Migu Video bets on the Olympics, mobile cloud growth slows down, what's wrong with China Mobile?

![]() 08/16 2024

08/16 2024

![]() 649

649

Produced by | Zidan Finance

Artistic Design | Qianqian

Reviewed by | Songwen

Unsurprisingly, China Mobile, the country's largest telecommunication operator, has once again delivered an outstanding performance.

According to its financial report, in the first half of 2024, China Mobile generated a revenue of 546.744 billion yuan, an increase of 3% year-on-year, and achieved a net profit attributable to equity holders of 80.201 billion yuan, up 5.3% year-on-year. Alongside these results, China Mobile also announced a mid-year dividend exceeding 50 billion yuan.

However, the market was not satisfied with China Mobile's performance. Following the release of its interim report, China Mobile's share price fell for two consecutive days, raising concerns about the company's growth potential.

1. Rapid rise through "M-Zone", now seeing a decline in growth rate

As the largest telecommunication enterprise in China, China Mobile's growth history is closely tied to the expansion of domestic network communications.

In 1986, shortly after the reform and opening-up, the demand for network communications in China increased rapidly. Against this backdrop, the Ministry of Posts and Telecommunications established the first national mobile communication operation and management organization, the Mobile Communication Department, in 1986. This was followed by the establishment of the Mobile Communication Bureau in 1994.

After reforms separating postal and telecommunications operations, China Telecom was split into four entities in 1999, leading to the establishment of China Mobile, which inherited the mobile communication business of the former China Telecom.

In its inaugural year, China Mobile generated a revenue of 35.11 billion yuan and a net profit attributable to equity holders of 4.797 billion yuan. Relying on China's vast consumer base, China Mobile grew rapidly. By 2001, it had surpassed 100 million users and made its debut on the Fortune Global 500 list.

Entering the 21st century, to align with the domestic information development trend, China Mobile transformed its brand positioning from "Mobile Communication Expert" to "Mobile Information Expert." However, it was the "M-Zone" brand that truly transformed China Mobile.

In 2003, targeting young people, China Mobile launched the highly cost-effective "M-Zone" brand and invited pop superstar Jay Chou as its first spokesperson.

With "M-Zone," China Mobile rapidly expanded its market share. By 2006, it had 301 million users, making it the world's largest mobile communication service provider by customer base.

The company's revenue grew from 58.1 billion yuan in 2000 to 280.6 billion yuan in 2006, marking a cumulative growth rate of 382.96%. During the same period, its net profit attributable to equity holders increased from 18.03 billion yuan to 66.11 billion yuan, representing a cumulative growth rate of 266.67%.

In 2009, with the popularity of smartphones, 3G, 4G, and wireless broadband services brought new business opportunities to China Mobile.

By 2016, China Mobile surpassed China Unicom to become the second-largest mobile broadband operator in China, with 75.51 million broadband subscribers. In 2018, it surpassed China Telecom to become the largest operator.

Driven by mobile broadband services and the proliferation of 3G and 4G networks, China Mobile experienced a renaissance, with its revenue growing from 464.8 billion yuan in 2010 to 1.01 trillion yuan in 2023, averaging an annual growth rate of approximately 9%.

However, due to declining gross margins across various businesses, China Mobile's profitability was not outstanding. For a long time, its net profit attributable to equity holders was declining, which contributed to stagnant share prices in the Hong Kong stock market.

It was not until 2021 that China Mobile's net profit attributable to equity holders began to recover, with a data-indicated growth from 107.8 billion yuan in 2020 to 131.8 billion yuan in 2023, averaging an annual growth rate of 7.4%.

Although China Mobile's revenue and net profit attributable to equity holders continued to grow in the first half of 2024, the growth rates slowed down, with revenue and net profit increasing by 3% and 5.3%, respectively, lower than previous years.

