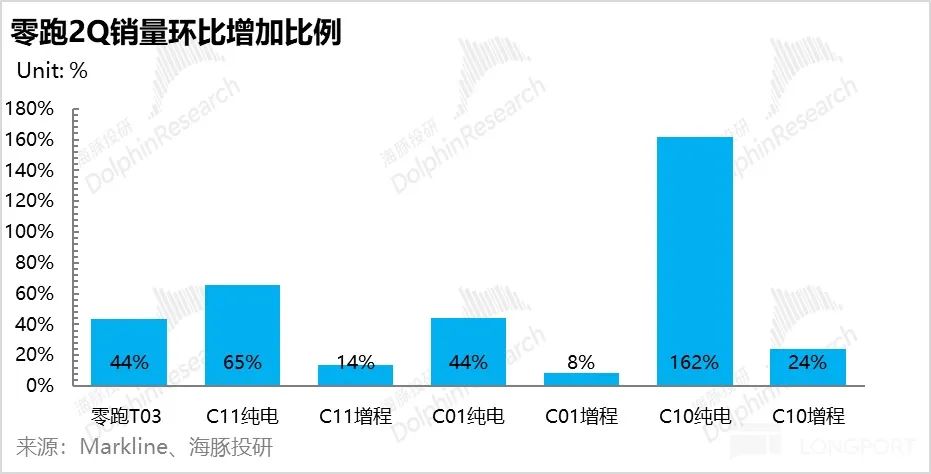

II. Sales Increased by About 59% Sequentially in Q2, with Faster Recovery in Pure Electric Models than Extended-Range Models

In Q2 2024, Lepin delivered 53,000 vehicles, up 59.5% sequentially, as sales recovered from the Q1 trough due to price reductions on older models and the launch of new, lower-priced 2024 models.

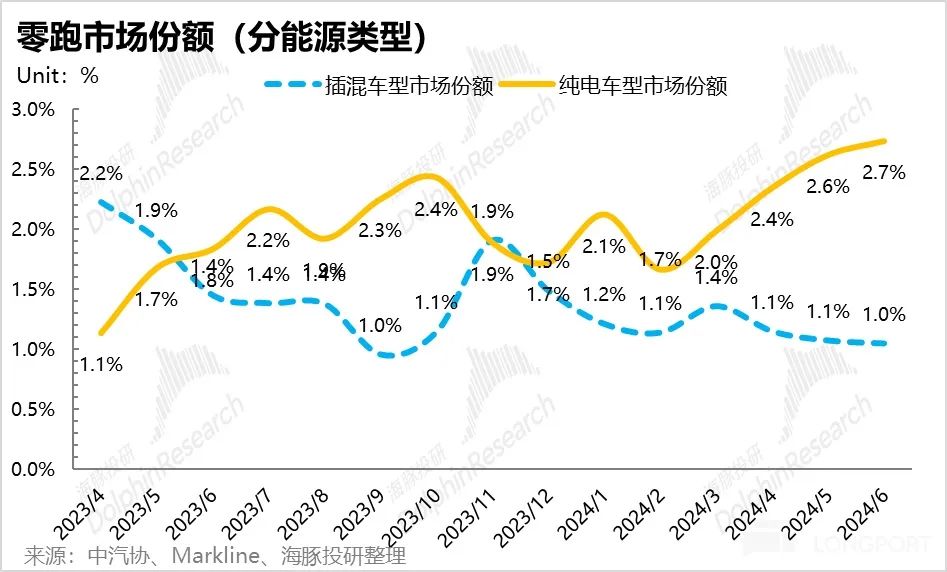

Looking at the sales breakdown by model, an interesting trend emerged: sales of pure electric versions generally recovered faster than extended-range versions. Excluding the low-priced T03 compact car, sales of extended-range versions only recovered by 26% sequentially, with their proportion declining by 10 percentage points to 31% in Q2. In contrast, sales of pure electric versions recovered by 93% sequentially, increasing their proportion to 69%.

Possible reasons for this trend include:

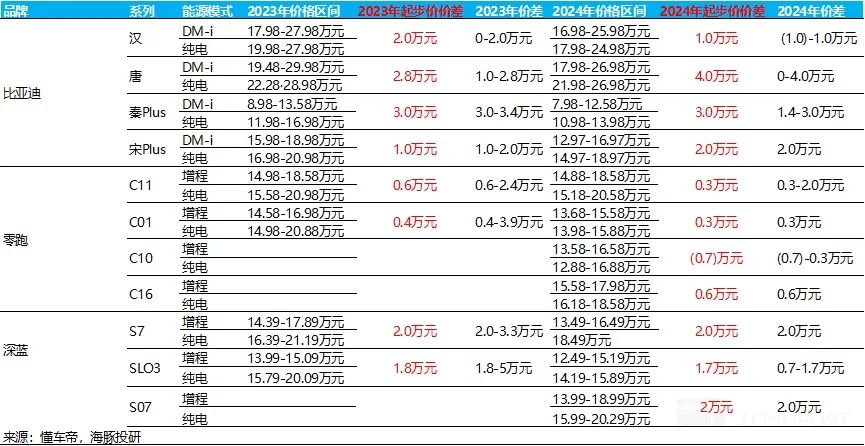

1) Lepin's primary price range of RMB 100,000-200,000 faced competition from BYD's "price killer" strategy starting in February 2024. BYD's launch of the Glory Edition in February pushed down the main price range for plug-in hybrids from RMB 100,000-200,000 to RMB 50,000-150,000. BYD also leveraged its DMI 5.0 technology to optimize range and fuel efficiency, competing for market share in this price range.

While Lepin could reduce manufacturing costs through full vertical integration (supplying about 60% of BOM costs in-house, excluding batteries) and high platform commonality (up to 99%), it still lacked BYD's advantages in cost and technology. For example, Lepin's C10 extended-range model had a similar starting price to BYD's Song L but lagged in size, fuel efficiency, and range, resulting in a decline in Lepin's extended-range market share from a peak of 1.9% in November 2023 to 1% in June 2024.

2) Lepin had the smallest price difference between its extended-range and pure electric models, with the pure electric C10 version even priced lower than the extended-range version, boosting pure electric market share recovery.

Compared to other automakers in this price range, the starting price difference between pure electric and plug-in hybrid models is typically RMB 10,000-40,000 due to higher battery costs. However, Lepin's starting price difference between extended-range and pure electric versions was only RMB 3,000-6,000, with the pure electric C10 version even priced lower. This made Lepin's pure electric models more competitive and led to a faster recovery in sales.

In terms of sales recovery, the fastest-growing model in Q2 was the Lepin C10 pure electric version, with sales up 162% sequentially. This drove the overall pure electric market share up from a trough of 1.7% in February to 2.7% in June. However, the lower price of the C10 pure electric version also dragged down the average unit price in Q2.

III. Revenue Fell Short of Market Expectations

Lepin's total revenue in Q2 was RMB 5.36 billion, up 54% sequentially but below market expectations of RMB 5.94 billion, primarily due to lower-than-expected unit prices in the quarter.

IV. Operating Expenses Hit a New High, R&D Expenses Surged

In R&D, Lepin adheres to full vertical integration. While previous R&D focused more on electronics, the focus in 2024 is on new models and intelligent systems. The 2024 models include intelligent driving versions, bringing intelligent driving technology to the RMB 150,000-200,000 price range. In sales, Lepin positions itself more as a manufacturing company, relying primarily on dealers, so manufacturing personnel make up the largest proportion of employees, while sales personnel have decreased slightly compared to the end of 2023.

1) R&D Expenditure:

Lepin insists on full vertical integration in R&D, focusing on developing core intelligent electric vehicle systems and electronic components in-house. Lepin manufactures about 60% of its BOM costs in-house, including key hardware and software, with strong vertical integration capabilities. The platform commonality rate of its LEAP 3.0 architecture has reached 88%, allowing for a 25% reduction in development cycles and a 40% reduction in development costs for C-platform models, contributing to significant cost savings and efficiency gains.