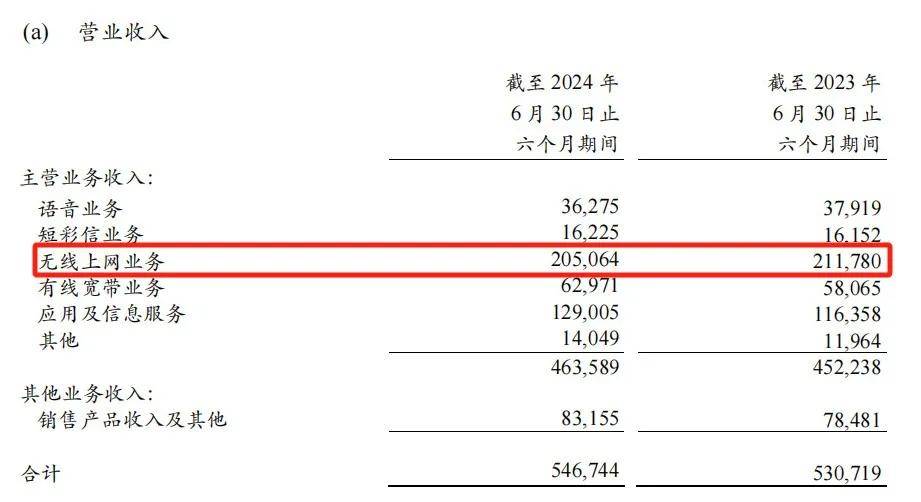

(Figure / China Mobile's 2024 Interim Report (in millions of yuan))

Following the release of these financial results, market concerns arose, prompting the company's chairman, Yang Jie, to address the slowdown in growth. He attributed it to China Mobile's ongoing transformation and upgrading process, which requires time.

In the two days following the announcement, China Mobile's share price fell by a cumulative 3.66% before stabilizing on August 13. As of August 15, China Mobile's share price was 104.94 yuan per share, showing an upward trend for three consecutive days.

For China Mobile, it has reached a bottleneck in its development. Whether it can navigate through the current challenges and reignite growth remains to be seen. "Jiemian News·Zidan Finance" will continue to closely monitor the situation.

2. Migu Video bets on sports events, trailing iQIYI in monthly active users

China Mobile's declining revenue growth is closely related to the drop in its wireless internet service revenue. As the domestic mobile data traffic nears saturation, China Mobile, as the largest mobile operator, has been significantly impacted.

In the first half of 2024, China Mobile's wireless internet service revenue was 205.064 billion yuan, down 3.17% year-on-year. Amid sluggish traditional businesses, China Mobile is focusing on developing new ones.

(Figure / China Mobile's 2024 Interim Report (in millions of yuan))

One example is Migu Video, a digital content business heavily invested in by China Mobile through its wholly-owned subsidiary, Migu Culture & Technology Co., Ltd. (hereinafter referred to as "Migu Culture").

Similar to iQIYI and Tencent Video, Migu Video is a long-form video platform. Unlike iQIYI and Tencent, which rose to prominence through variety shows and dramas, Migu Video's growth is primarily driven by sports broadcasting.

Since 2018, Migu Video has invested heavily in sports broadcasting. During the 2018 FIFA World Cup, 4.3 billion people watched the games on Migu Video, albeit with initial issues like lag and blurry images due to inexperience in broadcasting.

This laid the foundation for Migu Video's sports broadcasting, and with the support of its parent company, China Mobile, Migu Video enjoyed unique advantages in funding and resources.

Subsequently, Migu Video partnered with China Media Group to secure the broadcasting rights for four major events: the 2020 Tokyo Olympics, 2020 UEFA Euro, 2022 Beijing Winter Olympics, and the 2022 FIFA World Cup in Qatar.

Furthermore, Migu Video acquired the broadcasting rights for 14 major sports leagues, including the NBA, CBA, Chinese Football Association Super League, Ligue 1, La Liga, Bundesliga, and Premier League, covering mainstream football and basketball events both domestically and internationally.

Leveraging its extensive sports events portfolio, Migu Video's monthly active user base gradually expanded. According to Yuehu IAPP data, during the 2020 Tokyo Olympics and the 2022 FIFA World Cup, Migu Video's monthly active users surpassed 30 million, and even during non-major sports events, the number hovered around 20 million.

It's worth noting that despite Migu Video's heavy investment in sports events, the sports audience remains niche compared to those for TV dramas and movies, making it challenging for Migu Video's monthly active user count to experience explosive growth.