In terms of employee numbers, Lepin's R&D team has grown the most among all departments, increasing by 31% from the end of 2023 to over 3,800 people.

Lepin's R&D focus in 2024 is on intelligent systems. It is developing an end-to-end large model intelligent driving system and will continue to increase investments in human resources, computing power, and equipment in this direction. Dolphin believes this is primarily to compete with Xpeng's MONA intelligent driving system, which is expected to enter the RMB 150,000 price range.

Lepin's current intelligent driving system is priced as low as RMB 160,000 (the 2024 C10/C11/C16 high-end intelligent driving versions are equipped with Qualcomm 8295 and NVIDIA ORIN X dual high-end chips, offering 254 TOPS of computing power and over 30 sensors, including lidar and 8-megapixel high-definition cameras), creating differentiated competitiveness compared to similarly priced models.

Leopaard Auto is investing more in intelligence this year to enhance its competitiveness. It plans to launch more advanced autonomous driving capabilities and further optimize functions in the second half of 2024, including open-road point-to-point commuting and memory parking in parking lots. By 2025, it aims to introduce city autonomous driving capabilities (CNAP) based on an end-to-end autonomous driving model, with R&D expenses expected to continue growing significantly this year.

2) Selling expenses:

Leopaard Auto's selling expenses in Q2 were 470 million yuan, higher than market expectations of 380 million yuan.

The increase in selling expenses this quarter was mainly due to the delivery of 24 models, resulting in increased advertising and promotional efforts. However, compared to other new energy vehicle (NEV) companies, Leopaard Auto's selling expenses are still relatively low, positioning it more as a manufacturing-oriented company.

Leopaard Auto plans to expand its channel network from 560 stores at the end of last year to 800 stores this year. As of July, it had already established 665 stores in China, with the potential to further boost sales in the second half of the year.

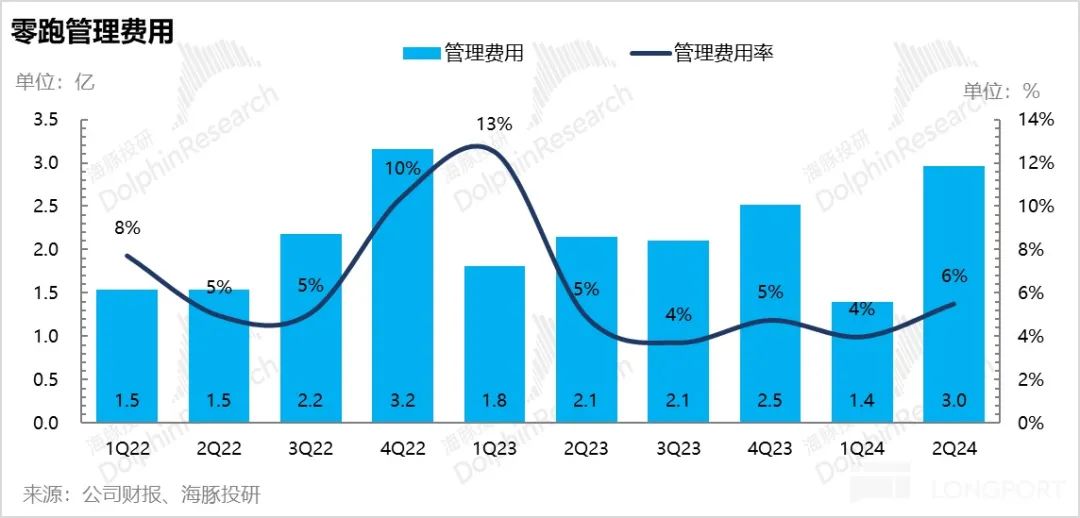

3) Administrative expenses:

Administrative expenses for this quarter were 300 million yuan, an increase of 160 million yuan from the previous quarter. This increase was partly due to higher option expenses (up 40 million yuan from 76 million yuan in the previous quarter) and partly due to an increase in the number of administrative staff.

Despite higher sales, operating profit was only -1.3 billion yuan due to the record-high operating expenses driven by increased R&D expenses and lower-than-expected gross margins. This was a significant decline from the previous quarter and market expectations of -800 million yuan. Net profit was also -1.2 billion yuan, lower than market expectations of -900 million yuan.

V. Leopaard Auto expects sales and gross margins to continue rising in the second half of 2024

Despite missing market expectations in this earnings report, Leopaard Auto provided positive guidance for the third quarter, with significantly higher sales than Q2 and expectations of better gross margins in the second half of the year. Dolphin believes that sales and gross margins will continue to improve in the second half of the year, driven by several positive factors:

1) 800V+ autonomous driving technology extended to the 150,000-200,000 yuan price range, creating differentiated competition

Leopaard Auto's mid-to-large SUV C16, with a higher price and gross margin, began deliveries in June. The C16, equipped with 800V technology across its range, is the first vehicle from the company to offer 800V technology in the 160,000 yuan price range. Positioned as a 6-seater family SUV, it creates differentiated competitiveness.

Meanwhile, 24 models have added autonomous driving versions equipped with NVIDIA Orin X chips (254 TOPS computing power) and 1 LiDAR, with a starting price of 165,800 yuan (for the extended-range C10 version). This is currently the lowest-priced model with similar autonomous driving hardware, differentiating it from competitors.

Dolphin believes that plug-in hybrids in the 100,000-150,000 yuan price range will see the fastest sales growth this year, while differentiated pure electric vehicles in the 150,000-200,000 yuan range still have room for further market penetration. Leopaard Auto is expected to benefit from this trend (though competition from Xpeng's Mona model, which also offers autonomous driving technology in the 150,000 yuan range, should be noted).

2) Improved model mix and overseas expansion contributions

The delivery of the C16, Leopaard Auto's highest-priced and highest-margin model, began in June and is expected to significantly impact the model mix in the second half of the year. In July, over 10,000 new orders were for the C16 (with cumulative orders exceeding 10,000 since its launch), and its steady-state sales are expected to reach 5,000-6,000 units, driving gross margin improvements.

In terms of overseas expansion, Leopaard Auto expects to sell 6,000-10,000 vehicles internationally this year, with the T03 and C10 as the main models. While overseas sales currently have a limited impact on gross margins (as Leopaard Auto primarily uses cost-based pricing to support Leopaard Auto International), significant growth is anticipated in 2025, with overseas sales expected to contribute 60,000-100,000 vehicles.

3) Further enhanced trade-in subsidies

Trade-in subsidies have been increased, with subsidies for purchasing NEVs after scrapping old vehicles rising from 10,000 yuan to 20,000 yuan. Scrapped vehicles tend to be around 13 years old, and their owners are often more price-sensitive, favoring lower-priced models. This further benefits NEV companies targeting the 100,000-200,000 yuan price range, such as Leopaard Auto.

4) A new round of cost reduction expected to manifest in the second half of the year

In Q4 2023, despite declining ASPs, Leopaard Auto achieved a record-high gross margin of 6.7%, mainly due to the impact of the previous cost reduction cycle. This round of cost reduction is expected to replicate the trend seen in Q4 2023 and manifest in the second half of 2024.

Dolphin will keep an eye out for any updates on specific sales and gross margin guidance during the 2Q earnings call.

VI. Leopaard Auto's medium-to-long-term upside potential lies in overseas expansion

Leopaard Auto's cash and cash equivalents (including restricted cash) were 16.5 billion yuan in Q2, a decrease of around 1 billion yuan from Q1. However, operating cash flow turned positive this quarter, increasing by 2.6 billion yuan from the previous quarter, likely due to the return to positive gross margins and increased sales, which improved upstream accounts payable. With Stellantis' capital injection, cash security remains adequate.

Leopaard Auto's sales target for 2024 is 250,000-300,000 vehicles, with a gross margin target of 5%-10%. Based on the current sales trend, achieving the lower end of the sales target (250,000 vehicles) would require an average monthly sales of around 28,000 vehicles over the next five months. However, given the limited expected contribution from overseas sales this year (6,000-10,000 vehicles), Dolphin conservatively estimates sales for 2024 to be between 220,000 and 250,000 vehicles.