Yuehu IAPP data shows that from 2018 to 2023, Migu Video's monthly active users remained stable at around 20 to 30 million, with no significant growth. In contrast, iQIYI and Tencent Video each have over 400 million monthly active users.

Apart from video content, Migu Culture is also actively deploying cloud gaming and Migu Music. With China Mobile's significant financial support, these businesses have developed smoothly, collectively forming China Mobile's digital content segment.

Data indicates that in 2023, China Mobile's annual digital content revenue reached 28 billion yuan, up 31.6% year-on-year. In the first half of 2024, the company's digital content revenue reached 14.5 billion yuan, a year-on-year increase of 11.3%, though this growth rate has notably slowed compared to previous years.

For Migu Culture to sustain its high growth trajectory, relying solely on revenue from major sports events is insufficient. Post-events like the Tokyo Olympics and the FIFA World Cup, temporary revenue spikes are unlikely to drive sustained growth for Migu Video. Enriching its offerings with TV dramas, variety shows, and other content may be the key to Migu Culture's continued breakthrough.

3. Mobile Cloud revenue growth plummets; can strategic businesses break through?

Apart from digital content, China Mobile's transformation and upgrading efforts are heavily focused on cloud computing.

In 2017, China Clearly propose to build “ Digital China ”, marking the beginning of a cloud computing boom in the country. In 2019, China Mobile embarked on its cloud computing journey, designating Mobile Cloud as its most critical strategic business.

In its inaugural year, Mobile Cloud generated 1.9 billion yuan in revenue for China Mobile. To capitalize on the "Digital China" opportunity, China Mobile spared no effort in investing in its cloud business.

At the Mobile Cloud Conference in 2023, China Mobile's Chairman Yang Jie revealed that the company had invested over 90 billion yuan in cloud infrastructure over the past three years and launched 200 proprietary products.

With robust infrastructure and the backing of a central enterprise, Mobile Cloud has flourished in government cloud construction. China Mobile has undertaken the construction of over half of China's provincial-level government clouds.

Driven by policy support and significant investments from China Mobile, Mobile Cloud's revenue has experienced explosive growth.

In 2023, Mobile Cloud generated a revenue of 83.3 billion yuan, exceeding 43 times that of 2019. This explosive growth in Mobile Cloud revenue has been a key driver of China Mobile's sustained performance growth over the past few years.

However, concerns arise as the once-booming Mobile Cloud seems to be slowing down.

In the first half of 2024, Mobile Cloud generated a revenue of 50.4 billion yuan, up 19.3% year-on-year. Although still growing, this 19.3% growth rate pales in comparison to the triple-digit growth rates seen in previous years.

The slowdown in Mobile Cloud's growth rate is closely tied to the cooling of the overall industry and price wars. Amid economic uncertainty, many enterprises have reduced their investments in digital transformation. Additionally, after years of development, cloud computing's penetration rate has increased annually, entering a relatively saturated stage, inevitably leading to a decline in industry growth rates.

(Image / Shutterstock, based on VRF Agreement)

Furthermore, competitors like Alibaba Cloud, Huawei Cloud, and even the rising JD Cloud are fiercely competing for market share in the cloud computing industry.

Take Alibaba Cloud as an example. To gain more market share, on February 29, Alibaba Cloud announced a price reduction across its cloud product offerings, with an average reduction of over 20% and a maximum reduction of 55%. On the same day, JD Cloud announced an additional 10% discount on top of Alibaba Cloud's lowest actual transaction price.

While Mobile Cloud has an advantage in government cloud services, it struggles to compete with rivals like Alibaba Cloud in terms of pricing, services, and technology in the enterprise sector. Securing a larger market share, therefore, poses significant challenges.

For China Mobile, its traditional wireless internet business faces a growth bottleneck, with declining revenue. The highly anticipated cloud computing business is also seeing slower growth amid industry cooling and intense competition. Meanwhile, the rapidly growing Migu Video, due to its smaller scale, struggles to significantly contribute to China Mobile's overall performance.

Facing these challenges, how China Mobile can break through and navigate its current predicament will be a test of the management's wisdom.

*The lead image in this article is from Jiemian News' image library.