The current share price corresponds to a 2024 P/S ratio of 1.2-1.4x, down from the 1.8-2x P/S ratio at the time of Q1 earnings. Although this quarter's results missed expectations, and the share price is expected to adjust further, gross margins and sales are expected to continue improving in the second half of the year. Overall, the valuation remains relatively reasonable for the year.

Dolphin believes that Leopaard Auto's medium-to-long-term upside potential lies in the incremental contributions from overseas expansion. Looking ahead to 2025, two new B-segment models, the A12 and A03, are expected to be launched, both targeted specifically at overseas markets (especially Europe, where smaller vehicles are more popular).

Leopaard Auto's partnership with Stellantis offers several advantages over other Chinese automakers expanding overseas:

1) Leveraging Stellantis' channels: Rather than seeking local dealer partnerships, Leopaard Auto can leverage Stellantis' own sales channels, eliminating the need for profit sharing and resulting in larger profit margins.

Leopaard Auto aims to have 200 overseas sales outlets by the end of 2024, with plans to expand to 300-400 outlets in 2025 and 500 outlets by the end of 2026.

2) Leveraging Stellantis' brand recognition to reduce trade barriers:

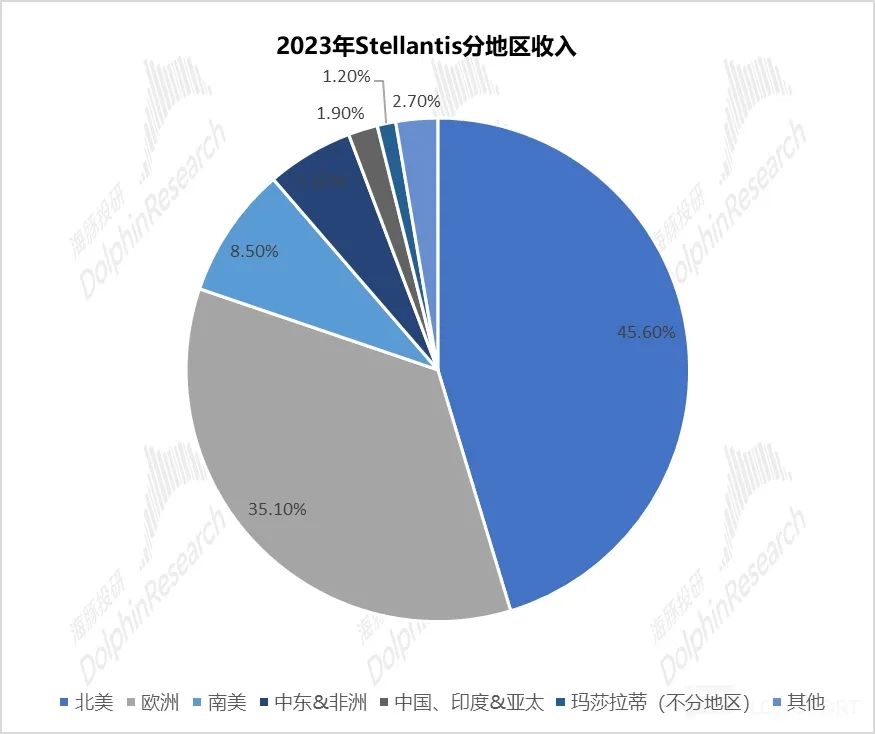

Stellantis' high international profile, particularly in Europe and North America (which accounted for 80.7% of its sales revenue in 2023), can help reduce trade barriers for Leopaard Auto. These markets are among the largest for automobile sales globally outside of China, but Chinese automakers face significant tariffs when exporting there (up to 100% for the US and typically over 30% for Europe). By leveraging Stellantis' existing overseas factories through SKD (semi-knocked down) kits or direct production, Leopaard Auto can reduce export resistance and gain a competitive advantage.

As such, Leopaard Auto expects overseas sales to contribute an incremental 60,000-100,000 vehicles in 2025, with the upcoming "A12" mid-size SUV expected to be a key contributor to sales and profits, aligning well with overseas demand for smaller vehicles.